We suspected this last year, but we know this emphatically today: The majority of companies we see will have some degree of an AI component.

AI is simply the new table stakes. AI is like water. It’s everywhere.

So now the race is on to come up with a few great answers to this question: What can we do now because of AI that was truly impossible before?

How can we creatively deploy AI in ways that create lasting value for users?

To do this, we want to share how we’re seeing AI applied right now and what we’re excited to see in the future.

- The 5-level AI Application Spectrum

- AI in Horizontal Markets

- A Deeper look at AI Leapfrogging

- The AI-First App Layer

- Our Lens for Evaluating “AI Companies”

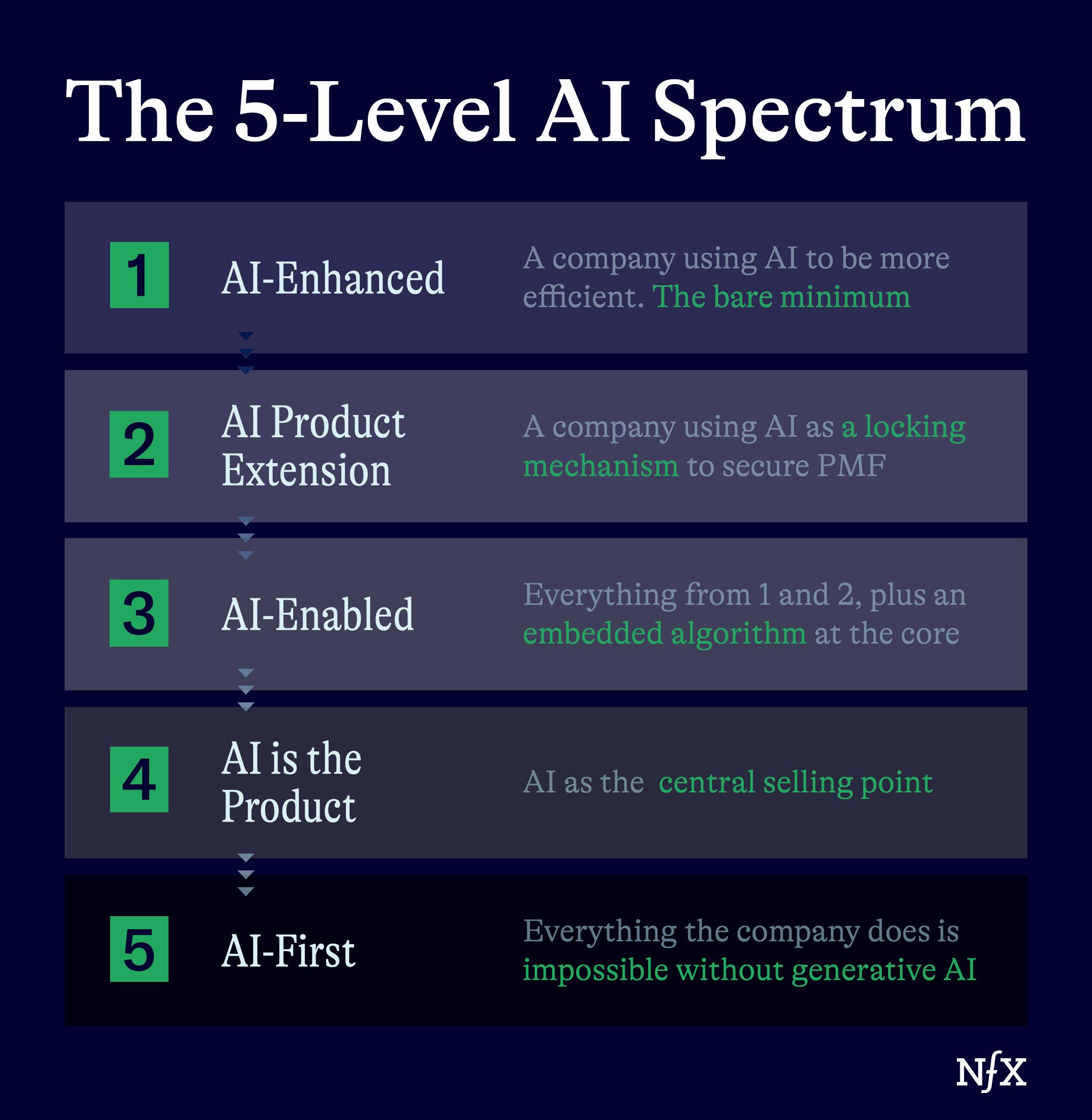

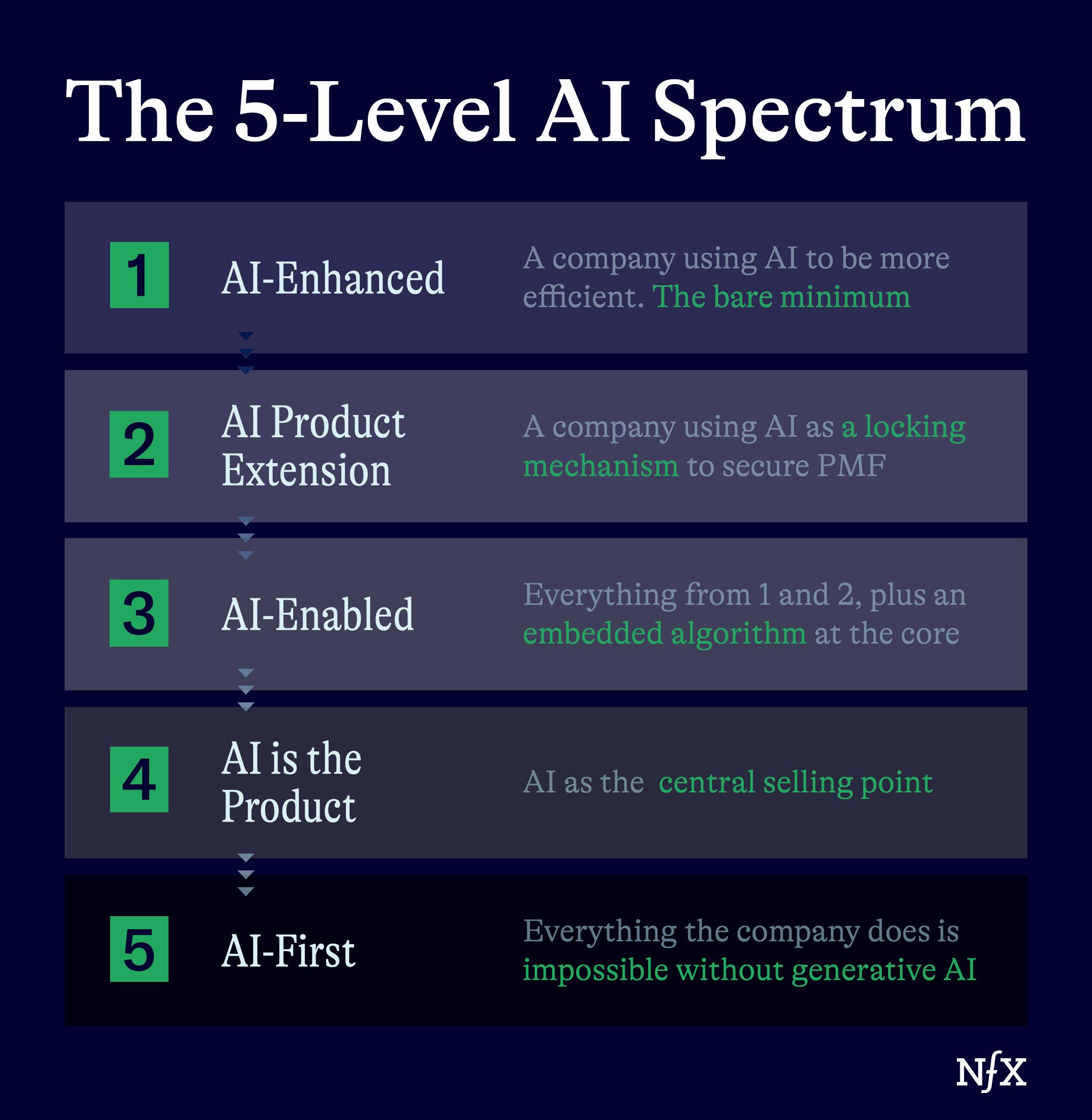

The 5-Level AI Spectrum

Some companies are simply juiced by AI. Others are AI-First.

To help compare apples to oranges as we’re reviewing new AI ideas and companies, we developed a 5-Level AI Spectrum.

It starts with Level 1, the “entry level” use of AI to enhance existing processes. It goes up through Level 5 which is where we expect to see AI-First ecosystems.

Level 5 is where we’re most excited about investing. These are the companies that simply weren’t possible before AI. We’re looking for the non-consensus markets and products with limited competition, either from incumbents or from other startups.

Level 1: AI-Enhanced companies

This is the bare minimum. Companies across industries will use AI for more efficient workflows and software development.

Level 2: AI Product Extension

A company using AI as a locking mechanism to secure PMF. These companies already have traction, and don’t need to transform themselves into AI centric products overnight.

