It’s remarkable how much new growth we unlocked at Trulia once we understood the counterintuive truths of pricing.

We had launched our product, revenue was doubling YoY, and the business was rapidly scaling. We were getting ready to IPO and had a huge vision for our product evolution. But we were missing a critical leverage point that ended up being one of our key growth drivers: Pricing Strategy.

Pricing is often treated as an afterthought at many startups, and a study of nearly 2,000 companies shows that pricing has an extremely high 72% correlation to startup failure.

What changed the game for us at Trulia was understanding the underlying mechanics of pricing. It is the hidden driver behind nearly every breakthrough company out there – Uber, Etsy, Trulia, Asana, Eventbrite, Superhuman, and more.

Madhavan Ramanujam is a legendary Jedi Master of pricing among tech unicorns including Trulia. He is the author of Monetizing Innovation and a partner at Simon-Kucher.

Today Madhavan and I are sharing the frameworks, tactics, and hidden truths Founders need to know about pricing — and how, when done correctly, it can dramatically lever-up growth.

Below are key takeaways from our conversation.

1. Pricing is a blindspot for startups.

- Silicon Valley loves creating amazing new innovations, but hardly pays any attention to monetizing them successfully. What we hear a lot: “Hey, I built a product. We have been working on this for the last two years and… oops, we need a price. And by the way, we needed it last week.” When you couple that with the failure rate of startups, then you start seeing some clear patterns.

- When you take a step back, the classic phrase that comes to mind in these companies is spraying and praying. In other words, the fundamental issue for the high failure rate of innovation is that people build products without any clue as to whether someone will value the product — or more importantly, whether they would pay for it.

- Pricing or commercialization becomes an afterthought after building the product. And that is the core reason why many of these innovations fail.

- The startup ecosystem has evolved to understand product-market fit, but I don’t believe it has fully evolved to look for product-market-pricing fit. There’s an appropriate realization that you need to test and learn from customers in terms of building your products — but often these testing and learning measures don’t involve any pricing insights.

- For example: The headphones that I’m wearing right now. If someone asked me, “Do you like them?” I would say, “Yeah, I like them! They’re great!” If they asked me: “Do you like them for $400?” Now, the whole conversation is different.

- If you don’t put pricing as part of your product-market fit validation, you’re just hearing what you want to hear. So it’s really about achieving product-market-pricing fit.

- As a company or an entrepreneur, if you think about it, you don’t have a choice about whether you will have a pricing conversation with your customers. It’s going to come down to a pricing conversation one way or another. You can build your products and then slap on a price and have that more painful conversation — spray and pray. Or you can actually have this pricing conversation much earlier in the innovation process, test and learn, and then truly try to understand whether people value the product and are willing to pay for it.

- If they’re not willing to pay, ask the most important question, “Why?” You’ll often hear so many insights on how you can design your products in such a way that you’ll maximize your chances of commercial success.

- While the ecosystem has evolved in terms of testing and learning capabilities, I do still think that there is a lot of room to grow for startups in terms of testing and learning pricing and willingness to pay. Pricing remains a black box.

- Most people think of this as an art, but they don’t realize that there are tools and it’s actually more of a science than an art. That’s where we’ve been spending quite a bit of time educating and demystifying pricing and putting more of the science and rigor into everyone’s thinking. When you think of it that way, you can take a systematic view of monetization and have a long-term commercialization strategy that goes along with it.

2. How to Test Willingness-to-Pay

- I urge Founders to start with ideas, wireframes, blueprints, whatever it is. Start having the conversation with customers, first of all, to see if their eyes light up.

- Pitch the value to your customers and have that conversation where you’re truly educating them about the value. Have that first and then ask the simple question, “Would you pay for it?”

- If someone says “no,” ask them the most important question, “Why?” And you’ll hear information to really design your products in such a way that they will actually pay.

- There are various ways that you can go about asking the willingness to pay questions. Here are a few techniques that you can try at your company:

- The simplest way after you’ve had the sales and marketing conversation is to put a price on it and ask, “Would you pay for this at this price?” If someone says “yes,” in your future tests, keep doubling it until you reach a point where people start reacting violently.

