Recently, we’ve demonstrated how network effects have produced the most valuable tech companies in the last few decades. Many were two-sided online marketplaces. Airbnb. Google (an advertising marketplace). Uber (an Asymptotic Marketplace). OpenTable. eBay. Craigslist. All marketplaces.

It’s a powerful business model.

However, two-sided online marketplaces are as difficult to build as they are rewarding. This was a lesson I learned firsthand as the founder and CEO of Trulia, where I spent ten years of my life — from 2004 to 2014 — building an online real-estate marketplace that merged with Zillow to create the world’s largest online real estate marketplace in a $3.5 billion transaction.

During that time, we were faced with many obstacles particular to a two-sided marketplace business model, with consumers on one side and the real estate industry on the other. But three of the biggest initial problems we faced were also amongst the most challenging. These were:

- How do you build the supply side (i.e. property listings and information) so as to incentivize the demand side ( i.e. homebuyers) from a cold start — the classic “chicken and egg” problem.

- How do you efficiently acquire and retain users with a commoditized supply side (how do you retain a competitive edge amidst an environment of rampant multi-tenanting, wherein it is costless for suppliers to list on other marketplaces).

- How do you monetize an online marketplace when the actual transactions take place entirely offline (especially in the midst of a market downturn).

Our success depended on solving each of these problems quickly and efficiently after raising our initial launch capital of $2.1M. Almost every marketplace will face similar problems in one form or another, but I believe our solutions at Trulia were uniquely effective. By sharing our story, I hope to cut through the of vague (and bad) advice out there with a detailed account of how we built a multi-billion dollar, category-leading marketplace in under 10 years; a story which, I hope, Founders will find both interesting and useful.

“Google for Real Estate?”

In the summer of 2004, I was a 29 year-old Stanford grad student recently arrived from England. This was also the summer of Google’s IPO. The buzz it produced in Silicon Valley was inescapable. It was the beginning of the revival of the digital economy, and after a four year barren patch after the dotcom bust, young entrepreneurs once again felt inspired about building transformative technology companies.

At that point, I had been in the country for less than a year. Silicon Valley was still new to me, as was the bewildering the Bay Area housing market. I had begun house hunting and, given that I was looking in the tech capital of the world, I expected to find a helpful online tool that would help me navigate local real estate. But, to my surprise and frustration, no such tool existed. I found it remarkable that given the size of the housing market and its fundamental importance in everyone’s life that consumers were so poorly served. Everyone I spoke to about it seemed to feel the same way.

So it was with these two matters weighing on my mind, the local housing market and the Google IPO, that I found myself sitting in the back of a real estate conference in San Francisco. I was there by chance, having been given a ticket by my summer internship. At the conference, it struck me that the real estate industry was really struggling with adopting technology. Although consumers were increasingly moving online to search for real estate information, it was clear that the real estate industry was still spending billions of dollars in offline advertising to reach homebuyers, principally through classified listings in newspapers.

As I drove back to Palo Alto after the real estate conference I had a eureka moment. What if I applied the online search model to the housing market? I could build a tool that would pull together important real estate information into one place and help people make the biggest financial decision of their lives. And no sooner had the idea occurred to me that I decided to put it into action.

An audacious plan

As I thought on the idea, it began to develop more fully. There were three key insights:

- There was a growing online audience for real estate. People are going to use the internet more and more to research their homes.

- Advertising dollars were going to follow that audience online.

- All the incumbents at the time were primarily serving the interests of real estate agents, not the consumers.

Therefore, it seemed clear to me that there was a big opportunity to create a content-rich consumer brand for online real estate.

The problem, however, is that the massive real-estate market was dominated by powerful incumbents, most notably the National Association of Realtors. This organization had over one million members and it controlled the 800 so-called “Multiple Listing Services”, which were real estate listing databases that could only be accessed by other realtors. But the fragmented nature of the MLS system, and the fact that it was closed off to the public, made it particularly hard to access real estate information and make it fully available to consumers.

Put simply, we saw an opportunity for a consumer product that did not currently exist in the market; one packed with the most comprehensive and relevant information available and a compelling user experience.

