Real estate has always been more than just the largest asset class in the world. It is the embodiment of home and work, family and business – the opportunity of generational wealth, writ large. The American dream.

One that has become increasingly out of reach to most Americans.

But, obscured by news of 14-year-high rate hikes, outsized mortgages, rising rents, and company layoffs, there is something important and largely positive happening at the edges of the real estate industry:

Paths to ownership of real estate are expanding. What “ownership” even means is also expanding.

It’s easy to see more constriction than expansion, and for good reason. Affordability and access to traditional home ownership has only eroded since the housing bubble in 2008, as lending standards tightened and home prices have soared in recent years.

And yet, restriction breeds innovation and market changes create opportunity. From the front lines with proptech Founders, we’re seeing early signs of a real estate revolution.

Source: McKinsey. Real estate continues to be, far and away, the largest asset class in the world. Its sheer size and dominance is often underappreciated: Real estate accounts for two-thirds of global net worth. In the U.S. alone, housing stock is worth approximately $43.4 trillion.

Over the course of my career, we’ve witnessed major shifts in the technologies and models underpinning the real estate market.

I started Trulia in 2005 initially to make it easier to find and buy a new home – to democratize access to information. This was Real Estate 1.0.

When we merged with Zillow in 2015, Real Estate 2.0 was just beginning. The Real Estate 1.0 companies, as well as new entrants, were focusing on streamlining and removing friction from the core “buy-sell” real estate transaction. The majority of the industry is still in this transaction revolution, and there continues to be great opportunity for growth and improvement.

Now, there are early signs of Real Estate 3.0, where startups are creatively tackling problems of affordability and accessibility of real estate. We’re starting to see viable ownership models that better align interests and unlock access for net new participants, via new paths. We’re going to see interesting ways to buy and sell real estate, both the physical model as well as the asset class.

Real Estate 3.0 is sparking to life on the periphery of proptech and will be moving inward toward the core of the industry over the next 10 years.

Once it reaches full expression, it will be nothing short of an ownership revolution.

Layers, Not Eras

To best understand the shape of Real Estate 3.0, it’s necessary to first examine the foundations we’re building on and how proptech has progressed.

Often when examining an evolution, we tend to think in distinct eras, where one gives way to the next. But Real Estate 3.0 is better framed as layers, not eras – in which one layer builds on the last and enables an increasingly more valuable stack.

Real Estate 1.0: The Information Revolution

The first phase of tech adoption in the home-buying process was Real Estate 1.0, an information revolution enabled by the internet. The problem was the lack of information about one of the most important financial decisions a person can make: buying or selling a home.

At the time, the real-estate information market was dominated by powerful incumbents, most notably the National Association of Realtors, which had 1M+ members and a chokehold on the MLS data, who were concerned about the internet eroding the role of real estate agents and reducing commissions.

But companies like Trulia and Zillow took traditional real estate analog research processes and made them digital and easy to use. Comprehensive and easy-to-access online property information became available to the public for the first time. You could see all the pictures and maps, find out what your own home was worth, and finally know how far your money could go.

This was revolutionary because it democratized real estate knowledge. It created a generation of educated and newly empowered homebuyers and sellers.

It also created central databases of real estate market data – an infinitely valuable resource that continues to enable further innovation today.

Assaf Wand, Founder and CEO of Hippo, a home insurance company, described it like this:

“We now have data abundance. Any transaction that happened in the last 20 years, it’s all documented. It’s all there. Just go to Zillow and type an address. You have so much data on every home, from taxes to size, pictures inside the house, every transaction that’s happened. Suddenly, at Hippo, I don’t just have five or 10 million customers. I now have information on 130 million households in the U.S.”

Real Estate 2.0: The Transaction Revolution

With Real Estate 1.0, we achieved the democratization of information and data, but a problem remained. The majority of home buyers and sellers could easily find homes online – but they were subjected to a complicated, costly, and slow transaction process. Even today, for many, closing a sale still takes weeks or months, and still requires in-person meetings and paper contracts. This can cost tens of thousands of dollars including commission, title costs, and other fees. Not to mention time.

Streamlining the user transaction experience is at the core of Real Estate 2.0. We continue to look for ways to make it easier to transact in this space by reducing friction, cost, and uncertainty within the buying and selling processes. In the last few years we have seen several innovative transaction models take root.