Rather, they can use AI to capture large adjacent opportunities. Example: Triple Whale.

Level 3: AI-Enabled

This level includes everything from 1 and 2, but adds a layer of intelligence on top. These companies often use some type of central algorithm to learn from data collected as part of the company’s core function, and create additional products based on that learning.

Companies deploying AI-based matching in marketplaces, for example, are good examples of this level.

Level 4: AI is the Product

AI is seen as the central selling point. This is a fragile place to be, as AI for the sake of AI isn’t something that we believe is new or interesting. Rather, successful companies at this level will use AI to effectively, and simply solve a huge problem in an existing space.

In Legal Tech, LLMs are drafting full documents and helping personal injury lawyers win cases.

This is the level where we believe we will see the vast majority of AI leapfrogging – when an industry that was largely untouched by Cloud or SaaS waves jumps right to an AI solution. Legaltech, healthtech, education, construction… these are all good candidates for Level 4 AI applications.

Level 5: AI-First

Everything the company does is impossible without generative AI.

This is the most exciting level of AI deployment. The ubiquity of AI will create new companies that could never have existed before, or new products we can’t articulate right now because we don’t have the mental models to envision them.

AI in Horizontal Markets

New, large AI platform companies will also be built in large, horizontal markets like sales, marketing, software development, customer operations and creative markets.

The major challenge here is the presence of large incumbents. These incumbents will do well. But these spaces are so vast that there are plenty of subsectors and niches for startups to gain hold.

This market architecture will reward technical entrepreneurs who have a unique insight into these niches and better serve those niches based on that insight. We cover this tactic at length in our piece on AI-first marketplaces.

We are focused on opportunities where we see a step change impact over previous processes and lack of incumbent advantages.

Specific areas of interest include:

- Step change in software development;

- Sales and marketing automation via new channels that are not well served by incumbents;

- Customer service and operations;

- Tools that enable creative professionals who have high engagement and high willingness to pay.

A Closer Look at AI Leapfrogging

There are some industries primed for what we call AI leapfrogging. Leapfrogging happens when an industry or market (usually an outmoded industry, or an emerging market) skips a step along the technology transformation chain.

These industries have historically not been digitized and don’t have a dominant cloud incumbent. We see greenfield opportunities with massive TAMs. For example, the US legal services market is $373 billion and the US manufacturing market is $7.2 trillion.

In these spaces we expect two things to happen.

First, with AI, improved product experiences can now break through the internal sales and adoption friction in these industries.

Second, there will also be new, more vertically focused businesses. These companies will use AI products as a wedge to digitize and transform large parts of the industry.

