There are 4 billion women in the world and yet many investors have treated women’s health as a niche. As a subset of healthcare. As “risky” or “mysterious.”

Here’s what’s actually risky: ignoring half the population’s healthcare needs, and the enormous financial returns to be gained from investing in women’s health right now. The numbers speak for themselves: only about 2% of VC investment is currently directed toward female-specific conditions.

Smart money knows that this is a massive market inefficiency and we are about to see exponential progress in basic science behind women’s healthcare.

Other than longevity, there’s a strong argument that women’s health is the biggest undervalued market in healthcare.

Here’s what we’re seeing, and what we want to invest in:

Why Now? The Convergence Creating Opportunity

We are already seeing the scientific, cultural and technological landscape around women’s health shift in five ways:

- The large data gaps in women’s health research are already beginning to close. Technology like AI, advances in imaging and analysis, and ex-vivo data collection will speed this up 10x.

- Women are no longer seen as a “special population” or niche market. There is general recognition that the TAM here is huge and always has been.

- The term “women’s health” used to just be shorthand for “fertility” or “uteruses.” Now the definition is more encompassing and focused on improving many more aspects of women’s health.

- Research and investment are flowing toward treating conditions, rather than invasive approaches, or managing symptoms.

- The biggest pharmaceutical players in the game are actively looking for startups tackling women’s health issues beyond just fertility. We’ve heard it from them first-hand.

The Research Gap Was Real — But Now It’s Closing

Until 1990, women of childbearing age were largely excluded from clinical trials due to concerns that hormonal cycles would disrupt experiments or out of fear for the safety of unborn children. The result was that studies done on men were considered generalizable to women. (They’re not.)

Because the basic research wasn’t happening, women’s health was deemed “mysterious” and economically risky by the mainstream for years. However, this gap created low-hanging fruit for today’s founders.

One major step forward was the NIH Revitalization Act — a federal law specifying that women and minorities be included in NIH-funded clinical trials. Critically, it also established The Office of Research on Women’s Health. This signaled the beginning of a broader focus on women’s health issues within biomedical research.

Some downstream effects of this new focus include:

- HPV vaccine, which is extremely effective in preventing HPV related cervical cancer

- Development of medications to prevent transmission of HIV from mother to child

- First approved oral drug for postpartum depression

- American Heart Association 2007 sex-specific aspirin guidelines

Notice that these are breakthroughs that improve the lives of both men and women. That’s because only 5% of conditions that affect women affect them exclusively.

Because of changes like this (and more), studies on sex differences in health have more than doubled in the last ten years. But there’s still far more room to grow. Today, 80% of surgical studies specifying sex have male-only subjects. In neuroscience, there are five studies on men for every one conducted on women.

Women make up about 80% of autoimmune disease patients, yet most immunology research still centers on male biology. In cardiovascular research, women account for just 38% of participants in clinical trials, even though heart disease is the leading cause of death for women globally, more than all cancers combined.

Technologically, We Have Never Been Better Equipped

Techbio advances are enabling the enormous white space in women’s health to be mapped and analyzed.

First, there’s the AI component. AI can now analyze patterns across millions of women’s health records to identify previously invisible correlations between hormones, symptoms, and treatments. For example, AI is already revealing patterns humans can’t see in dense breast tissue to predict outcomes.

Techbio platforms are rapidly progressing, integrating software, hardware, and wetware. These platforms are generating the data to power AI models. Two prominent focuses include:

- Large-scale multi-omics analyses are now pinpointing hidden molecular drivers of complex women’s conditions

- Ex-vivo organ modeling allows researchers to test thousands of drug combinations on actual human tissue samples, dramatically accelerating discovery timelines

This data explosion is already unraveling the biology behind polycystic ovarian syndrome (PCOS), endometriosis, and postpartum depression that were previously considered manageable but not treatable.

The enormous white space in women’s health is being mapped, analyzed, and translated into real treatments and commercial opportunities. It’s just a matter of time, money, and will.

The Strategic Shift We’re Backing

We’re entering a new phase in women’s health. There’s more money, more research, and better technology. As a result, we’re seeing more biotech and biopharmaceuticals, and fewer healthtech approaches and devices.

In 2019, healthtech dominated the women’s health investment landscape in the US and Europe with 44% of funding, followed by devices at 31%, while biopharma trailed significantly at just 15% of invested capital.

