The universe of fundraising and vanity metrics may fool you into believing that your current performance is indicative of future success. But therein lies a logical fallacy:

Performance is a trailing indicator. Power is a leading one.

“Power” in this context is the underlying mechanism that makes your company defensible.

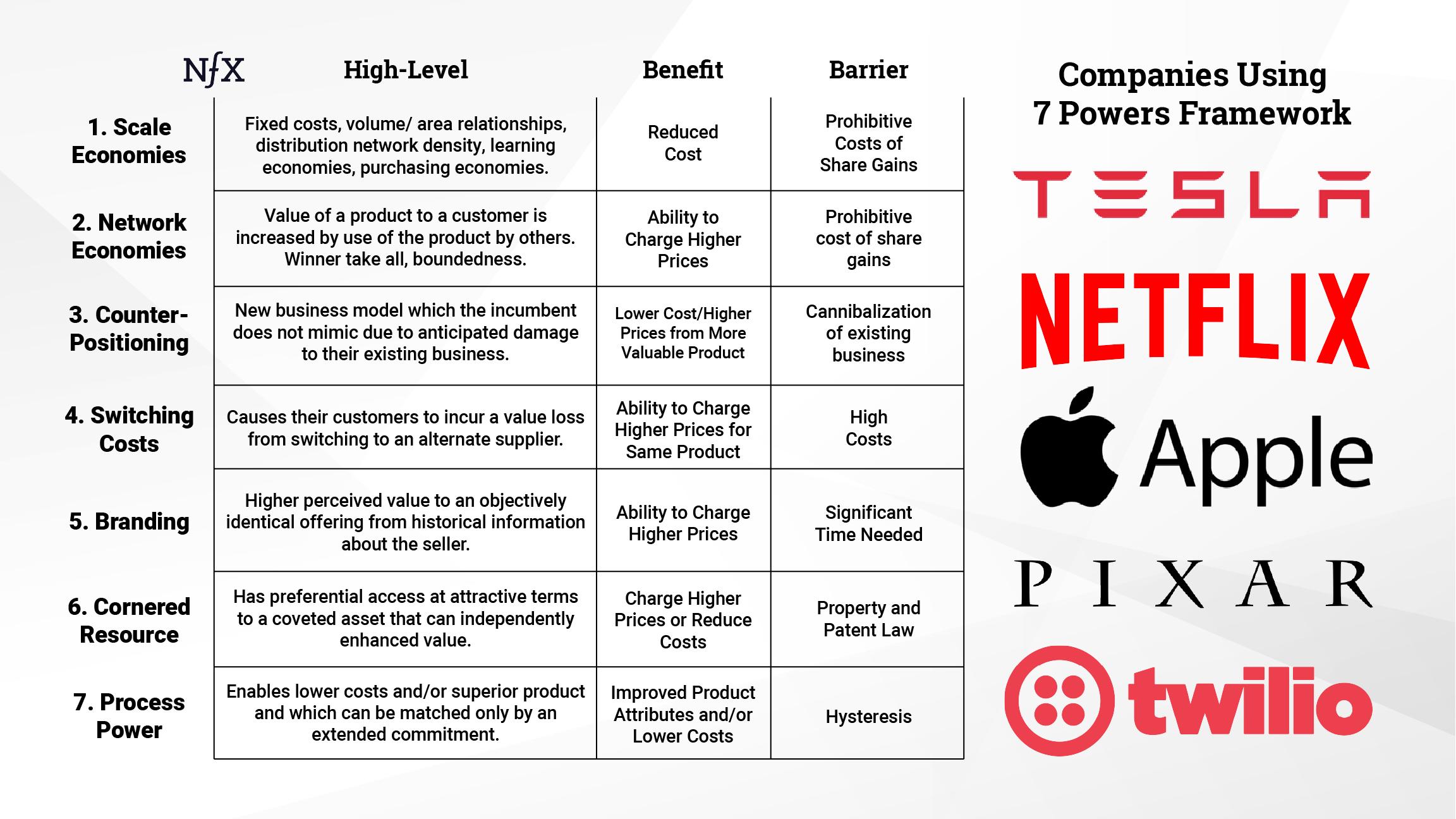

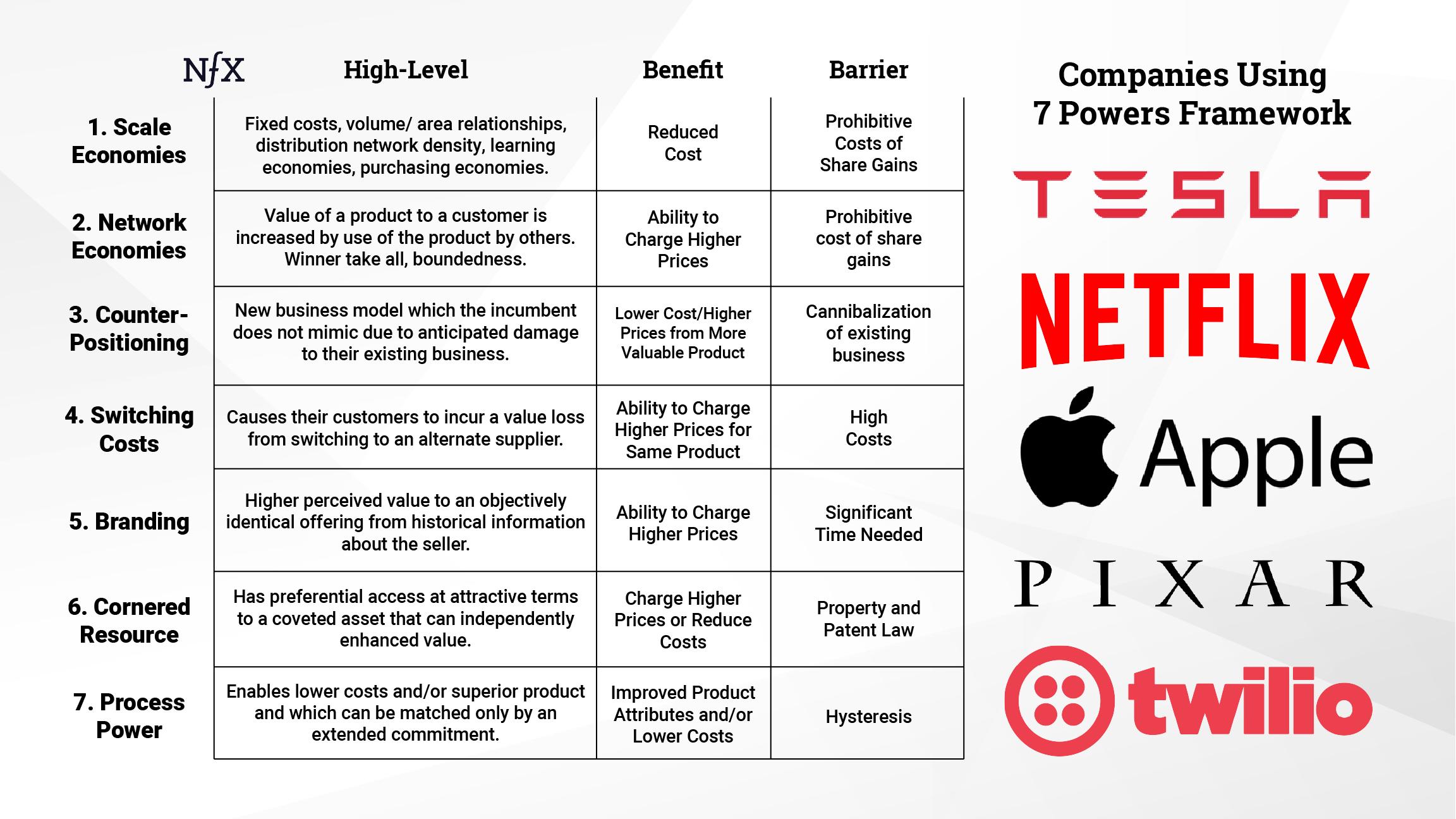

Look at today’s great CEOs running highly defensible companies — Jeff Lawson at Twilio ($67B market cap), Daniel Ek at Spotify ($56B), Reed Hastings at Netflix ($224B), and Patrick Collison at Stripe ($95B valuation).

They’re all practitioners of a little-known framework called “7 Powers” created by author, strategist & Stanford professor Hamilton Helmer. Helmer’s framework reveals that you can intentionally craft the conditions for persistent & durable differential returns.

In this special NFX conversation, Jeff Lawson (Co-Founder & CEO at Twilio) interviews Hamilton to analyze the 7 Powers, getting at the core question: What is it about certain businesses that keeps the force of competition away?

7 Powers is Hamilton’s cognitive guide to building an enduringly great business.

“Why I think strategy is a dirty word”

- Jeff Lawson: I’m going to start by saying why I think strategy is a dirty word, and then you can rebut that with your hypothesis for 7 Powers.

- What I have often told Twilio employees through the years is that strategy is a dirty word because it is this idea that the people at the top of the company have developed a strategy and everyone in the company is supposed to blindly follow this strategy, whether or not your customers want you to follow that strategy.

- Therefore, I’ve always thought that strategy is basically just a way of telling your people to pay attention to the C-suite and the executives of the company, as opposed to the customer.

- One of the things I’ve often said at Twilio is, “There is only one true strategy, build products and services for which your customers will pay you.” That is the one true strategy.

- Anything that distracts from that is really preventing us from executing the one true strategy.

- My example has always been, for some reason, this always has stuck in my head, Google Plus. If you think back to the early 2010s, Google clearly had a strategy, their strategy was to go beat Facebook.