- This is a really simple way to find out when you are crossing some psychological thresholds. Start including price as part of the conversation.

- To take the headphones example from above, if I was testing and learning, I would pitch the value and say, $100, $200, $400. At some point, it’s going to break. I just want to understand where that is.

- Another way to test this is to anchor people and test in a relative way. I kind of tongue in cheek say that “people are absolutely meaningless but relatively smart.” What I mean by that is if you go and ask someone, “Hey, how much should I charge for this product?” You’d get some garbage back because people don’t understand magnitudes.

- They’re not supposed to even tell you that stuff because that’s your job. But relatively speaking, people are a lot more comfortable in making judgments on options versus coming up with them on their own.

- For instance, let’s assume you’re a SaaS startup. Pitch the value, have the sales and marketing conversation, and then switch gears and ask them, “Do you use Salesforce?” If they say “yes,” ask them, “If Salesforce was, let’s say, indexed at 100 in value that it brings to the table, where do you think we would stand?” This trade-off most people can actually make because you’re asking relative to something they already know. So if they say 80, that means that your relative value is 20% less than Salesforce.

- Then ask them the question, “Let’s say if Salesforce was indexed at 100 on price, where do you think we should be?” And again, this is something that people can actually make judgments for.

3. Acceptable, Expensive, or Prohibitively Expensive?

- I think there are some simpler techniques. Things can get a bit more interesting when you actually do this more systematically.

- One of the interesting ways to do this is by asking: the acceptable, expensive, and prohibitively expensive questions. This is a way to quickly identify psychological thresholds.

- After you pitch a product, talk about the value. Ask someone, “What do you think is an acceptable price for this innovation?”

- Of course, we know that people love to low-ball. They love to negotiate with themselves. They will give you an answer. Clock it, then ask them, “What do you think is an expensive price for this innovation?” And then follow that up with, “What do you think is a prohibitively expensive price for this?”

- What we have seen over and over again from many thousands of projects that we’ve done, acceptable price tends to be the price where people not only love your product, but they also love your price.

- If you’re at a growth stage, you need a low friction price — maybe an acceptable price is okay because it becomes a no-brainer.

- Expensive price tends to be the price that is more value-priced, as in prices align with the value that you deliver and people don’t necessarily love you or hate you. They’re kind of neutral and that’s that.

- Prohibitively expensive tends to be the price where people laugh you out of the room.

- If you do this at scale, even through quantitative surveys, you start plotting graphs that actually show you cliffs in the demand curve where there are some psychological thresholds across the population. Knowing these thresholds is important.

- I heard Rahul Vohra from Superhuman talk about this on one of your podcasts. This is the exact technique that he used after reading Monetizing Innovation to really identify pricing at a Superhuman.

- We also talk about more advanced methods of having the willingness to pay conversation by using trade-off exercises, but I would leave that to people who want to read the book. And if there’s one chapter you read in the book, read chapter four about the willingness to pay conversation and how to have it.

Case Study: Superhuman

Pricing is one of the most important and least understood aspects in the startup world. Here, Rahul Vohra, Founder & CEO at Superhuman, shares his methodology for pricing influenced by Madhavan Ramanujam’s book, Monetizing Innovation.

Before you figure out pricing, you must first figure out your positioning. For example, Superhuman is a premium tool for a premium market, and what follows is a relatively easy way to get a pretty accurate answer of what would make for a decent price. Now in the book, Madhavan covers lots of ways to develop pricing. We use one of the easiest methods, which is the Van Westendorp Price Sensitivity Meter. So in late 2015, we asked hundreds of our earliest users the following questions:

- Number one, at what price would you consider Superhuman to be so expensive that you would not consider buying it?

- Number two, at what price would you consider Superhuman to be priced so low that you would feel the quality could not be very good?

- Number three, at what price would you consider Superhuman to be starting to get expensive so that is not out of the question, but you would have to give some thought to buying it?

- And number four, what price would you consider Superhuman to be a bargain, a great buy for the money?

