Broadly speaking, there are two types of startups I meet with as a VC: those reinventing an existing market and those creating a new one.

These two types of disruption are commonly thought of as distinct, but there’s actually a lot of fundamental overlap that goes unseen.

Take Uber. Which category does it fit into? The answer is not as simple as it may first appear. In the short term, they’ve reinvented an existing market (taxi-hailing). But their bigger vision in the long term is creating an alternative to car ownership.

Often, the bigger long-term opportunity is in creating entirely new markets. Transformative companies that create the greatest value often fall in this category.

But not every startup that ends up creating a new market starts out that way. Amazon began by reinventing the bookstore online. Using that as a beachhead, they have now created whole new market categories from e-readers (Kindle) to smart speakers (Alexa), while simultaneously reinventing cloud services (AWS) as well as shipping and logistics.

This essay is intended to help Founders identify and anticipate the nuances between reinventing an existing market and creating a new one so that they can accurately understand where they stand and what their right strategy is.

Not all startups begin with creating a whole new market and trade off market risk for execution risk. Other startups are truly staking out terra nova. Either path is viable; the important thing is to know which signposts to look for that indicate which path you’re on. In both cases, the scale of value creation that’s possible is consistently underestimated.

What Reinventing Existing Markets Looks Like

One of the biggest ways in which we continue to see existing markets reinvented is through digitizing and organizing existing offline behavior.

The covid era has accelerated digitization in every industry. This is most obvious in e-commerce, but it’s visible across the board — every part of life from going to the dentist (which now requires online booking) to eating at a restaurant (online reservations) has increasingly moved online.

One of the big lessons from digitizing offline behaviors is that if you incorporate a compelling network effect and embed some sort of payment or fintech component, what initially may look like a small niche business can eventually turn into something quite massive.

