There’s a perception that most value in the Generative AI space will accrue to incumbents.

Fueled in part by the recent Generative AI boom of ChatGPT, tech incumbents had some of their best 12 months in recent memory. Since ChatGPTs launch in November 2022, Amazon and Microsoft are up about 55 percent. Google is up about 42 percent. And the incumbents are doubling down on this new trend, 44% of the capital invested in generative AI is controlled by Microsoft, AWS, Anthropic, GitHub, OpenAI, and Alphabet.

Significant new technologies can create seismic shifts in the economic landscape. The internet disrupted traditional media enormously creating massive new companies such as Google, Facebook, and Netflix. The mobile revolution similarly created many new multi-billion dollar companies, but also further extended the position of incumbents like Google and Apple. So what will happen with the AI revolution? Will most of the benefits accrue to the incumbents which have substantial resources or will they accrue to the new startups which can move quickly and build compelling and novel experiences?

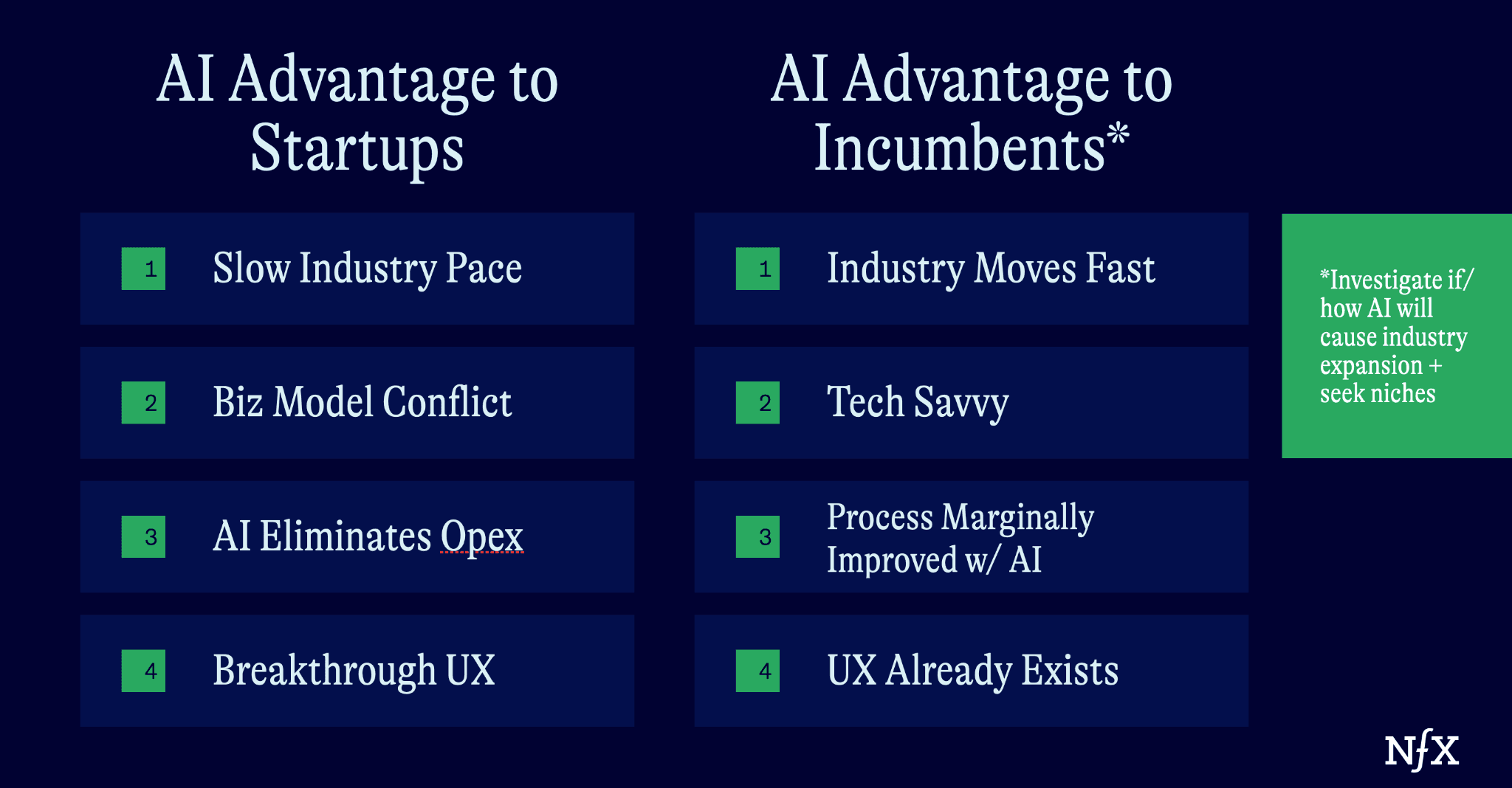

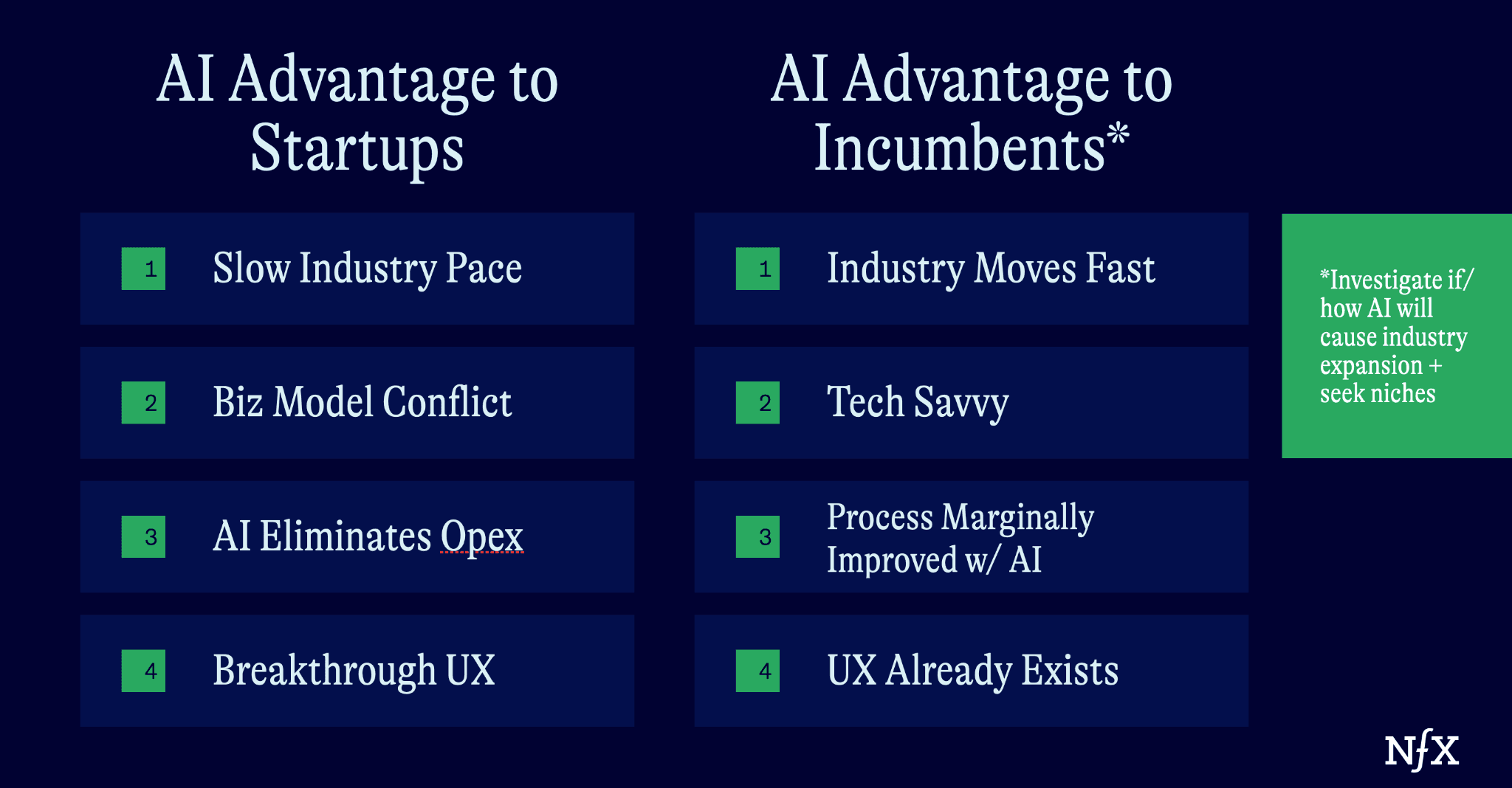

As it was with the mobile revolution, the answer is maybe unsatisfying: it depends. But by asking ourselves this question, it becomes clearer which markets, and strategic deployments benefit startups over incumbents (and vice versa). We can’t just assume that AI will disrupt every market in a way that benefits startups. Founders building in AI today have to be especially smart about how, and in what arenas, they choose to challenge incumbent players.

Here are some factors to consider when you make that decision.

Sustaining Versus Disruptive Innovation

You have to understand if, in your industry, AI’s primary effect is disruptive or sustaining. Disruptive innovation creates entirely new markets and services. Sustaining innovation improves, accelerates, or refines those that already exist.

