Every time we see a significant new enabling technology, a window opens in the marketplace world. This platform shift is an opportunity to create something unimaginable even a year ago.

For example, smartphones with GPS gave us Uber and Lyft. This breakthrough technology turned everyday drivers into potential taxis – unlocking a whole new form of transportation supply and gave demand the opportunity to book rides in real time.

The rise of search and SEO allowed a range of marketplaces like Trulia/Zillow to carve out market share in real estate, or startups like Indeed to spin up liquidity at very low cost in the job search market where powerful incumbents with strong network effects dominated.

AI is another one of these once in a decade or more technology shifts. Likely, it will prove to be even bigger. Which means this window is opening once again. All software and digital experiences are going to be infused with AI. This is a rare moment where unique opportunities for marketplace startups open up, and incumbents are forced to innovate with speed and conviction or risk becoming irrelevant.

Here’s how it’s happening, and where we see the opportunities.

Marketplace Evolution

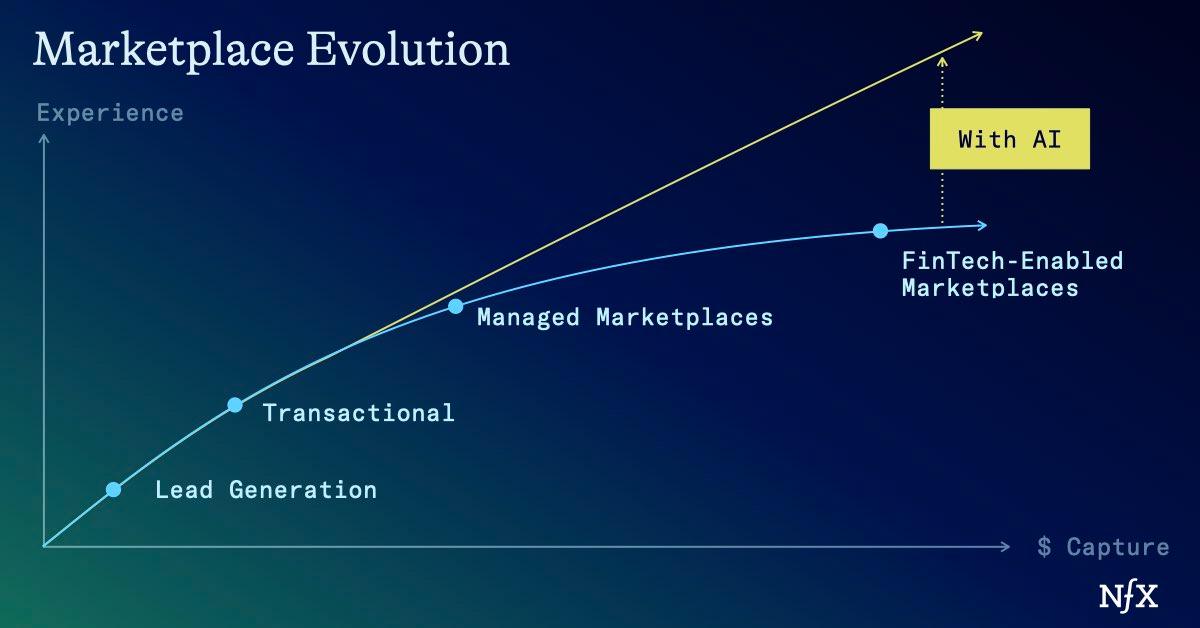

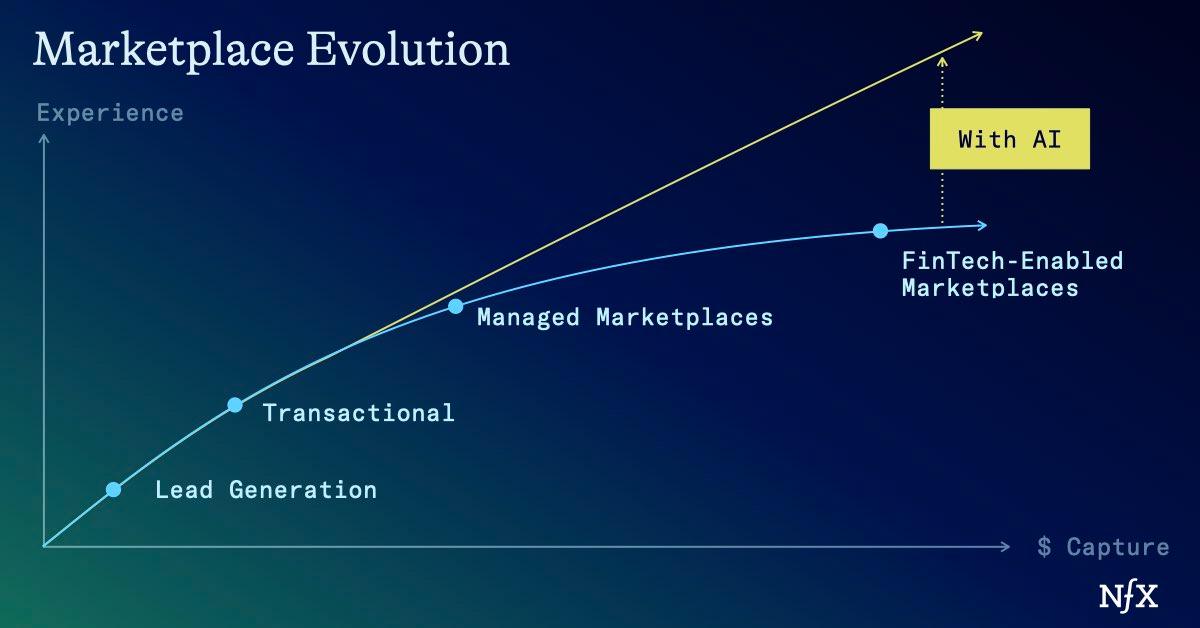

Marketplaces are relentlessly evolving towards a better user experience – whether that’s better inventory, better curation and decision support, or reduced transaction friction.

Often the underlying driver of these tectonic shifts are new enabling technologies. For example Seamless and Grubhub had market leadership in food delivery in the pre-mobile era. But after the mobile boom, Doordash was able to provide its own delivery network. This added significantly more supply to the marketplace and a better experience overall for a mobile first transaction.

That was sufficient for Doordash and Uber Eats to displace incumbents and become the new market leaders.

The rise of the fintech enabled marketplace was another example. Embedded fintech made the transaction a seamless part of the marketplace experience – and today we expect to complete all or most of the transactional process on platform. That has allowed marketplaces themselves to capture increased share of the transaction (i.e. through take rates, etc) and new marketplaces to be formed.

In our 2019 article, we proposed that fintech enabled marketplaces will primarily help marketplaces to capture more margin and reduce transaction friction as follows:

