For years, there have been two paths for founding a company in the life sciences.

Most are familiar with Path #1: You’re a scientist who makes an incredible discovery. You’re put into contact with a local venture formation firm. They take the reins. You publish the paper and go back to the lab.

Path #2 is newer, but gaining ground: You’re a scientist who makes an incredible discovery. You start coming up with great company names and recruiting your colleagues. You start pitching VCs. You want to run the business yourself.

These paths often go by another name: “The East Coast Mindset” and the “West Coast Mindset.” You could also think of it as the difference between venture formation (often seen on the East Coast) and Founder-led investing (emblematic of the West Coast).

Right now, most people find themselves leaning toward one mindset or the other. But there’s no need to climb on a bandwagon or treat this as an either-or choice.

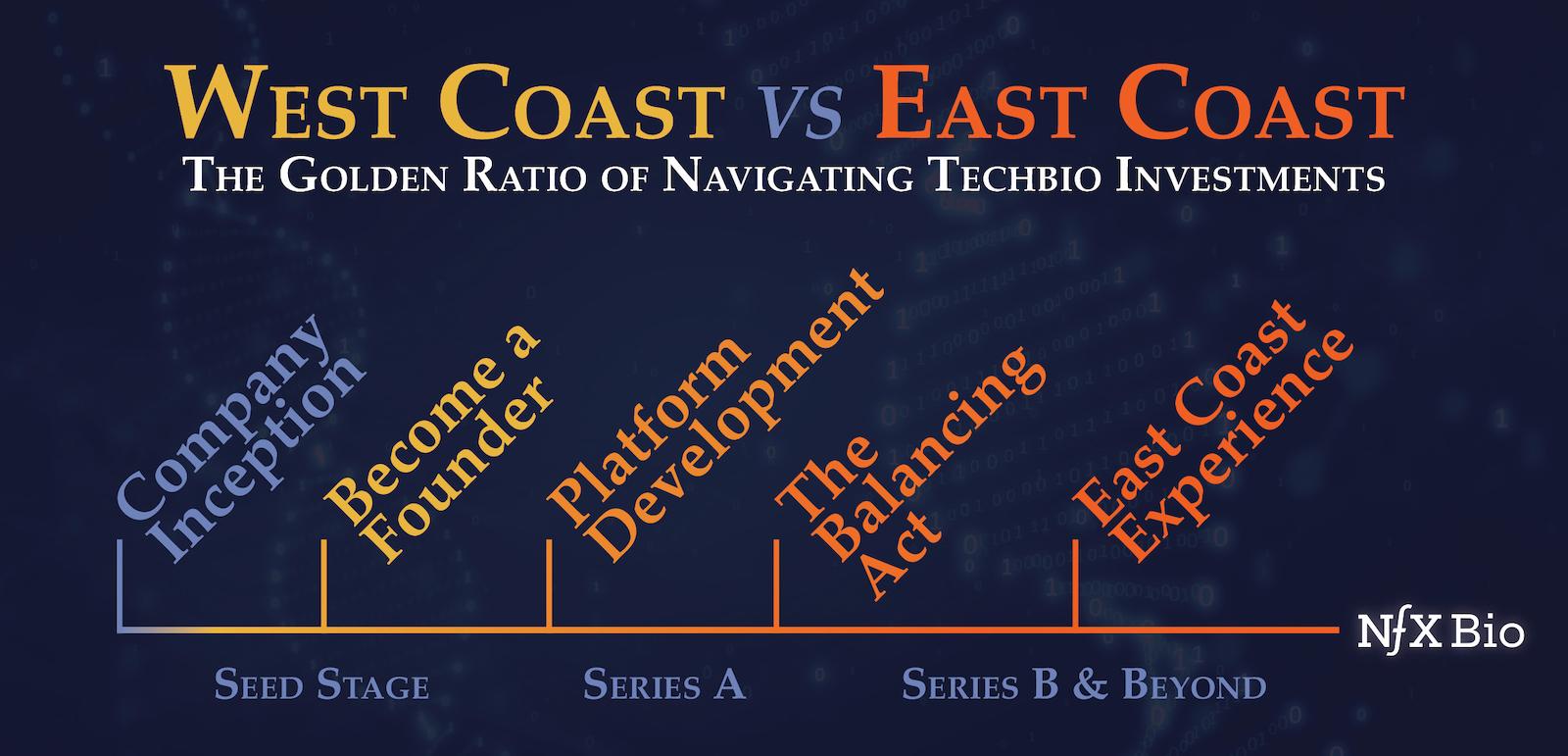

Both of these models work. We shouldn’t think of them as warring factions. Rather, think of them as part of a continuum – different sections of the same timeline. They are complementary forces you will need to employ at specific stages of your company’s lifecycle.

Before we dismantle this binary mindset, we’re going to briefly define each investor and dispel the myths that have kept them in largely separate silos – until now.

Meet the West Coast Investor – The Founder Led Champion

Meet the stereotypical “West Coast investor.” They most likely studied at Berkeley or Stanford. The best of us are PhDs and scientists themselves, but still too few of them are. They’ve probably been a Founder at least once. They want to back Founders with explosive ideas, and the entrepreneurial will to get there.

The West Coast investor is marinating in a universe of Founder-led tech companies: like Amazon, Facebook, and Tesla. West Coast investors in the life sciences want to see Scientist-Founders starting and running companies, an ideology that’s borrowed from the tech world.

Because of this, there’s a myth that these investors are unsophisticated and overeager, that they are blinded by the “Founder journey.” Or that they might push a premature company forward while dangerously glossing over the underlying science in Theranos fashion. But you’ll notice that few scientist-investors took Theranos seriously.

Of course, there are some cases where that has happened. I’ve seen companies that lacked great scientific results get by with visionary storytelling, while companies with superb technology and weak storytelling floundered. But the best West Coast investors aren’t fooled by this. They care just as much about the core science as anyone else does. They understand it, can evaluate it, and will vet your claims (this is why top biotech investors saw right through Theranos).