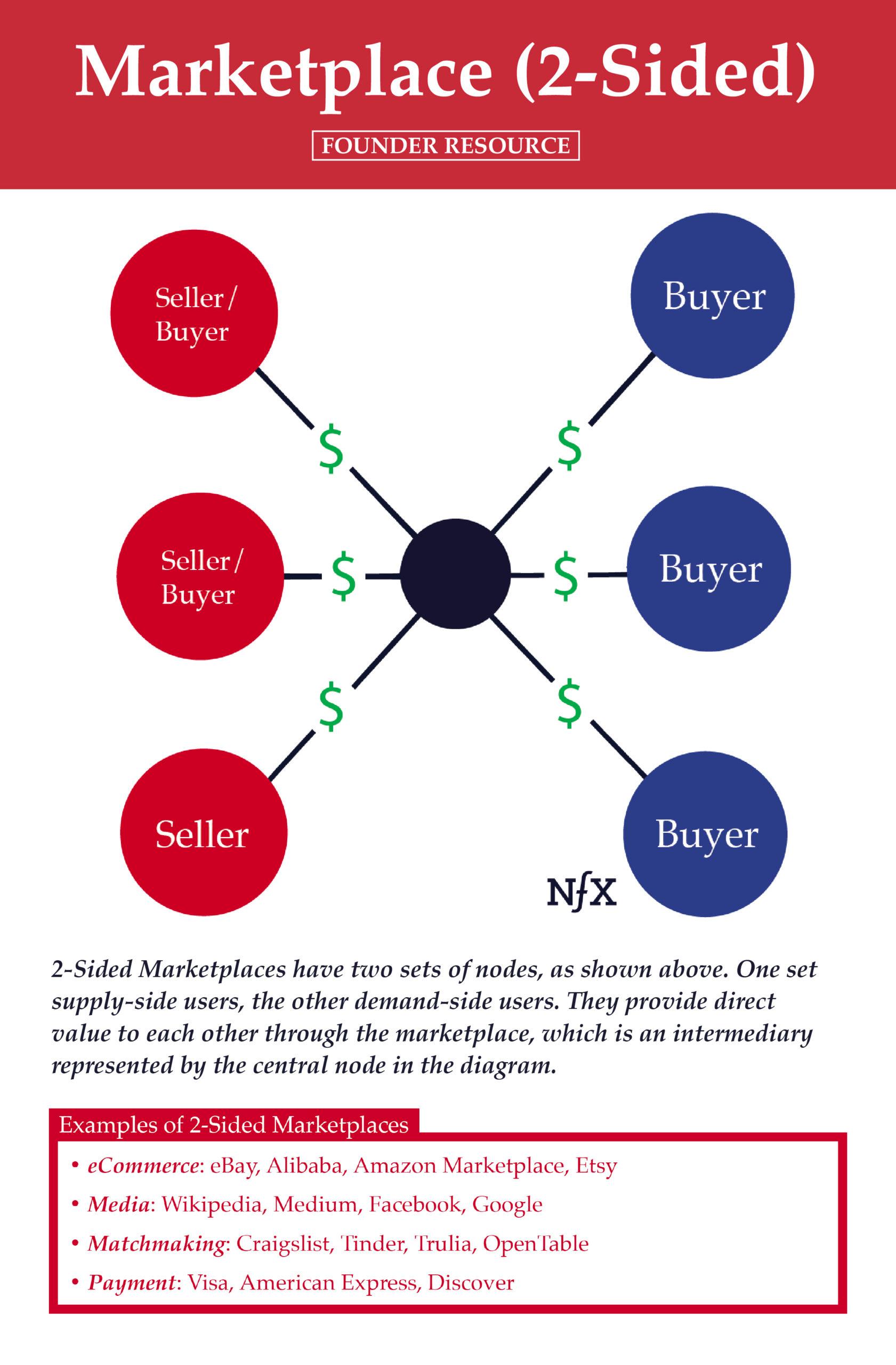

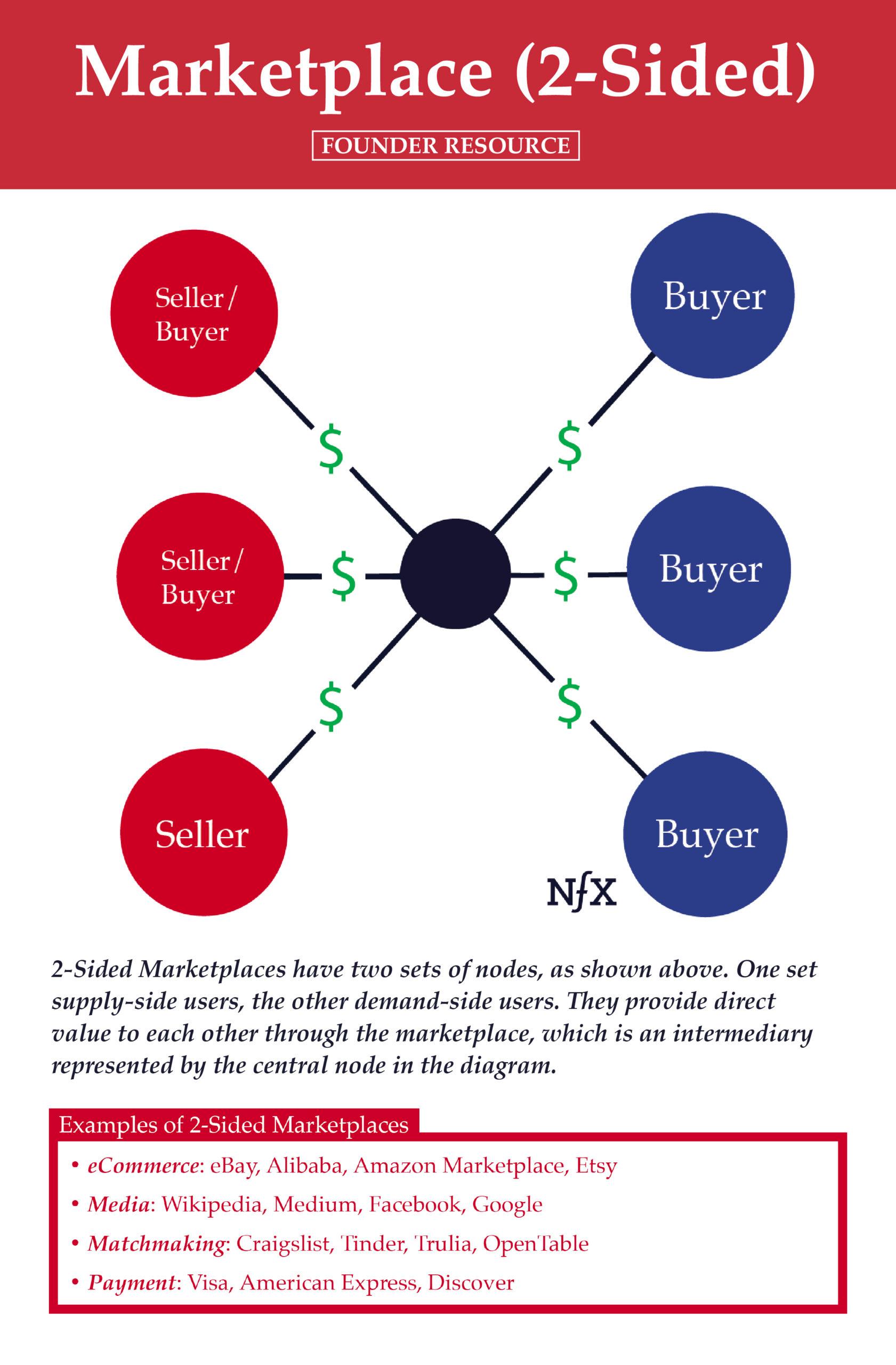

For example, many restaurants in the Covid pandemic don’t take walk-up diners and have moved the formerly offline activity of going to a restaurant partially online through platforms like OpenTable, which has a powerful 2-sided marketplace network effect and has built a business worth billions of dollars simply by digitizing offline behavior.

One of the biggest trends we are seeing is that offline behaviors are permanently shifting to online behaviors at an accelerating pace, and this presents continuing opportunities for startups reinventing new markets.

This trend of digitizing offline behavior falls under a broader framework that has stood the test of time: the formula for reinventing markets is to take a compelling new technology or approach and apply it to a specific industry.

Vertical search engines like Kayak and Trulia are examples from the early 2000s. Born in the wake of Google, which, at the time, represented a compelling new horizontal technology (i.e. search engines), they found success reinventing their respective verticals (online real estate and online travel) by applying search technology.

We saw many other examples of this in the first two waves of the internet, with mixed success. Zynga, for example, had the same idea (applying new social media tech to the gaming vertical), but they turned out to be too entrenched in the platform they were born from (Facebook) and incurred too much platform risk as a result.