If you have a premium position, the question to focus on is the third question, which is when does it feel expensive, but you’d still buy it anyway? One can imagine that Tesla did that with the Model S. And for us, the median answer to that third question actually turned out to be $29 per month, and then a few conversations with some pricing experts later and we rounded up to $30 per month because when you end a price in the number nine, that doesn’t signal quality, that actually signals value, and we’re all about signaling quality. So, that’s how we picked our price.

But for most Silicon Valley companies, they’re not actually positioning like a premium tool or a premium piece of software. They’re mostly positioning as value for money. And that’s because most Silicon Valley companies are trying to expand their user base as rapidly as possible, leaving pricing optimization until later. And so most Silicon Valley companies would optimize around the median answer to the fourth question, which is at what price would you consider this product to be a bargain or a great buy for the money?

So that’s how I would advise folks to figure out the first answer to their price. But once you’ve done that, it is important to do a quick gut check on market sizing. For example, with that price, can you grow into a billion-dollar valuation? Now, let’s assume at that point, valuation is 10 times your run rate. So our run rate would have to be a hundred million dollars for Superhuman. That would be 300,000 subscribers at $30 per month. And that’s conservatively assuming no other ways to increase revenue per user, for example, without building new products or going further upmarket. And we asked ourselves, do we think that we can get to hundreds of thousands of subscribers? We answered emphatically, yes. And so we went ahead with that price.

Read more about the product frameworks Rahul developed at Superhuman.

4. How To Think About Pricing During Extreme Swings

During the COVID-19 pandemic, we are seeing at a high level two types of patterns. Either your demand spikes like crazy or demand is falling and often pretty fast.

What to do when customer demand is spiking

- If you look at companies benefiting from the crisis, those would be companies in the video conferencing space, delivery platforms, collaboration software, and so on. Stuff that was already digital, but you need more of it during a lockdown period.

- For companies that are seeing a demand spike, it could be tempting to think about a price change in terms of an increased price because you’re seeing more demand. Classic economics would tell you to increase your price because you are also seeing increased demand. But the obvious backlash is that you could come across as gouging your customers and that is absolutely something you should not do.

- Instead, a better strategy would be to focus on gaining as much market share as you can, but at the same time, creating more premium lines of services. If you’re onboarding many more customers, chances are you can also sell more premium stuff to those existing customers. Focus on more of a land and expand strategy.

- For instance, if you are a delivery platform creating a new line of services like rush delivery or extra add-ons, those can be up-sold to customers. They are the things that you really want to focus on if you’re seeing a demand spike.

- Differentiate your products in such a way that you’re still landing and gaining market share in a disproportionate way. Also, preserve some expansion room by using other products and innovations that you might actually be able to sell to them.

What to do when you are losing demand

- The far more dominant pattern that we are seeing right now is companies losing some sort of demand, 10 to 20% or even more. And hence, on average, they are 10% to 20% or a bit more down on revenue.

- For these companies, it could be super tempting to lower the price. You’re seeing demand fall down. Should they lower the price to gain back the demand?

- Lowering the price would be absolutely the wrong thing to do in most situations.

- If you lower the price, it does not necessarily mean that you will get the demand back. What you might want to do is think about options that you have at your disposal that could probably achieve the same purpose, but without dropping your price.

- If you drop your price, you’re training your customers to expect your service for less when things pick up again.

- The one rule that I give startups: Think of 3 non-pricing concessions before you even think about dropping prices.

- For example, can you give more product away and preserve the price? Let’s say you have a good, better, and best product lineup and you’re seeing a drop in demand. Can you give a better product and preserve your price so that customers won’t leave? Can you be more flexible with payment terms? Can you work on a risk or reward basis? Can you bundle products and create a white-glove service?

- There are various things you can do to see if you can achieve, or perhaps even create a lower entry offering. De-feature the products and create a low-entry offer that people can actually buy during these times so they still are in the system, but at a reduced value.

- Essentially, keep the price and value alignment intact even during these tough times.