By 2024, this hierarchy had been completely upended: biopharma surged to nearly tie with healthtech as the market leader, while devices—once commanding a third of all investment—saw their share collapse to roughly 18%.

This transformation in women’s healthcare particularly excites us because it makes clear that biotechnology companies are driving innovation in this field. We’re especially enthusiastic about two key developments: first, the digitization of biological processes (using technology to better understand and analyze biological data), and second, the creation of biotechnology platforms that can identify the underlying causes of conditions that predominantly affect women and develop multiple treatment options.

As this field develops, we see two major trends:

Better Data Leads to More Targeted, Less Invasive Treatments

Techbio advances are driven by improved data collection and analysis. When we have better data about diseases, we can develop treatments that are more precise and less harsh on patients. A good example is how breast cancer treatment has evolved over the past twenty years, becoming more targeted and personalized.

Understanding Root Causes Enables Actual Cures, Not Just Symptom Management

As we’ve discussed in our longevity investment thesis, when we truly understand what causes a disease, we can shift from simply treating symptoms as they appear to developing treatments that address the underlying problem and potentially cure the condition entirely.

This approach is particularly important in women’s healthcare because many conditions affecting women have lacked effective treatments for decades. Take polycystic ovary syndrome (PCOS) as an example: it affects up to 13% of women of reproductive age (though most cases go undiagnosed), yet for decades the only available options have been symptom management drugs (birth control is a common option). Remarkably, there are still no FDA-approved drugs specifically designed to treat PCOS itself.

Specific Opportunity Areas

With that background, below are the themes where we see asymmetrical upside.

Systems-Level Understanding

We’re especially interested in companies creating systems-level understanding by integrating novel data inputs, like genetic complexity, epigenetic interactions, and hormonal fluctuations to better understand women’s health and develop a myriad of assets.

We’re excited to see companies apply this systems-level knowledge to many different indications that affect women disproportionately or differently.

We also expect diagnostics to be a critical intermediate step here – acting as the bridge between better understanding of data to the validation of clinically relevant biomarkers. Together this sets the stage for asset development later on.

This mirrors our bioplatform thesis. One dataset or breakthrough → many assets, and lives saved.

A great example of a company in this arena is Dionysus Health, which focuses on predictive mental and physical wellness diagnostics. Dionysus collects a variety of psychological and epigenetic markers, and is using that understanding to develop the first epigenetic predictive test for postpartum depression.

Conditions That Affect Women Disproportionately

When you apply a women-first angle to healthcare, you notice there are clear therapeutic gaps. There are many conditions that affect women disproportionately. For example:

- ~80% of autoimmune disease patients are women: For every 1 man:

- Hashimoto’s thyroiditis affects 10 women

- Graves’ disease affects 7 women

- Rheumatoid arthritis affects 3 women

- Osteoporosis is 4x more common in women than men

- Women are 2x more likely to develop Alzheimer’s

- Major depressive disorder is 2x more common in women

- Chronic pain is more common in women, and costs us all $600B

There are also conditions that are common in both men and women that tend to affect women differently. Cardiovascular disease, for example, presents differently in women than men. And women are 50% more likely to die a month after a heart attack than men are.

There are many companies that may not see themselves as women’s health companies per se, but are already in this space due to the nature of their patient population. In situations like these, founders and patients will benefit if the company focuses on treatment design with a “customer-first” (i.e. women-first) mindset.

At NFX, we’re not just talking about investing in women’s health. Just recently, we invested in a stealth team out of Stanford with that mindset. This team is focused on identifying cryptic pockets and using computational design to create molecules targeting various pain and bone indications that disproportionately affect women.

Focus on Conditions That Solely Affect Women

The opportunities here are staggering because these conditions have been systematically under-researched and under-treated for decades.

Postpartum depression affects up to ~20% of new mothers. Despite affecting millions of women annually, the first drug for postpartum depression was only FDA-approved in 2023. The market is wide open for better diagnostics, preventative interventions, and targeted treatments.

Polycystic Ovarian Syndrome (PCOS) affects up to 13% of women of reproductive age (most go undiagnosed), making it one of the most common hormonal disorders. Yet remarkably, there are still no FDA-approved drugs specifically designed to treat PCOS itself. Current “treatments” are either symptom management drugs borrowed from other conditions or lifestyle tracking apps. This is a massive unmet medical need disguised as a solved problem.