The AI tectonic shift changes the trajectory on both supply and demand axes. We anticipate that AI has the potential to meaningfully improve the experience for demand, reduce cost of accessing and curating supply, and increase the efficiency of the entire operations of a marketplace.

That’s going to create four new features within marketplace architecture:

1. Automation Unlocked Supply

AI automation allows us to expand the pool of supply in ways that previous technologies couldn’t. Especially in complex industries where there is a very clear demand signal, but a bottleneck in supply. (Think: therapists, drivers, tutors and basic coding).

AI can learn to drive a car. It can become a 24/7 personalized counselor. It provides opportunities for endless upskilling across verticals (writers can become coders, or data engineers), and eliminates time-sucking rote tasks, allowing labor to take on more projects.

AI-unlocked supply will emerge first in the form of embedded co-pilots (tools to do design work on platform, for example). But it will move toward full services (like personalized AI chatbots or autopilots).

While autopilots are the most likely endpoint, in the case of the marketplace, the co-pilot is actually a powerful intermediate step. AI copilots can dramatically increase the productivity of certain service marketplaces, and through that mechanism, increase potential supply even before full autopilots emerge. Copilots also solve for the inherent trust issues that rise with new technologies focused on important problems.

That said, it’s not clear there will be a large profit pool in massively increasing supply. Whenever you are dealing with AI advancement, it’s important to understand how available training data is to all parties and how proprietary your model and entire experience is. Whenever it is easily accessible, it will be easy for your service to be copied. This opens up the possibility of a race to the bottom.

The AI autopilot in whatever industry your marketplace occupies will be the standard. If you charge a fee for it, it’s likely someone else will come along and charge less.

Imagine a logo design marketplace that employs designers to create logos for new companies. For the same cost of working with a professional to create one potential logo , you could use AI to create thousands of logos and just pick the best one. In this case, the effective price will trend to zero.

