“I don’t think Uber would have ever started from within the taxi drivers association, or Airbnb from hotel management.” – Assaf Wand, Co-Founder & CEO at Hippo

To truly disrupt an industry, you have to look from the outside.

But how can an industry outsider, starting at zero, compete against 100-year-old incumbents with thousands of employees, millions of customers, and billions in revenue?

I faced this question when I was first building Trulia in 2004 (acquired by Zillow in 2014 for $3.5B). At the time, the real-estate market was dominated by powerful incumbents, most notably the National Association of Realtors, which had 1M+ members and a chokehold on the MLS data.

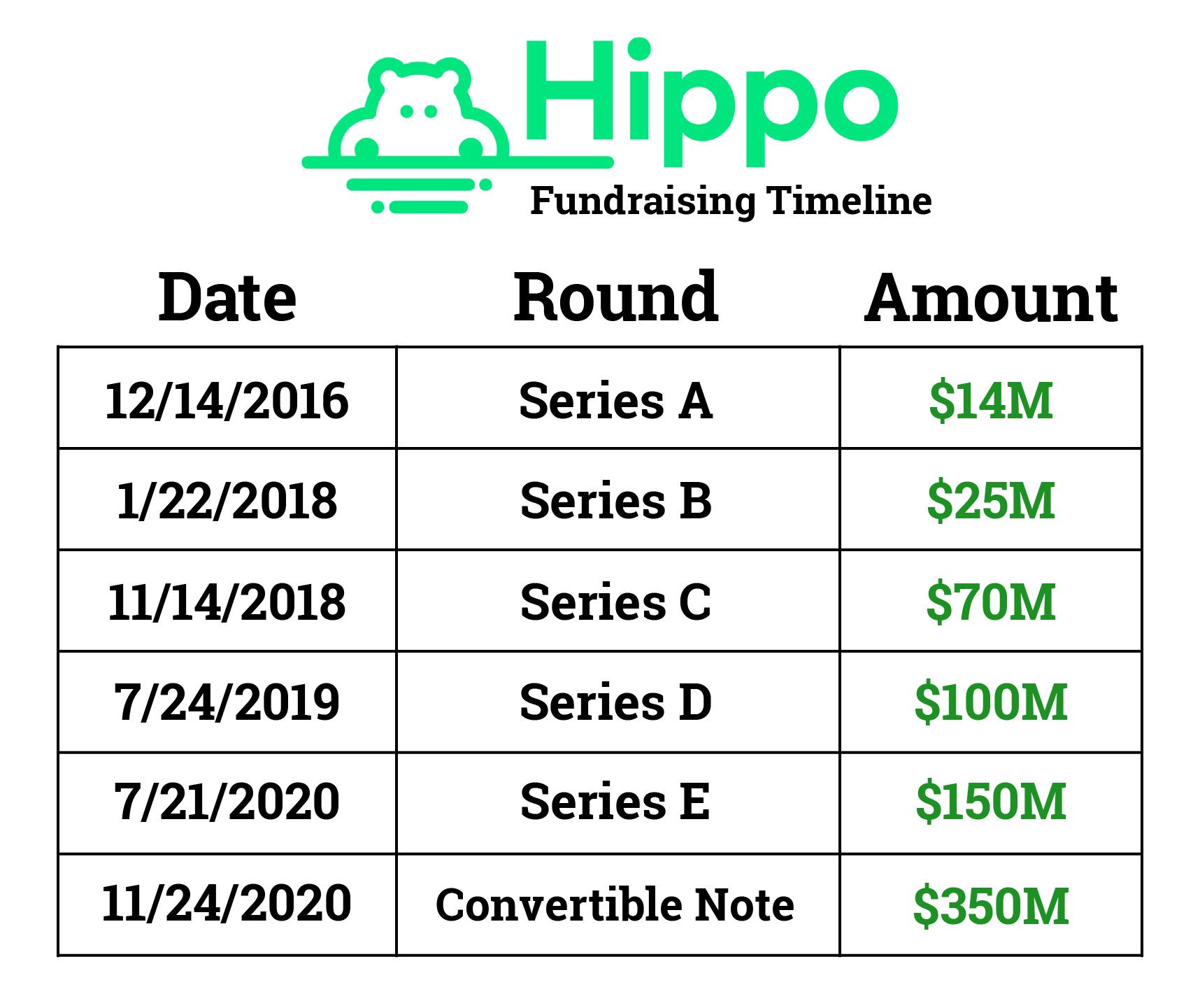

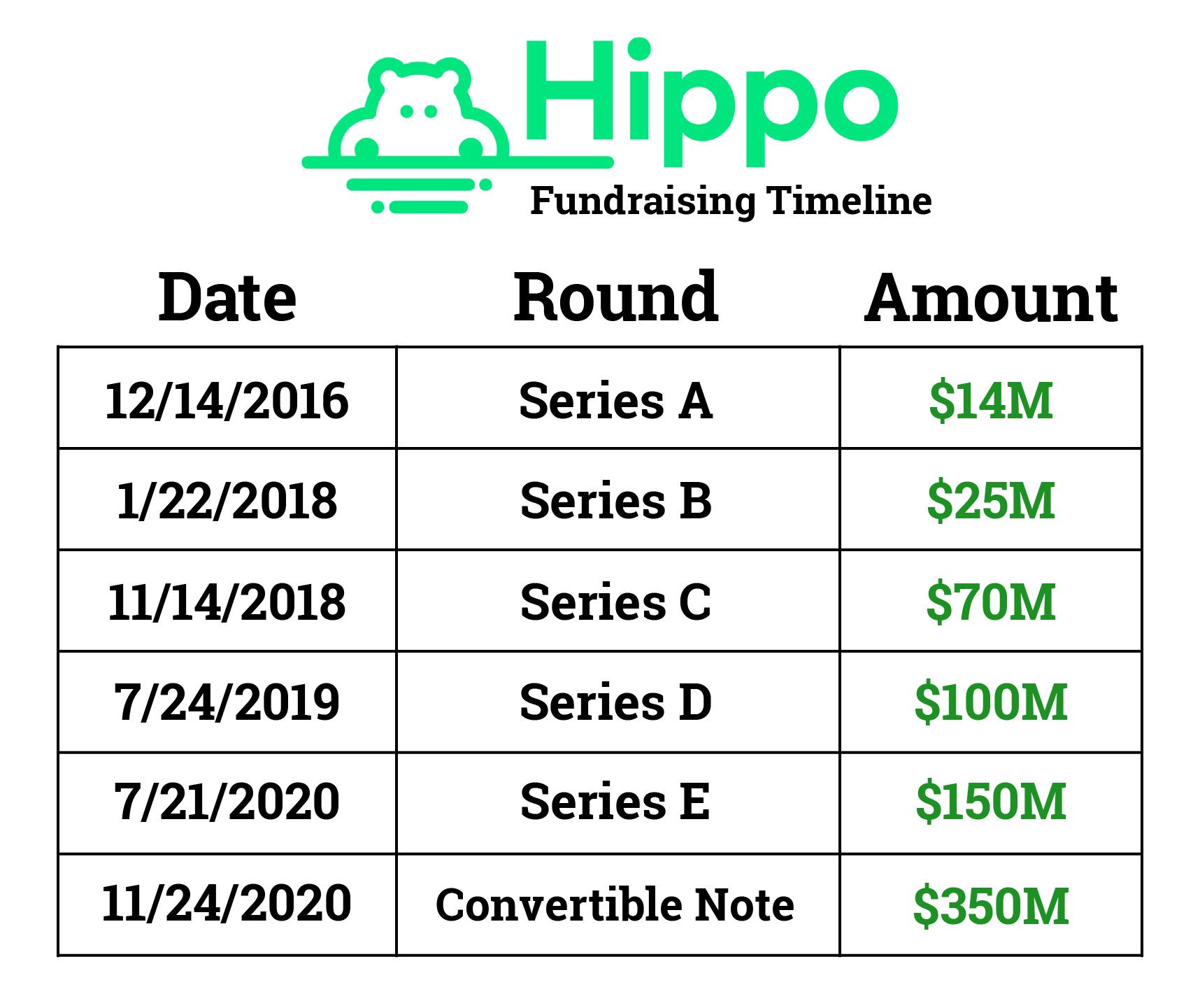

Today, Assaf Wand, Co-Founder and CEO of Hippo, analyzes his own startup vs. incumbent battle for dominance as he took the insurtech startup from idea to a $5B SPAC in less than 6 years.