Now, in the internet’s third wave, we’re seeing a similar formula with AI and blockchain applied to new verticals. In general, if you’re a startup doing something like “AI + mortgage”, it’s a sign that you’re in the business of reinventing existing markets. This approach can be a helpful way to start. The best companies are those that evolve their value proposition rapidly and develop a deep understanding of their customer.

While this is a tried and true formula, timing is key. If you’re a Founder looking for new startup ideas, how do you know which markets you might potentially target?

One of the telltale signs that a market is ripe for reinvention is traditional advertising. If you see a lot of advertising in a market category, that’s a good signpost that there’s significant product atrophy. Usually, advertising signals that existing players are competing for significant revenue, but they can’t rely on product differentiation and therefore they compete on ad spend.

Think about the amount of advertising that goes on in categories like automotive and insurance. Look out for this: where there’s large advertising spend is often the biggest opportunity for disruption.

Companies that recently went about reinventing the automotive and insurance categories — i.e. Tesla and Lemonade or Hippo — are now the largest companies in their industries by market cap by choosing to spend significantly on product development and not on advertising.

Why? Because they were able to reinvent the market, creating innovative and differentiated products in a market overcrowded with commoditized players.

However, Founders should keep in mind that reinventing existing markets isn’t all about product innovation; it’s often just as much about execution and go-to-market.