Endometriosis affects roughly 10% of women of reproductive age – that’s 190 million women worldwide – but takes between 4-11 years to diagnose. Non-surgical treatment options are limited to hormone therapy and pain management.

We see diagnostics acting as a bridge from managing symptoms to creating cures. DotLab, for example, is developing a non-invasive blood test for endometriosis – potentially cutting that 4-11 year diagnostic odyssey down to a simple blood draw.

Premenstrual Dysphoric Disorder (PMDD) affects 3-8% of women of reproductive age with severe mood symptoms that can be debilitating. Current treatments are limited and often borrowed from general depression protocols, despite PMDD having distinct hormonal triggers and patterns.

Menopause and ovarian aging: The average woman spends one-third of her life post-menopause, often dealing with systemic effects. Women face sharply increased risks of cardiovascular disease, osteoporosis, metabolic syndrome, cognitive decline, pelvic floor disorders, and certain cancers.

The Buck Institute’s Center for Healthy Aging in Women is creating the first-ever comprehensive map of the ovaries across space and time to elucidate the effects of ovarian aging on the whole body.

We’re excited to see initiatives like this spawn innovation outside the lab, in the real world, at scale.

Ex-Vivo Data to Fill the Research Gap Faster

The research gap between men and women has begun to close, but there are technologies that will allow it to close faster, and perhaps more efficiently.

We have seen impressive progress in the field of ex-vivo, women’s specific data sources. Muse Bio, for example, is creating a stem cell biobank from menstrual blood. Opal Therapeutics is using menstrual blood and tissue biopsies to isolate and expand reproductive cell populations, fueling their biobank pointed toward drug discovery.

Organoids allow us to understand maternal-fetal interactions, and the early development of endometriosis or endometrial cancer. To facilitate ex-vivo progress and minimize complications, endometrial organoids are being derived from menstrual flow, which eliminates the need for the invasive biopsies typically needed to create these structures.

We’re also seeing interesting developments in the digital twin space – like models of the pelvic floor that pave the way for personalized diagnostics and treatments.

These are just a few examples of how transformative ex-vivo data can be, especially in women’s health. There are many creative approaches stemming from the B2C space. Our portfolio company Stardust, which leverages AI to help women track and understand hormonal phases, may eventually help women identify trends and share that information with healthcare professionals and participate in clinical trials.

Weaving these threads together, we at NFX are excited to support companies enabling rapid generation of more detailed and personalized data to drive the shift in women’s health that’s only just beginning to emerge.

Women-Specific Longevity

NFX Bio is all in on longevity for everyone – specifically medicines that extend our healthspan by keeping the body healthy and functional.

Many of the first indications for longevity-based technologies will lengthen the fertile window. Within our portfolio, Renewal Bio, is planning to develop genetically identical egg cells to allow women to have biological children later in life. Another NFX portfolio company, Nodal, is tackling this issue from another angle, creating a surrogacy marketplace to allow women even more flexibility in how and when they start a family.

That said, we want to see longevity technologies develop with a mind toward women’s biology beyond fertility. From estrogen to immunity, women’s biology extends past reproduction.

Women already live longer than men on average. But women also have a larger gap between their lifespan and healthspan than men do – suggesting that they experience a greater percentage of their life in poor health.

We need founders to be thinking about how women can live longer and more healthfully. The answers might be different for women than they are for men. (Interestingly, the major drivers of the lifespan-healthspan gap between men and women seem to be different, according to early research that suggest musculoskeletal, genitourinary, and neurological diseases contributed most to the healthspan-lifespan gap for women.)

Market Context

Let’s get this out of the way once and for all: the women’s health market is genuinely massive.

Not only are women 50% of the population, they make up 51% of the workforce. They also make 80% of healthcare decisions in the household, and historically spend more on their health than men do.

The women’s health market also has high growth potential, projected to grow from $41B in 2023 to reach $66B by 2030. Though 60% of women’s health companies are less than a decade old, evidence of returns already exists. From 2019 to 2024, there were 35 successful exits, including four IPOs and 31 mergers or acquisitions.

With strong bio investment to help drive new innovations, the women’s health market will be further de-risked and even expanded beyond current projections.

What We’re Looking For and How We Help

We want to see talented, ambitious, visionary scientist-founders with a clear perspective on women’s health, and motivation to right some historical wrongs (a chip on your shoulder isn’t a bad thing).