We cover the newcomer advantage as compared to the severe channel conflicts and innovator’s dilemma of a massively entrenched industry. Founders looking to compete in any existing industry would be wise to rethink what they believe to be barriers, in order to realize their opportunity.

Below are highlights from my recent podcast conversation with Assaf Wand.

“If something is so obvious, why isn’t anyone doing it?”

- When I was a consultant with McKinsey in New York, I could tell from my projects with financial institutions and insurance companies that it was all broken. You couldn’t implement anything, you couldn’t do anything.

- The gist of the idea for Hippo came from the fact that the average age of an insurance agent in 2015 was 58. Now, there are less than half of the agents that there used to be 10 years ago. They’re just retiring.

- 87% of new agents to the profession are leaving the profession within less than three years. It’s like social security. Not enough people are coming in and a lot of people are leaving. What I saw was that if no more newcomers were coming to the profession, if no new agents were joining, something had to change.

- I thought the change was going to be direct. It’s not a massive realization because this is what happened in auto insurance. The only two carriers that are getting market share in the US are Geico and Progressive. We thought, “Fine, let’s build a Geico for home insurance.”

- But it felt a bit trivial. There was not a crazy a-ha moment. It’s like, “Okay, fine.” It’s a good, logical explanation, but we thought everybody knew that. If I’m an insurance company, if I’m Liberty, Allstate and State Farm, it’s a trivial insight.

- Most of the time I spent was actually less on the finding, but more on trying to figure out what I was missing? Why aren’t they doing it? It was more about my own introspection.

Cannibalize to Compete

- There were two hurdles explaining why it hadn’t been done. One is from the incumbents and the other one was why there weren’t 15 different companies or entrepreneurs pursuing this opportunity?

- Home insurance is a $104 billion market, now growing at 5% a year. It could keep on going forever, so I thought we were going to see dozens of these companies popping up.

- From the incumbent side, this was the most interesting industry I’ve ever seen in my life because I have never seen such a severe channel conflict and innovator’s dilemma in any other industry.

- This is an industry that for 150 years built one channel, and that channel was an agent. But whoa, these agents are 60 now. So what can they do?

- If you are a CEO of an insurance company and someone comes to you and says, “I want to start a direct insurance company and yeah, it might cannibalize our business but we have to do it.”

- What would happen is you’re going to say, “Fine, go for it.” But you have a $10 billion book of business that is basically sitting with agents and you need to start building something that will cannibalize it.

- All of the agents are going to say, “Whoa, what are you doing? This is not the deal that we signed up for. You’re supposed to take your marketing dollars and direct people to us, not go and compete with us. If you don’t stop, we’re moving, we’re leaving to another company. We’re taking our business with us.”

- No CEO wants to make the decision of $10 billion versus a billion dollars. Hence, they’re all frozen.

- The second thing is that they’ve not set up a technology company, it’s an insurance company. And because of that, there’s no CTO. There are no product managers or engineers to build a product.

- Guidewire is the backend, someone else is doing the billing, and Accenture is doing the implementation. It’s not set up like a technology company hence they’re dependent on a third party for the systems, on implementing, on making changes, and making product decisions which becomes even more burdensome.

- The last thing they have is a current book. So if you say you have an $11 billion book of business in home insurance and the regulation is such that if you want to change something, it requires you to file with 50 different states. Now, if you file something, you need to attribute it to all of the people in that state that are getting the renewal.

- Basically, there are structural inefficiencies that prevent incumbents from competing. And they did it to themselves because for the last 100 years they put up all of these barriers of lobbying and regulation. Now, they can’t compete.

Timing Is Everything

- I actually looked at starting this business in 2007, but I quickly put it back on the shelf.

- The reason I put it on the shelf was that I thought, for starters, I couldn’t build the backend. I’m not going to go to Accenture and I’m not going to go to Guidewire. It’s going to take me four years and $300 million to build it.

- The second thing was the lack of data. How could I compete with, fill in the blank, who has 5 million customers while I didn’t have anybody?

- The third one was that I wasn’t certain people would be willing to bet on a newcomer, a new brand in insurance, which has to do with trust.