The near-term objective, if you’re a disruptive new startup, is to scale up distribution before the incumbent can copy you. The expectation for many startups and investors is that the incumbent has many structural advantages that will enable them to copy a new innovator. But if a startup is able to get distribution quickly enough, you should be much less worried about incumbents because their ability to innovate is generally weak and it’s quite hard for them to copy you.

Don’t Become What You’re Trying to Disrupt

While there is a danger of incumbents copying startups, I find that startups copying incumbents can often be an even bigger danger.

If you’re reinventing an existing market, don’t become what you’re trying to disrupt. For example, when Amazon was starting out, one of the biggest mistakes they could have made would’ve been going out and hiring a bunch of executives from the incumbents in the market they were trying to disrupt.

Imagine if the early leadership of Amazon had included people with long careers at Borders or Barnes & Noble. Those executives would have wanted to implement the same basic business model all over again.

The point is that this is a danger you should be aware of if you’re a startup reinventing an existing market: you might start out with a disruptive model, but end up getting pulled in the wrong direction to do things the same way as the market incumbents — which is less innovative and more about capturing pre-existing revenue.

This often manifests by hiring too many industry veterans. When I was at lastminute.com, we hired a lot of travel executives, and I felt this kept us too tethered to old ways of doing things. So when I founded Trulia, we deliberately didn’t hire people who worked in real estate. The more you fill the executive ranks with industry veterans, the bigger the risk that you’ll end up copying the incumbents too much to really reinvent the industry.

Startups can’t afford this. You have to think like a contrarian. You have to resist the temptation to follow the tried and tested. Startup innovation is all about venturing into the unknown and blazing your own trail.

Frameworks for New Market Creation

As mentioned earlier, while reinventing existing markets is often a good way for a startup to start out, creating a new market is often where the real value ultimately lies. If you want to become a truly transformative company, it means creating a new market.