For example, there are two NFX companies transforming the transaction on the buy-side. Tomo is a digital mortgage provider streamlining (and accelerating) the entire process. Ribbon is a transaction platform and speciality real estate finance service that works with consumers, mortgage brokers and real estate agents. Traditionally, these three parties have all had offline or siloed workflows, leading to a time-consuming home buying process. Ribbon is bringing those disparate threads together – another example of the transaction revolution at work. On the sell-side, companies like Opendoor and Offerpad are also working to speed up and clean up the selling process. Taken together, all these companies are rapidly evolving transaction models aimed at improving the experience for consumers overall.

We remain squarely in Real Estate 2.0 today. As an industry of investors, Founders and consumers, despite a pull back in recent housing demand due to increased interest rates, we are experiencing a great deal of success and advancement here. We’re seeing growing market adoption of companies offering streamlined transactions to buyers and sellers, renters and landlords, commercial businesses and their property managers. The overall user experience of proptech is starting to feel much more like a consumer interaction, to the benefit of us all.

Introducing Real Estate 3.0: The Ownership Revolution

In Real Estate 3.0, the very concept of ownership is what’s at play. Ownership structures and mental models are both changing.

The real estate mental model for years has been: white picket fence, 30 year mortgage, kids, job. This model bundled together both financial and cultural ideals: you live the American dream, and own a financial asset that generates wealth over time (thereby securing that dream for future generations).