Some disruptive innovations are obvious. Uber and Lyft created new pools of supply in the taxi industry that didn’t exist, disrupting the established supply side of the market: taxi companies. They created the rideshare market.

Often, it’s not clear how truly disruptive certain innovations are right away. Sometimes there’s a delayed reaction that’s 100x times that of the initial disruption. The iPhone’s launch in 2007, was clearly disruptive to the existing “smartphone” market controlled by Blackberry and Palm Pilot. But a few years later, the iPhone went on to disrupt nearly every industry via the creation of the mobile interface. (And we predict that a similar delayed reaction is likely to happen in generative AI as well).

Because of the compounding nature of adoption and improvement of disruptive technologies, value is created exponentially. There’s little movement at first as technical hurdles are overcome and user experiences are iterated on. Then it all happens seemingly all at once. This is another reason disruptive innovation often benefits startups, because they’re more agile, often don’t have an existing business model to protect, are able to move faster, and often more willing to take on risks early on.

Sustaining innovation targets existing markets and customers, and improves those processes. AI applied ad targeting on Facebook is an example of a sustaining innovation. We already know that certain segments of people on Facebook are interested in certain products. AI-led ad targeting helps advertisers reach them faster.

In this way, sustaining innovations often work as lock-in mechanisms, helping established players maintain their lead. The underlying dynamics of the market or business model don’t change radically, they’re just aided by tailwinds of new technologies.

The dichotomy of AI is that we’ve seen it used effectively in both ways. Google has used AI to augment existing search services (sustained), while ChatGPT created the idea of natural language models as search vehicles (disruptive, as it changes the underlying ad models used by search engines right now).

This tells us that AI as a technology is not inherently not one or the other. Everyone is using generative AI to further their own aims. This means two things for Founders. First, it means you have to recognize whether your product and market are better served with disruptive innovation or sustaining innovation.

If it’s the former, you have to deliver a truly disruptive value proposition that opens up new markets, undermines existing business models, or creates a totally new, unimaginable experience. The same way Uber and Lyft created the rideshare market.

If it’s the latter, as it is in some limited circumstances, you have to tailor your product, messaging and business model to work alongside the existing giants. For example, in the early days of e-commerce, PayPal didn’t attempt to create its own online marketplace and displace ebay. It focused on creating a smoother transaction process for ebay users, and cemented its fintech as a sustaining innovation for rising e-commerce marketplaces.

Today, we’ll take a look at both scenarios and what conditions benefit each approach.

Highlighting AI’s Disruptive Qualities

Most startups deploying AI believe the technology is truly disruptive to their chosen industry. But this is only true if your product or service satisfies two core conditions:

- Does your technology fundamentally unlock something that was previously impossible or unimaginable?

- Is it challenging to copy what you are doing and how you are doing it?

There is no shame if the answer here is no. You can still build a successful company by pursuing a different path.

If you do satisfy those core conditions, your AI may benefit from AI’s disruptive qualities. But ideas are commonplace. Execution is everything.

Here are some points to consider as you try to capture the tailwinds provided by AI’s disruptive qualities, and take on incumbents.

Operate in Markets Where Speed is a Greater Advantage

There will always be an arms race between innovation and distribution, as Alex Rampell has summarized. Incumbents already have distribution advantages by nature.

But remember: winning can often be as simple as going faster than the others in the race. So target markets where the incumbents are notoriously slow.

There are many markets where incumbents are simply incapable of deploying AI fast enough to compete with a startup operating at full gas. This is one reason we believe that AI will be so disruptive in “lagging” industries, like govtech, healthcare, legal, construction, education. The incumbents are going to move at a slower clip (or they don’t exist at all).

It would be a mistake to attempt to take on incumbents directly in markets where they are built in to adapt to new technologies fast. (Skilled workforces, built modularly, to aid in annexation of new technologies). Combined with greater distribution, and preferred attachment their use of AI as sustaining innovation has a greater chance of sinking you.

100x Better, Nothing Less

Be wary of creating an AI value proposition based solely on selling a faster process with greater efficiency. To be absolutely disruptive, your solution shouldn’t just improve existing roles, it should greatly eliminate large sections of your target customers’ opex.

It has to be truly 100x better. That means it must render some tasks, or even positions, obsolete.

Exploit Business Model Conflicts

If you are operating in a space where incumbents are present and powerful, AI can become disruptive if it inevitably eats away at the existing business model.

For example, if Google monetizes their service by directing users to certain promoted pages, it is not strongly incentivized to round up information in a ChatGPT like format because that format eliminates ad clicks.

This was likely one reason (of many) that Google has had to play catch up with ChatGPT for so many months. The new user experience created by LLMs fundamentally undermines some of the major product features that drive much of Google’s ad business.