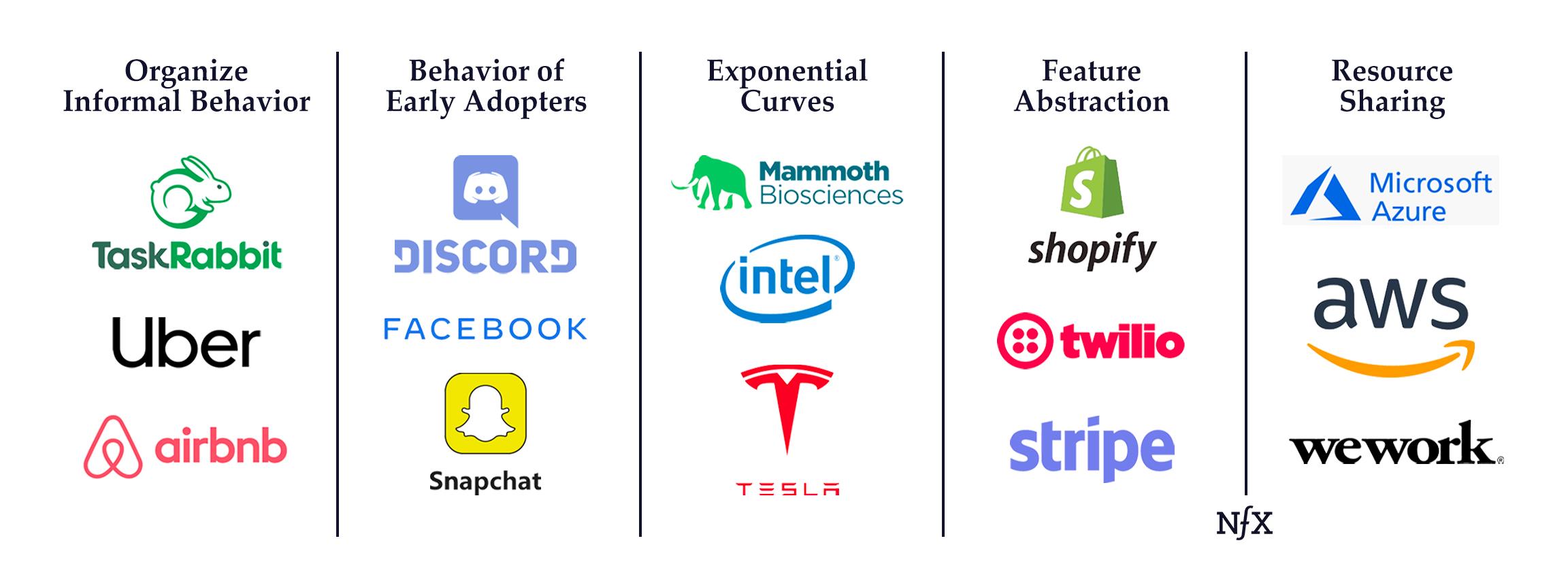

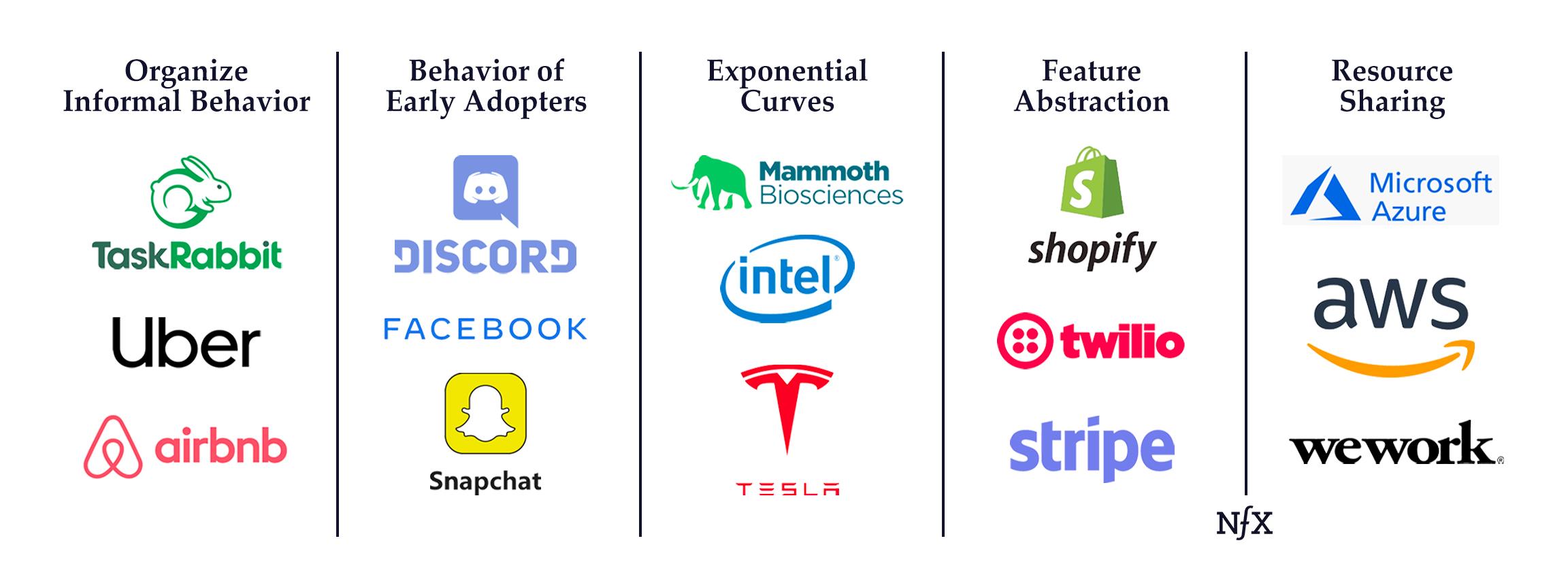

But that’s a daunting prospect. How do you even begin to think about this? To help structure your thinking, I want to offer 5 places to look for the potential to create new markets.