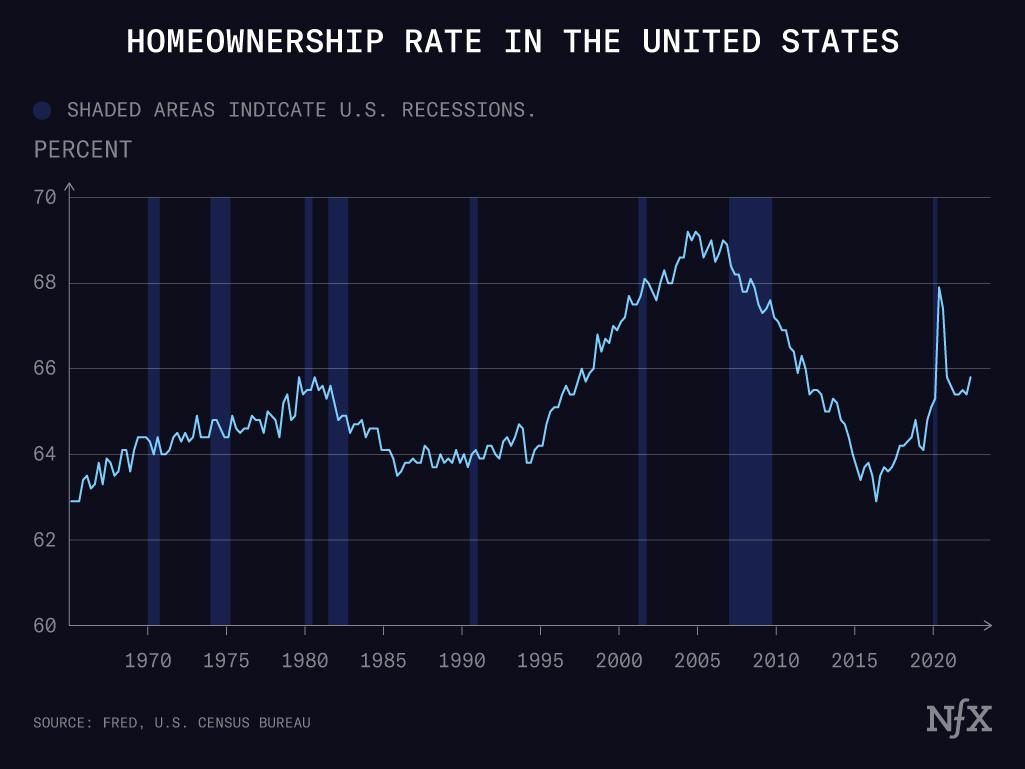

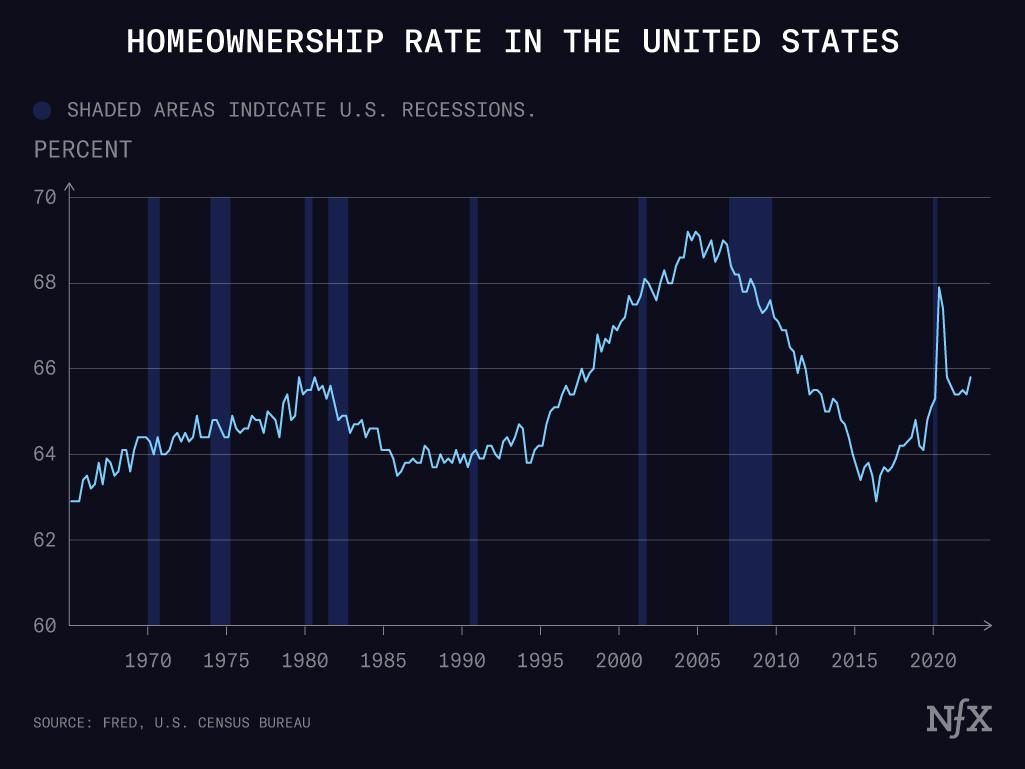

This type of “classic” residential home ownership is likely not dying. 65% of families in the US are home owners. There’s a reason this number has stayed within a remarkably narrow range of +/- 4% from an average of 65% over almost 60 years. A home is still seen as financial stability, security, safety net. Despite exciting rises in nomadic living fueled by the pandemic, when it comes to schools and families and establishing community, being in one place and owning is going to continue to be important for most Americans. Certainly not all, but most.

This might prevent these people from being early adopters of too much early innovation too quickly in Real Estate 3.0. We’re still in the very early days.

Despite a consistent home ownership rate, as markets rise and wealth gaps widen, property ownership has begun to feel like a luxury. Extremely high prices of a whole, heavy asset – a whole home – stops people from entering the market. According to a 2021 Pew Research Center survey, 70 percent of Americans believe that young adults have a harder time buying a home than previous generations.

This is the problem and the opportunity driving Real Estate 3.0.

Real Estate 3.0 Drivers & Multipliers

Today, Real Estate 3.0 builds on its 1.0 and 2.0 predecessors, and now with new multipliers.

These are the conditions, drivers, and multipliers of Real Estate 3.0:

- Abundance and transparency of data

- More educated consumers than ever before

- Proliferation of fintech platforms

- Continued digitization and automation of processes

- High barriers to entry fueling a new generation of discontent/demand for new access

- Founding teams and executives who have deep experience of the capital markets, and can also build break-through software products

- Ever more institutional capital flowing into proptech – in the first half of 2022, $13.1 billion was invested in real estate technology companies, including commercial, construction, residential, industrial, and other real estate sectors, an increase of 5.65% over the previous year.

- Plus the not insignificant accelerant of new web3 technologies – blockchains, crypto, smart contracts, tokens and more.

When you can digitize, take out cost, and break apart the ownership model, we see things change quite meaningfully.

New Ownership Models

If web3 is generally communicated as products and services that turn internet users into owners, then the feeling is mutual for Real Estate 3.0 – where we are working to increase access to entirely new kinds of ownership.

There are several new models expanding the definition of owners and ownership.

What if, instead of owning an entire home, you could own a piece of one?

What if, instead of paying rent forever, those rent payments earned you fractional pieces of your house (or your business’s property)?