We also see the potential for strong network effects with many AI leapfroggers. In particular, with products that have high frequency use cases with embedded software that acts as an important control point in the value chain.

The AI Consumer Layer

Another area we’re looking hard at are new consumer companies that are likely to emerge from AI.

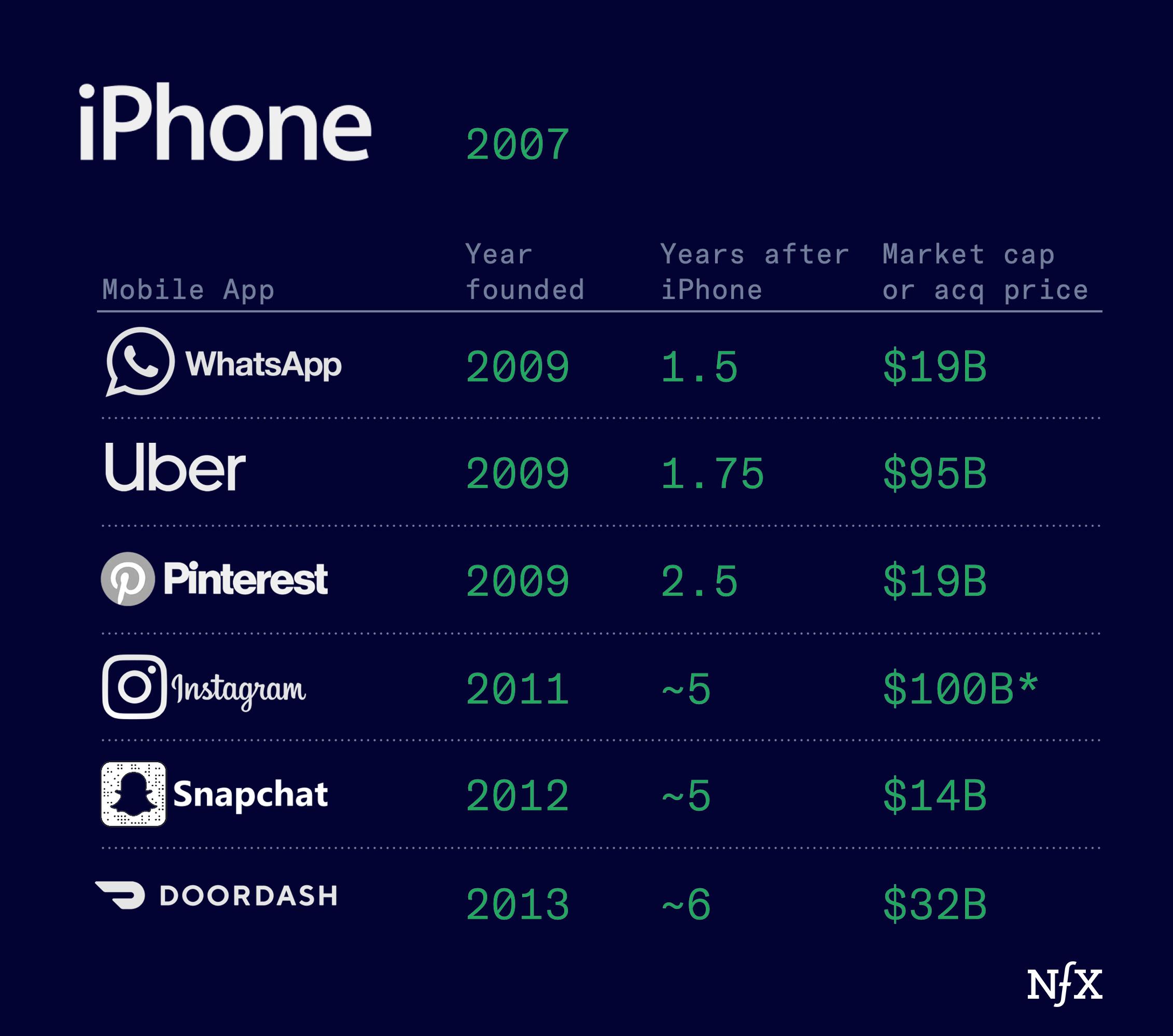

It’s a lot like the explosion of consumer apps that came from the iPhone. The big mobile native apps came out in this golden period of app development, starting about a year and a half after the iPhone came out and running for about 5 years. This is when we got WhatsApp, Uber, Pinterest, Instagram, Snap and DoorDash.