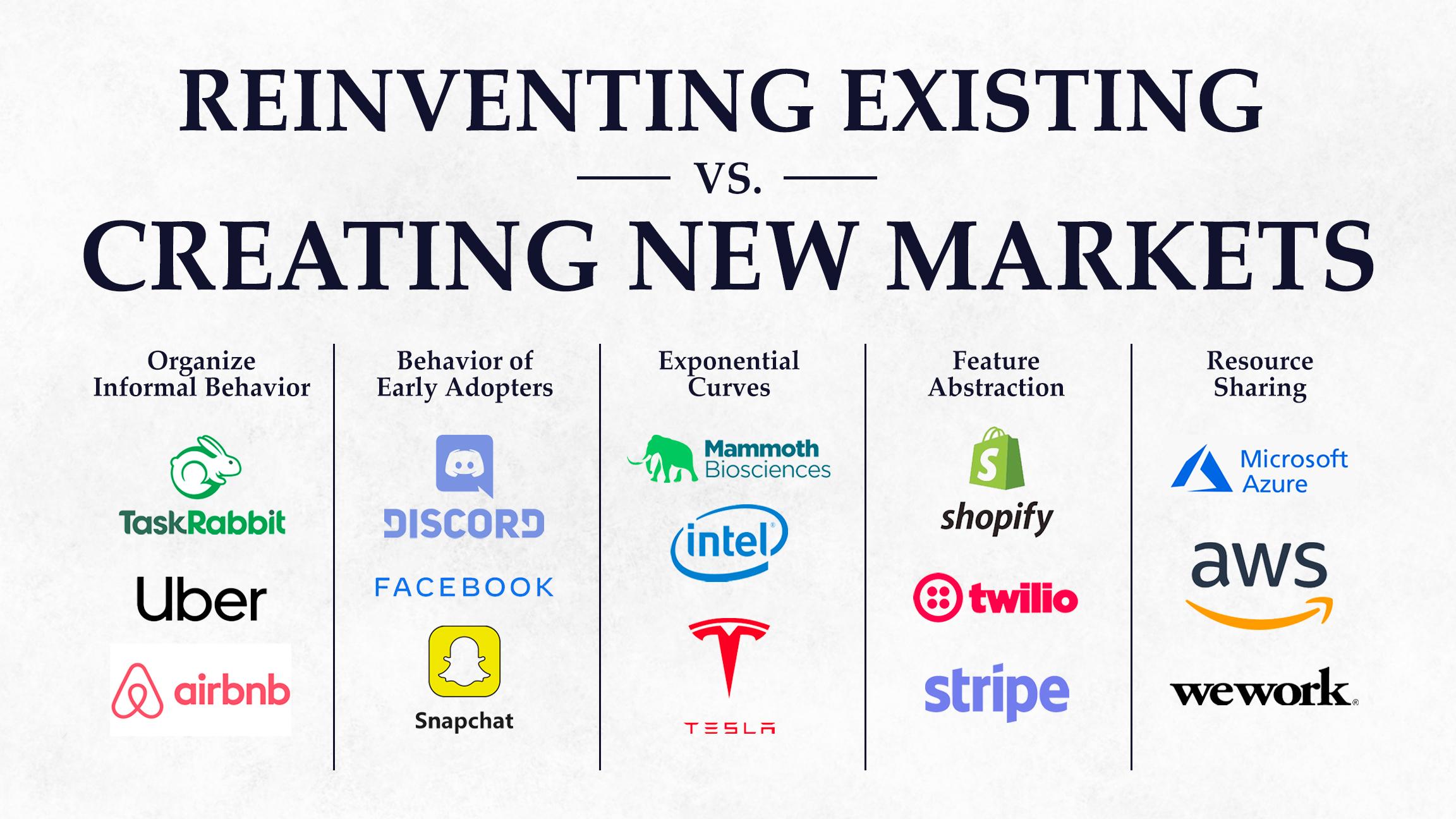

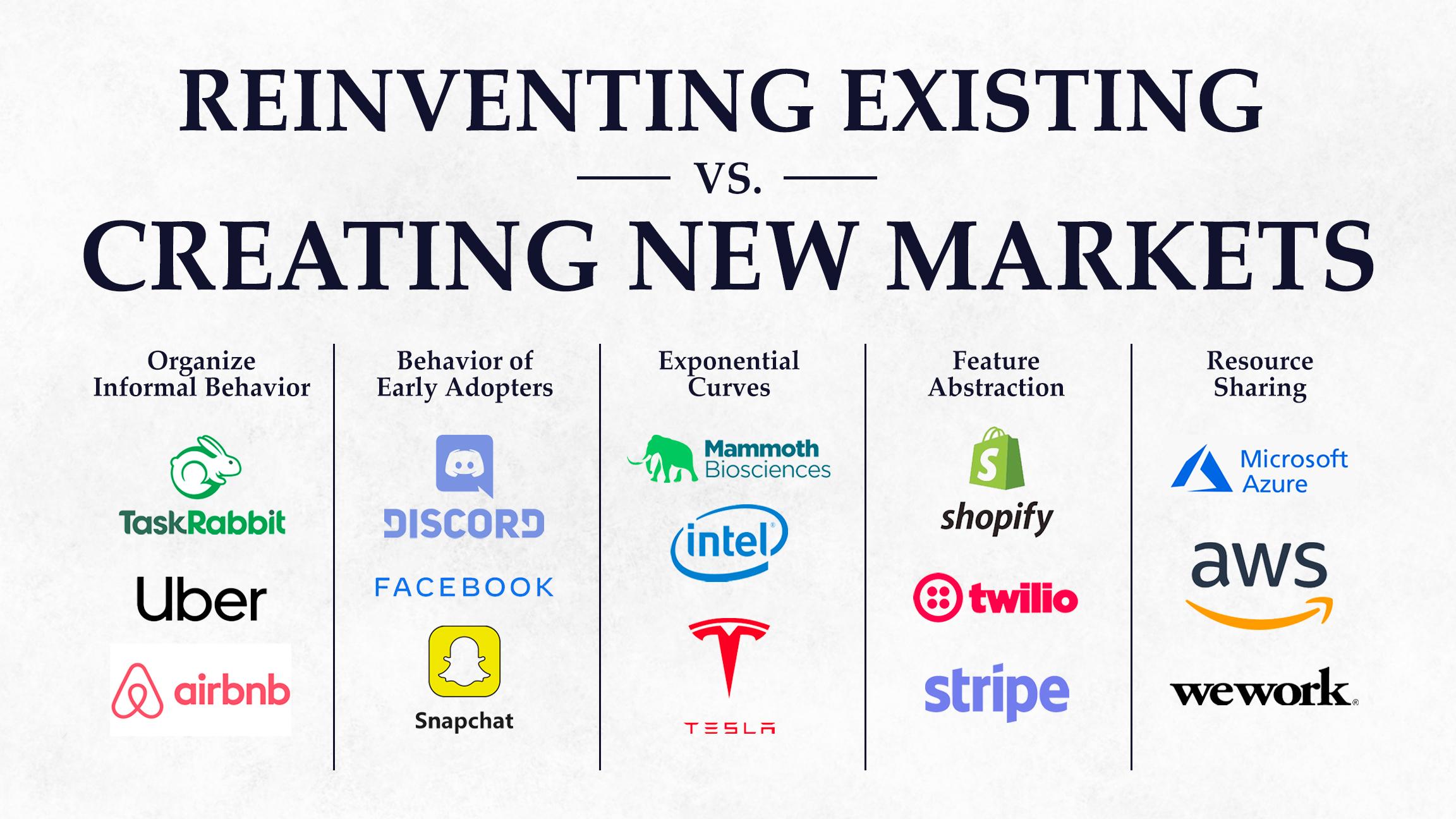

1. Organize Informal Behavior

Organizing previously informal behavior into something that can be done commercially and at scale is one place to look.

TaskRabbit, Airbnb, and Uber are all recent examples of this. In the early days of TaskRabbit, for example, one of the biggest use cases was getting rides at the airport — a previously informal activity that TaskRabbit was able to commercialize.

You see a lot of new market creation via organizing informal behavior in horizontal marketplaces, which often serve to unlock latent supply in a situation where there was previously constrained supply paired with large demand.

For example, Instagram, where you see influencers selling products that they use — a previously informal activity (people recommending products to their friends) that got organized, commercialized, and eventually professionalized, creating a new profession.

Wherever there’s a potential to organize informal behavior at scale, there’s a potential new market opportunity.