So what protections can you put in place against this race to the bottom? First, the market opportunity simply shifts. We will likely see the monetization of those types of marketplaces move up or downstream of this easily commoditized tool. To go back to our logo example, you might be able to cross sell marketing solutions on how to grow your new company, as opposed to just logo design.

And second, the more challenging it is to unlock that supply, the greater your moat will be. NFX-backed Moov, for example, is able to locate and evaluate the condition of manufacturing equipment – a process that was previously offline and inaccessible. By building software to help manufacturers understand the utilization of their own equipment and buy and sell additional assets, Moov created a secondary market for capital equipment where only fragmented transactions had existed before.

Such AI-based tools will be par for the course. Any marketplace that isn’t using automation to enhance or even generate supply is going to be left in the dust.

2. Better Demand Side Embedding

In a marketplace, you’re constantly trying to spin up liquidity. If you can create a breakthrough tool that attracts demand immediately, you can use that good will to monetize further downstream.

For example, NFX-backed Tailorbird speeds up the process of multi-family building renovation by using publicly available visual data to instantly generate architectural quality drawings. This process reduces the costs of preparing for the work, and turns a month-long process into a two-week long process.

That is just part of Tailorbird’s service. From there, users can take those plans directly to a marketplace to obtain hard bids on materials and service providers. (Note: this is also a good example of moving the monetization downstream of the AI tool).

Here, we see that Tailorbird is capturing both the planning and procurement process. Previously, a marketplace might just help you find building materials. But Tailorbird helps you both design and source those materials all at once – it simplifies life for the demand side.

This is just one approach. You could also imagine tools that help demand side run financial analysis, to streamline their marketing. LinkedIn performed a similar move in building an enormous recruiting marketplace off the back of a professional network and database of record.

We also see AI being potentially very good at complex procurement or organizational tasks where it’s necessary to manage multiple variables including price, time-based availability, quality or product interdependencies. You could imagine AI keeping the trains on the tracks for anything from a family vacation itinerary to new home construction complete with architectural design and materials procurement.

The overarching principle for you, as a marketplace, is to provide a service that offers a high frequency and highly retentive experience that makes it easy to monetize downstream transactions.

This change comes down to adopting a new mental model. Ask yourself what AI can provide to the demand side to buttress the transaction? What’s their workflow leading up to the time when they need to make a purchase? What happens after they make that purchase? How can I make it in their best interest to stay here and make another purchase?

The more of that user experience you can capture on the platform, the more successful your marketplace will be. And it will become a self-perpetuating cycle. Demand will come for your AI services. They’ll stay for your marketplace.

3. Reimagining the Search Box

The modern marketplace starts with a search box. You look for an item, (or find something you didn’t know you wanted). You find it using keywords or matching algorithms. You buy it.

But if you zoom out, the classic “buying cycle” contains far more steps than that:

- Awareness: customer realizes they have a problem (this is the stage where most marketing efforts are targeted)

- Consideration: Customer seeks detailed information to solve that problem

- Intent: Customers makes a decision based on that information as well as other financial, or emotional cues

- Purchase: the purchase is made

- Repurchase or Continuous purchase (for subscription businesses): customer reconsiders initial choice

Most marketplaces only capture steps two and three. You must come to the marketplace with intent to buy, and select the purchase that makes the most sense.

AI will allow us to bake the awareness and consideration stages of purchasing behavior into the marketplace itself. Imagine an AI companion that can intake your personal goals and tell you which couch might fit in your living room, or match your decor. Or tell you exactly which contractor has the availability and skills to complete your project.

The keyword-based search box is going to be complemented by intelligent, personalized guide mechanisms.

Over time, we expect this to mature into a “push” rather than “pull” based consumer experience in the marketplace.

We’ve already begun to see this happen with platforms like Facebook and Google, where AI is already heavily used via ad targeting algorithms. You know this as that uncanny feeling where you see an ad for a product you’ve been thinking about, but not searching for. It’s a function of advanced AI making predictions from your web activity.

This advanced AI matching is going to start appearing in more places that have enough data and context. And more, smaller scale marketplaces will have that data and context thanks to the accessibility of generative AI models.

(A side point: That uncanny feeling is important to note. The most successful push-based marketplaces will be subtle. While an algorithm might have the perfect match, customers don’t want an “arranged marriage.” Rather, they’ll want to be able to see everything that’s available. Improved, hyper-relevant matching will make the search process easier, and less frustrating.)