What if you could own slices of other people’s homes as an asset, and sell them as easily as you would a share of GOOG on the Nasdaq?

The idea that home ownership can be both fractional and/or a widely available asset class is an interesting development that increases access for more consumers to participate in the larger real estate market.

In these early days of Real Estate 3.0, ownership innovation is emerging in niche sectors that have traditionally been underserved by the stable and ever-supreme, government-backed U.S. mortgage industry. It’s also creating new sectors that haven’t existed before.

- Rent-to-own

- Lease-to-own

- Single family rentals

- Vacation homes

- 2nd homes

- Real estate as a digital financial asset to trade

- Co-ownership

And while these innovations are mainly happening around the periphery right now, they will find a more central locus over time and make a real impact on traditional real estate.

5 Areas of Opportunity in Real Estate 3.0

Contrary to the popular saying, sometimes you can better understand the forest by examining the trees. Let’s take a look at the opportunities we’re seeing within Real Estate 3.0, and a few of the new companies exemplifying each.

We see at least 5 areas of opportunity for startups working in Real Estate 3.0, and will identify more over time.

Opportunity 1: The Evolution of Rent-to-Own

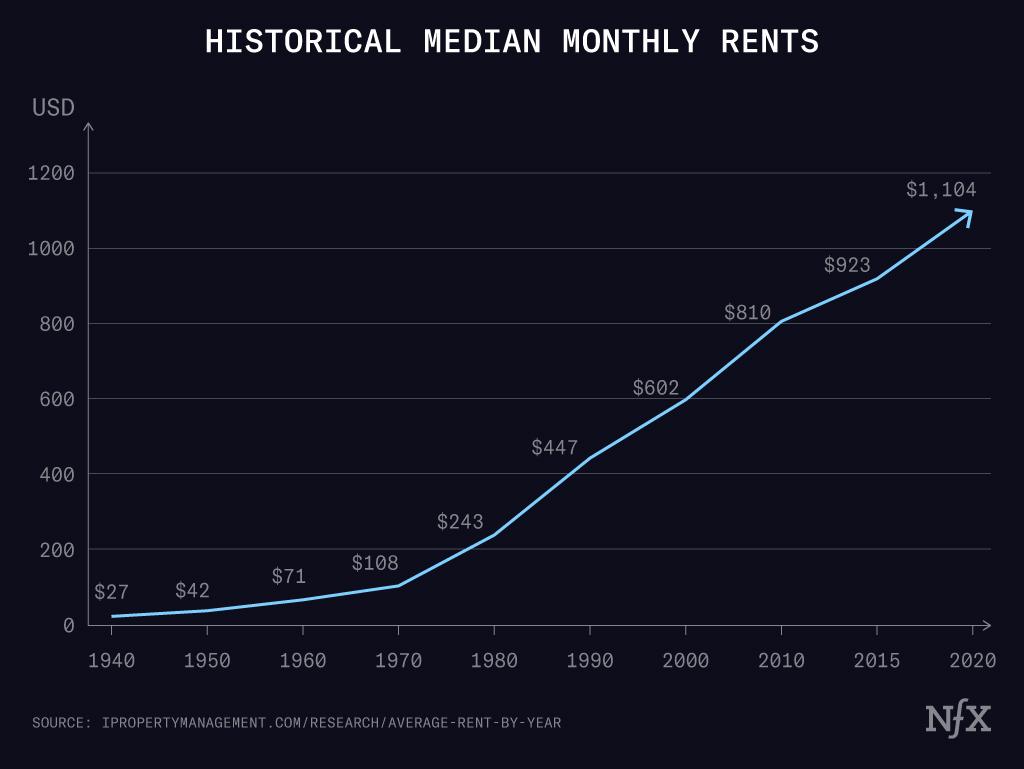

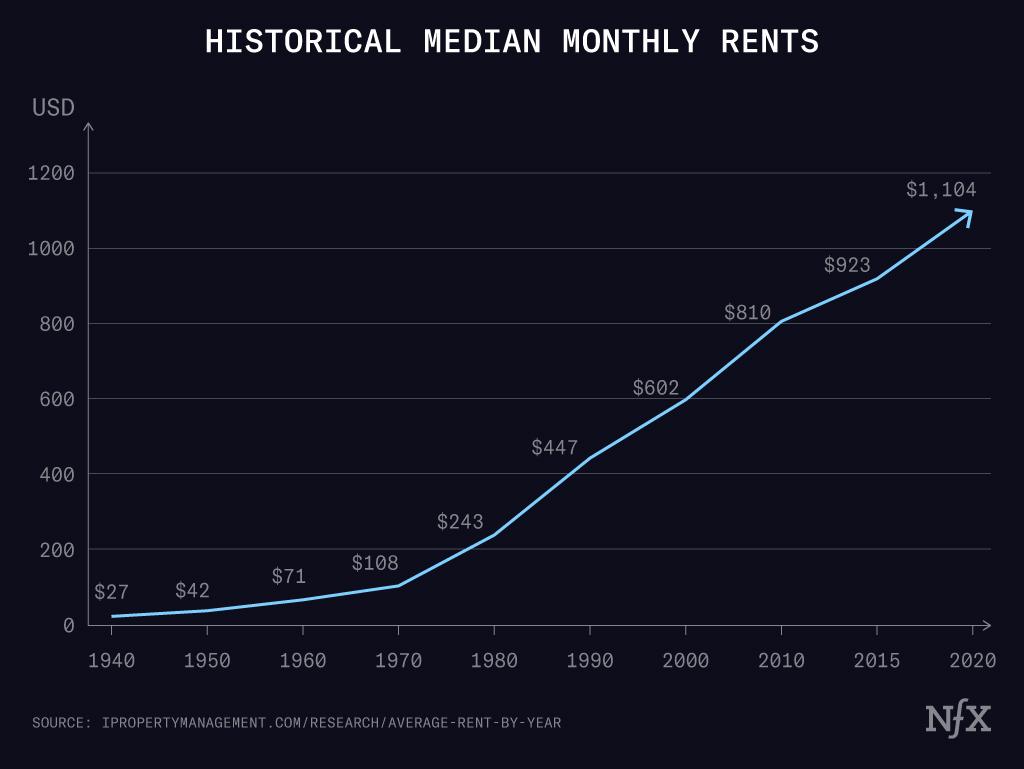

Renting has long been the main alternative financial structure to owning. Sometimes by choice, certainly, but also often because of prohibitively expensive mortgages. Over the last few years, rent costs have been skyrocketing and hit a new all-time high.

Source: https://ipropertymanagement.com/research/average-rent-by-year

Yet renting still builds no equity and generates no returns over time. That’s a major driver behind the proliferation we’re seeing of rent-to-own, which is significantly more appealing than throwing money out the window in a pure rental situation. Permutations of rent-to-own home ownership models will likely continue to rise as the prices of homes appreciate and new buyers enter the market.