- The strategy required integration of social across every part of Google’s properties. And from people I’ve spoken with, every product manager, every engineer, everyone on the front lines of building all those products were like, “Why are we doing this? Our customers don’t want this. It’s making the products worse.”

- But they pretty much had to do it because that was the strategy of the company. And sure enough, customers hated it.

- Nobody wanted it and they lost a lot of energy in building it.

- It’s not that they shouldn’t have tried something new. It was that this ‘strategy’ was driven by an executive idea of who their competition was, as opposed to what customers wanted. That has always been my example of why I call strategy a dirty word.

- But then I read 7 Powers and I started to think a bit differently about it. So, Hamilton, why don’t I give you a chance to rebut my natural skepticism of “strategery”?

- Hamilton Helmer: It won’t be much of a rebuttal because I’m in violent agreement with you. And in fact, it’s why I wrote the book because I believe that strategic planning is essentially an oxymoron.

- What you’re talking about is trying to treat strategy as something that’s a top-down plan that you impose on people.

- When you really understand it deeply enough and go back to what strategy is about, what you realize is that its roots, its first cause is inventiveness. That shouldn’t be a surprise. I think that’s the first cause of everything that’s really important.

- So the challenge that I tried to take on in my book was what I call the Mintzberg challenge. Henry Mintzberg was this wonderful strategy thinker way back when, who wrote this very influential article. He said that for strategy, you don’t sit down and think through logically and design strategy, but you actually craft it, which is very similar and consistent with what you’re saying, Jeff.

- This is something that evolves over time as smart business people are responsive to their markets and as their customers develop.

- So the question is what could somebody like me, whose whole career has been around this topic of what makes businesses enduringly successful, offer to anybody like you or your team who’s in this exercise of crafting.