5. Think creatively about value and market share in a downturn

- I think there are a lot of pricing lessons that startups can take from the last recession.

- Some examples of things that really worked well in the last recession include flexible payment terms. Hyundai said something like return your car if you lose your job. Hyundai’s market share increased by 5X just based on some of those adjusted payment terms mechanisms.

- One of the startups that we recently worked with changed their entire licensing model to be more of a usage-based rather than a fixed fee. With this usage-based model, we did not lose a single customer because if you’re not using the product, you’re actually not paying for it. But if you are using the product, you will pay in alignment with the usage. That feels fair to the customer.

- When things pick up again, the price is now going to be aligned with value and it’s not going to just be a simple per month per user kind of subscription, but more on a usage basis.

- They have not only kept their customers and reduced their churn risk, but they will recover when things become stronger.

- At the highest level, testing and learning pricing during these times has become that much more important because all the stuff that you knew about your elasticity has gone out of the window.

- A lot of it will probably depend on your market situation, your market positioning, where you are relative to others, your willingness to impact price and product, and the competitive set.

- As the saying goes, when there is a strong wind, some people take shelter, the best ones build windmills. You need pricing windmills.

6. How You Charge > How Much You Charge

- How you charge is often way more important than how much you charge. This is an aspect that most people actually neglect because when they think about pricing, they’re thinking about a dollar figure, which is just a price point.

- How you charge is way more important because you can align price with how your customers perceive value. And if you do it in the right way, then you have a winning model. Choosing a price point becomes that much easier.

- Even when there is a breakeven situation, people have inherent preferences for pricing models.

- The idea for one exercise is to put people through breakeven situations. So for instance, let’s assume that I’m an eCommerce platform and I’m charging based on a commission structure. Let’s say their customer is selling something at $10. If you ask them, which of these following fee structures is more appealing to you? 3% as a commission, 30 cents or 1.5% commission, and then 15 cents, or you’re indifferent among these options.

- If you’re an economic, rational human being, you’d say you’re indifferent because all of the math adds up to the same thing. But we’ve literally not found a single case where people would actually say this in a dominant fashion, which means that people have an inherent preference for what makes sense.

- What we have seen in these kinds of examples is that people gravitate to 3%. That actually intuitively makes more sense to them than a flat fee.

- If you tap into this and you identify pricing models that just make sense for your customers, then you’re often unlocking a lot of magic because then you’re aligning your pricing with perceived value automatically.

- There are companies, for instance, AWS, that pioneered some of this. It is based on usage. Metromile is insurance on a per-mile basis.

- Don’t rush to come up with a price point, think about pricing models. How you charge is often way more important than how much.

7. Five Monetization Models That Work, Time And Time Again

1. Subscription

- The first is subscription, which I think is pretty obvious for most people because it’s so common. This is charging on a per month basis. If you’re a software company, it might be per user per month.

- One caveat though: don’t rush to a subscription on a per user per month, because that’s the most familiar model for you. Test and learn if that is the right model.

- If you’re on a subscription basis, what is the right metric to align your pricing?

2. Dynamic Pricing

- There’s also dynamic pricing, which is becoming increasingly important, especially when the world is moving more digital.

- Dynamic pricing is having the ability to flex your price based on supply and demand. Even in many consumer situations where it was thought not to be possible, it’s actually becoming more and more possible because you can hyper personalize an offer to a customer through a combination of pricing and promotions.

3. Market-Based Pricing

- Market-based pricing or auction-based models are also getting to be used more.

- This is when you set prices according to current market prices for similar products.

4. Pay As You Go

- The pay as you go metric or aligning more on a per-usage metric is probably one of the hottest trends in SaaS companies.

- People are asking if there is a usage-based metric or a usage-based model that they can come up with because often when you just have a subscription price, you’re capping out on your monetization potential.

- Of course, you’re giving predictability to your customers, but your price is not necessarily aligned with usage or the value that people derive. So if you can unlock pay as you go, like Snowflake, for instance, that could be really meaningful.

5. Freemium

- The last one is freemium pricing. To us, it’s more of a model than a strategy because if you really have freemium pricing, the key is to have a proper expansion motion from the land of free to expand to paid offerings.