Google is one of the companies likely to find a way around this. (Search is definitely a market where incumbents may operate at a faster clip.)

But this is a pattern you will see in other, less densely crowded industries. If you can use AI to undercut existing business models and replace it with something else, that’s clearly disruptive innovation.

One way we’re seeing this undercutting dynamic play out is through “bundling and unbundling.” We expect to see incumbents add innovative technologies as features. Conversely, startups will observe what incumbents are doing, and aim to unbundle – i.e. create specialized tools or capabilities. For example incumbent SaaS companies will naturally be looking to add AI features to increase adoption and justify price increases to their existing products. While these features are valuable to some, the product can get bloated, creating opportunities for startups to innovate and focus on the core new AI first product experience.

This creates an interesting tug of war dynamic. In some circumstances, startups with a singular focus can deliver a cheaper, better experience than incumbents who are grafting on features without much thought. But in other circumstances, incumbents are just too far ahead thanks to their data and distribution advantages.

This is why we suggest operating in markets where speed is an advantage and there is first mover or proprietary access to important data. This tips the tug of war balance slightly in the favor of startups.

A New User Experience

For most people, a large technology platform shift is only as good as the user experience. People have to know how they’re going to use that technology right away if you want to demonstrate its value.

From a technologists’ perspective it’s easy to forget this. If you have been following the development of AI for years, it was clear even before ChatGPT that we were on track for a once-in-a-decade advancement. But it was the user experience offered by ChatGPT, and the first steps that ChatGPT has taken toward teaching us to work with AI, that have made it consensus among non-hobbyists.

The same is true if you think back to companies that dominated previous platform shifts, like Google, Facebook, and Uber. Each one created a breakthrough user experience that made a new underlying technology radically accessible.

AI opens up many new user experience possibilities. The most obvious ones we see today (thanks to ChatGPT) are chat and voice. But there will no doubt be novel experiences that Founders will be able to identify over time. They are less obvious now, but have the potential to define how users interact with AI in certain categories.

Seek Veins of Unstructured Data

Incumbents currently control vast quantities of both structured and unstructured data. Applying AI to these walled gardens is sure to yield valuable insights, and provide incumbents with competitive advantages.

That said, AI has increased the quantity of usable data 100x. Unstructured data sources like text, image, video, etc, create more space for startups to deliver valuable insights and products. The key for startups is to find accessible sources of unstructured data, and extract meaningful conclusions from them faster than existing incumbents (again, highlighting the value of building in markets where incumbents are slow). There is great potential for startups to handle unstructured data in a more efficient and insightful way.

A clear issue here, however, will be the accessibility of this data. If one startup can access it, it’s likely that many others will be able to as well. This is one reason why data, as powerful as it is, is very rarely a truly long-term defensibility.

Efficient leverage of unstructured data sources can give you a wedge, and a head start on a slow incumbent. But it may not protect you in the long run from a startup that’s able to move just as fast as you are.

A Strategy for Fields Where AI is a Sustaining Technology

How can a startup compete in an industry with a strong incumbent that is incentivized to use AI as a sustaining innovation, and is doing so successfully?

This path is harder, but can be more rewarding if you have a clear vision. That’s because there are certain industries that grow infinitely larger with the introduction of groundbreaking technologies like AI. They spawn niches that incumbents are either incapable of serving, or are unaware of in the first place. And those niches are where startups can win, as Chris Dixon has pointed out.

The key is to recognize if you are in an industry poised to undergo this change, and have a clear vision for what that change will be.

What might these industries look like? They are often built around processes where the core output remains the same, but the process can take on infinite permutations (and in turn open up new niches for you).

How does this work? For example, let’s examine the influence of AI on chess over the past three decades. It’s a simple example, but it is also one of the earliest “industries” that has had large amounts of AI investment and as such might give us clues as to how other industries are going to be impacted by AI.

In 1997, the Deep Blue’s victory over Gary Kasparov cemented AI’s dominance in the chess discipline. It was a watershed moment, but did it put an end to all human chess players? Is the “industry” of chess completely dominated by AI?

No. The opposite has happened. It has actually made the chess industry far larger. Today’s players are more sophisticated and the game is more diverse.

Soon after his defeat by Deep Blue, Kasparov became an advocate for “advanced chess,” a version of the game where humans and AI work together to select every possible move for an optimal outcome. It was seen as a way to create more inventive, tactical, beautiful forms of play.

Today, AI is a ubiquitous training tool in the chess world. Nearly every grandmaster uses AI to perfect their craft.

AI chess engines have also made chess infinitely more accessible at lower levels. AI provides infinite training scenarios and practice rounds. This year, researchers studied the impact of chess computer engines on amateur chess players ratings, and found that people who have trained with a chess engine are 3% more likely to beat people of the same skill level who have not trained with an engine.