- What I realized is that you have to be a lot more modest about it. It’s not that you hire me and all of a sudden I turn lemons into lemonade or something like that. It’s rather that I can provide you a cognitive guide to what builds an enduringly great business.

- The key there is the enduring part because that’s where strategy comes in.

- What I’ve learned after looking at hundreds of cases of companies I’ve advised, hundreds of cases that my students have pulled apart at Stanford, is that there’s a durability aspect, which is essential to this.

- So the natural question you ask yourself, what is it about certain businesses that keeps the force of competition away? What kind of thing do they invent?

- If you go back to Google Plus, one of the reasons, of course, is that social is a multi-sided platform and you have to get critical mass. If you don’t get there, there’s no value to customers.

- They didn’t get there so it was just not worth much.

- My book is really about what it takes to develop one of these structures that gives you this durability. That’s what power is.

- Jeff Lawson: I liked that you reframed the notion of strategy. I’m always amazed at what people call strategy.

- I tend to say, “I don’t think that’s a strategy. I’m pretty sure it’s just an idea that you’re calling strategy because you want people to pay attention, as opposed to it really being a strategy.”

- I like that you don’t really use the word strategy very much in the book. You define what the real goal is, which is power.

- Power is kind of a funny word, right? Because it can be perceived as control or all sorts of things that antitrust regulators might not want.

- But power, in your definition, is essentially the idea that you can craft the conditions to create durable returns for shareholders to get long periods of outsized returns, to paraphrase your language.

- And that stuck with me because that is clearly the goal of every business leader and every entrepreneur. It’s not to have a strategy or align the troops or anything like that. Really, what you’re trying to do is to create outsized returns and do that durably.

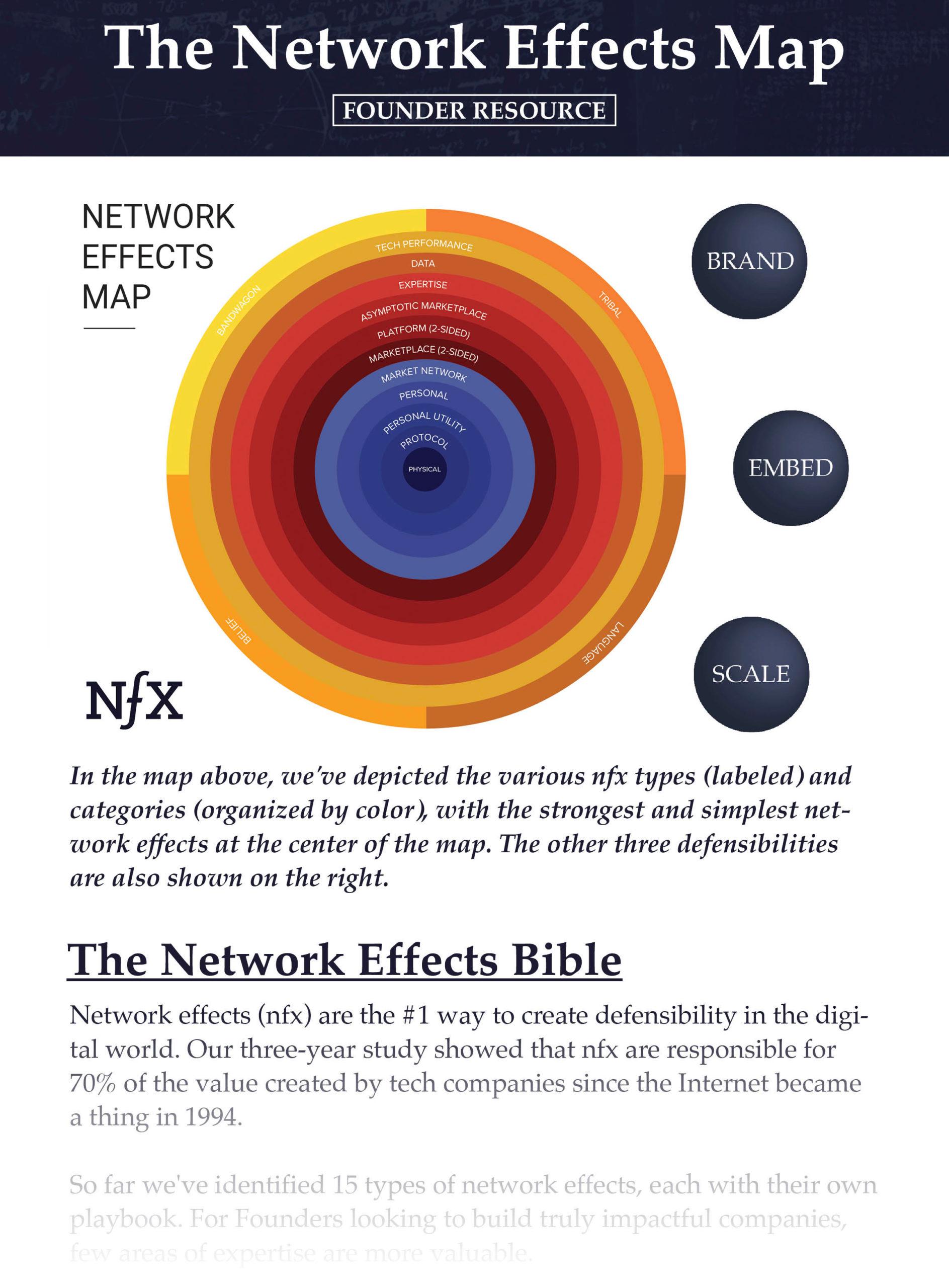

1. Network Effects

The value of a service to each user increases as new users join the network.

- Jeff Lawson: There’s only one idea of strategy that seems to have taken hold in the technology world and it is essentially network effects.