- Many companies that put out freemiums don’t think about this very strategically and often have given the product away. There’s no room to expand.

- What we find time and again is Pareto’s rule likely applies to customer value and willingness to pay as well. 20% of what you build dictates 80% of the value.

- Most entrepreneurs and startups build 20% of things pretty quickly, and they call it an MVP and throw it out in the market, but they’ve given away 80% of the value.

- They then focus over 80% of their energy on trying to build stuff that’s only worth 20% more and they don’t have any room for expansion.

- Before rushing into freemium, think hard about it. And if you do, do it in such a way that there’s a proper land and expand motion or restrict the freemium usage beyond a certain point so that there’s a natural expansion that happens in your customers.

8. Why 72% of Attempts to Monetize Innovation Fail

- Routinely, we try to understand, what is the state of the union on pricing?

- We were able to run some of the world’s largest studies on pricing monetization. The last time we ran this it was across 2,000 companies with predominantly C-level employees. We were trying to understand, what is the success or failure rate of innovation and why is that happening?

- What we found is that 72% of the attempts to monetize innovation fail. 72% of innovations don’t meet the light at the end of the tunnel.

- That’s pretty high and it’s not just us saying it. If you look at Harvard Business Review, you’d see eight in 10 startups fail.

- We were able to go back across the thousands of projects that we’ve done in pricing and try to understand what are the failure types. It all comes down to four monetizing innovation failure types. When you recognize these four, you can avoid them and build a fifth category, which I call breakthrough success.

9. The 4 Ways Your Monetization Fails

1. Feature Shock

- The first one is what I call feature shock. These are products where there’s simply too much going on. It’s over-engineered, often over featured. And because it’s over featured, it’s overpriced and it just does not sell.

- It happens in the best of companies. For instance, Amazon, when they built the Fire phone, there were a plethora of features that people simply did not need.

- One of them was four cameras that could actually track your eyeball movement so that you didn’t need geeky glasses to get 3D perspective. Sounds cool, but would you pay for it? No.

- The phone launched at $179, and in six months, it was 99 cents and they ruled out the business in another three months. It was an over-engineered, feature-rich product that simply no one wanted.

- The way to avoid feature shock is to build versions of the product so that you’re not trying to build what I call a one size fits none. You are rationing the product based on different types of customers you might have.

2. Minivation

- The second monetizing failure that we often see, especially with companies that have product-market fit, is what we call minivation.

- This is a failure type where you probably have the exact right product-market fit, lightning in the bottle, but you just didn’t have the courage to charge the right price. You undervalued your own innovation. You basically charge much less than what you could have charged.

- To give you an example, one of the semiconductor startups here in the area came up with a groundbreaking chip that was supposed to revolutionize consumer electronics.

- They were thinking about how to come up with a price. They said, “Okay, the last generation we priced at 60 cents, maybe this is really groundbreaking. We can’t be pricing it less than the previous generation. Let’s do this at 85 cents.”

- This product flew off the shelves, but the hidden secret in the room was that everyone knew that they could have done better at pricing.

- When they did a post-mortem for their own pricing, they found out that these consumer electronics companies charge up to a $50 premium because this part was inside those electronics.

- If you look at the economic value of $50 generated at 85 cents, that’s simply not fair. In fact, the companies that participated in the post-mortem were joking that you could have charged up to $5 and we wouldn’t have blinked. If you don’t have the courage to charge the right price, you’re under monetizing and producing a minivation.

3. Hidden Gems

- The third type of monetizing innovation failure we see is what we call hidden gems. These are products that simply go against your DNA if you’re a company and you probably don’t bring it out because you’re worried about cannibalizing your existing business.

- If you don’t go looking for them, you’re never going to harness them and find these hidden gems. The classic example of a company that failed to do this was Kodak. They had the IP for digital photographs back in 1973, but they never productized it because they were worried about cannibalizing their print business.