- But when I really looked at it in 2015, I figured, “Wow, we can actually build everything on AWS, do the payments with Stripe, and do the chat with Intercom. Now, the technology is ready for me to start this thing.”

- We’re in an era of data abundance. I don’t just have five or 10 million customers. I have 130 million households. Any transaction that happened in the last 25 years, it’s all documented. It’s all there. Just go to Zillow and type an address. You have so much data on every home, from taxes to size, pictures inside the house, every transaction that’s happened.

- These are regulated industries that actually have all of this data at their fingertips.

- We have an advantage because I’m not looking at the book, I’m looking at what’s going on with all of the 130 million households.

- The last component is that there’s a point of realization that every other aspect of your life has basically moved to a newcomer, especially on the financial side. Your bank account, student loans, where you’re managing your money, and where you’re trading is all with new companies.

- Insurance is just one more thing in this world. There’s a higher propensity for people to trust a new brand or a lower barrier to trust a brand that’s coming in now.

- These three things happened and I thought, “Wow, the barriers are low and the competition can’t really react, let’s launch something.”

- Now, if you fast forward to today, we’re preparing to go public via a SPAC with Reid Hoffman and Mark Pincus. It all started with the right timing.

“To really disrupt and change an industry, you need to come from the outside”

- I went and talked to all of the McKinsey partners that I know and asked, “If you were to start an insurance business now, what would you have done knowing what you know now?” And then the second question, “If you’re a CEO of an insurance company, what do you think are your three biggest pain points?”

- It was about digitization. It was about millennials. It was about going direct. So it gave me confidence, and then I just read and read.

- I did the license to be an agent, then I did more licenses and I read, read, read.

- I went to some conferences and I kept reading until I got to a certain point where I felt like I had high enough conviction for what I’m doing. I learned a lot in the process.

- I always tell my team that there was zero chance I would have started a business knowing what I know now.

- It’s not bad not to know, there’s a lot of power in naivete. I actually think that it is one of the superstrengths of entrepreneurs.

- I had enough information to get to conviction and not too much information and know-how that it would scare me.

- I think one of the interesting things is in general, to really disrupt and change an industry, you need to come from the outside.

- I don’t think Uber would have ever started from the taxi drivers association and Airbnb from hotel management. I think you need to come up with a fresh mindset of looking at all of these things, looking at the customer differently, and not take the approach of: this is how everybody else is doing it.

“Only the Paranoid Survive”

- Covid is accelerating everyone into a digital environment, including incumbents. Some of them will fight back. Some of them will not.

- But it’s also not a winner-take-all situation. There’s space for incumbents that can adapt — and newcomers.

- I do think that the pace of innovation is only going to keep on increasing with the move to the cloud and other external tools.

- Companies will actually be able to focus more on the stuff that they need to focus on. There will be a lot more of a focused approach to what you do with tools, digitization, and customers who are expecting a different experience. The pace is just going to increase.

- It’s a very, very difficult thing to change the state of mind of incumbents.

- One of my favorite books is Only the Paranoid Survive. In it, there’s the story of Intel trying to disrupt itself. It covers the problem that the people at the top are the people who constantly made the right choices on the previous business.

- The people at the top constantly made the right choices and their entire DNA is wired to a certain thing. But now you need someone to make the opposite choices that are counter to what got them to be the CMO, and the CEO, and the CFO of the company. So that’s what’s going on in incumbents right now.

- You’re trying to ask the CEO of a company that is a $30 billion business to make choices that are counter to his or her DNA, it’s just not going to happen.

Natural Atrophy in Organizations

- To reverse this force, I think it all starts and boils down to decision-making. We believe that the company is a meritocracy of ideas. We believe in strong opinions, loosely held.

- I think at any decision point, I should not have a disproportionate amount of weight. The decision has to do with domain expertise multiplied by conviction.

- You try to have people who are independent thinkers who are okay with being challengers. Hence why it’s not the people who are the most senior making the decision, it’s the people who actually have the highest weight for the decision and the highest conviction that’s going to win.

- There’s this natural atrophy in organizations. If you’re not proactive, if you don’t brainstorm, if you don’t talk about it in management, then you stand the chance of becoming an incumbent.

You can listen to the entire podcast conversation here.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.