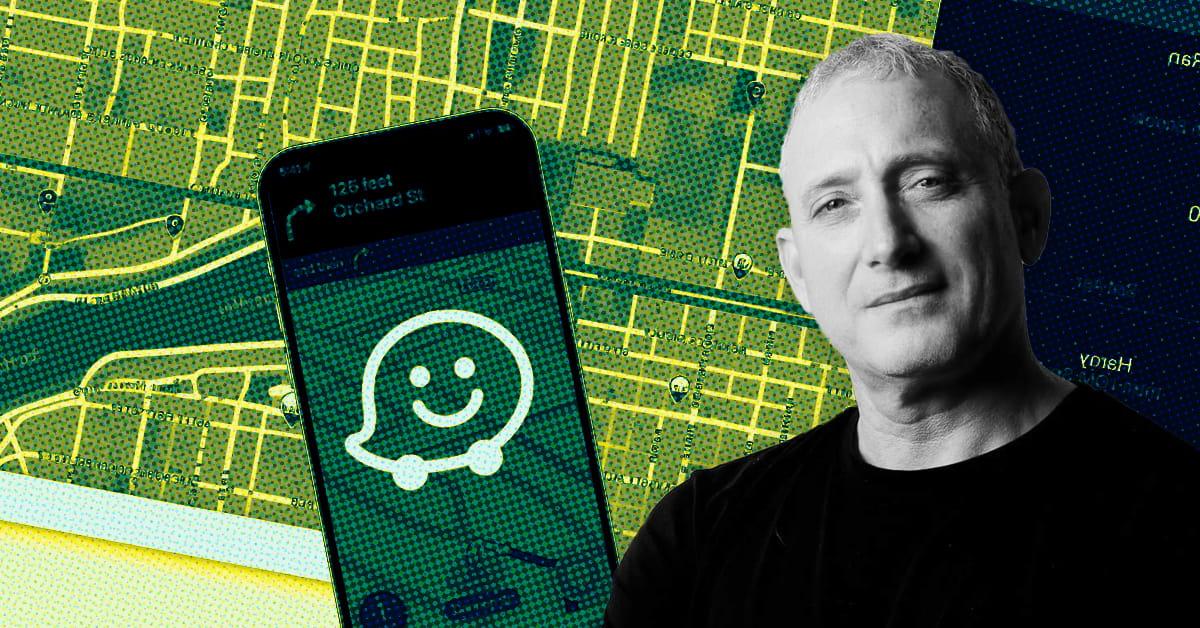

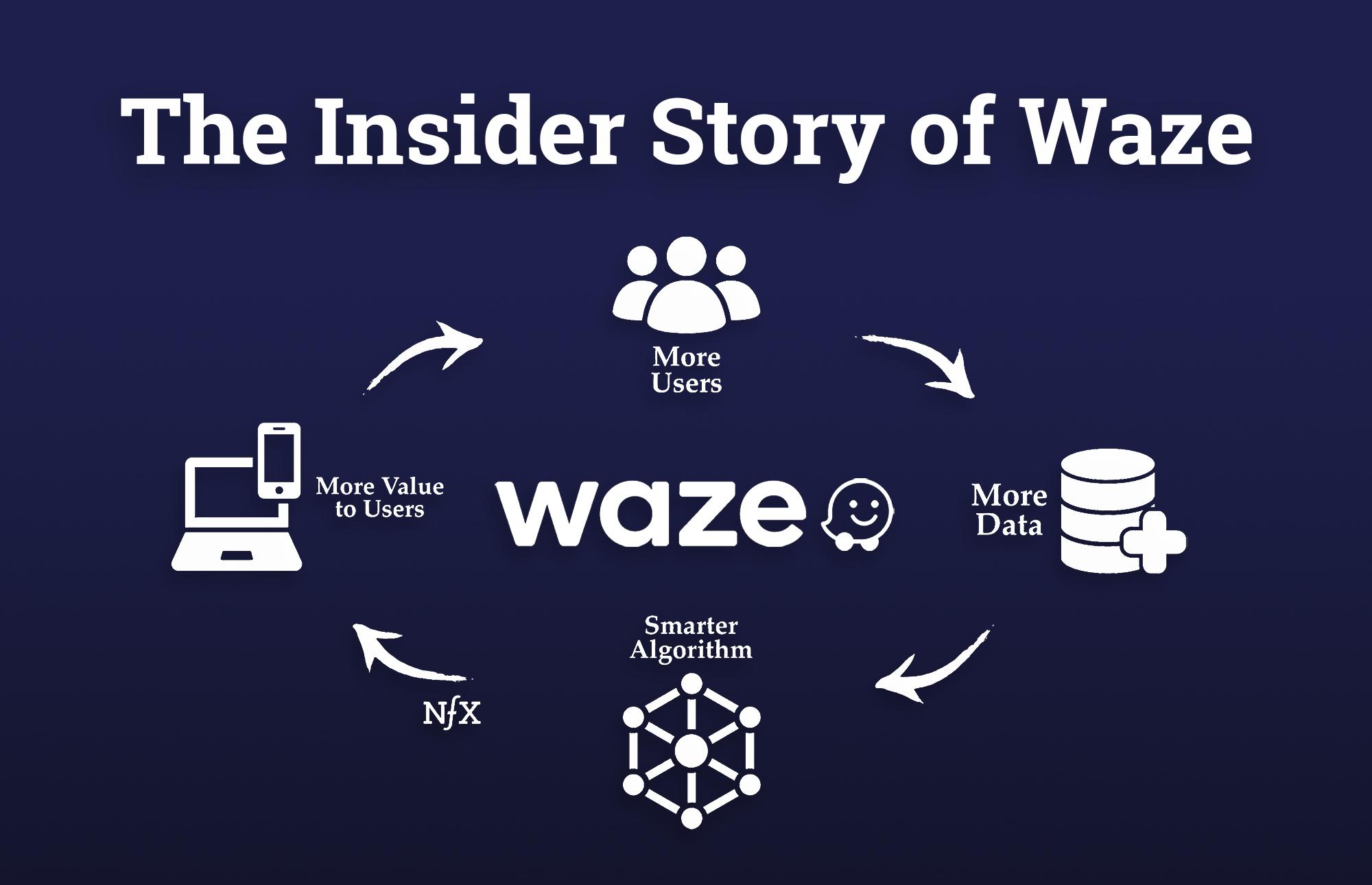

Underlying Waze’s journey is a little-known approach to product thinking, super-powerful data network effects, and a guiding north star metric. This is Waze’s insider story, as told by their former CEO, Noam Bardin.

I recently sat down with Noam, who told me the step-by-step story of the company’s growth, starting from their early days in 2008 with just 2,000 monthly active users, through being acquired by Google for $1B in 2013, and hitting 140M monthly active users at the time Noam stepped down in Feb 2021.

Early-stage Founders are wise to study as many successful growth stories as they can. While there is no single playbook of best practices, each case contains deeply valuable learning that we at NFX aim to pass along from Founder to Founder.

Where The Streets Have No Name

- Waze began as an open-source project by one of the Founders in 2006. Ehud (Shabtai) basically started this on his balcony — which is the Tel-Aviv equivalent of a garage in America.

- Things began taking off and they decided to turn it into a company. They officially raised their A round in March of 2008. I joined the company in March of 2009, 3 months after it launched as Waze in Israel.

- I met the Founders early on and we spent a lot of time together. We reached a point, before we went to the investors, where they said to me: “Look, we want you to feel like a Founder. And we want you to act like a Founder and not like a hired-gun CEO.”

- You have to remember the time also. This is 2008. Nokia was a dominant player in cell phones and Blackberry was the dominant one in the US. And Microsoft was a major player in mobile phones.

- The very first iPhone ever had just come out. You had to jailbreak your iPhone to even install navigation software; It was a very, very different world from today.

- I had never installed an app on any of my phones. There weren’t app stores then. Waze was the first app I’d ever installed. Installing meant going and installing an executable and running it.

- The company had about 22 employees, it had launched a service only in

Israel. There were probably about 2000 monthly active users at the time. - Fast forward to February 2021, when I stepped down as CEO, we were at about 140 million in monthly actives, doing about 36 billion driven kilometers a month in every country you can imagine.

- So any country where people drive cars today, there is a Waze map being built. It’s a community-driven product, it literally grows wherever people want it to grow.

