In light of Uber’s IPO, we’re releasing our Inside the Marketplace podcast about the 5 Lessons Founders can learn from their path to market dominance in addition to the in-depth teardown of Uber’s network effects strategy below.

Uber’s biggest asset is their network effects, and they know it. In their S-1 they emphasized that “the foundation of our platform is our massive network.” But there are cracks in that foundation.

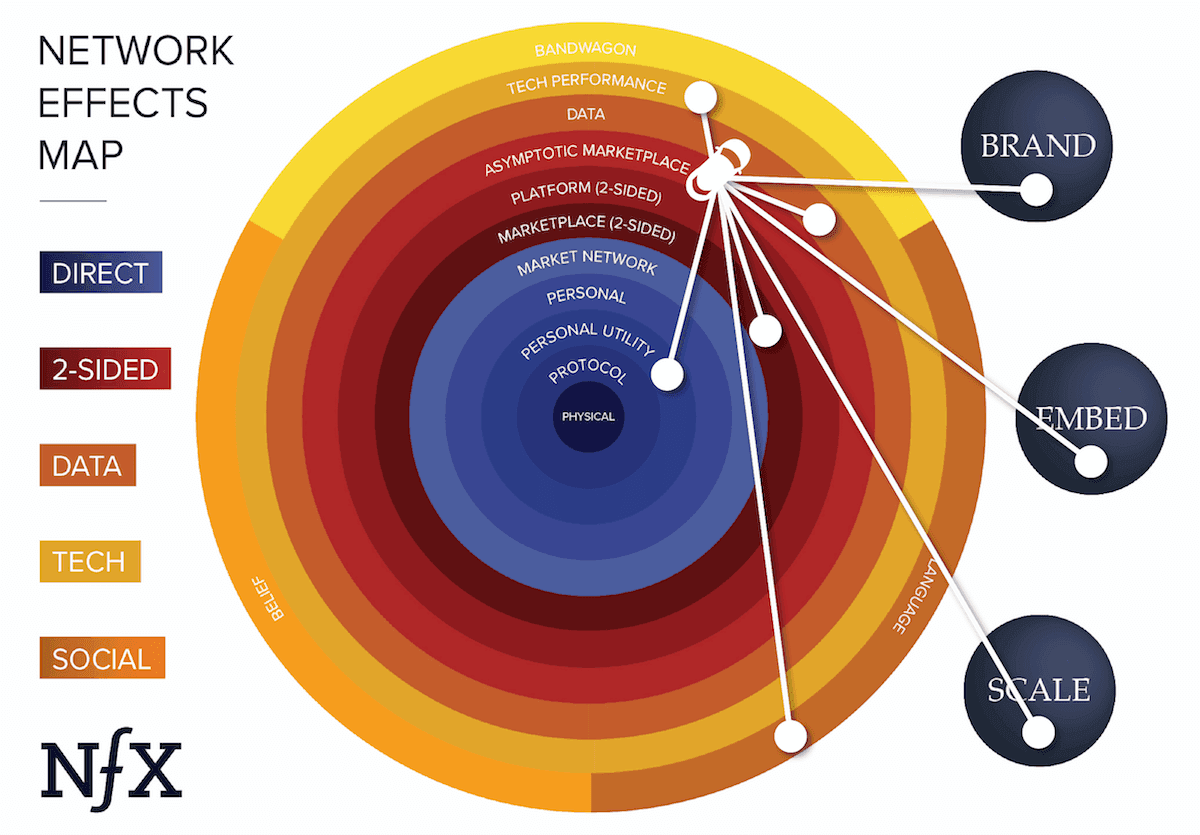

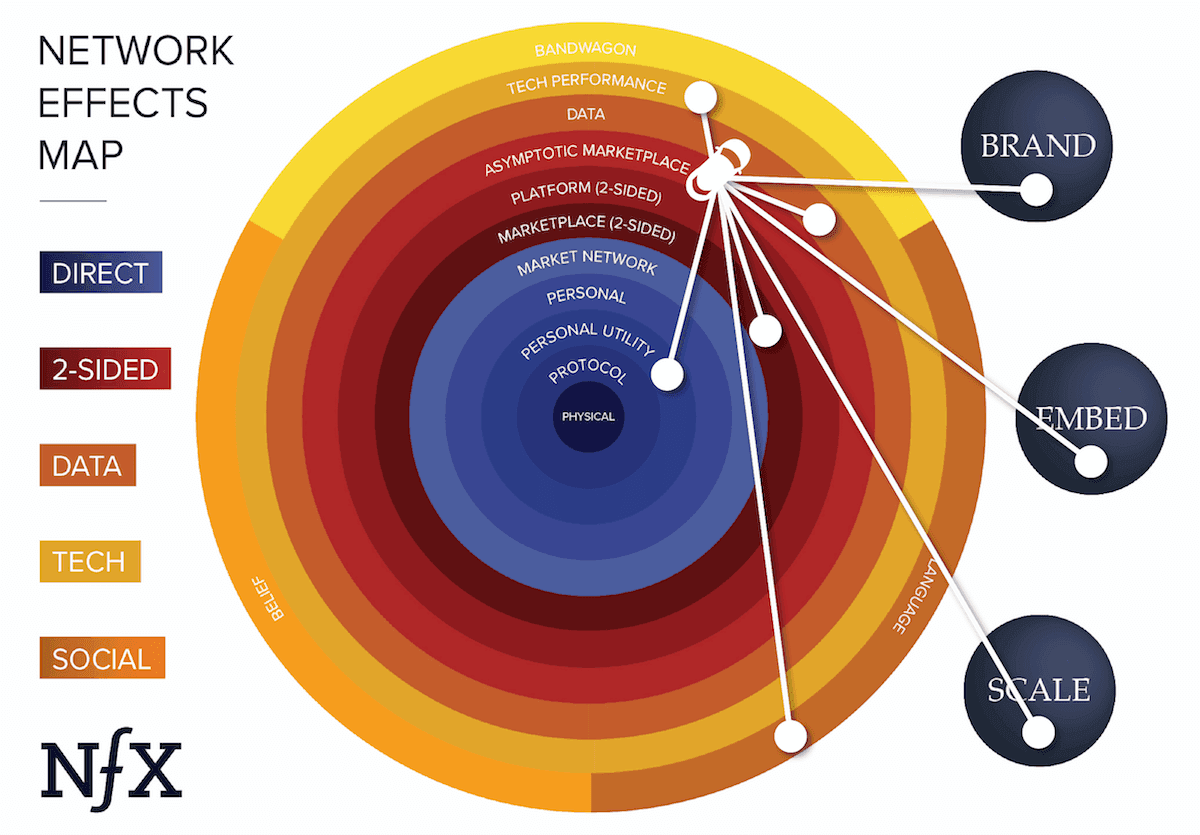

Although network effects are the best type of defensibility still remaining in the internet age, Uber’s core network effects are deceptively weak. As we’ve described elsewhere, not all network effects are created equal. Uber’s network effects are asymptotic rather than true 2-sided marketplace nfx. Not nearly as strong.

Realizing this, Uber has made a series of moves to reinforce their core network with other defensibilities. Heading into their IPO, their success as a public company will depend on how effective those efforts prove to be.