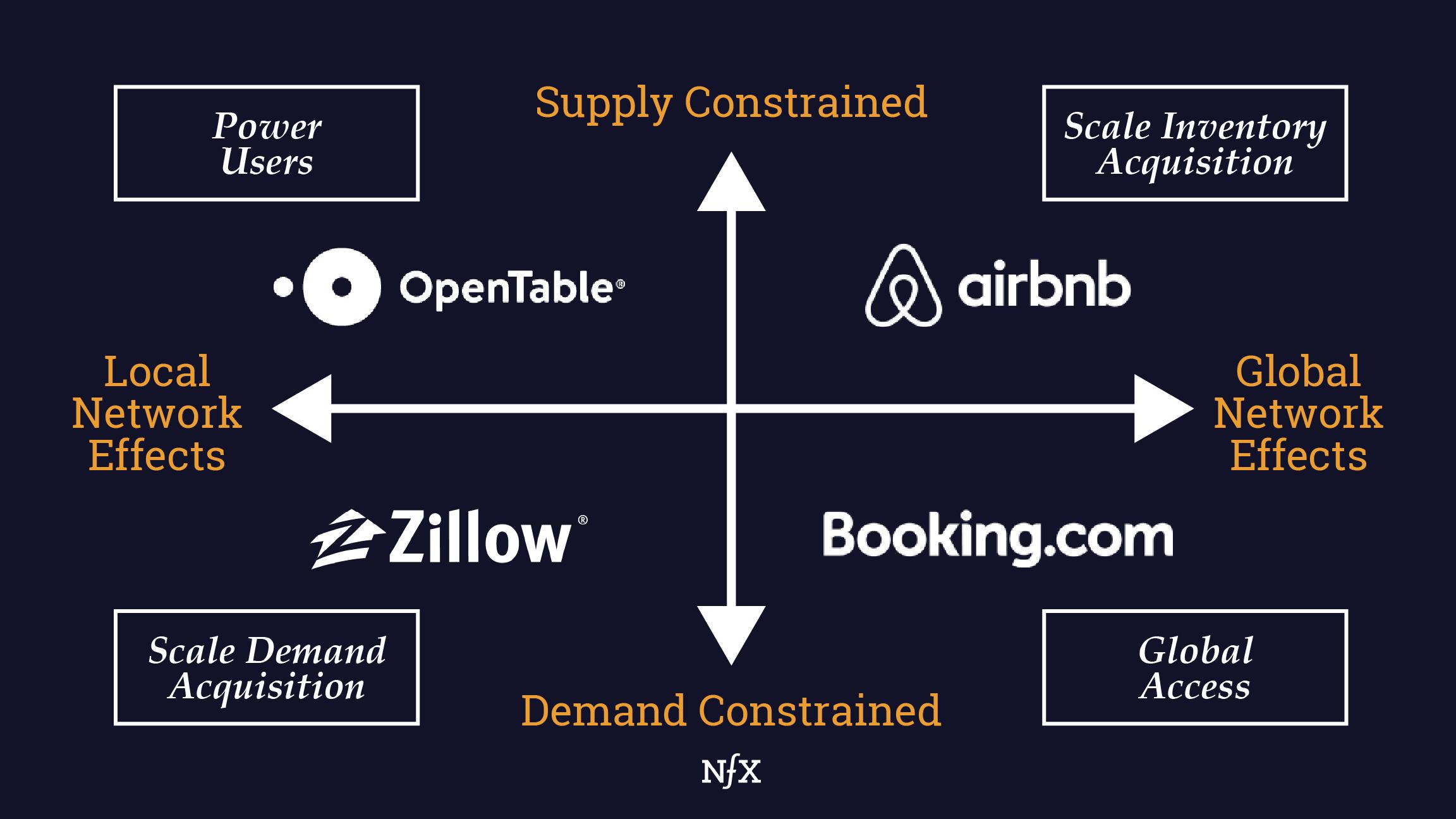

- Companies that did this successfully might include Autotrader or Cars.com. When they realized that the age-old advertisements in newspapers were going away because of the infection of the internet, they built two-sided marketplaces which are now multi-billion-dollar businesses.