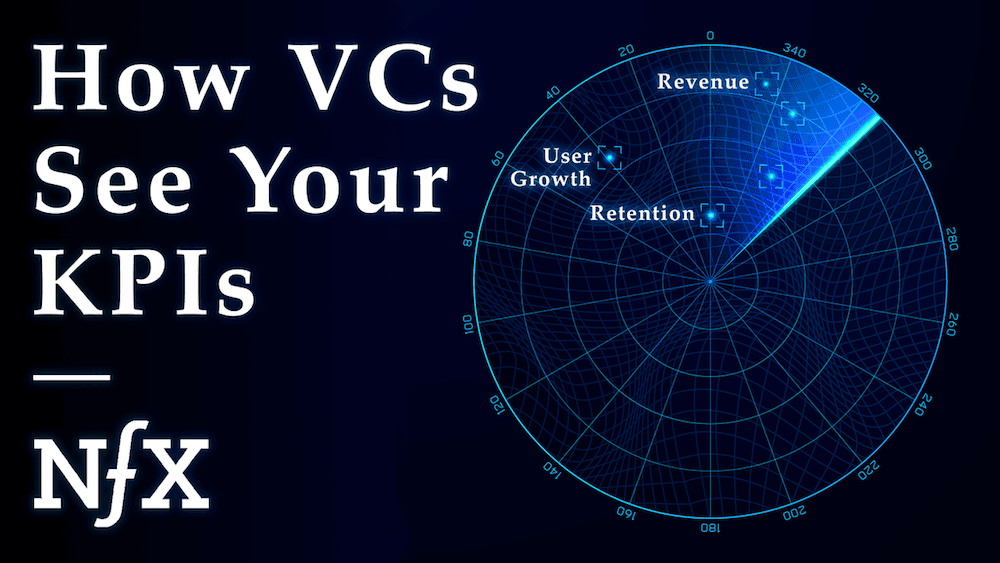

KPIs Through 3 Growth Phases

1. Beginning Phase: KPIs for fundraising

- Startups usually start with very, very simple KPIs: downloads, users, something.

- Retention KPIs didn’t even make sense at the beginning for us because we had very, very high retention from a fraction of the users and no retention for most of the users, because the product just didn’t work very well yet.

- Your early KPIs many times just represent what investors are expecting to see. Because a lot of times, especially in the early stage, startups are really focused on trying to raise money.

2. Early Growth Phase: What’s the KPI that drives your business?

- But when you actually think about it, as a company grows, the KPIs become more and more specific and deeper and more representative of the business and the user experience.

- For us, a few years after we founded, we realized that “driven kilometers” was really the most important metric of our service.

- That doesn’t mean that it made sense to an investor, or was comparative to other services.

- But when you think about what our network produces, the more people who drive with the service adds up to what we call driven kilometers. It’s a great cycle: How many kilometers did you actually drive that month? Then we collect data from it. They spend more time using Waze. We can make more advertising revenue. The more people use our product, the more features they discover driving more usage, et cetera, et cetera. And so all of these things really made driven kilometers one of our most important metrics.

- There are obviously lots of other KPIs. But as a CEO, I always like to look most at what’s the ultimate KPI? What’s the KPI that drives your business?

- Now, if you look at reporting activities reporting per user, something like that, it’s a very important KPI for the PM or the team working on reporting as a product. You’re going to have a lot of KPIs for your teams.

- But when you think about the company on the whole, if I have to choose one KPI, look at one that’s the best explanation of how your business works.

3. Later Growth Phase: Relentless prioritization

- After we raised a lot of money in our B-round and poured on some gasoline, we started seeing growth in usage.

- But what we saw was our users kept growing, but our KPI of driven kilometers stayed flat. Meaning we were churning users. New users were coming in, getting churned, and a very small cohort kept using Waze the same amount.

- We announced it as a crisis internally and we stopped everything we were doing and focused only on understanding why that happened.

- We stopped development on everything, and we invested a lot in analytics and all kinds of stuff, and in surveys and talking to our users and focus groups, everything.

- Usually, when you do this you find inconsistencies between what people say and what the data shows. But here, what we saw was complete consistency with what the data showed and what the users said!