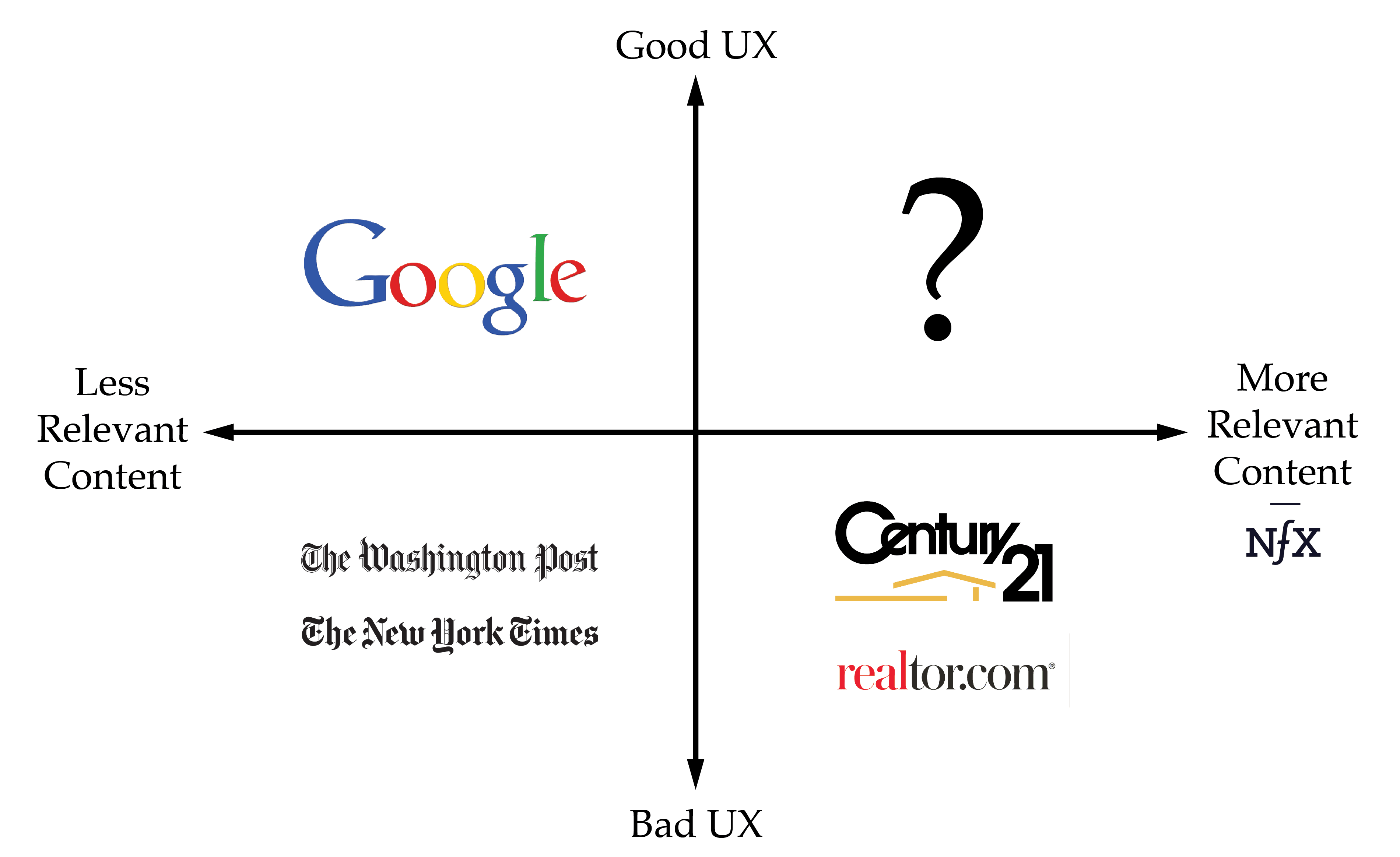

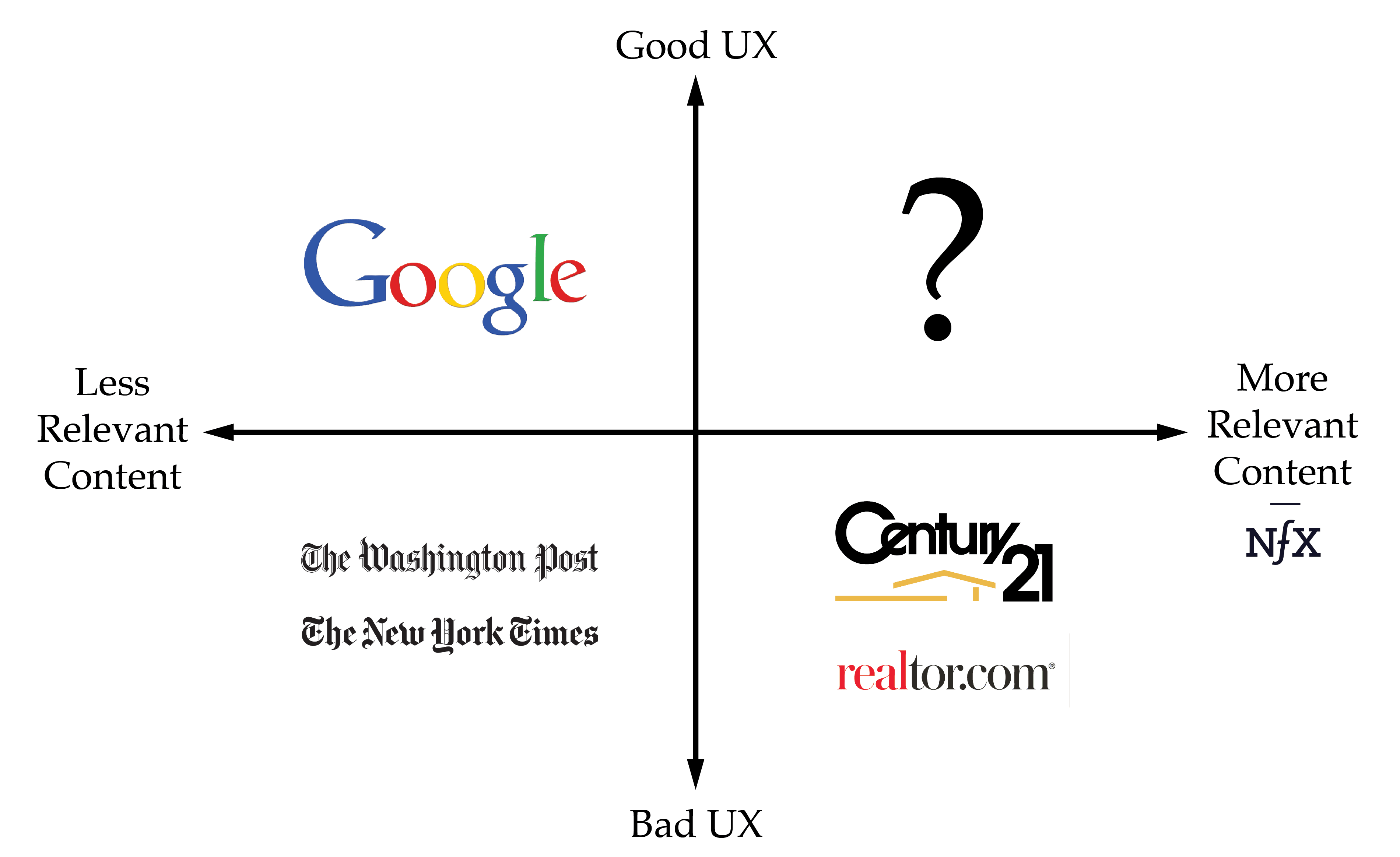

What we did see fell far short of that. As we mapped out the existing options for consumers searching for online real estate information, we arrived at the following landscape:

Google, obviously, had an awesome user experience as it was very fast, easy to use, and functional. But the problem with Google is that it wasn’t vertical-specific. It indexed the entire internet, which means that search results were almost never relevant if you were searching for detailed real estate information in a particular locale. And because the NAR was leaning on the various MLS’s and on licensed realtors not to make content accessible to search engines, very little content was available for Google to index in the first place.

Homeseekers would have had even worse luck in the online classified sections of local newspapers, having to comb through a subset of the available listings using interfaces that were typically designed by newspaper execs, not online product designers. Newspapers were not especially quick to adapt to the digital age, but they still commanded billions in real estate advertising revenue.