4. Vastly Improved Internal Efficiency

One of the hardest parts of running a marketplaces is managing both supply and demand on platform. Securing supply is cumbersome (especially if it’s locked up in disparate silos). Enticing demand is expensive.

Together, these make up the bulk of the costs for any marketplace. AI has the potential to vastly reduce those costs.

On the demand side, AI leads to improved personalization, marketing automation, enhanced SEO or automated SDRs and customer services. Even small savings here will allow marketplaces to operate faster, enable reinvestment in the product or improve profitability.

Though not a classic marketplace, we see shades of how this can happen in companies like NFX-backed Smith.ai. Best known for its virtual receptionists, Smith.AI has leveraged natural language processing to improve lead qualification, intake and outreach for law firms, homes services companies and other high-value SMBs. Systems like these may help lower costs on the demand side of the marketplace as well.

On the supply side, again, we see AI as a tool to unlock latent supply at lower costs. This allows new marketplaces to undercut incumbents in terms of take rates, giving them a previously non-existent wedge.

3 Areas of Opportunity

With these architectural changes in mind, we see three major opportunities for the next generation of AI-First marketplaces:

1. Native, AI-First marketplace

New marketplaces will spring up that never could have existed before. A recent example of this type of spontaneous marketplace evolution was seen during the crypto boom. The most valuable marketplaces of that era were exchanges like Coinbase or NFT marketplaces.

In its first incarnation, we are seeing many emerging marketplaces that are built on top of the products and services that enable AI, e.g. GPUs, algorithms, data and data labeling, RHLF, etc.

However, given we are in the infancy of this industry, there will be new enabling technologies developed and perhaps more interesting marketplaces built around the outputs, assets or derivatives of these new AI services.

Update: OpenAI has already sent a signal that this is a major opportunity. The company recently announced it will create a marketplace for custom GPTs (versions of chat GPT trained with personalized instructions and data).

These are greenfield opportunities with the potential to be very interesting.

2. AI Leapfrogging

AI has already started to make significant inroads in industries where no large, cloud-based digital incumbent exists.

These industries are digital laggards and often have low digital penetration and challenging sales cycles. Interestingly, AI has proved to be a good fit for a number of these spaces because it efficiently organizes disparate market participants, and delivers instant solutions, keeping switching costs low.

Because of this we expect new marketplaces to emerge in fields like legal, construction, manufacturing, govtech, and health. These fields are primed for “AI leapfrogging” – more on that here.

3. Unlocking Supply + Meaningfully Better Experiences for Demand Can Give Startups an Edge Over Incumbents

Let’s be clear eyed about this first:

Existing digital marketplaces with large amounts of data, distribution, capital and talent will be major beneficiaries of AI. This is important to note, because incumbent digital marketplaces are far more aware of the threat posed by potential platform shifts than they used to be.

There are three reasons for this:

- Modern technology stacks for tech companies are built in a modular fashion, allowing the fast adaptation of new technologies via microservices and APIs. Companies behind foundational AI models know this and will continue to make their products easy to integrate.

- The last big platform shift for marketplaces was the rise of mobile. But mass adoption was dependent on consumers buying a new piece of hardware. Adoption of AI is entirely software driven which massively increases the near term addressable market.

- Many tech investors and executives realize that they didn’t move fast enough to jump on the mobile paradigm. They won’t make the same mistake again.

What does this mean for you? Founders starting new companies need to focus on speed and orthogonal evolution to capture this opportunity.

No one is going to take on Amazon head on and win outright. Rather there are small, underserved niches that can benefit from AI-fueled innovation on both the supply and demand side.

This is where AI’s potential to expand the pool of available supply becomes an attractive proposition. You may be able to access supply in underserved niches neglected by large incumbents.

On the demand side in particular, there may be even more avenues of attack. Incumbents are often so focused on generating revenue from the supply side, that the demand side is left with subpar experiences. Look for areas where you can create a high frequency retentive experience for demand, where none exist (or existing tools are thoughtless or inadequate).

