In the aftermath of Covid, the issue of where Founders should locate their next startup has become a hot topic. Startups are “new networks within larger networks,” so it’s important for Founders to understand how the network conditions of their surrounding ecosystem can impact their culture, hiring, access to capital, access to information, and chances of success.

Accelerated digital and remote work introduced new models for startup success, including:

- Fully distributed companies, which works for some businesses.

- Businesses HQ’ed in a core hub, with support or technical roles in a cheaper location.

- The emergence of new, rising tech ecosystems other than Silicon Valley, Beijing, and Israel.

- More specialized tech networks where you can create deeper connections with less noise, e.g. Utah in enterprise SaaS, fintech in NYC/London, security in Israel, etc.

- Hiring just a few highly specialized people remotely that you can’t find in your geography, but who are 10X value-adds and put the secret sauce in your technology, product, or sales.

- Founders should be aware of these patterns and consider them when they set up their companies. NFX is certainly investing more outside our core areas of SF Bay Area and Israel than ever before.

Remember that a startup is a 10-year endeavor, so you should optimize your business planning for the long term. Regardless of the trends above, the math of networks predicts that geographical clusters of innovation will persist.

The question for Founders is, which geographic cluster should you be based in?

In making this decision, bear in mind that the impact of network math on creating successful startups is enormous. As we’ll see below, the network strength of an ecosystem can be a 3X, or even 7X, multiplier on the efforts of startups and Founders, which means that strong ecosystems tend to attract the most ambitious and talented people.

Founders with smaller-scale startup ideas will increasingly be empowered by remote, and large companies will continue to be helped by remote work. Given the 3-7X return on the network effects of geography, Founders seeking to build transformative companies will continue to be primarily headquartered in the world capitals of innovation.

Long-term thinking has the biggest payoff at the greatest moments of volatility. This is one of those times. For Founders looking to start a startup, understanding the importance of geographical network effects is a competitive advantage.

Today, we want to bring this bigger picture into focus for Founders by showing:

- Why the historical network and cultural conditions prevalent in Silicon Valley created a powerful tech ecosystem that made it an outlier in the recent past.

- Why cities in general — and not just Silicon Valley — will continue to be centers of innovation and economic activity even in a world with widespread remote work.

Just like in life, the decision of where to start a company is a crossroads moment because of its powerful network implications, and today we’ll lay out the underlying patterns to help Founders make the best choice.

Thanks to Chris Anderson, Josh Elman, Pete Flint, and Gigi Levy-Weiss for their thoughtful feedback on previous versions. Their insights were indispensable in developing this essay in its final form.

What Made Silicon Valley A World Capital of Innovation

Among tech ecosystems, Silicon Valley remains an outlier. It is home to far more than its fair share of startups that have reached billion-dollar-plus valuations, relative to its population.