- I remember fundraising for Twilio and there were a bunch of VCs who had listened to the whole pitch and then at the very end, they just said, “And how do you have network effects?”

- I would say, “Well, we’re not Facebook. If that’s what you’re looking for, it’s the wrong conversation. But there are a lot of ways in which we can build a great business here. It’s not going to be based on network effects though.”

- What I like is that you talk about other forms of power too.

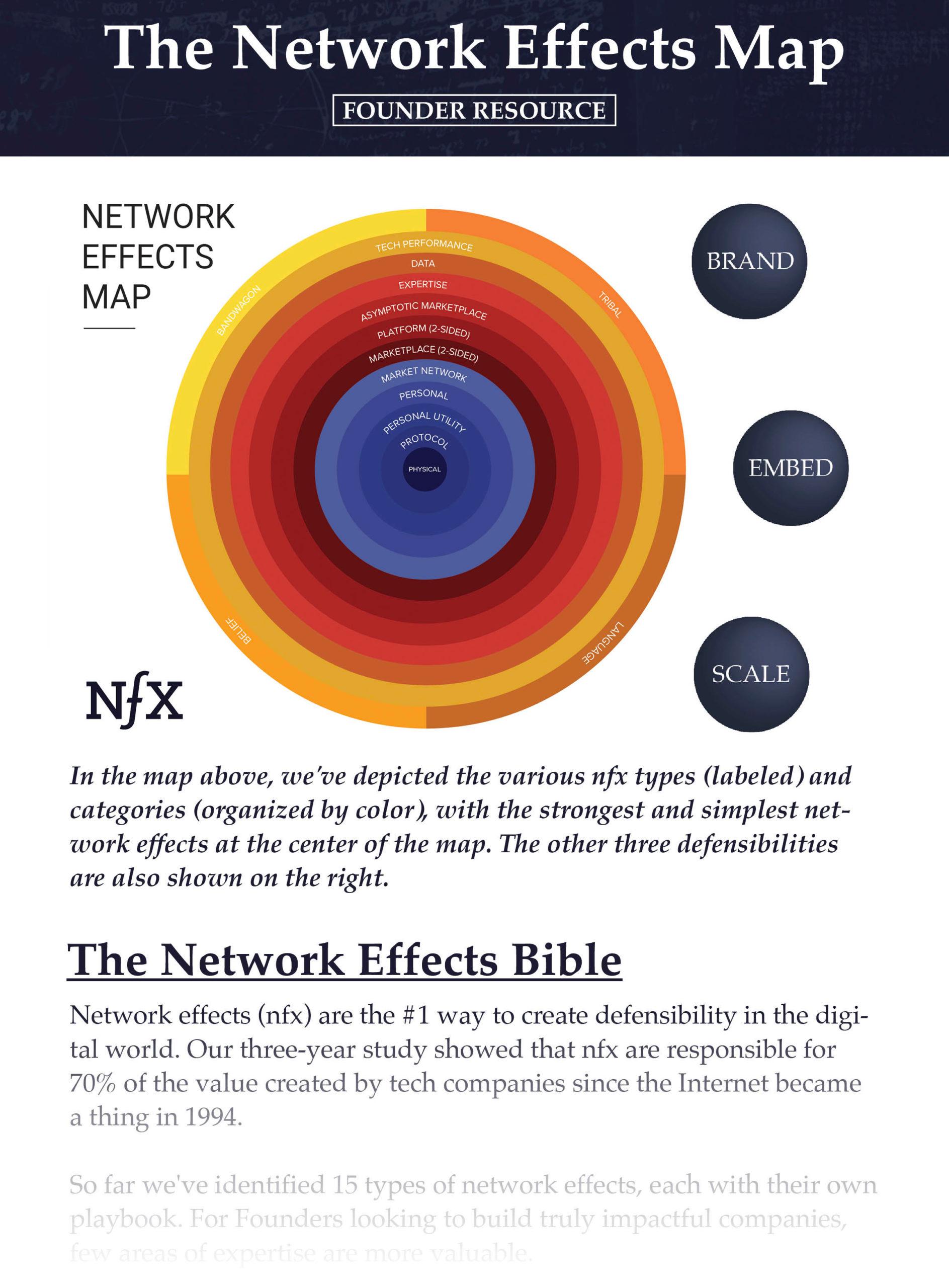

- There’s one power called network economies, but there are 6 other powers and great businesses can have any number of these. In fact, several of them can work in conjunction together.

- Hamilton Helmer: That’s right but first I want to step back and just talk about building a business and how that relates to network effects and network economies.