We expect the same with AI. Founders and developers start to really understand the product and design possibilities with these new technologies after they’ve existed for about a year or so.

There is a developing AI consumer application layer today, but we believe that once the true breakthrough Level 5 AI-First companies emerge, this ecosystem will really come into its own. There will be tens of thousands of these applications built for various needs in the next 2 years – some of which, we can’t imagine right now. Incumbent software providers will add generative AI features. New companies will create competitors to the old, emphasizing AI as a wedge. Or they will create brand new, Level 5 AI applications people will use with generative AI as a starting point.

These apps have the potential to create multiple, multi-billion dollar businesses. And this is where understanding the network effects that have created long-term defensibility in previous eras of tech will be particularly important.

We are actively looking for companies in this area, building on our expertise in consumer and gaming investment. We have two guiding principles:

- High engagement and frequency use cases, given the faddish nature of some AI tools.

- We’re avoiding “wrapper” type companies that are lightweight apps built on top of LLMs.

How We Look At “AI Companies”

So far, we’ve covered our methods for applying AI, and what niches are going to yield the biggest opportunities for this generation of startups. But we also want to take a moment to outline how we view “AI companies.” Unless you are developing the picks and shovels behind Generative AI, there is no such thing as an “AI company.”

We expect all our companies to be applying this technology. Anyone who isn’t is missing a huge opportunity.

We are not interested in AI for the sake of AI. We are wary of hype that can lead to overinflated valuations, or neglect of the true business principles or network effects that can make or break a company at later stages. (This is why we’ve developed our AI litmus test for founders).

But any time we see a company with a significant AI component (and eventually this will be all companies we see), these are the questions we ask:

Is this an excellent, fast team? We want teams to be fast, technical and, above all possess a unique market insight. Given the pace of this industry, speed is an absolute necessity.

How strong is the economic moat? Many AI products are on the way to becoming commoditized. We want to see products that attract customers with high willingness to pay in large markets.

How clear is the initial market opportunity? Much of the initial returns of the Generative AI explosion will accrue to incumbents (more on this perspective to come). For now, startups need to pursue orthogonal innovation. We want to see companies with attractive initial markets, with limited incumbent activity and straightforward sales cycles. You must be able to implement fast and demonstrate value to customers quickly.

What is the long-term defensibility? Do you have proprietary data, and have you thought about how to bake network effects into your product from Day 1? How are incumbents positioned in this space and are they in a better or worse position to capture the opportunity.

Fair valuation: When we look at valuation we ask if it’s representative of the business long term, regardless of Generative AI hype.

Breakthrough product: Is this a product that’s AI for AI’s sake? Or is there a breakthrough product?

The AI Underground is Maturing

Prior to the last year, few had even heard the term Generative AI. Then we all saw the AI underground emerge in Cerebral Valley. We met the first founders ready to dive into the emerging technology.

A year later, it’s still early. Insanely early. But a shift is beginning. The technology is going to get 100x better, and 100x faster. This is the moment where we start to learn from the early experiments of the past year.

We’ve seen what works, and what doesn’t. The incumbents are aware. The media has caught on. Generative AI is growing up. There’s still a lot of untapped value, but this is a key moment for serious Founders to step up to the plate.

Now is the time when we will start to see the large, enduring generative AI ideas enter the space. The same way the founders of the large mobile companies emerged 2007.

It’s an exciting time. And if you want to be a part of building something real, enduring, and meaningful, talk to us.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.