- We had thought users didn’t understand what we’re trying to do. We thought they wanted it to be more of a navigation app, a traditional navigation app. Or we thought they wanted it to be more of a social app, we had all these theories. But when we talked to users, they actually understood completely what we were doing and why we were doing it and how it would work.

- The main difference between a user who churned and a user who stayed was their patience level, not their understanding. That basically meant that we just weren’t delivering a good enough function quickly enough for them — but we had delivered a good enough mission and a good enough experience, just the product itself didn’t work well enough.

- Once we understood that, we could focus all our energy on the core of the map, the navigation, text to speech, and basic functionality that wasn’t working very well.

- As we improved the core functionality, we saw the numbers just go through the roof.

- We reached a level of clarity that we would never have gotten to, and a level of prioritization of what we were doing that we would never have gotten to. And once we had that clarity, literally we could see how every one of our activities drove that KPI.

What Do You Want Customers To Say About You 5 Years From Now?

- The very first time I tried the Waze app, I remember my wife saying, “Wow, there are other people using this. I don’t feel alone.” That feeling was very, very important and stayed with me.

- When you think about the technology, there’s the functional side of what it

does. And then there’s what it makes you feel. - And a lot of times, startups focus too much on what it does and the hard aspects of the feature, the functionality, the performance.

- But you also need to focus on what the user feels when using it.

- You need a combination of the thing working well and the feeling you get.

- This really goes back to the importance of having a clear mission and vision in terms of what you’re trying to do. I’m talking about the consumer space now, but it’s probably the same for SaaS businesses and for some enterprise — I try to ask them:

- When a user 5 years from now describes your company, what are the words they’re going to use?

- This seems silly. But actually, their answer is the output of all your strategy, mission, and vision.

- Obviously, when you’re starting out, you don’t know what they will say about you. What do you want users to say about you?

- If you have a strong vision of how you want them to describe you, then you can begin talking in consumer terms.

- So what are the emotions they’re going to express?

- What do you do for them that changes their life or that makes their life

better, or that helps them in something? Those kinds of questions, if you can answer them from the consumer perspective, brings clarity to your whole business.

Stop Negotiating With Yourself

- When you look at other companies, you’re constantly thinking about how their strategy is going to affect you, but you forget that nobody cares about you.

- Nobody knows you. You’re a startup. No one’s ever heard of it about you. And you also have no way of understanding why other companies are doing what they’re doing.

- And again, this goes back to you thinking about your product, you’re thinking about distribution and strategy. They’re thinking about getting promoted or this VP not liking the other VP, or Amazon did this so we need to do this. And the criteria is so different.

- One thing I try to tell Founders is to stop negotiating with yourself. Do what’s right for your users and for your business. Don’t assume you understand what’s going on in the other companies.

- We made this mistake in 2009 when Google maps came out (long before they acquired Waze) with their navigation product which was a hundred times better than ours and worked and it was free. That caused a terrible panic on our side.

- We made the classic mistake of trying to think that we understood what’s going on within Google. We said, “Okay, Google is probably going to follow their playbook,” meaning we expected they’d open up APIs for navigation, like they did with everything. And they’ll go from the US to the UK, to Germany, to France, which is how they roll out their products usually. And so we thought what we need to do is quickly go to a different part of the world where we can build up assets.

- And so we started focusing on Latin America and that meant that for about a year we took our eyes off the US market. And that was a huge cost.

- We lost time, we lost focus, we lost a lot of things.

- Looking back, it was just a terrible decision based on emotions. It was based on the fact that we panicked, that we thought we knew what’s going on at Google.

- Don’t try and understand what the behemoths are doing and why, what your competitors are doing and why.

- Yes, when you own 20% of the market, you can start thinking about it.

- But in the beginning, you’re nothing. Don’t assume that the other party is looking at you. They don’t even see you. Just focus on your users.

Kickstarting Network Effects

- I think the way we grew, ultimately, was very much by staying focused and really understanding what we’re trying to solve at each stage, and overall for the company, and not getting distracted. We had some missteps, as discussed, but overall we at Waze were very good at focusing on what product to build for what stage.

First stage: Building the network with early adopters

- The first thing we needed was a map. And for that, we needed a small number of highly engaged users to spend hours working with us building the map.