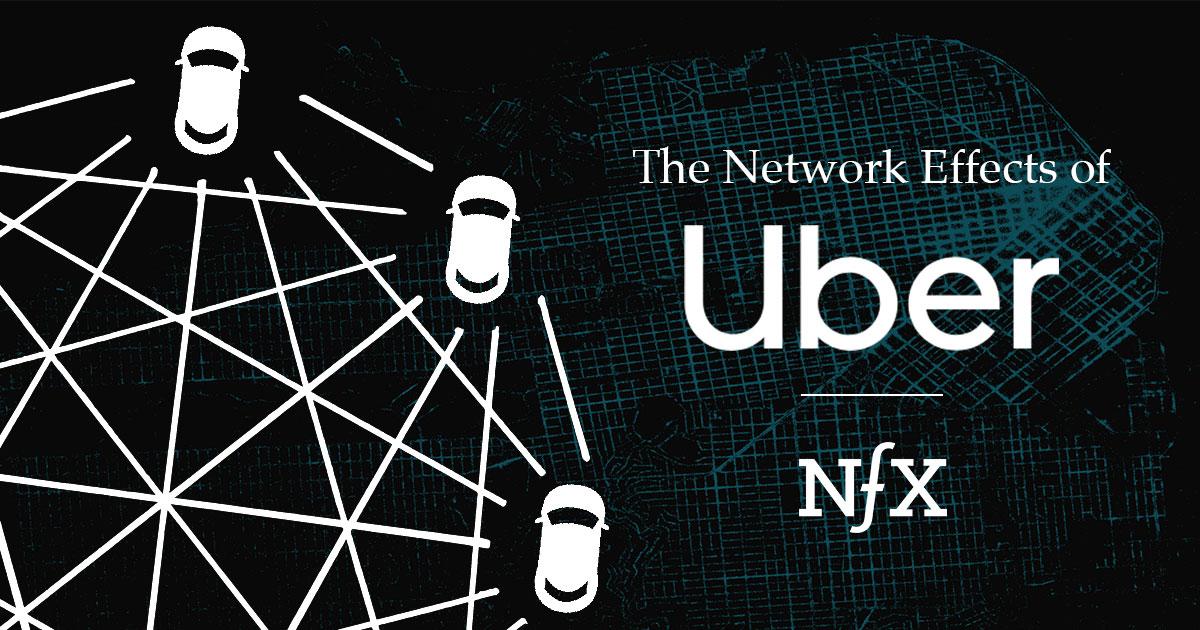

- I’m going to use Uber as an example. Think of what they’ve been through, creating this incredible invention: a multi-sided platform that revolutionizes human transport, then off the charts scaling. It’s just incredible.

- The investment community has gone wild for them. You would think that in some way that would be enough as a business person. But the issue there is that you need an economic structure that would capture some of the value that they’ve created because they’ve created enormous value.

- There’s this incredible value and there are network effects here, but the problem is that more than one company can benefit. Lyft can also take advantage of that incredible value and compete with Uber in that market.

- Network effects, in this case, are a profound driver of product-market fit. One of the key things about my book is that product-market fit is actually more or less orthogonal to long-term profitability.

- You can create tremendous value for customers, but you have to be able to keep some of that for yourself. If you don’t, it will end up being a business that’s just not fun to manage, your investors will be after you. Eventually, you’ll probably attract activist investors. Whereas, if you do find a way to have power, you can become an iconic company.

- So in the case of Uber, if you think of what keeps a competitor at bay, it is that there are scale densities in specific geographies. It’s actually an economies of scale play.

- But the problem here is that if you ask the question, what happens to the average distance between two entities, like a driver and a passenger for Uber, that varies with the end route?

- Of course, there’s a two-dimensional space, it’s geographical, so it’s a square root function, which is to say, there are diminishing returns.

- The larger area you have, the less the advantage an Uber would have over somebody like Lyft. You can easily have two competitors in large markets.

- They can compete against each other and that will be the basis of their competition. They’ll both benefit from the network economies and so it actually isn’t a source of power.

- Network economies are one of those things that’s profoundly important for product-market fit, but it’s one that is much rarer in power. That’s a confusion that often takes place.

2. Cornered Resource

A business that leverages a cornered resource has preferential access at attractive terms to a coveted asset that can independently enhance value.

- Hamilton Helmer: If you have rights to certain resources, or assets of some sort, and those can’t be taken away from you, that’s what I call a cornered resource.

- They are materially valuable and sufficient so that if they were transferred to another company, they would also enjoy the economic benefit of them.

- Where this looms large is in patented pharmaceuticals. If you develop a drug that really works and you have the patent on it, that’s super valuable. And if you transferred it to somebody, they would enjoy that same value.

- The example I use in my book is less obvious, which is Pixar.

- What happened there was in the early stages of Pixar, there was an early group that went through the hell of developing Toy Story One and Two and Bug’s Life and learned how to work together in this incredibly creative way.

- Every person involved in that became able to direct these amazing movies. And Pixar ended up with this incredible string of successes, really unparalleled in the movie business.

- Since then, they’ve been a cornered resource, comprising the talent that it takes to make these digital films. The entire group is the cornered resource.

- Individually, there are talents like that, Steven Spielberg, for example. But a studio pays for individual talents.

- It’s the person that realizes the creativity, not the company that hires Steven Spielberg.

- But in this case, this group was devoted to Pixar. If DreamWorks wanted to hire them away, they wouldn’t go. Disney, in fact, tried to hire back some of them and they wouldn’t go.

- Eventually, Disney bought them. They were a valuable resource that created the success of the company.

- If you take that a step further and you look at the later directors, it wasn’t that this guaranteed that anybody who came to work for Pixar could make an amazing movie. The later directors had more trouble and were replaced more often.

- If you think of the strategy question for Pixar, it’s adding to this director pool.

- There’s this initial group that was their cornered resource. And for Pixar to continue on into the future to be a great company, they need to add to that director pool.

3. Scale Economies

A business in which per unit cost declines as production volume increases.

- Hamilton Helmer: Scale economies occur if there’s an economic relationship when as volume increases, cost per unit goes down. It means the leader has an advantage.

- So if you’re larger, you have a lower cost position, so that means at the same prices you make more money. That’s a great thing.

- The example I use in my book of scale economies is Netflix.

- Netflix went through this incredible transition when they had this bruising battle with Blockbuster for their red envelope business and eventually they emerged.

- But had Blockbuster taken them on a year earlier, I’m not sure they would have made it. I think Reed would agree with me on that.

- So they have emerged, but that’s not enough. This just gives you an idea of how hard it is to be an entrepreneur. It wasn’t enough because they knew that physical delivery was eventually dying as a technology.

- They knew that it would eventually be replaced by streaming so they had to go into the streaming business.

- But the problem with the streaming business is that if you’re just a distribution channel, anybody can do that. The technology isn’t that hard.