The creation of advanced chess. AI-assisted elite chess training. The onboarding of new chess players into the industry. Those are three new niches that could never have existed had AI not entered the chess “industry” and changed its DNA.

In realms, like chess, where there is truly infinite capacity for improvement, the job can never be truly finished. A new approach is always possible that will make the task better, faster, more beautiful. And that will always be the goal. And so, the DNA of the industry itself will change to accommodate a new technology – more niches will be created, and with those come opportunities.

Ben Evans has put this another way: when a new tool emerges, we initially make a tool to fit the work. Then, we change the work to fit the tool. The goal of a startup in a field with powerful incumbents is to predict how we will change the work to fit the tool before incumbents can respond.

If you, a startup, can present a clear vision for that type of innovation, you are in a very good position.

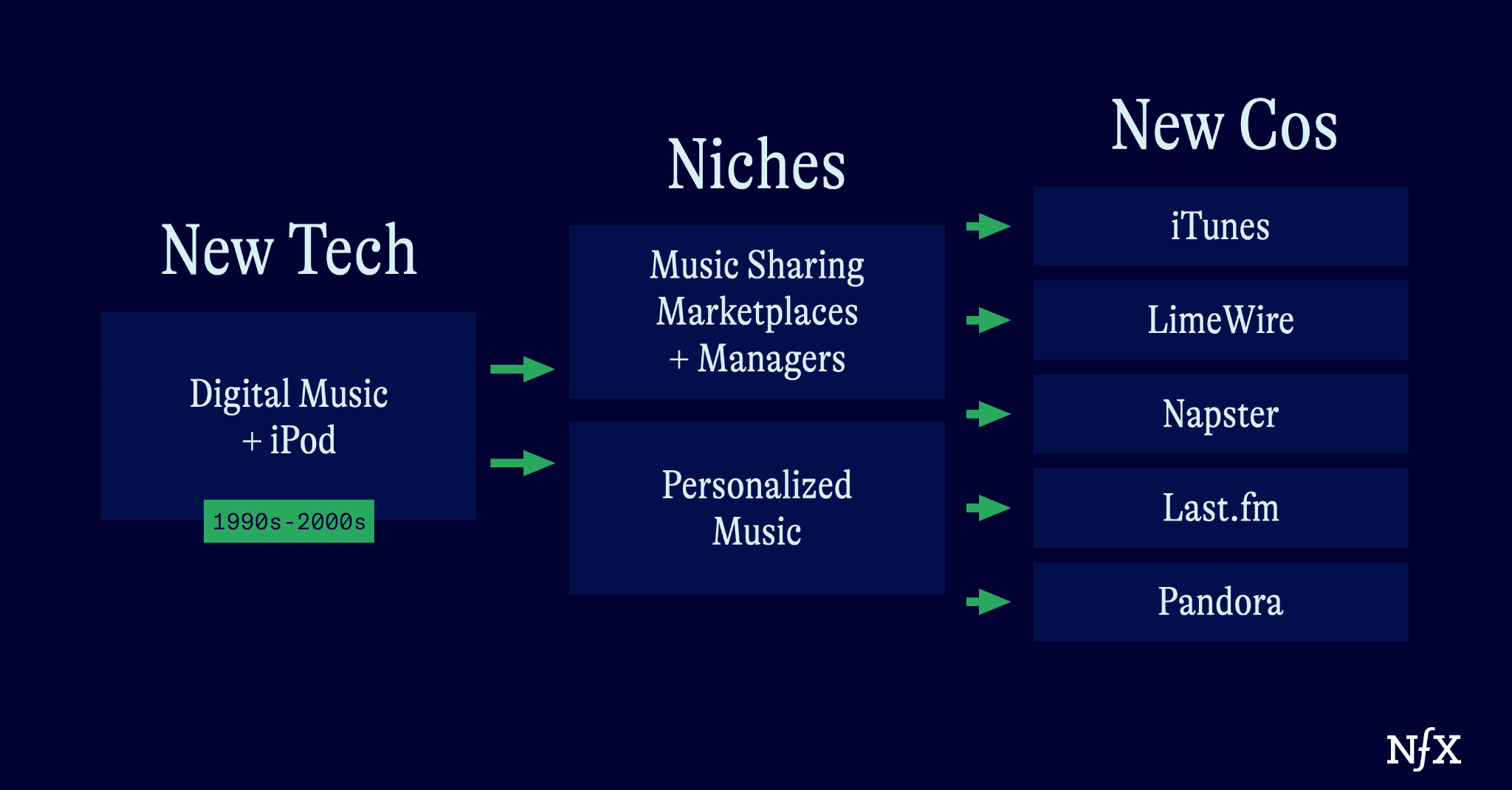