- We needed a group of people, like Wikipedia writers, to drive around and build our map using the GPS in their phones. If you were the first user in a country and you installed Waze, the map would be empty. A totally blank canvas. You’d start driving and your icon would turn into this road roller, like what you see paving roads. And you’d start paving a road that you’d see on the app being created behind you. And that was the first road in that country.

- And as you drove, more and more and more of these roads began connecting. And then they’d build out this grid of the network. But there was no utility for the users at that point. They’re just contributing.

- Our first versions of our app were much closer to call it more traditional GPS applications. And not in the way it looked, but in terms of it would tell you if you’re disconnected from the network or not, and the strength of the GPS signal, and the direction that you’re driving and all kinds of things that for early adopters is very important.

- Now, early adopters like to find things that are broken. They want to find things that are broken. They want to complain and then see that it’s fixed. They want to be the first one to find the bug.

- A lot of startups make the mistake of trying to overpromise to the user. Overpromise to the investors, that’s fine. But overpromise to the users? That is the kiss of death.

- A lot has to do with the language and the relationship and the transparency you have with your users.

- Our head of product was really, really good. She would say: “Okay, we’re going to talk to our users about the features right now, and also about where this is going. We’re going to be very clear that right now, we’re not there yet.”

- We wanted users to come with us on our mission, to join us. So they needed to understand what the mission is, why this will be good in the future, and why it’s not there yet today — and actually, how they could take control and help us build it.

- When you’re targeting early adopters, you don’t need your product to be super smooth and clean. You’re creating the wrong impression. If you have a super smooth, clean, beautiful product that just doesn’t work, you’re going to disappoint a lot of people. If you have a product that’s broken and janky but it has a lot of functionality, and you’re targeting early adopters who are going to help you make it better, they’re going to see how they’re impacting the product. Let them see how they’re making things better. That’s very important for them.