- Netflix went at it the way you would hope. They tried it out. They did their ‘Watch Now’ feature and it turned out to have modest success.

- But then they did the Starz deal and the Starz deal gave them a lock on content that was really attractive to a lot of people. All of a sudden their subscriptions just skyrocketed.

- Now with product-market fit, they thought, “Whoa, streaming really does it.”

- But the problem was the Starz deal was a one-off deal. I think it was $30 million or something with Starz. Nobody had any idea that it would be that valuable.

- The question was, could they do an at-scale deal where people realized how valuable this was but they’d still be able to do it?

- They did the Epix deal, which I think was for a billion dollars. What happened with that was now, all of a sudden, they were getting exclusive rights to content and there are scale economies in that because exclusive rights are a fixed cost.

- If you think of a single production, think of when they did the show, House of Cards, for say $100 million dollars.

- If Hulu had done the deal, Hulu was about a 10th their size at the time, the cost per viewer would be 10X. Netflix’s cost of content per viewer went down with scale.

- This is a case where the scale of content, which is about 50% of their cost structure, would not diminish. The scale economy would continue over time and remain powerful. That’s an important source of power.

- The key thing here is that they could have prices that would give them very good profitability, but not so much for Hulu.

- This advantage could go on forever. It’s these underpinnings that lead to a durable, iconic company.

4. Switching Costs

Stickiness of your product can protect you from the forces of competition if it locks your customers in.

Jeff and Hamilton didn’t spend much time on switching costs during their conversation. They quickly moved on because they reasoned that it was one of the more obvious powers, but for the benefit of Founders, here is more context on switching costs:

- SAP is a classical example of switching costs.

- Enterprise software like SAP is not only expensive and time-consuming to implement, but they typically require customized workflows and training for employees.

- After vendors achieve lock-in, customers are far less likely to switch to an alternative even if another product is superior.

5. Counter Positioning (Hamilton’s favorite Power)

A newcomer adopts a new, superior business model which the incumbent does not mimic due to anticipated damage to their existing business.

- Hamilton Helmer: Counter positioning is my favorite. It is actually rather contrarian.

- Of course, from an investment side, it’s terrific because it’s contrarian enough that it often represents good investment opportunities.

- What it involves is that, as a challenger, you develop a new business model that creates value so it’s better for your customers. But for an incumbent to mimic it would cause them serious damage to their business.

- It’s a little different than the classic innovator’s dilemma. There are some fine points to that because it doesn’t always involve technology.

- I’d say In-N-Out is a counter position against McDonald’s and so on.

- This applies with the software eats the world perspective. When a company develops a new business model that’s based on software and the incumbents are not software companies, to be able to now become a software company often implies they have to blow up their company.

- They have to have different people, different compensation structures, a different organization, and a whole different perspective on life.

- My view of, for example, Apple with the iPhone versus Nokia was that Nokia was an incredibly effective hardware company. They had supply chains that were finely tuned, their product development cycle was masterful.

- But Apple came along with a product that’s basically software-driven, which confronted Nokia with this existential dilemma of accepting somebody else’s software or trying to do it themselves, which they couldn’t do. They would’ve had to blow up all their existing business.

- Quite frankly, this is what VW is facing now against Tesla. I give Diess (CEO at VW) extremely high marks for how aggressive he’s being in understanding that threat.

- I think software-driven businesses are canonical examples of counter positioning, where the incumbent just has this terribly difficult choice.

- But, Jeff, let me ask you. You’ve developed a software-driven company and there are other approaches to what you do that are not software-driven.

- Have you found that for your non-software-based competitors, for them to try to adjust to your software-first approach, was an almost impossible task for them?

- Jeff Lawson: I think oftentimes the counter positioning comes in the form of the economic impact because that’s what really keeps companies from being able to adapt quickly.

- When you’re driving at the core economic engine of a company, they see the world through the lens of that engine, and they are so hesitant to adapt because it could mean an existential crisis.

- At the very least, there could be disruption in their shareholder base. But it’s also just a mindset.

- It’s like when you see the world a certain way, it almost is unfathomable to see it a different way.

- I wouldn’t have called this counter positioning because it was just the obvious thing that our customers wanted, but it shows up in how we paid per use or how we charge per use.

- The pricing model of Twilio is you sign up for Twilio, you spend your first penny to send a text message, make a phone call, do a video session, or have a chat.

- You just take these embeddable building blocks and you only pay for what you use.

- In an industry where there’s so much around the selling of seats and licenses in software, or on the Telco side of having a two-year agreement to buy a line that’s bundled with voice messages. If you’re a developer building a new service, testing out a new idea, you don’t want to sign a two-year deal and you’re not buying seats. There’s no such thing as seats.

- You just want to start prototyping and spend as little as possible because the more you can reduce barriers and friction, the more ideas you can enable.

- Experimentation is the prerequisite to innovation. Therefore, our job at Twilio is to encourage as much experimentation as possible.

- I think it turns out that it’s very hard for companies that are accustomed to selling seats, licenses, or two-year deals and line access to switch.

- It becomes very hard for them to think of a business where they’re going to sell something for a fraction of a penny because they’re like, “How do I incentivize my sales team? I’ve got a big sales team. I got to feed the sales team.”

- And the ASP that used to be $100,000 is now a penny? I can’t feed a sales team like that.

- So you get this entry point where people don’t know what to make of it. They can’t fathom, how could that possibly be a business?

- They certainly don’t know how to execute and they have no will to execute on it. That gives you a many years head start to build value before someone might wake up and say, “Oh wow, there’s something there. Maybe we should think seriously about this,” but it’s really hard for them.

- Even once they wake up, it’s really hard for them to do it, let alone the fact that they will discount it for long periods of time because they just don’t understand it.