And while the NAR’s site (realtor.com) and the thousands of brokerage and franchise sites such as Century21.com, remax.com, etc. had access to a comprehensive set of high quality listings, they lacked the consumer focus and expertise to build a great online consumer experience. Furthermore, they were inclined not to give consumers all the information they possessed, such as historical housing transaction data. Doing so might alienate the agents they worked with, who used such information to attract customers in the first place (although it was already publicly available).

Knowing this, we set out to fill the gap by building the first online real estate marketplace of its kind. And thus, Trulia was born.

Building a Marketplace Network Effect: hacking the supply side

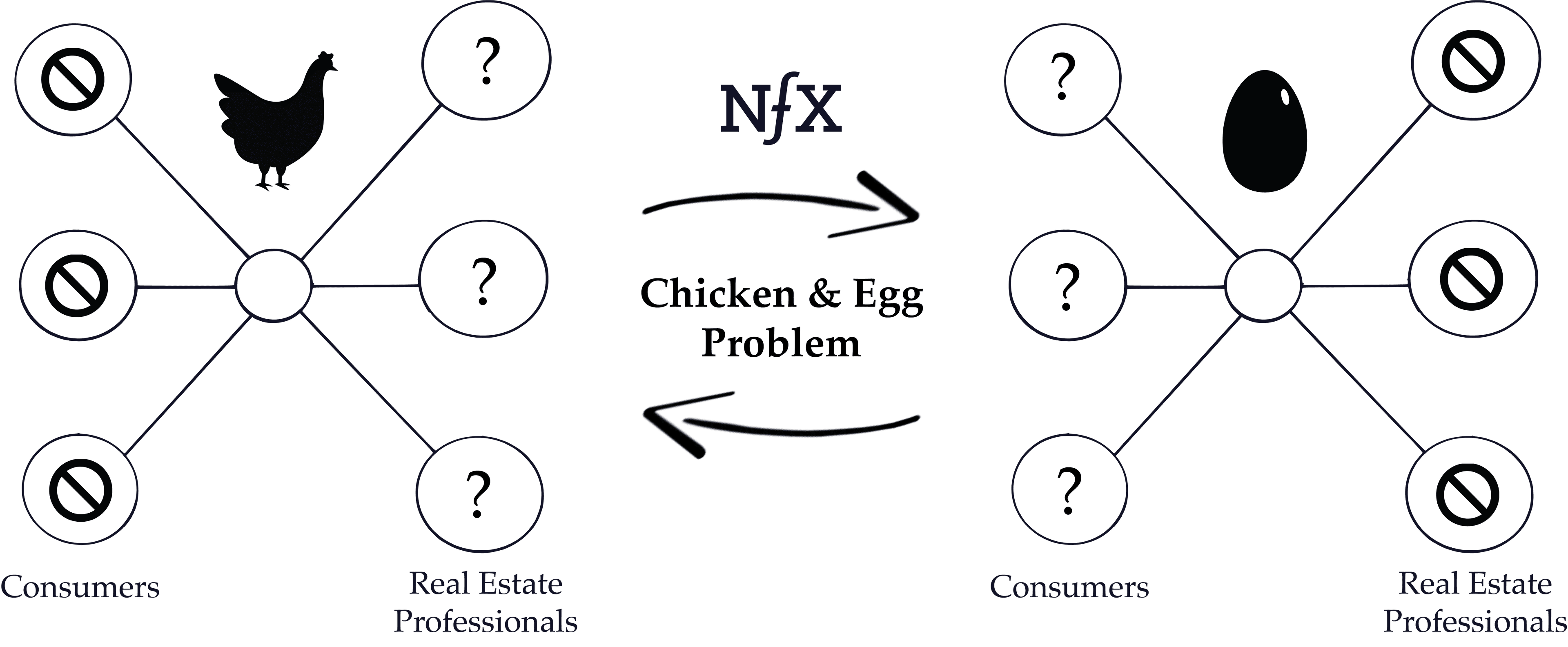

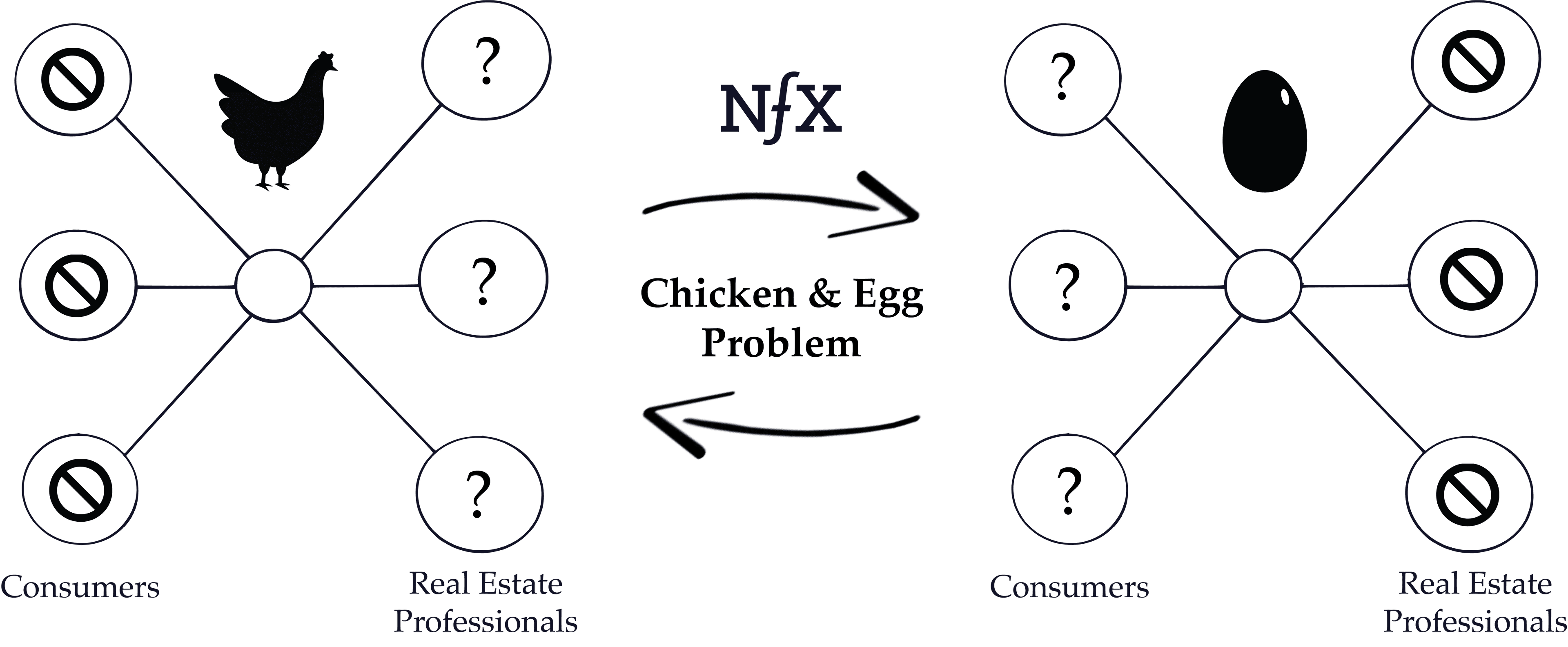

Our first big challenge, one which every online marketplace must reckon with, was the so-called “chicken-and-egg” problem. How could we attract a consumer audience (homebuyers) without any listings, and how could we attract listings without an audience?

Without one side of the marketplace, in other words, what is the incentive for the other one to show up?

The problem was compounded by the real estate industry at that time. Organizations like the NAR were concerned about losing control of real estate listing information, which had up until now been under their control, to the internet. They feared that if they weren’t able to maintain their exclusive access to proprietary information, then real estate agents would go the same way as travel agents, who had recently gone extinct after the explosion of online travel sites like Expedia and lastminute.com.

To navigate this, we started by asking brokers for access to their listing data feeds. But no such feeds existed (yet). So our only choice was to build a real estate specific search engine to index an agent’s own listings directly from their broker and agent websites. We would then use the snippets gained to build the supply side content for our marketplace. To benefit the agent as well, we would then send traffic back to the website that was the source of any given listing.

It was technically complex to build a search engine from scratch to do this while navigating fair use copyright laws, ensuring correct attribution, and including opt-out and search engine provisions, but that’s precisely what we did when we developed our working prototype. Before long, consumers and agents on both sides of the marketplace started to see the benefits and Trulia usage began to surge.