- Hidden gems often happen when there’s an inflection point. This is pretty crucial, especially given the last pandemic year.

- When companies try to switch from offline to online or when a software business also wants to pivot to hardware or the other way around. Whenever there’s an inflection point, there’s often a hidden gem waiting to be uncovered.

- It’s the startups that are the fastest moving and have less incumbency baggage that can take advantage of hidden gems.

- But if you don’t go looking for hidden gems, you’re never going to find them. They remain hidden.

- I think knowing when to pivot, what to actually do, is the hidden gem. I think startups definitely have an advantage over more established companies because it’s part of their DNA.

4. Undead

- The fourth monetizing innovation failure, and probably my favorite, is what I call undead. These are products that you should have never launched because they come back to haunt you.

- They come in two flavors. Either they’re the wrong answer to the right question or they’re an answer to a question no one cares about. Either way, you shouldn’t have productized it, but you threw it in the market and hoped for the best without understanding the product-market-pricing fit.

- A classic example of this was Google Glass, which was thrown in the market for $1,500. It probably lived on with the paparazzi for a few weeks before it was gone. That just creates massive internal disruption and distraction and then obviously brand damage as well.

10. Frameworks for Avoiding Monetizing Innovation Failures

- It starts with having that willingness to pay talk early. Without talking about it, you can’t prioritize what you’re actually building — and you can’t integrate pricing and willingness to pay into the product design process.

- You also need to maintain your pricing integrity and avoid knee-jerk reactions when it comes to pricing. Some of the key steps that people probably have to internalize are: have the willingness to pay conversation early and don’t default to a one size fits all solution. I often call it one size fits none.

- Like it or not, your customers are going to be different. Understanding segmentation and differentiation is at the heart of monetization.

- We already covered that how you charge is way more important than how much you charge. The pricing model is an important step. Having the right monetization strategy is important in the sense that you are scheming. Are you penetrating the market or are you maximizing short-term goals? Trying to understand what the strategy is and how to pick one is important. And I would probably say last, but not the least, if you don’t speak value, no one will get it.

- This is a mistake that I see startups do time and again. They’re so obsessed with building products and are probably more engineering-focused so they talk about features and they don’t talk about benefits.

- Features are what you build; benefits are what people get. You need to articulate benefits and speak value, not speak features. We’ve actually seen double-digit improvements in revenue by just changing the articulation of value.

11. Pricing Examples: Etsy, Uber, Amazon, and Evernote

Etsy Case Study

- We worked with Etsy in 2018. We helped them change their pricing model and they also rolled out new monthly seller subscription packages.

- I remember the Etsy stock price was something like left for dead and their stock price came roaring back. That’s literally what happened on the day the pricing changes were announced. The stock price for Etsy increased by 40% and they never looked back.

- Josh, the CEO, actually announced that the most significant news of their second quarter at that time was the change in pricing. They announced this and the street rewarded them.

- More importantly, what they were able to do was to align their price with the value that they delivered. They also created these seller subscription packages that got to the right product for the right value at the right price instead of having a one size treatment across the board.

- I think many of the lessons that we talk about in Monetizing Innovation actually applied in Etsy’s particular case.

- Pricing is a gift that keeps giving, because it’s not just a one-time activity, it’s an annuity.

Uber Case Study

- For Uber, we helped them design the Uber rewards or loyalty program. If you open the Uber app, there’s a systematic way to earn points based on your spend patterns and use those points to qualify for reward tiers. You can also redeem those points in a rewards store to gain rewards back for the points that you own.

- The entire loyalty program design we helped them with and helped them operationalize it. This gave a proper mechanism for Uber to invest in their customers, especially the ones that were providing value to Uber.

- Pricing and monetization is a really broad topic. You really need to think about customer lifetime value. And when you think of it that way, loyalty programs are at the crux of your overall strategy.

- In many cases, a loyalty program when combined with other things can actually make a lot of sense. Let’s say for marketplaces, there’s a lot of emphasis on giving promotions. They are used to gain demand, but promotions end up training customers only one way.