- Hamilton Helmer: The heart of it is that it strikes at the economic model.

- Again, using the Netflix example, when they first started, HBO was a powerhouse, they were much larger and very profitable.

- HBO went through video providers, Comcast, and so on.

- So Netflix went over the top, direct streaming, and for HBO to contemplate doing that business model, you can imagine the reaction that they would get from Comcast. They’d say, “You do that and you’re off the system.”

- So that prospect of their economics turning so badly on them makes them drag their feet, and drag their feet, and drag their feet.

- It is quite common in software models for incumbents to have that difficulty.

- Again, I’ll come back to the Tesla case, the idea that a car is a software platform all of a sudden changes everything.

- Now, if you think of a traditional automobile, ICE manufacturer, or automobile manufacturer, they have these elaborate supply chains. And in those supply chains, there is embedded technology.

- The distributor has a certain technology, or the fuel injection system, or this and that. And all of those sub-components have their own integrated circuits.

- Jeff Lawson: My favorite part about the counter positioning of Tesla versus auto manufacturers, and I’m from Detroit originally, is the dealer network.

- If you think about it, Tesla doesn’t have dealers. Literally, the State of Michigan passed a law that said it is illegal to sell a car, not through a dealer.

- You can’t buy a Tesla in the State of Michigan because they legally require dealers.

- But here’s the interesting thing. You could say, “Okay, we’re going to roll out electric cars to all of our dealers.” And what do the dealers say?

- Well, they make all their money, not by selling the cars, but by servicing them, and electric cars have 5% the number of moving parts than an ICE car does. Therefore, they break less often.

- The dealers would make no money, so they say, “Well, we don’t want electric cars.”

- The dealers were very hesitant because they saw that it would erode their ability to make their profit. It’s fascinating.

6. Brand

The durable attribution of higher value to an objectively identical offering that arises from historic info about the seller.

- Hamilton Helmer: There is a real difference between branding as power and brand awareness. Not that brand awareness isn’t important, but you can buy an ad in the Superbowl and you will have brand awareness. You’ve paid for it.

- But branding is something that’s far more durable than that. What it involves is building up an understanding in your customers so that they attribute a higher value to your product, even though the competing product may be identical, objectively.

- An easy example is when you go into a shop, you may pick up Del Monte pineapple, rather than the Walmart brand or the Safeway brand, just because you have a certain amount of trust that that’s going to be a quality product. You know what you’re getting.

- If scientists opened the two cans, they’d probably find they were identical, but you’ll pay more for the Del Monte brand.

- To build up that perception for people to pay more takes a long time of people becoming familiar with something.

- It can be this expectation of additional quality, or it may be that you just have a good feeling about it, so that you like to be seen with it.

- As another example, some people pay $50,000 for a Hermès handbag.

- They’ve developed this understanding with their customers over time, it’s something that they trust more or they just want to be seen with it.

- I think in the tech world it’s less common to see branding in this form. But I think there’s no question that Apple has it.

- This was the result of a very long process of Steve Jobs emphasizing aesthetics. Not just talking about it, but actually building aesthetics into their corporate culture.

- The customers now think there are many people who would prefer to be seen with an iPhone than with a convenient product, which is not to say the products themselves aren’t great.

- The key thing about brand is that it takes a long time to develop. It only works in certain types of products and I think Apple is the canonical example of it in tech.

7. Process Power

Embedded company organization and activity sets which enable lower costs and/or a superior product.

- Hamilton Helmer: Process power is another power. The example I used in my book is Toyota and lean production.

- If you have an incredibly complicated business process, think of automobile production, and all the supply chains, and the production itself.

- Over time, bit by bit, you do a little of this and a little of that, and it gets embedded in how you do things in the company. Often, it’s what one of my old professors used to call tacit knowledge.

- It’s not even written down in many cases, but all those things together are enough to be material.

- In other words, it’s enough to move the profit needle.

- It turns out that a competitor who wants to do it has a terribly difficult time. It could be because it’s too complex, there are so many little things they have to do, or opacity, that nobody even really knows exactly what’s going on.

- The time cost of being able to do that is so long you end up like Toyota, gaining a lot of market share and being highly profitable.

- But, Jeff, there’s an important caveat about this, which you know as CEO, most of your time is spent on operational excellence. Let’s make this organization as great as it can be.

- You’re not spending all your time thinking about strategy, you’re thinking about how to make this a great organization. But most of the time that’s not power and most of the time it’s something that can be emulated.

- It’s absolutely appropriate that that’s what you spend your time on. But, most of the time, it is just something that another company can do by hiring away the people you get.

- There are armies of consultants that teach people best practices. But they’re usually something that can be imitated over time.

- So process power is extremely rare. Toyota is a good example. But most of the time operational excellence, in the end, isn’t power.

- One more caveat, which is that in getting to power, operational excellence is unbelievably strategic.

- I’ll give you an example of that, which was in the early days of Apple. They had this incredible lead in personal computers and they owned the operating system, so they would have had power network economies from that.

- And yet, when it went from the Apple two to the Apple three, this was an execution issue. They completely dropped the ball.

- It was very costly, their pricing was wrong. And it just opened the door for the IBM PC and Microsoft Standard and almost caused the company to end.

- So, in getting to power, operational excellence is absolutely critical. But in terms of establishing a position of power or of having a position of power, it’s typically not enough.

- There are those rare cases where it is like Toyota, where it’s so complex and takes so long that you can’t do it. It’s an uncommon form of power.

A Founder’s Strategy Menu

- Jeff Lawson: One of the things that I heard you apply to almost all of these powers is that they take a long time, a lot of discipline, and a lot of focus to achieve.