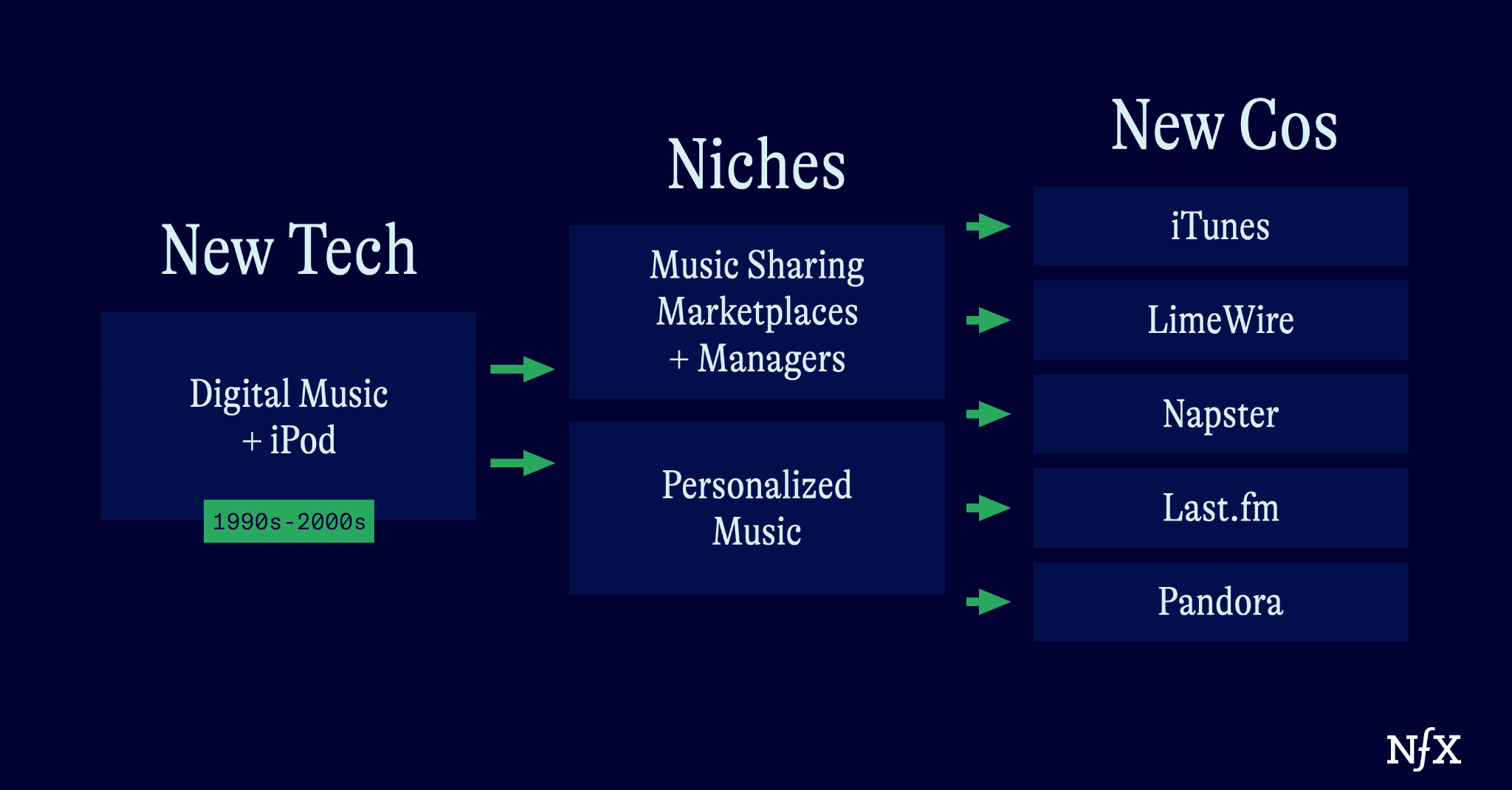

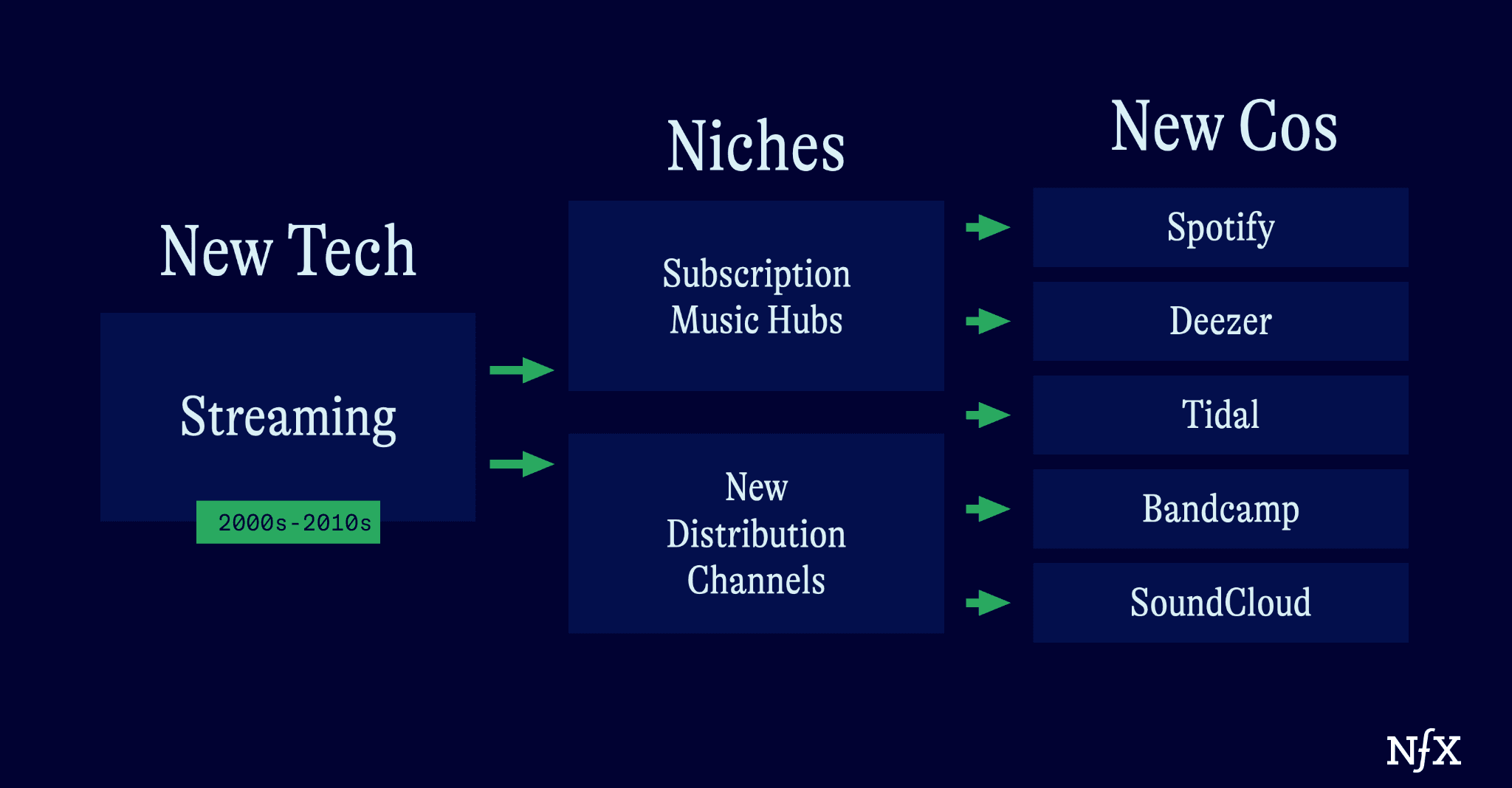

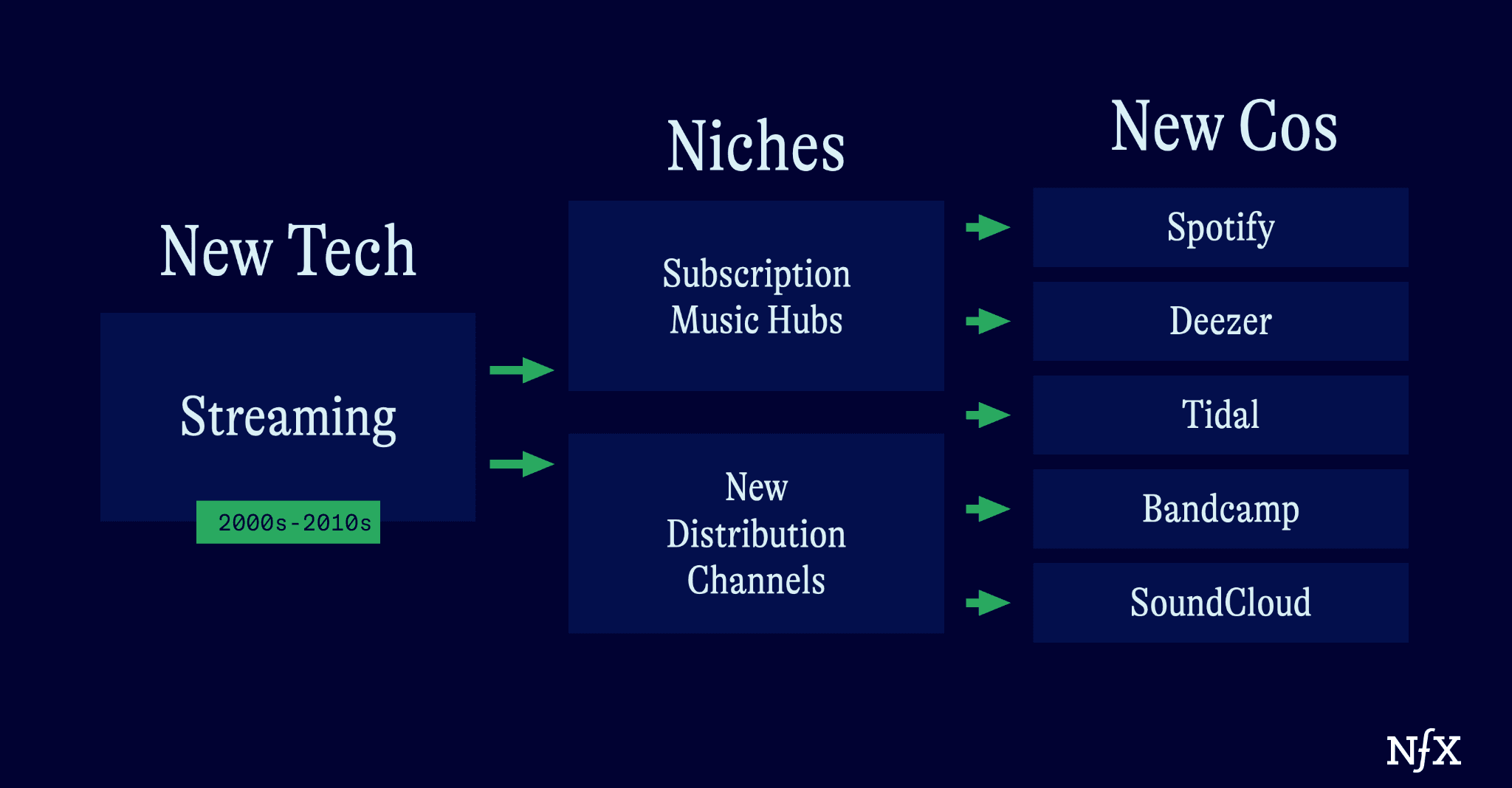

There are many markets where we’ve seen this happen. The music industry was littered with incumbents. The advent of streaming changed the way we purchase, price, and consume and distribute music. Companies like Bandcamp allowed artists to sell directly to fans. Platforms like Soundcloud created new platforms for artists to get discovered. Spotify changed the way we price and consume music.

Because of streaming, we changed the way we consumed these things to fit a newer, better tool. And startups were able to take hold, and gain market share, because they saw this future coming.

Online payments would be another example. PayPal didn’t invent the idea of an online transaction. But they were among the first to recognize that online transactions were going to be the future of commerce. So they cemented themselves at the center via dependable relationships with US banks. And as a result, we now have new generations of companies that aid in managing these types of transactions.