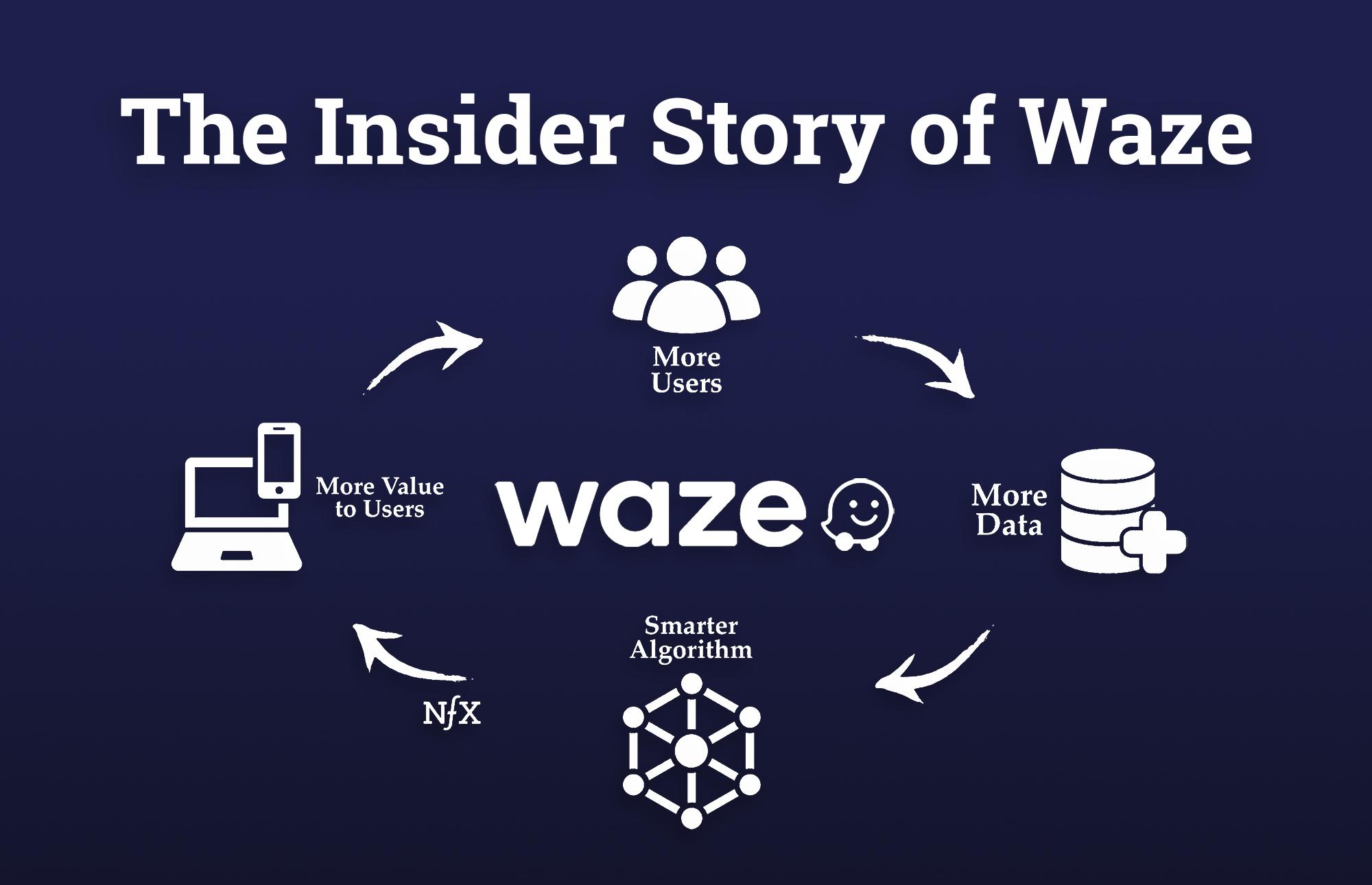

Second stage: Building the data, which means needing a lot more people

- So now you have this grid. Great. But now you need a lot more people.

- And it’s a different kind of user. They don’t need to be the 1% power user contributor who helps you build and edit maps. Basically, you just need them to drive.

- Because as they drive, we’re learning directions, we’re learning speeds, we’ll begin building a historical database. This is where we started to get a lot more data.

- And as they’re driving, we’re collecting the GPS data automatically from their phone. That GPS data is raw material that our algorithms and people can then analyze to understand speeds, directions, etc.

- So for all that, you need more users who are driving around, but they are still getting no functional value. But they are getting emotional value. We built a gamification platform using points and virtual goods and all kinds of stuff to allow a larger percentage of users to come and play.

Third stage: Building the utility

- This is when the real-time traffic component was strong enough that people who joined didn’t even know there was a community behind it — there was just so much utility. The app just worked.

- We had built up a historical database of speeds and data.

- When you’re ready to go to mass market, you have a very different relationship with your users than you had with your earlier adopters.

- We smoothed the app, made it much more fun and clean. We took out a lot of the raw functionality, which made our core users mad, but for our new consumer, it didn’t matter. They didn’t care what the strength of the GPS signal was, for example, but for an early adopter, it did.

Key insight: customize your product thinking for each stage

- That clarity of who the user is at a specific stage is so important.

- What’s the problem you’re solving for that user, what’s the emotional experience you’re creating for that user — at that stage?

- What’s that wow moment that the user is going to be so excited for — at that stage?

- For us, in the earliest stage, seeing another Wazer was a wow moment. People would go crazy when it happened.

- Of course, today, that’s not a relevant experience, because obviously there are just so many users. Seeing other people on the map isn’t the wow moment anymore – but we do still show it to communicate that you belong to a network.

The Truth About Data

At NFX, as the fund focused on network effects businesses, we’ve always looked with admiration at Waze as what we think is one of the best — if not the best of the data network effect examples out there. But when we explain to people what makes the data network effect strong, many people misunderstand it. They just hear “have a lot of data,” which is wrong.

- Noam: Data is one of the most misused terms today in the startup world.

People have the idea that data is valuable. Data is only worth what you sold it for! That’s it. - I see so many companies telling me, “Oh, we’re collecting all this data, isn’t that great” but I don’t care. Just to say that because you have a lot of data that it’s valuable, no. You can have a lot of data, but who cares?

- Data is not valuable. What you do with the data is valuable.

- If you can sell the data, package it in a way that someone will pay for it — that’s valuable. If you can take that data and create a product that provides value to the consumers, then that’s value.

- When it comes to data network effects, I would say the most important thing is to understand: Why are you collecting the data? When you say it’s valuable, what is the value? Are you selling it? To whom? Is the value in producing a product?