Divvy is one example of this. It is a service designed for people who, to use the company’s own words, are “not ready for a mortgage.” Divvy offers them an alternative pathway to ownership: you pick out your home, Divvy buys it, you put down 1 to 2 percent of the selling price (much cheaper than your traditional down payment), which goes directly into a fund for your future down payment. Then, you rent from them at market rate for about three years. But 25% of that rent is put toward a down payment nest egg, rather than into the landlord’s coffers.

Divvy customers are renters, but they move the needle toward ownership piece by piece. They also build value that can be called upon later on: either by buying the home itself or by walking away with the cash. In short, they access some of the huge benefits of owning a home, without actually owning it yet or participating in the traditional mortgage process.

Helping people transition from the renter headspace to the owner headspace is also a big part of real estate 3.0. We’re seeing companies build tools that encourage people to see themselves as potential buyers.

Landis is one of those companies. Landis is building tools that help people gauge when, and how they can make that critical step. The process begins with tailored coaching to help clients improve their financial picture. Landis steps in, makes a competitive all-cash offer on a home, and sets clients up with a sustainable rent-to-own timeline.

Rent to own is also gaining traction in the commercial real estate market. NFX-backed Withco is the first commercial property ownership platform for small businesses. Traditionally, small business owners can qualify for a lease, but very few of them are able to secure a large enough down payment to qualify for a mortgage. Withco’s platform programmatically purchases commercial properties in partnership with small business owners and works to transition them to full ownership over the course of a standard lease term. This innovative technology and approach helps small business owners turn one of their largest expenses – rent – into meaningful wealth.

Adam Neumann’s Flow, as yet unlaunched, is one other notable example of an exploration to come in this space. It’s a twist on rent to own – building up equity as a renter, while not being tied to the same location.

What it takes to win in rent-to-own:

The best teams in the space will bring four key competencies to the table.

1. They will have strong working relationships with agents – allowing them to acquire customers in a cost effective manner.