West Coast investors are different not because they don’t get the science, but because they are also students of the Founder mindset. They are also good at recognizing great potential in a Founder – even if the Founder hasn’t realized it yet.

There is unique value in this hybrid of science and entrepreneurism. This is what makes it possible for West Coast investors to see what many others do not – to identify a future entrepreneur within the established scientist. These investors are often there at the genesis moment when new techbio companies are born. They are magic-makers in the very earliest stages of your startup.

Meet the East Coast Investor – The Growth Stage Accelerant

Now, meet the stereotypical East Coast investor. Maybe they have a PhD from MIT or a Harvard MBA. Maybe they started their own company before moving into VC, or they worked for a top ten pharma company. A lot of people picture this person armed with a suit and a spreadsheet.

They’re ready to talk about clinical endpoints and your process for bringing an asset to market. They may already have a venture creation process in place.

The myth here is that this person is impossible to please or doesn’t trust a scientist Founder to see the journey through. Instead, they’ll just shove you out, dilute you like crazy, and install a tried-and-true pharma CEO.

Again, this myth obscures the nuance: The East Coast investor is a pragmatist, not a judge. Like any good scientist, they want evidence, on both the scientific and business side of things. They want demonstrated confidence signals that a company’s leadership can bring an asset to market or run a mature company.

Sometimes those signals are demonstrated by twenty years at a top ten pharma company, but that’s not always true. If you check the scientific and experiential boxes (and we argue that many scientist-Founders can learn to do the latter), this investor is powerfully helpful for the growth stages of your company. They’re also particularly useful in business development, when you’ll want intros to top pharma and biotech CEOs.

The Golden Ratio: Start with the Best of the West, Grow with the Greatest of the East

The best way to navigate the East Coast West Coast continuum is to strategically cultivate relationships with both types of investors. That may seem obvious, but how, and when you lean into each type of ideology is critical. You have to manage your ratio of West Coast to East Coast conversations over the course of your company’s lifetime. That is especially true if you are building a Techbio platform– a base technology that allows for more capabilities to be built, programmed, or discovered (think: reprogramming immune cells, or mapping novel connections within the microbiome).