We only launched in one state (California). But within a year we had gone nationwide and spent an enormous amount of time with the real estate industry communicating the value of our search engine to an audience who traditionally didn’t welcome outsiders. With the supply side bootstrapped, a Marketplace Network Effect had clearly gained significant traction.

Fortifying supply-side defensibility with a Protocol Network Effect

As our audience grew, so too did the appeal of directly submitting new property listings to Trulia instead of waiting to get indexed. For many agents, we had quickly become the second highest source of traffic to their websites (second only to Google), and these began to submit their listings of their own accord. It was free to list on Trulia and that was important to build a compelling and comprehensive consumer proposition.

This had always been our plan; indexing listing information from other sites with crawling software was just a stopgap measure. But we wanted to do all we could to build on that and further incentivize the agents to start publishing their listings directly on Trulia.

A key realization we had is that the supply-side was commoditized: we wouldn’t be able to build defensibility from our supply-side relationships purely on the basis of a Marketplace Network Effect, because it was in the interests of the real estate agents to syndicate their listings through every possible channel. We needed to find a way to make sure they kept coming back should the incentive of a big audience (strong demand) not prove enough.

So we created an XML feed standard which allowed real estate agents to syndicate their listings to Trulia from their own websites and Listing Syndication in real estate was born. This prevented brokers from having to go through the hassle of posting them manually to every channel, and soon our competitors had adopted the same XML standards for their sites as well. It was a bonus for the consumers experience too, which benefited because the data was more accurate, more complete (with pictures and details, etc), and more timely.

Thus we were able to take advantage of a Protocol Network Effect, in addition to the marketplace nfx we had already captured, to accelerate our growth on the supply side and thus our defensibility.