- You don’t get them overnight. You usually don’t get them accidentally. It is a long period of focusing, repetition, and culture in a lot of the cases too, to achieve these powers.

- So, how do you think that an entrepreneur today should think about the journey to developing power?

- Hamilton Helmer: Great question, Jeff. It really gets to the heart of the matter.

- The key thing here is that, first of all, getting to a position of power is a creative act. You’re figuring out something that hasn’t been figured out before.

- You’re not just copying something, you have to figure it out. And that takes place, as you say, over time, as you react to what customers want, how the technology is progressing, and so on.

- The message that I would like to convey here is that the overall types of power, the genotypes, if you will, are simple. There are seven of them, as far as I know.

- But the phenotypes, the specific instantiations of them for each company, are incredibly complicated.

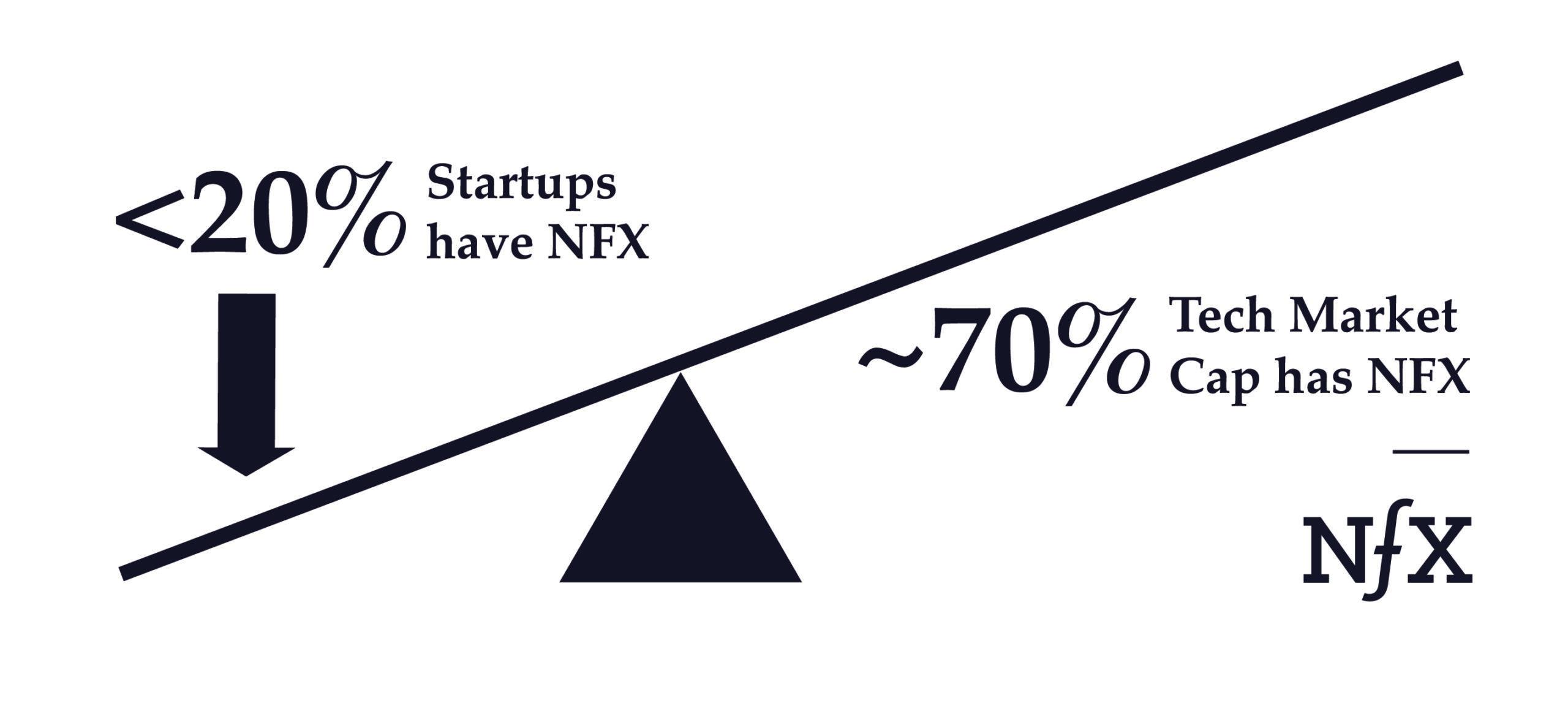

- We’re doing this interview with NFX and their business is based on the incredible complexity and subtlety of network effects. That’s true across all of the powers.

- As a business person, you have to go into this environment and ask yourself, how can I create one of these seven powers? And look at what’s coming at you over time.

- This is a hard thing to do. After you’ve had this amazing experience of getting product-market fit, you go, “Oh God, the journey’s not done.”

- But that’s the challenge. It’s that over time you have to figure these things out. It’s very different than product-market fit. You have to think in a different way.

- What my book is about is just giving entrepreneurs and business people an understanding of what those structures are for pattern recognition, as they’re going through that process.

- Jeff Lawson: Thank you so much for joining us today, Hamilton. It’s been great talking to you. I feel like we’ve just skimmed the surface of the 7 Powers framework.

- For anyone who’s interested in really diving in, there’s the book out there, I’d suggest you read it.

- I found it to be a very useful tool for organizing the toolkit that we, as entrepreneurs and leaders, have to build durable businesses that are going to create value for long periods of time.

- Having that menu, so it’s not just words sitting out there and it’s certainly not just, “Hey, ‘strategery’ everybody.” It’s actually an organized framework of the various ways you can go about building power.

- It’s enlightening, so check out the book.

- Thank you, Hamilton, for giving us a window into your brain and into your thinking today.

You can listen to the entire podcast conversation here.