- Loyalty programs are more you’re giving something, but you also get something back and what you’re getting back is people’s loyalty. So focusing on customer loyalty is critical in many of these marketplace companies and that’s what we actually helped Uber with.

Amazon Observations

- For example, Amazon has a rewards program which is of course different than Uber’s because it’s a paid membership through Prime.

- If you look at Prime, the key proposition is that you eliminate all kinds of shipping costs. A membership program really works well when there is a single or a handful of pain points that everyone has. And if you pay for a membership, those pain points go away, like for instance, the shipping costs.

- In those situations, a paid membership could make sense. For instance, even in companies like food delivery platforms, if you have a subscription that gets rid of all the delivery fees, that is usually a home run in many kinds of situations.

- I would broadly classify that example as a membership program, not just a subscription. In those situations, a membership or loyalty program makes sense.

- In other situations that are highly competitive, you need mechanisms to keep your customers. Things like loyalty programs with points and redemption structures make a lot of sense because the endowment effect kicks in. If you give something to people, they value it more.

- With the points and other mechanisms, people actually start expressing their interest and loyalty to a brand because they have some skin in the game and they have some points which they hold.

- We’ve seen over and over again that you’re creating an alternate currency, but the value of this currency increases a bit irrationally when you have loyalty constructs.

Evernote Case Study

- If I remember correctly, Business Insider called them the first dead unicorn in 2014. They were going through really tough times. We actually worked with Evernote in 2016. The core emphasis was trying to understand how we could accelerate more conversion from free to paid and what is the right packaging and pricing strategy?

- We tested a whole bunch of things on behalf of Evernote. What is the right product set? What are the right features that go into products? What is the right monetization model? The key nugget came down to changing the monetization model.

- They used to charge based on a per user per month model. What we changed this to was a per user per device model.

- If you actually go and try to use Evernote today on two or fewer devices, it is free. If you use Evernote on three or more devices, you need to pay for it. This was a change in the monetization model, which greatly benefited them when we operationalized this in 2016.

- They ended up almost doubling their conversion and in three months switched from red to black. We coincidentally also ended up writing a Harvard business case with them on the Evernote monetization strategy.

- At the heart of what we did with Evernote, it totally made sense because it was aligned with how people perceive value. If you’re using Evernote on three or more devices, it feels more like you’re getting all the benefits of a cloud-based, note-taking application. So it made sense. And if you’re not, then you don’t pay for it. I think that was a key example of how you charge is way more important than just how much.

12. P.S. Pricing Principles Applied to Life

- Let’s talk about pricing philosophy applied to life. If I have to abstract this away at the highest level, at some point, people need to realize what value they bring to the table. What price, rewards, or compensation do they need to get in proportion to the value that they bring to the table.

- I think the lessons from price and value equate to our own lives to some extent.

- Latin has only one word for price and value, it was called pretium. I think they figured out long ago that value and price are reflections of one another.

- Let’s say you are in a position to negotiate your compensation, all of the methods that we talk about in terms of anchoring and negotiation techniques probably also apply when you’re negotiating your own compensation package.

- Put another way, putting yourself in a situation where you have stake in the outcomes, I think becomes way more important because then you’re aligning yourself with the value of what your entity provides.

- Partaking in the overall equity or value generation of your company actually becomes that much more important. That’s one of the main reasons that pushed me to be a partner in my current firm.

- We are all products. If we are all products and we are pricing ourselves as in pricing our own services, let’s say you’re a contractor or a consultant, if you’re pricing your own services, avoiding a cost-plus mentality is critical.

- You want to align your price with the value that you actually bring to the table rather than a dollar per hour default which is easier to do but often the absolutely wrong thing to do.

- Thinking about more value-based pricing or pricing based on outcomes is also something that you want to think about if you’re pricing yourself or your services.

13. Listen to Other Top Pricing Articles from Founders & Investors

NFX recently asked the startup community to nominate their favorite essays on pricing, which we turned into Founders’ List audio readouts of pricing insights from Ash Maurya , David Skok, Tomasz Tunguz & more.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.