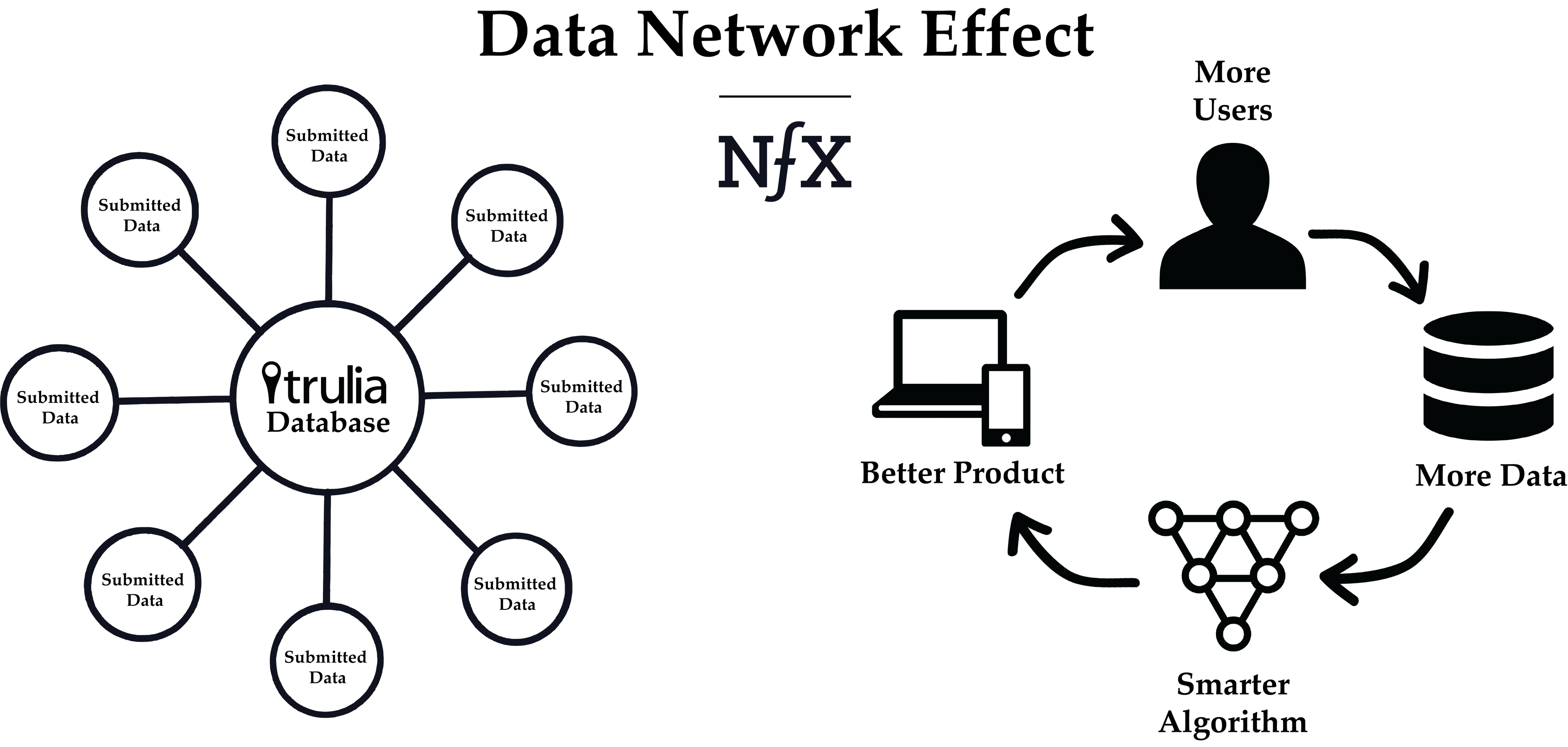

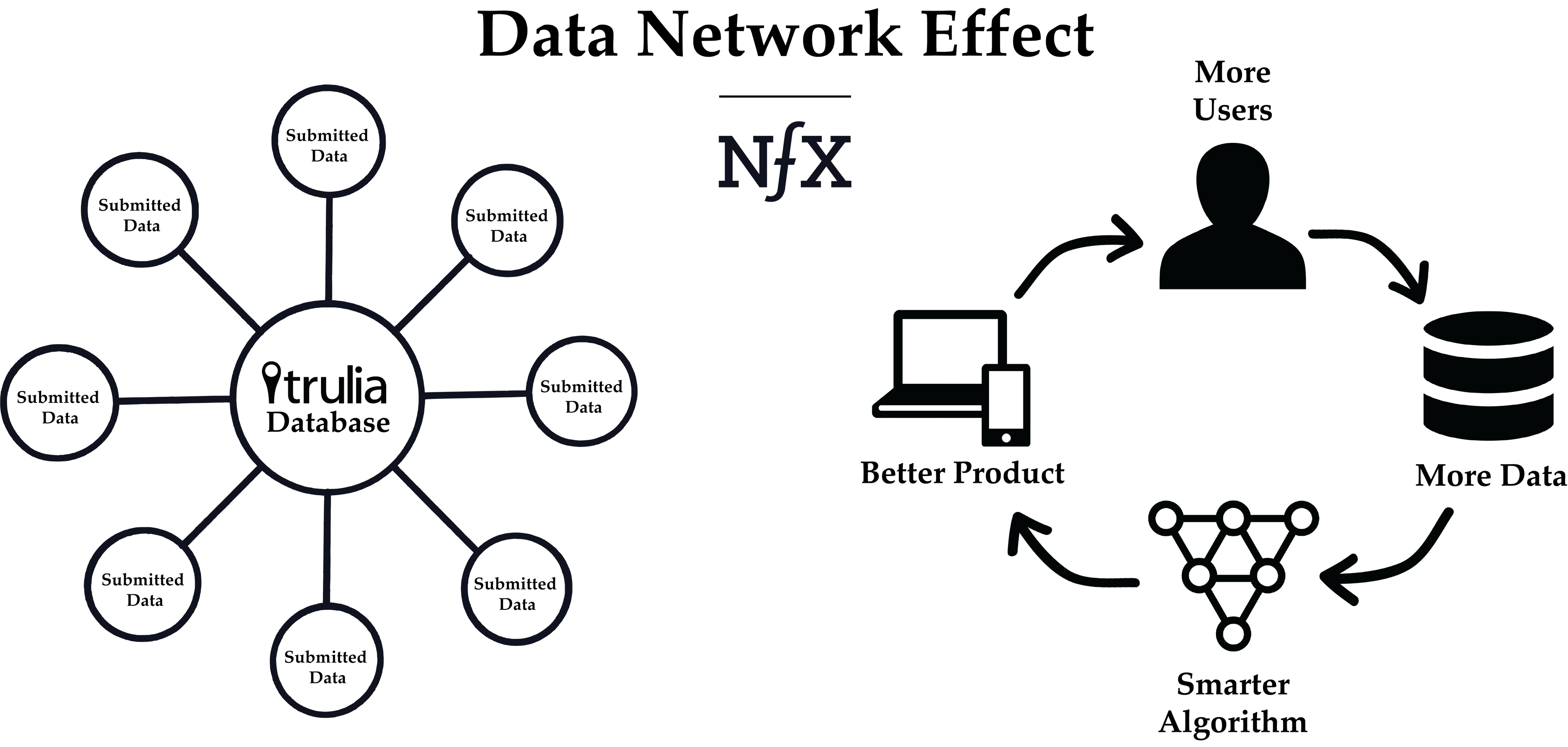

Building demand-side defensibility with a Data Network Effect

As consumers looking for housing flocked to our site, they began to encounter an ever-expanding breadth of content (a high density of local listings, detailed housing information, neighborhood intelligence reports, etc.). They were also met with a fresh-looking site with all kinds of filters, maps, content and sorting tools not available at any of the more traditional franchise sites or newspapers.

The category was hyper-competitive, with literally thousands of agent and broker sites and a very well capitalized competitor, Zillow, launching just 4 months after Trulia did. Growth and defensibility became critical.

The way we aimed to do that was by layering a Data Network Effect on top of our existing defensibilities: using the data that came from our users to improve the overall user experience.

To produce a Data Network Effect, we provided tools for consumers and agents to add data and content themselves — either by participating in our Q&A forums or by getting homeowners and agents to add and change property information. These actions helped contribute to Trulia’s Data Network Effect by powering a number of different product tools, for example our recommendation engine (“if you liked this home, check out these others”). The more information Trulia had, the more valuable the site was for users, and the more likely it was that users would continue to add more data.

All this helped us drive engagement and audience scale which helped us achieve a very large audience with no marketing spend.

Monetizing an online marketplace with offline transactions

With a growing base of both demand-side and supply-side users, we were off to a good start in the first years after launch. Early on, our approach was to focus our limited resources on the largest franchisors, brokers, and franchisors, as they had the biggest budgets. But, as we realized later, the biggest customers were also the farthest from the actual transaction.