2. Behavior of Early Adopters

The behavior of early adopters of new technologies is often a good place to look for new markets.

One good prompt I like to use: look at what students and engineers are doing. These have been the leading archetypes of early adopters in the past because they have very dense social networks with a high propensity to discover, adopt, and disseminate new technology.

The hot new products that engineers use so often become the hot things that we all use — products like Discord and Slack. The same applies to students and young people, as we saw with Facebook, Reddit, and Snapchat, or new lifestyles like digital nomads.

The behaviors of students and engineers are leading indicators of new markets.

3. Exponential Curves

Another place to look for new market creation comes from either the exponential growth of a new adjacent market (e.g. the growth of the internet > e-commerce) or an exponential collapse of pricing (e.g. genomic sequencing for biotech, Moore’s Law for computing, solar energy cost for EV / clean energy tech).

The nature of exponential growth or collapse is such that it tends to happen much slower than we think, and then all at once. This can make the state of the market hard to judge because our intuition is linear — not exponential.

But exponential behavior is something you find again and again, and that often creates a breakthrough opportunity. Startups by design are able to attack fast-moving markets more quickly than incumbents. As we often say, speed is your number one advantage as a startup.

4. Feature Abstraction

Another framework that has been used for identifying potential new markets, particularly in B2B, has been feature abstraction, i.e. turning features or products into platforms. Shopify, Twilio, Stripe, and Snowflake are all examples of B2B businesses built around products that were initially features.

Engineers in a company solving a particular problem is a signpost for this. “Is this a feature, or is this a company?” is often a question we ask startups as investors. Often, it can be that this is just a feature, but sometimes a feature can become a company if the market need is sufficient.

Slack started off building an internal collaboration tool for a game. PagerDuty began as a notification service that is now a SaaS instant response platform for business IT departments and is valued as a billion-dollar company.

5. Resource Sharing

Turning fixed costs into variable costs is another place we often see new market creation. For example, WeWork turning office space from a fixed cost into a variable cost according to office space usage, or AWS doing the same for cloud storage.

A lot of the easy versions of this have already been done, but though the low-hanging fruit may have been picked there are likely still opportunities.

Consistently Underappreciated Opportunities

The framework I’ve outlined here is useful for thinking about where your startup lies between reinventing vs. creating markets, but keep in mind that it’s a spectrum, not a dichotomy.

Did Tesla create a new market (EVs) or reinvent an existing one (Automotive)? Rarely do companies fit into one category or another, and sometimes where you lie on the spectrum changes over time.

But it’s good to know where you are on this spectrum for a couple of reasons.

The first is about playing to your strengths. As a VC, if I meet a team with a lot of industry experience, they tend to excel at creating businesses that focus on reinventing an existing market because they have built up the ability to execute well over their careers and it makes more sense for them to take on execution risk.

On the other hand, the archetype for Founders creating new industries is that they’re often creative, technical, and positively naive (in a good way, as they lack industry experience which can be a double-edged sword when it comes to innovation). Founders who have success creating new industries are often people who are able to think from first principles and are outsiders with limited business experience, but with deep domain knowledge from a technical standpoint.

The second thing that’s important about knowing where you stand is recognizing that creating new markets often produces larger outcomes because they’re contrarian — businesses creating new markets are doing something much less obvious than reinventing existing markets by applying a new technology, which means that they rarely have much competition to deal with.

In either case, however — whether a startup is reinventing an existing market, or creating a new one — I’ve noticed that the TAM opportunity tends to be underappreciated.

In new markets, this is because it’s consistently difficult for people to visualize the value created by something new, especially when it comes from exponential growth or exponential collapse of prices.

With existing markets, many don’t see that when you digitize something and add network effects, your potential market share can be much higher and your margin structure can be much more favorable. So you can’t just look at the offline equivalent and extrapolate from there. The “restaurants booking” TAM is a completely different beast offline than it is online.

So while creating new markets often creates the biggest outcomes, no matter where you lie on the spectrum, if you understand this framework and play to your strengths, your startup will have a good chance of defining or redefining a category.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.