2. They’ll have strong underwriting experience, which allows them to understand which customers are the best candidates for the rent-to-own model.

3. They have sophisticated experience within capital markets, enabling them to close on homes.

4. And, of course, they’ll deeply understand how network effects lead to long-term defensibility in real estate.

Opportunity 2: Fractional Home Ownership – The Lifestyle Version

Fractional home ownership is a model whereby several people share a property, usually a vacation property, and have an arrangement that allocates usage rights. This model is on the rise predominantly because we’re starting to see:

1. A lot of people are moving and bouncing between locations, both for personal and work travel. Some companies are reconfiguring away from an HQ model and are instead wanting their teams to be able to quickly and physically assemble in other locations. This means more people doing frequent long trips to specific locations. It can make more financial sense over time to purchase a part of a home than to lose money on an AirBnB stay each time.

2. Vacation homes and rental properties can be hard to research and purchase, and very hard to maintain – and are mostly vacant.

3. In the last decade, consumers have seen the enormous and enduring wealth creation that comes with owning home equity. Naturally, they want a piece of that financial momentum. But they also want to be able to actually enjoy these assets. Home ownership allows both to happen at once.

Pacaso is an example of a company embracing the fractional ownership idea. Pacaso buys luxury vacation homes, converts them into LLCs, and allows people to buy an equity stake in those homes through that LLC. In return, they get to stay in the home for as much time as that stake allows. For example, you might own 1/8th of a house, and get to stay there for a few months at a time.

That model of ownership takes advantage of the rise of alt living, which we identified as an opportunity a few years back and was accelerated, for some, by the pandemic. It’s a model that supports a nomadic lifestyle, or opens the door to second-home ownership – both of which are not the norm, but which onboard a number of new users into the market nonetheless.

We see other companies like La Haus, using similar structures. La Haus embodies many real estate 3.0 themes – the company is looking to simplify the home search, closure and financing process with software. But it is also encouraging people to buy fractional shares of vacation homes, which they can either use or rent to someone else (that rent application has shades of another flavor of real estate 3.0: increased accessibility of housing an asset class).

What’s necessary to capitalize here: think carefully about taking on the burden of property management. We see companies like Pacaso do this, because it’s clearly of value for people in transition – or on vacation. No one wants to fix a leaky roof if they’re only going to be there for a few weeks. However it is operationally intensive and it’s important to have the right DNA for early stage startups to execute on it.

Another important thing to note is that asset-heavy inventory is going to be a huge competitive advantage for platforms servicing the vacation/lifestyle segment of the market.

Opportunity 3: Fractional Home Ownership — The Pure Asset Version

This ownership model has a different flavor to it. This isn’t about someone buying a house for their family to live or vacation in – it’s about gaining access to the investment value of a property. Much the way people would invest in stocks. This is a real pain point and real opportunity: tradability of these assets.

Fractional ownership of the pure asset is increasing the frequency of trades, and increasing the supply (shares to buy fractions of properties) with the goal of onboarding more users into the real estate market. This is further bolstered by the fact that prices of real estate across the board are appreciating rapidly.

Fractional home ownership seems to be one of those emerging opportunities that will expand and endure in Real Estate 3.0 in different variations.

One example is NFX-backed Landa, which is expanding access to ownership by turning properties into securities, thus democratizing the $43 trillion residential real estate market. Landa allows individuals to buy into the real estate market with pocket change – starting at just $5.

Historically, if you wanted to get into the real estate market as an investor, the best vehicle available to you (outside of owning a home) was the real estate investment trusts for commercial properties (REITs). But these investments eliminate any form of investor choice.

Instead, Landa looked to turn properties into securities. Retail investors can buy shares of each property on a mobile app. They aim to make owning real estate – fractions of it, like shares – easy as buying shares of AMZN, TSLA, and the S&P 500.

Their platform lowers the barrier to entry, welcoming investors with all levels of capital and experience. People who have never had access to owning real estate can get into an investment property.

Founders, if you want to build in this arena: you must build trust. People don’t buy real estate because they want to play risky games – it’s classically been a safe harbor. A big part of that is demonstrating that you can keep properties fully rented and maintained while also adding more and more inventory to your marketplace over time.

Opportunity 4: Rapid Liquidity for Real Estate Owners

If you’re going to create security-like markets for real estate, you need to be able to facilitate liquidity. That comes down to thinking creatively about how you can smooth out the transaction process from start to finish – building on the Real Estate 2.0 layers, perhaps with new technologies.