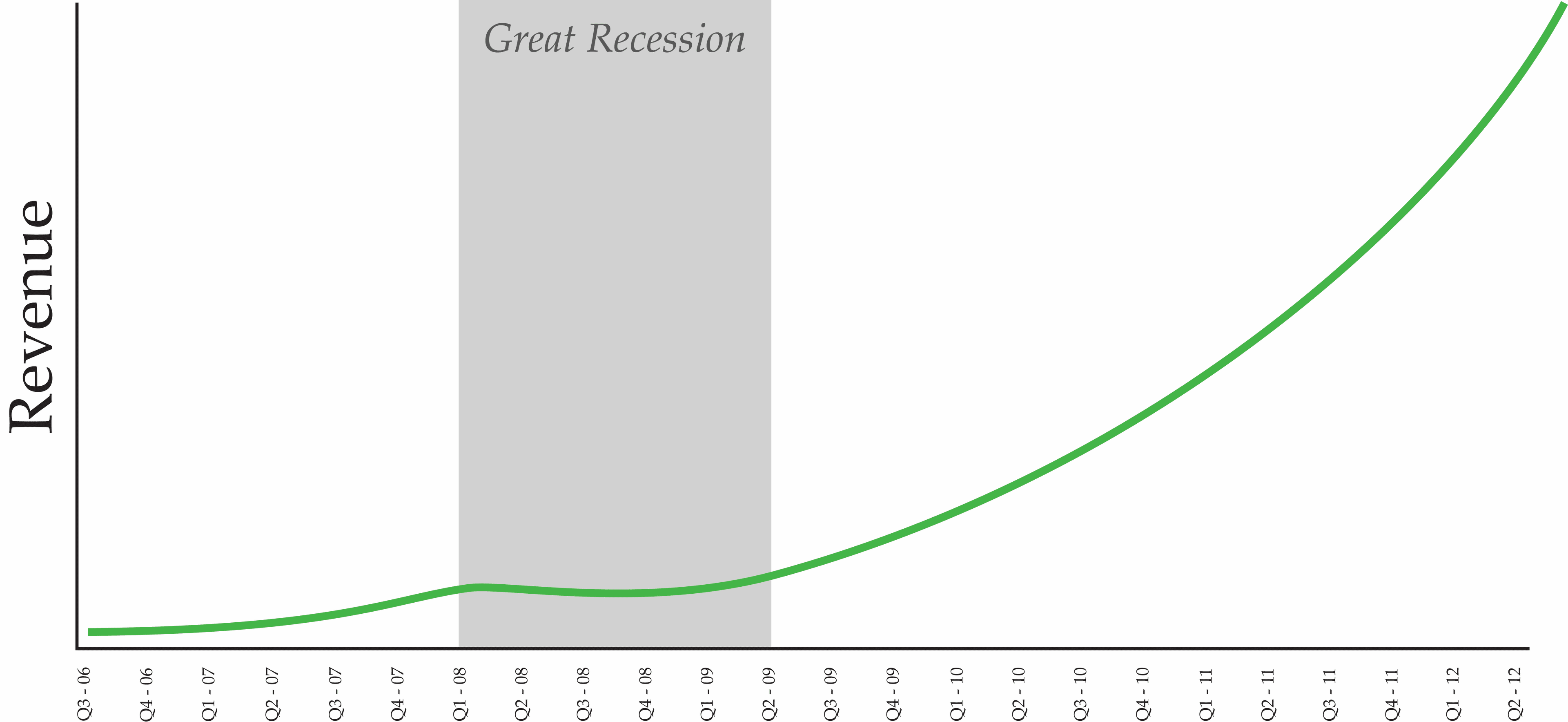

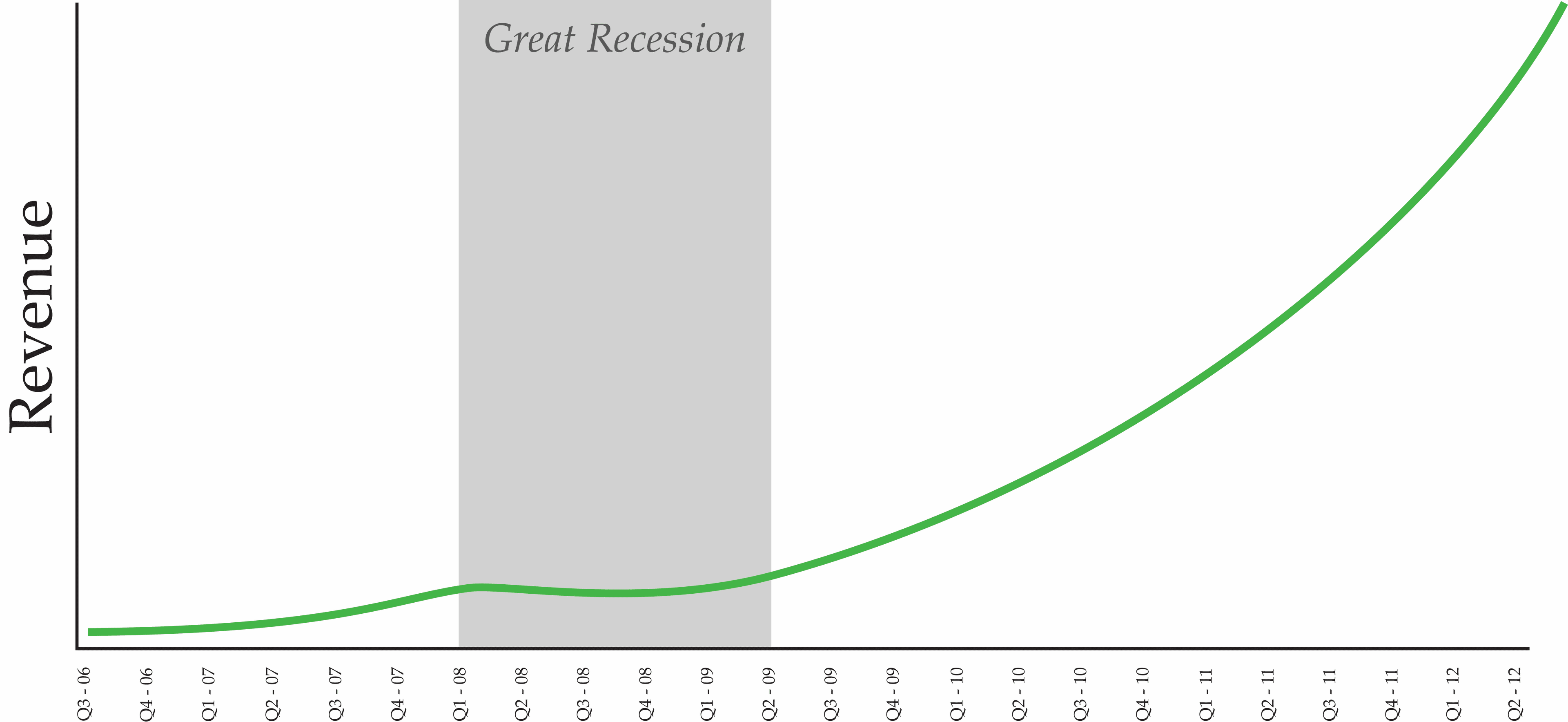

But in early 2008, that began to change. Home prices were falling rapidly, triggering the financial crisis, which in turn caused a full-blown collapse of the housing market and the US economy. While our market share was still growing, our existing customers started cancelling their contracts with us left and right as they fought to survive. Housing transaction volume was plummeting, and our business was in serious existential peril.

The problem of monetizing our marketplace had always been tricky, even before this. Transactions took place offline, often after a sales cycle of several months or more. So unlike transactional marketplaces, we couldn’t charge a percentage of every transaction on the platform in order to monetize. Instead, we had to sell leads and ad space.

So in the depths of 2009, with our largest customers retrenching, we started selling to individual real estate agents. Unlike the big franchises, individual agents had the incentive to pay for Trulia’s help in attracting new leads and consumers because were much closer to the transaction. To scale this new monetization strategy targeting smaller customers, we set to work creating cost-effective marketing and lead generation products for the individual real estate agents.

Our gamble paid off. We weathered the storm of the financial crisis with the new revenue stream from individual agents, built painstakingly, and as the housing market recovered we came out in pretty strong shape. It turned out that the very thing that made our customer base so hard to build is the same thing that made us so hard to displace; good luck to any new competitor trying to replace us. And because of our momentum coming out of the crisis, we were able to IPO in 2012 at a $500 million valuation.