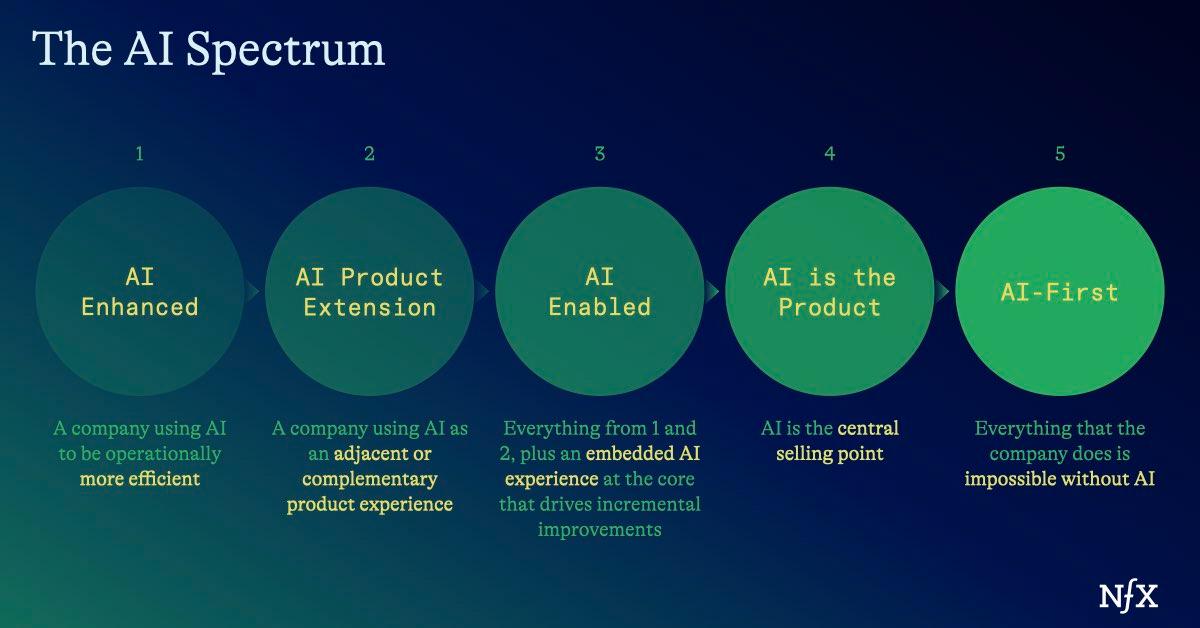

The AI Deployment Spectrum

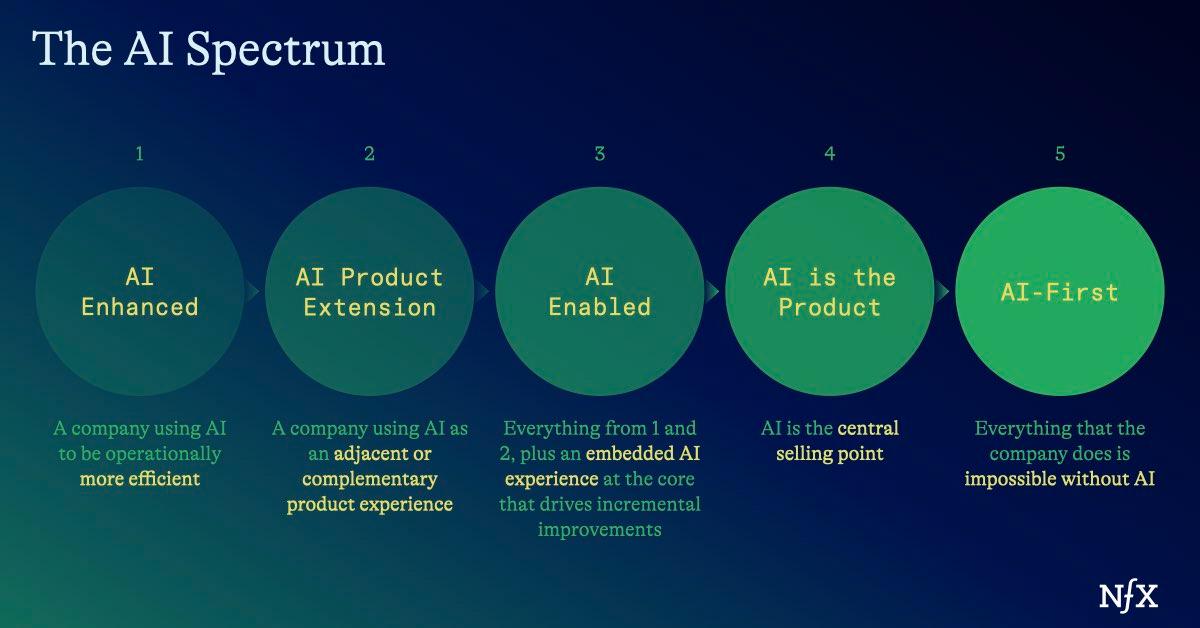

Going forward, all companies – not just marketplaces – are going to include some element of AI. But there will be degrees to which companies fully embrace the architectural shifts offered by the technology.