There are other industries where this may happen. Some potential examples:

- Academia and education: You could imagine AI helping academics continue to ask better research questions, creating new fields of study, or opening up education opportunities to new groups of people.

- Art, Design, Architecture: AI helping artists make better work. AI assisting writers. New forms of art – writing, games, visuals – will be created.

- Sales and marketing teams: tactics to optimize the marketing channel mix and sales productivity .

- Law: AI may replace some legal work but ultimately will spawn entirely new areas of the legal field – AI laws are being written as we speak, AI creates a need for new legal expertise. The whole field may expand because of AI.

- Human Resources and Talent Acquisition: Again some tasks may be eliminated, but new metrics for candidate selection or sourcing may be surfaced via first-wave AI technologies.

Ultimately in these fields, the core product or service being offered is the same: a transaction, a sale, a piece of art. AI is a tailwind to a well established process that will always exist, but will spawn new niches over time.

Like chess.

See Yourself Clearly

The biggest mistake you can make is pretending to be something you are not.

If you review the value propositions of so many of the earliest AI startups, you see that they’re actually pitching sustaining innovation with limited defensibility within their chosen industry – not true disruption. These startups run the risk of being outcompeted by incumbents with distribution advantages.

Conversely, we see startups trying to compete in fields where incumbents hold strong advantages by trying to do what incumbents already do, but better. In these circumstances, you have to think differently: how will AI change this industry in a way that an incumbent may not predict? Or does it have the capacity to change dramatically at all?

Both techniques can, and have built billion dollar companies. We expect the next generation of AI unicorns to be no different.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.