Even further defensibility: building a Market Network

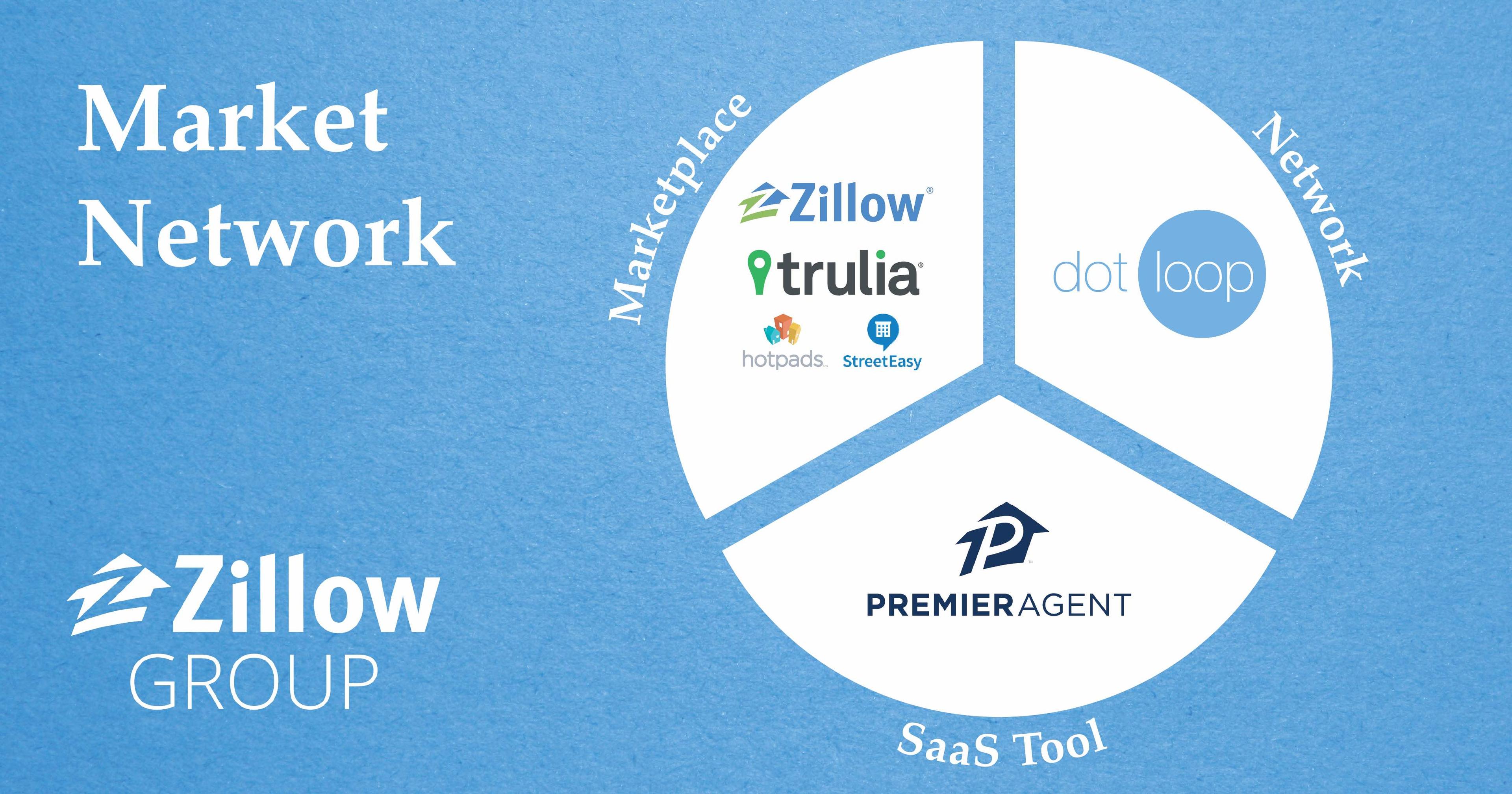

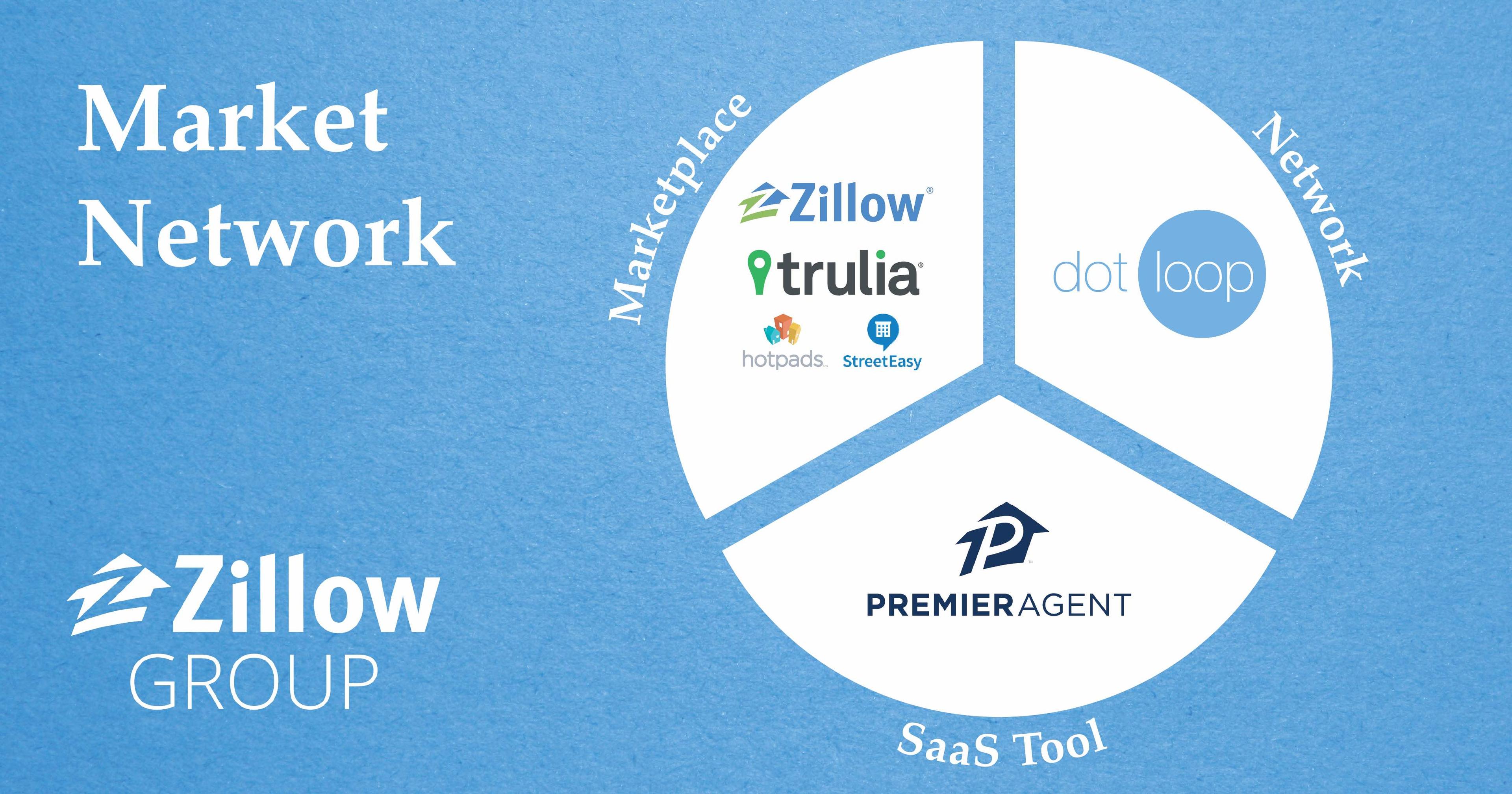

When Trulia merged with it’s biggest rival Zillow in 2015, defensibility was greatly bolstered by the scale of the combined companies, which had become the number 1 and 2 US online real estate sites. But it also kickstarted the formation of a final, and very powerful, network effect: that of the Market Network.

A Market Network combines the elements of a professional network, an online marketplace, and a SaaS tool all in one. As a result, its network effects and defensibility are more powerful than that which any of the three elements would provide alone. Both companies knew that the core marketplace was not as defensible as other marketplaces due to the significant multi-tenanting on the supply side, so there was a drive for scale and deepening the network effect.

If one considers Zillow Group today, it has really evolved we think of as a true Market Network. It combines the core marketplace businesses of Trulia and Zillow with a SaaS tool, the Premier Agent App which came with Trulia during the acquisition. The final piece — a professional network — fell into place with the later acquisition of DotLoop, which allows real estate professionals to manage transactions with other trusted members with profiles tied to their identities and reputations.