This degree of adaptation is important because AI is only useful if deployed purposefully. AI for the sake of AI, as we’ve written before, isn’t defensible, nor is it particularly useful.

In that vein, here’s how we think companies can embrace AI intelligently. (This isn’t just a guide for marketplaces, though it will certainly apply to these types of companies too.)

Level 1: AI Enhanced

If you are not using some form of AI to become more efficient, you’re leaving resources on the table. AI-driven scheduling, marketing, coding support, product management…there are many systems that can be automated today that couldn’t have been yesterday.

This is the bare minimum. We will expect all companies, marketplaces or not, to use AI to enhance their own business activities in some way.

Level 2: AI Product Extension

Companies with strong product market fit with a non-AI enabled product don’t necessarily need to overhaul themselves to become AI centric overnight, but they can capture large adjacent opportunities.

These companies should focus on using AI as a locking mechanism to secure that PMF. A company executing this well right now is NFX-backed Triple Whale. Triple Whale, a full-service AI data and analytics platform for small businesses, has leveraged generative AI to create platform-native creative ad generators.

This functionality is not central to Triple Whale’s core service, but these tools create another reason for a user to stick with your product and generate additional revenue

Level 3: AI-Enabled

This level of AI adoption includes everything from levels one and two, but adds a layer of intelligence on top. These companies, largely, embed an algorithm at the core of the service being offered.

Companies deploying AI-based matching in marketplaces (like NFX-backed Lev, which intelligently matches lenders and borrowers for commercial real estate deals) are good examples of level three companies.

Level 4: AI is the Product

These companies feature AI as the central selling point. This can be a powerful, but fragile place to be. You must ensure that you are using the AI to offer a complete, one-click solution to a real problem that you uniquely can solve.

If you don’t you risk becoming just another workflow – easy to copy, and with traditionally high switching costs.

This is the realm of the countless AI copywriting, or video editing or chatbot companies we’ve seen. Some of these workflows end up taking more time to learn than they save to use, and are easy for competitors to copy.

Remember that AI for the sake of AI can never truly be the product you are selling (even if it is the core of your service). AI must be the means to a truly industry-changing outcome.

A company executing this well is NFX-backed EvenUp. EvenUp is leveraging NLP to create instant demand letters for personal injury lawyers. We expand upon their strategy here. But it’s critical to note that EvenUp isn’t selling an AI-assisted workflow product, it’s selling the complete, and instant generation of the demand letter.

Level 5: AI-First

This is perhaps the most exciting level of AI deployment. The rollout of AI across companies will create either new companies that couldn’t exist before, or secondary markets borne of AI adoption.

As highlighted above, these are native AI-first marketplaces built around essential enabling technologies of our new AI era. There will also be many more marketplaces built around the outputs or components of AI. This could start to impact consumer markets such as media, creatives and advertising models, as well as many B2B markets.

AI to AI trusted platforms are likely to form. These will look more similar to what we think of platforms today rather than marketplaces. These would facilitate access and control points between different services, enable permissioned communication, and execute other tasks.

As AIs start to permeate all software, we see enormous potential here and we are fascinated about what might come out of this.

A Rare Moment for Marketplace Evolution

Taken together, this an exciting moment to be building any company – but it’s especially exciting for marketplace founders.

We haven’t seen a large enabling technology alter marketplace architecture since the rise of mobile (fintech was somewhat more subtle). And as a result, the large marketplace incumbents have been relatively secure for years.

But AI has finally caused a crack in the ecosystem. New AI first marketplaces will be spun up over the next few years built entirely around AI tools and their derivatives. Also, founders who act quickly may be able to take on incumbents orthogonally. They will be able to run existing marketplaces far more efficiently.

Ten years from now, marketplaces will look very different from the way they do today. Now is a rare opportunity to build at the very beginning.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.