In this essay, we look at Uber from a few angles:

- Why Uber’s core network effect makes them vulnerable

- What moves they’ve made to reinforce that core vulnerability

- 5 lessons Founders can take away from Uber’s story [Podcast]

Why Uber’s network effects are vulnerable

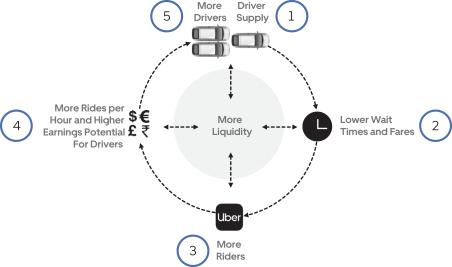

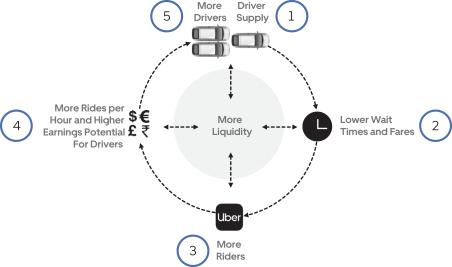

Knowing that network effects are central to their business, Uber included a diagram of their nfx in their S-1, describing it as a “liquidity network effect”.

With this diagram, Uber tries to show exactly how each new Uber user adds value for all the others — the fundamental definition of a network effect. They see their network effect as having 5 stages, each stage leading to the next.

Stage 1: Driver supply

Stage 2: Lower wait times and fares

Stage 3: More riders

Stage 4: More riders per hour, higher earnings potential for drivers

Stage 5: More drivers

This sequence explains how Uber’s cross-side network effects are supposed to work. But if you look closer and think a bit, you may notice that Uber deviates from the formula for a true 2-sided marketplace nfx in the transition from stage 1 to stage 2 — increased driver supply leading to lower wait times.

The loop breaks down at that stage because it’s impossible to go below zero minutes of wait time without violating causality and/or spacetime. Drivers can’t pick up riders sooner than instantaneously. What’s more, the difference between 0 minutes of wait time and a nominal 3 or 4 minutes of wait time for the average rider is very small from a utility perspective. Indeed, those 3 or 4 minutes of lag could even be useful for the rider grabbing their coat, waiting for the elevator, using the bathroom, saying goodbye to someone, etc.

Data bears this out. The average wait time for an Uber rider in late 2018 was 5 minutes. That’s probably close to optimal. The benefits of increasing supply beyond this point has steeply diminishing returns: you’d have to more than double the “fleet” of drivers to halve the wait times from 4 minutes to 2. That’s why Uber’s nfx “asymptote” early on — each marginal supply-side user after the 4-minute inflection point has diminishing incremental value for all other users, and the supply side will settle into an early equilibrium.

Barriers to entry for ridesharing businesses are relatively low as a result — it’s not hard to get down to 4 minute wait times. New ride-hailing apps can easily gain critical mass on the supply side in a given geo and try to compete, like Juno in New York did. Unlike true marketplaces such as OpenTable or eBay, Uber can’t establish an escalating supply-side advantage with their network effect, and their core business is vulnerable to new entrants.

Compounding this are the extremely low switching costs of ridesharing for both the demand and supply side, leading to rampant multi-tenanting. It costs nothing but a couple of seconds for riders to switch from their Uber to their Lyft app on their smartphone, meaning that many riders have both apps downloaded and decide based on price. Drivers can also simultaneously drive for both Uber and Lyft (and some third app) with little to no cost to them.

“The personal mobility, meal delivery, and logistics industries are highly competitive, with well-established and low-cost alternatives that have been available for decades, low barriers to entry, low switching costs, and well-capitalized competitors in nearly every major geographic region. If we are unable to compete effectively in these industries, our business and financial prospects would be adversely impacted.” – Uber S-1

Left unaddressed, competitive exposure due to this flaw in their network effect could get Uber into a situation like we see with the airline industry, where there’s razor-thin margins and high sensitivity to price competition. That’s a stark contrast to the high margin, winner-take-most market you normally see with network effects companies.

Uber’s ~$80+ billion valuation, not to mention its stated ambition to corner the $12 trillion global transportation market, is based on the assumption that it will end up looking more like a company with true network effects, not like an airline. So it stands to reason that they’ve been doing whatever they can to avoid the commoditized fate of the airlines. Enter reinforcement.