- And then ask yourself, can I achieve that value differently? Is the data the only way to achieve that value? Or can I do that with humans, manual work, hard-coded things?

3 Types of Data at Waze

- For us at Waze, we talked about different types of data. We started with one level of data, which was building our own raw data.

- It was important for us from day one to own all our data. But that was a risky approach. It created a lot more value for the company, but it meant

that we moved much slower in the beginning because our data was pretty

terrible. - People think that maps are free, that if you want to, you can go out and buy a map today for navigation — you can’t. There’s an open street map, an open-source map, which has several advantages and disadvantages. Google has its map — they’re not selling it. Nokia has maps — they’re very expensive if you want to buy them. And Apple doesn’t sell its map. So you can’t really get raw data.

- So, for us, owning the raw data was crucial, and that went into the data that we had that users built, but also whenever we could acquire data, we did as long as it was rights free and we could own the rights forward.

- The second type of data we got were things you get from GPS traces. So those are things that you could also buy today from fleet management companies. But if you’re buying your data off trucks, they’ll show you traffic when they go up a hill, because they’re driving slowly. And obviously, consumers are not. It’s imperfect for consumers.

- The third level of data is the reporting and all the interactions with the users, which only a human can do. I can see a policeman there and report them. No amount of algorithm can detect that from the GPS. And so, for us, it was always this combination of things.

Humans + algorithms together

- At Waze we had a core philosophy: you need to combine humans and algorithms. Neither of them is a slam dunk on its own, but working together, they can do amazing things.

- People usually underestimate how powerful manual human work can be versus how complicated automated, scalable things are. When you start out as a company, you don’t really have data. All that machine learning you’re building and all that doesn’t really matter because there’s no raw data in there, so garbage in, garbage out.

- A human can do what might take you hundreds of man-years to develop algorithmically, a human can do that instinctively by just looking at it. So there are pros and cons for each one.

- At the same time, when you’re dealing with masses of data, you can’t have humans dealing with that. So you’ve got to find those combinations.

- I recommend to many companies

- Step 1: Start out super manual as a first step. Get humans engaged and doing valuable tasks for you.

- Step 2: You want to optimize the manual processes so each person can do more with less time.

- Step 3: You want to begin adding in algorithms that help enhance the

humans and take-off tasks that humans are not good at. - Step 4: At the end, you want to reach a point where you’ve automated as much as you can. And so it’s important to understand that flow.

Organic, First

- We always tell companies not to focus too much on business development early on, because then even if you succeed, you’re trying to put your destiny in somebody else’s hands, which is not great.

- One of our core theses was you want to do marketing and partnerships and

inorganic activities only when you see an organic trend. - We tried many times to open up a specific city or a specific country and invest in it, whatever, and it never worked.

- While at the same time, in a place that had started organically, you can pour the gasoline on the fire and it’ll light. And so that was one of the things that happened.

- We’re one of the strongest app brands in France, but in Germany, nobody uses us. We still don’t understand that. But when we saw things going well in France, we invested there. We saw things going well in the UK, we invested there. But in Germany where we never saw organic use, we didn’t invest there.

- Don’t try to get this business development thing going until you have the organic trend happening so that you can basically accelerate the organic trend.

Final Thoughts: Narrow, Not Wide

- Early-stage startups and every stage, every company needs to understand what their core strengths are and what matters. They need to have a clear vision mission strategy about where they want to go and how they’re going to get there. And it seems obvious, but it’s not.

- Most companies are too caught up with the everyday details to ask themselves: Are we doing the right things? We’re doing things well, but are we doing the right things? And I think that’s a huge advantage that startups have.

- You need to be pushing yourself all the time to be narrow, not to be wide. Narrower, and narrower and narrower, understanding your customer, understanding your product. What is it you’re trying to do and how every action that you’re doing, or every initiative ladders up into that.

- You have your ability to say no. To say no to everything, except a very small number of things that matter. And if you can do that and be very, very focused on that, you can beat anyone because; but if you don’t have that, then you’re nothing.

- If you’re doing one thing and you’re doing it a hundred times better than anyone, and you understand it deeper and every action you do ladders up into that one thing, getting better and better and better, you can take over the world.

Listen to the full podcast with Noam Bardin.

If you’re an early-stage company working to build out your network effects — and your data network effects — we’d love to hear from you.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.