Let’s begin with the seed stage. Assuming you’ve negotiated with your university’s tech transfer office and incorporated yourself, you are now spending the bulk of your time fleshing out your platform, and learning the skills of entrepreneurship. Again, let’s be clear: “fleshing out the platform” doesn’t mean you haven’t done rigorous experiments or proved your concept backed by IP and peer-reviewed publications. It means that you have those building blocks, but need the flexibility to explore ideal go-to-market indications or rev up your discovery engine.

These new challenges are right in the West Coast investor’s wheelhouse. The West Coast investor will take on the risk of shaping you into a Founder, provided you have a strong enough scientific concept to hang your hat on.

At this point, the conversation ratio skews towards the West Coast investors, but you should still be in touch with a few trusted East Coast sources you can talk to about your platform’s endgame.

How do you know when to change that ratio? Eventually you will reach a fork in the road during platform development. You need to ask yourself: How deep are we going on this platform? How deep are we going on specific assets? Which indications are even interesting, given the platform’s capabilities? This fork will probably emerge during your seed stage, but it should definitely be something you’re thinking about as you near a series A.

At this point, start testing the waters with the East Coast investors. Your conversation ratio needs to shift to one to one: equal amounts of East Coast and West Coast conversations.

That’s important because you are setting yourself up for a strong Series A, where you are going to be spending equal time talking about your platform, or your platform’s potential assets. The East Coast investor’s added value is helping you decide what’s even interesting and plausible to pursue in the long run.

At this point, the experience and pragmatism of the East Coast investor becomes extremely valuable. That value will only continue to grow, especially when you reach B or C stages, and need to be especially serious about endpoints, and regulatory plans.

The further you get in your company’s lifecycle, the more the conversation ratio concept demonstrates its value. By cultivating both types of relationships, you’ve heightened the chances of warm intros and interested investors at the different, critical points in your techbio startup timeline.

The Future of the East Coast-West Coast Mindset

You’ll notice that world-class East Coast and West Coast investors care equally about the strength of your underlying science. The real difference between the two mindsets comes in how they view leadership, and what data points they want to see at certain times.

That’s why they work best as a tag team. With the guidance and support of a West Coast investor, you will develop into an entrepreneur. You’ll refine and strengthen your core science. You’ll maintain your ownership and not get diluted and booted. Then, East Coast investors can further support your growth, expand your network, and get your innovations in front of the patients or customers who need them.

And, to make things even better for you, these mindsets are already merging. The same way that we encourage Founders to incorporate ideas from both camps, investors are seeing value in each other’s approaches. It’s never been easier to strategically work with both ideologies at once as they converge around a few core ideas.

While venture formation firms are still dominant on the East Coast, they are taking on some traditionally West Coast attributes. Flagship Pioneering has spun out multiple platform-based businesses: Moderna is an mRNA platform, Alltrna is a transfer RNA platform, and Generate Biomedicines is, essentially, a protein design engine. That’s a venture formation fund that’s clearly buying into a platform mentality.

(That’s a good sign that East Coast investors are ready to see value in platforms. But we believe that the West Coast investors, are uniquely well positioned to help you get that platform off the ground – and keep you in charge.)

Meanwhile, we see traditionally East Coast-centric pharmaceutical companies embracing relationships with founder-led platform companies. Mammoth Biosciences, for example, has been able to form critical partnerships with Bayer and Vertex, while keeping a passionate young scientist-Founder at the helm.

Great scientists, great entrepreneurs, and great investors all have one thing in common: They see hidden signals in the noise. The idea that there are stark and irreconcilable differences between the East Coast and West Coast mindsets is simply noise. At NFX, we coach our Scientist-Founders to seek both types of expertise, and at the right time.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.