We also want to partner closely with pharma companies and with other VCs in the sector to map the white spaces, support founders, and advance the field. The momentum in women’s health right now is real, and collaborative energy can push it even further.

If you have defensible magic and a vision that aligns with the momentum we are seeing, or if you want to partner, reach out to us.

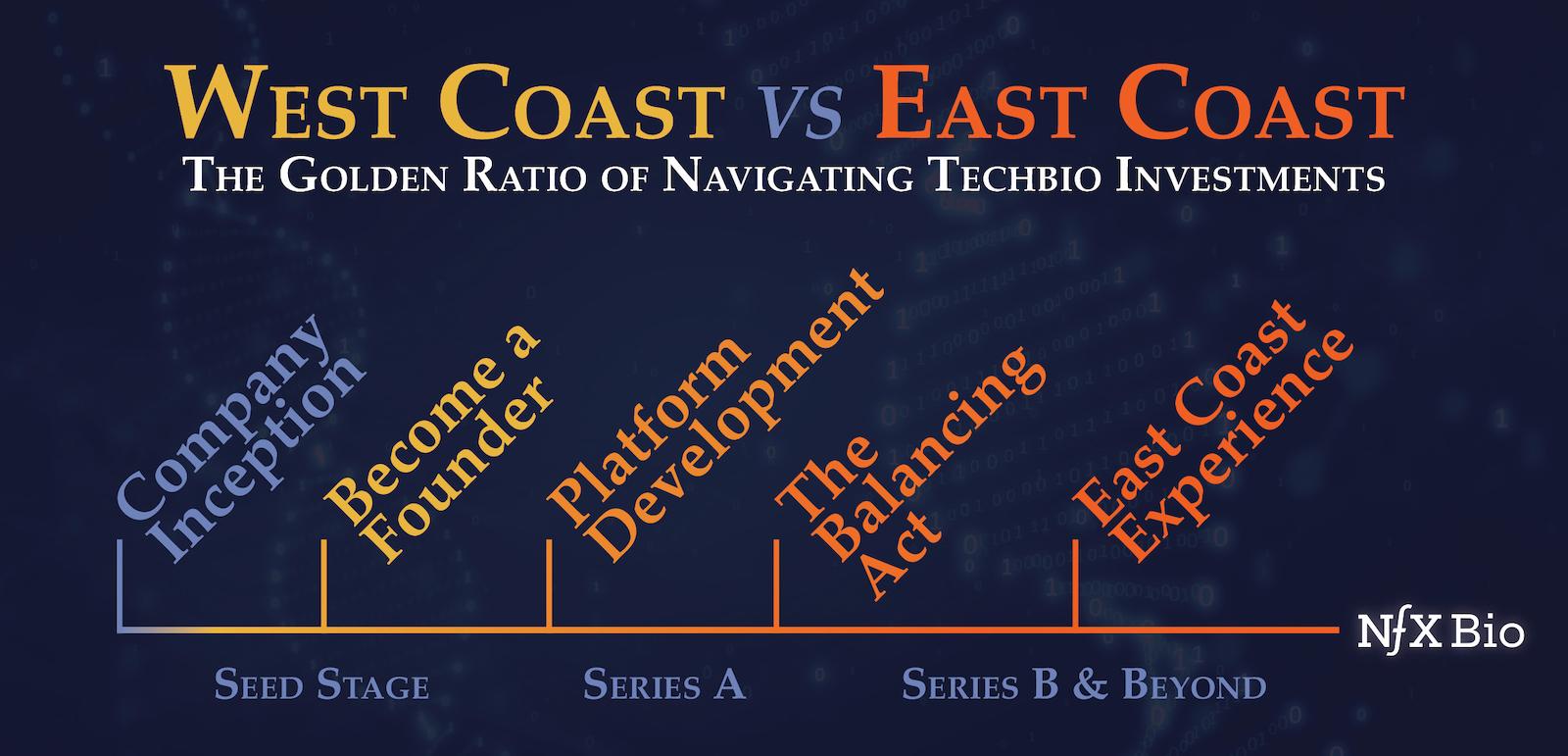

We are experts at helping you move from your post-doc or PhD into founder mode.

You can do it, and you should do it. Don’t wait. We’ve been waiting long enough.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.