Rapid liquidity in a Real Estate 3.0 world means you can now sell shares and buy shares of a property entirely online, without the whole closing process involving 50 different individuals and entities.

The huge benefit of this will be for individual homeowners as they sell their homes in different markets or turn their current properties into an investment property.

This leads to easier tradability – and also opens easier ways to buy and sell fractions of a property into a marketplace, which leads to greater access. A Real Estate 3.0 flywheel.

Here it seems crypto and smart contracts are playing a huge role as they abstract the manual effort traditionally involved in buying and selling properties – even fractions of one that generates income for you. We will explore that in more detail below.

The big thing to know about companies providing this liquidity: is ensuring that the supply side is always there. Demand for high value properties that can be rented out (often in an area that is expected to appreciate rapidly) is always there. However the key for many of these platforms is ensuring that they can dominate and find the best properties for their investors to choose from.

Opportunity 5: Rapid issuance of mortgages and loans

Speed is an asset in Real Estate 3.0.

If you’ve ever gone through the process of getting a mortgage or applying for one, or even applying to get a HELOC from the bank to finance an upgrade to your home, you’ll know how painfully slow and difficult and underserved this market has been.

Real Estate 2.0 has already enabled big improvements here, and that may be enough to start with. However, we expect there’s more to come.

Founders in Real Estate 3.0 will ask the question: Who you are making borrowing faster and easier for? Are they people traditionally served by existing systems? Are there segments that get left out?

Key technologies driving Real Estate 3.0

All of the companies discussed in the above sections have different features and models, but they are all creating new access and entry points to participate in the real estate market – they are all enabling new variants of ownership.

Now let’s look at the key technologies enabling Real Estate 3.0: digitization, crypto & web3, and automation – with smart contracts as a subset of these. Combined, these technologies enable better, faster user experiences that appeal to diverse sets of customers with different ownership goals.

The technology stack of Real Estate 3.0 will likely grow quickly, but for now these are the main components.

1. Digitization

Digitization is the 50,000 foot view of the technologies at play in the entire evolution from Real Estate 1.0 to today’s early signs of Real Estate 3.0.

In the 3.0 world, digitization continues to eat real estate. Our financial profiles and bank accounts are digital. All property information is digital. The transaction process, as well as the trading process – and the legal paperwork underpinning it – is getting massively more digital.

And while our physical houses and commercial buildings aren’t truly digitizable – we still need a place to lay our heads – almost everything about the ownership of that real estate can be digitized. (Also automated, as we’ll discuss below.)

2. Crypto and Web3

It’s not a coincidence, but also not fully causal, that Real Estate 3.0 is evolving alongside web3. Web3, which is loosely defined as a new phase of the internet based on blockchain technology, cryptocurrency and NFTs, aims to “give power back to the users in the form of ownership.”

Real Estate 3.0 and web3 are both building on progress from versions 1.0 and 2.0. They share themes of decentralization (distributed ownership), access (imagining a world where no one gets left out), and automation (via the disruption of outdated infrastructure).

But thematic alignment aside, there is potential for crypto to be used as an accelerant in this space, provided it’s layered on at the correct time.

Smart Contracts

Smart contracts are an important enabling blockchain technology. A smart contract is basically computer code which can self-execute as well as self-enforce the terms and conditions of a legal agreement. A smart contract can bypass expensive ‘middlemen’ such as financial institutions.

Smart contracts act as support structures for people who are planning to use real estate as an asset, because they instantaneously (on a blockchain) execute transactional protocols according to legal frameworks.

Simply put: a smart contract introduces a trustworthy way to perform fast and automated transactions.

Crypto and smart contracts are good candidate technologies for scaling the transaction volume needed to support these increasingly liquid real estate 3.0 marketplaces.

We have seen some small scale examples of this emerge recently, but they haven’t quite taken off. That’s because the bigger problem here comes down to creating a liquid market (it’s one of the trickier things about building marketplace network effects). But eventually, once those market problems are solved, smart contracts will become a complimentary force.

It’s exciting to think about a startup that has already achieved sufficient liquidity – by likely focusing in on a specific segment of the market and achieving early momentum – then using web3 technologies to scale this and take further friction out of the process.