Looking back at the years since Trulia’s launch in 2005, it’s astounding to see how the business model has evolved and grown. If you had told me as a young, immigrant grad student hanging around at the back of a real estate conference that my idea would one day become a multi-billion dollar, 1000+ employee company that merged with its biggest competitor to create the largest online real estate company in the world, I wouldn’t have dared believe you.

But in hindsight, it’s clear to me that two things contributed to the magnitude of Trulia’s success. The first was the growth tactics we employed, which helped us achieve enormous scale with massive capital efficiency — a topic I’ll be returning to later. The second was identifying and implementing network effects early on, which allowed us to survive the tough times and thrive when they were over.

Disclaimer: Pete Flint was formerly a member of the Zillow Group Board of Directors after the merger with Trulia and is a Zillow Group shareholder. His comments are his own and don’t reflect the views of Zillow Group.

***

Pete Flint is the founder and former Chairman and CEO of Trulia. In 2015 Pete merged Trulia with Zillow in a transaction which valued Trulia at $3.5BN, after which he served on the Zillow Group board. Previously he was part of the founding team of lastminute.com which was acquired for over $1.1BN. Today, he is a Managing Partner at NFX. Follow Pete on Twitter here.

NFX is a Pre-Seed and Seed venture fund based in San Francisco. Founded by entrepreneurs who built 10 companies with more than $10 billion in exits across multiple industries and geographies, NFX is transforming how true innovators are funded. Follow us on Twitter here.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.