Mapping Uber’s reinforcement strategy

Having realized that it’s vulnerable at a time when the stakes are high, Uber is furiously building other defensibilities. Starting with a core network effect (even a weak one) makes this easier because they can leverage their large network to roll out new defensibilities.

As Uber puts it in their S-1, “each new product adds nodes to our network and strengthens shared capabilities, enabling us to launch and invest in additional products more efficiently”. The diagram below is a map of Uber’s attempts to add these defensibility “nodes” sequentially over time. At this point, we count no less than 9 additional defensibilities Uber is pursuing to reinforce their core network effect.

-

- Brand – There was a period of time where barely a day would go by without some new news story about Uber. They really took the saying “no press is bad press” to heart and have been very effective at staying in the press almost from day one. Their brand recognition is quite strong as a result, though not always with the best connotation.

- Scale – By rapidly scaling to over 700 cities in less than 10 years, Uber is the world’s first global ridesharing network. Although they recently scaled back somewhat in Asia, they’re still active in 63 countries where they can claim 2% or more of the population as users. And with $41.5 billion in gross bookings in 2018, they have a significant scale advantage over new entrants.

- Embedding – Embedding Uber in other apps as a default option is an additional advantage against new ridesharing entrants, heightening those low barriers to entry. Users of Facebook Messenger, Google Maps, Apple Maps, and other popular apps automatically see Uber suggested as a ride service.

- Language nfx – The company name, Uber, means “topmost” or “superior”. Choosing this word was a great move by Uber. As we know from Eugene Wei’s great essay Status as a Service, people are “status-seeking monkeys” and Uber’s name appeals to that impulse. Why would you want something less than superior? Their name let them develop a language network effect, which happens when the dominant brand in a market category becomes shorthand for the entire category, like Kleenex with tissues, or Google with search engines. Phrases like “Can you grab a Kleenex?” “Google it” and “Let’s Uber there” are now in common usage.

- 2-sided marketplace: Uber Freight – Although Uber’s core business isn’t a true 2-sided marketplace, they do have a true 2-sided logistics marketplace in the form of Uber Freight. On the demand side are businesses, and on the supply side are trucks. The more trucks (supply), the more powerful the network effect, and there’s no lower asymptotic limit like with drivers and riders.

- 3-sided marketplace: Uber Eats – Uber built a 3 sided marketplace with Uber Eats, comprised of drivers (supply), restaurants (supply), and users (demand). The defensibility of Uber Eats, like Uber’s core business, does suffer from multi-tenanting on the supply side, where many restaurants also list on other food-delivery apps like DoorDash.

- Data nfx – Across all of their products, Uber gets better with each user because of the data they provide lets them improve demand prediction, matching and dispatching, pricing, and routing. The more people use Uber, the better the product becomes, leading to even more usage.

- Tech Performance nfx – Uber ATG, which has raised billions of dollars to develop autonomous vehicle technology, is a play for a tech performance network effect defensibility. In the digital age, proprietary tech advantages have a short half-life and aren’t very defensible — unless the technology gets better the more the underlying technology is used. Autonomous vehicles, because of the strong ML component, have that property. If Uber can get a tech performance network effect going, it will make their business massively more defensible at a rate of increasing returns and more than justify the investment.

- Personal Utility nfx – Uber Commute, a carpooling service that hasn’t been rolled out to Uber’s global platform yet, is an online peer network of commuters currently in Uber’s India market — a direct network with personal utility to each user. Products with personal utility network effects are highly defensible, so if Uber Commute ever achieves significant scale it could be a game-changer.

5 Lessons for Founders: Inside the Marketplace Podcast

The case study above takes a broad look at Uber’s defensibility moves, but I also want to leave Founders with some lessons they could take away for their own startups. There are 5 lessons I think Founders should take away from Uber:

- Be fast and be aggressive

- Focus on defensibility

- Use capital as a competitive weapon

- Make your vision as big as you can

- Understand that language and naming matters

To hear these lessons fleshed out, listen to the NFX podcast below.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.