In the future, it’s possible that smart contracts may enable consumers to purchase the rights to rent, lease, or outright purchase an asset with near instantaneous speed. An individual would own their personal data in their own crypto wallet. When they purchase the NFT that provides some type of rights to the property, the ownership entity can immediately draft up the legal documentation, and, in theory, accept the NFT purchase as a signature on the docs.

Again, it accelerates the transactional process 10x – the aforementioned goal of Real Estate 2.0 writ large in Real Estate 3.0. This unlocks speed, transparency and scale that allows for frictionless tradability of real estate – which in turn onboards more people as participants and owners in the market.

These technologies are just the cusp of what will truly enable real estate 3.0 companies to introduce new ownership structures and financing opportunities for property owners.

It’s not just about handling more transactions faster. It’s also a matter of reducing friction. Smart contracts encode the manual effort involved in buying and selling properties – even fractions of one that generates income for you. Again, these will be tools to further streamline the transaction.

3. Automation

What does automation give us? Certainly it enables speed, smoother transactions, less friction and cost. But as automation evolves in Real Estate 3.0, it not only increases convenience – it also becomes a major enabler for more people to enter and trade real estate assets, at scale.

It’s hard to treat real estate like a tradeable asset if it’s a logistical nightmare to buy and sell. If you look beneath the surface of Real Estate 3.0 companies, you see that automated processing of legal paperwork is enabling several innovations. In some cases it’s automating the creation of LLCs and other entities, to make it possible for many people to own a share of a certain property.

Let’s take Lev, an NFX portfolio company, as an example. Lev is the mortgage marketplace that has digitized commercial real estate transactions. They have used automation brilliantly. Lev analyzes millions of datapoints with machine learning to truly understand the goals of lenders and borrowers. That facilitates quick and accurate matching of those lenders and borrowers in an industry that traditionally was highly analog.

Without automation, none of these types of ownership structures and transactions would make financial sense. The manual paperwork, filing process and time required for a single transaction to occur makes the cost of selling fractional shares high. The ability to electronically and automatically create and file the necessary paperwork allows consumers to have this automated-like experience – they never see this legwork happen.

Advice For Real Estate 3.0 Founders

We believe that Founders who make the most of Real Estate 3.0 will have a few core strengths:

- Following in the footsteps of some of the strongest consumer fintechs and web3 companies that opened asset classes to millions of new users like Robinhood and Coinbase, Founders of Real Estate 3.0 companies have to be able to build compelling digital product experiences that delight and engage users. Consumer and business expectations are so high and strong products can drive strong organic adoption giving an unfair advantage to the highest quality product experience.

- Great early teams of Real Estate 3.0 companies will benefit from individuals with deep experience or interest in real estate finance. If not initially, then over time add in individuals with technical experience with web3 technologies such as but not limited to crypto, smart contracts and automation. It is not essential that this is present immediately, but to scale it will be essential.

- The next generation of real estate companies will be far more capital efficient than many Real Estate 2.0 companies that raised large funds or rounds when capital was cheap. They will be smart about managing the large capital needs that still dominate this industry. Right now, many Real Estate 3.0 companies are still purchasing homes and taking on risk. You have to learn to be maximally efficient, and there’s little room for error.

- They likely are (or will become) experts in “tokenomics.” If you want to treat real estate like a security, you need to understand the ins and outs of those marketplaces. In the world of web3 and tokens, this is a frontier field of study, but those who are able to take that knowledge and bring it into real estate may find themselves with an unfair advantage.

- Founders will likely be looking at niche emerging markets that have been largely ignored by the real estate industry for decades. These people will see what others do not when it comes to underserved segments of the real estate market. They will recognize that most people do want to own their own homes and make use of the strong US mortgage system. But they will find and enable participation for the people who want a piece of markets that have traditionally been gatekept.

- Founders in Real Estate 3.0 will find ways to leverage web 1 and web 2 network effects and layer on new or bolster existing network effects that will be native to Real Estate 3.0 companies

Investing In The Future

As we wrote 3 years ago, here at NFX we see proptech to be a massive opportunity overall – and we see the onset of Real Estate 3.0 as a major exponent to the base.

We are investing in Real Estate 3.0’s efforts to expand affordability, access and ownership of property by creating new niche markets while at the same time competing to lower barriers to entry for more individuals to enter a highly desirable and often lucrative asset class.

Real Estate 3.0 – and its web3 cousins and components – is by no means perfect yet, but it does start to give people a fair opportunity to invest.

The ownership revolution of Real Estate 3.0 is just getting started.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.