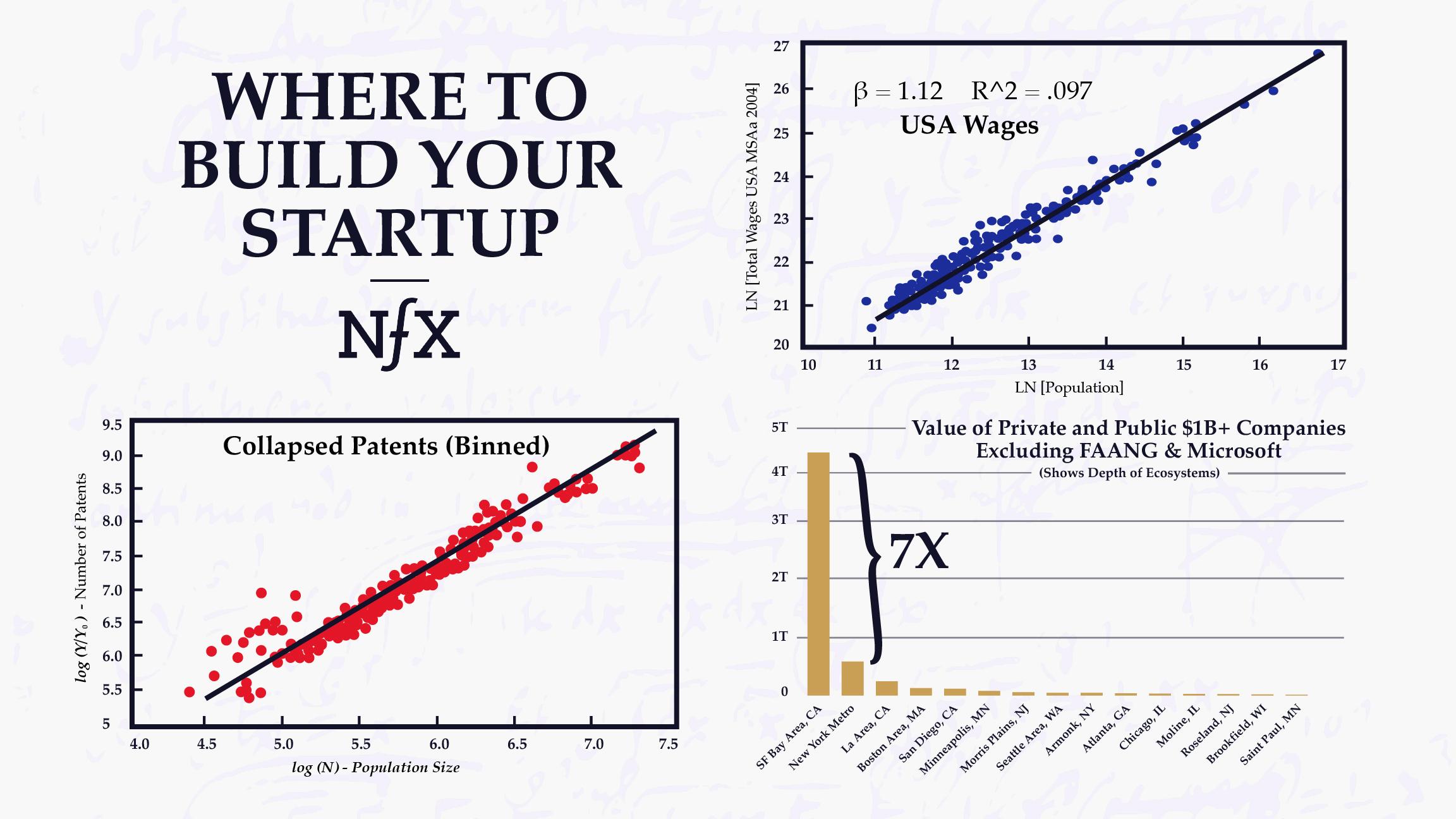

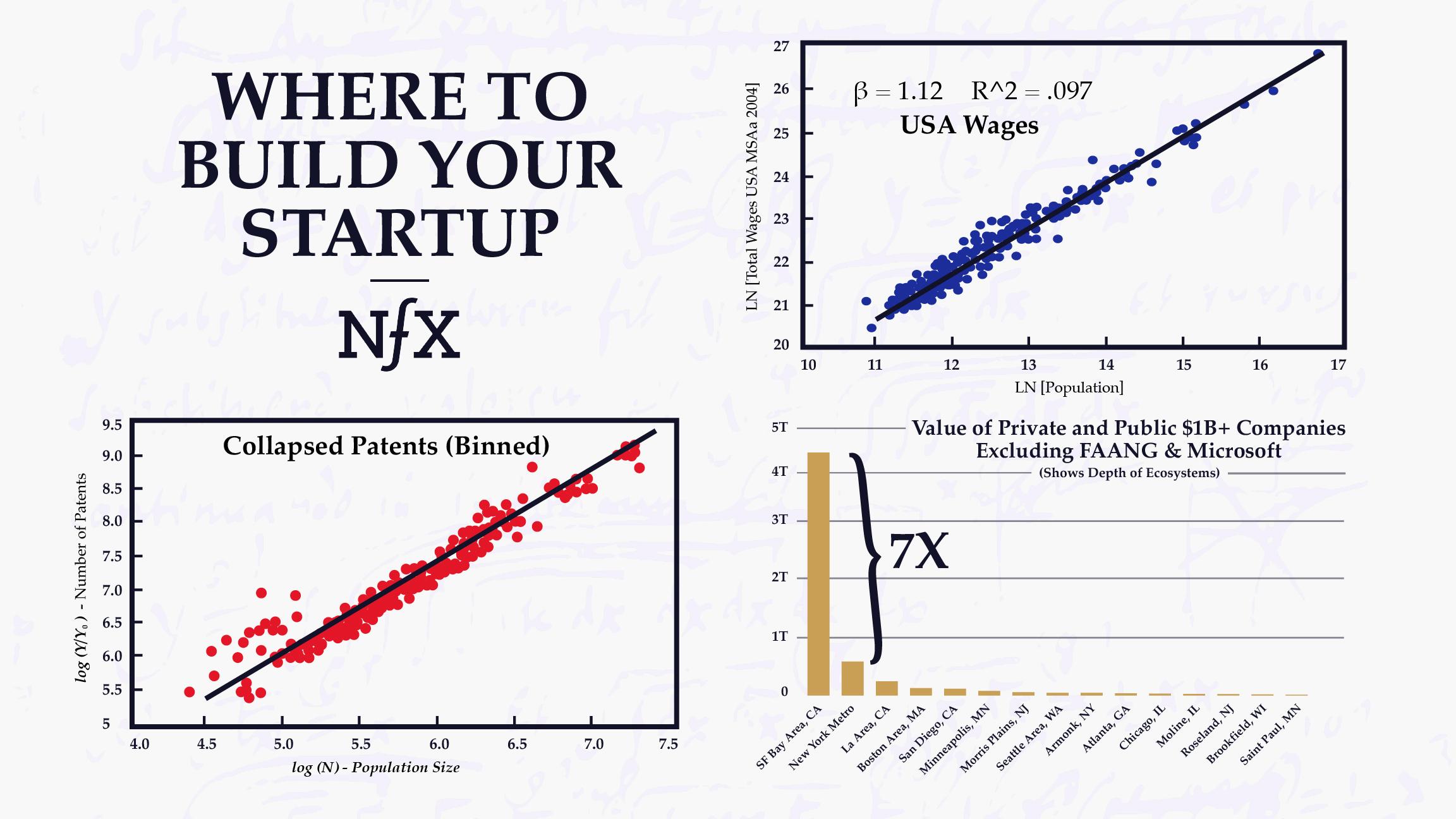

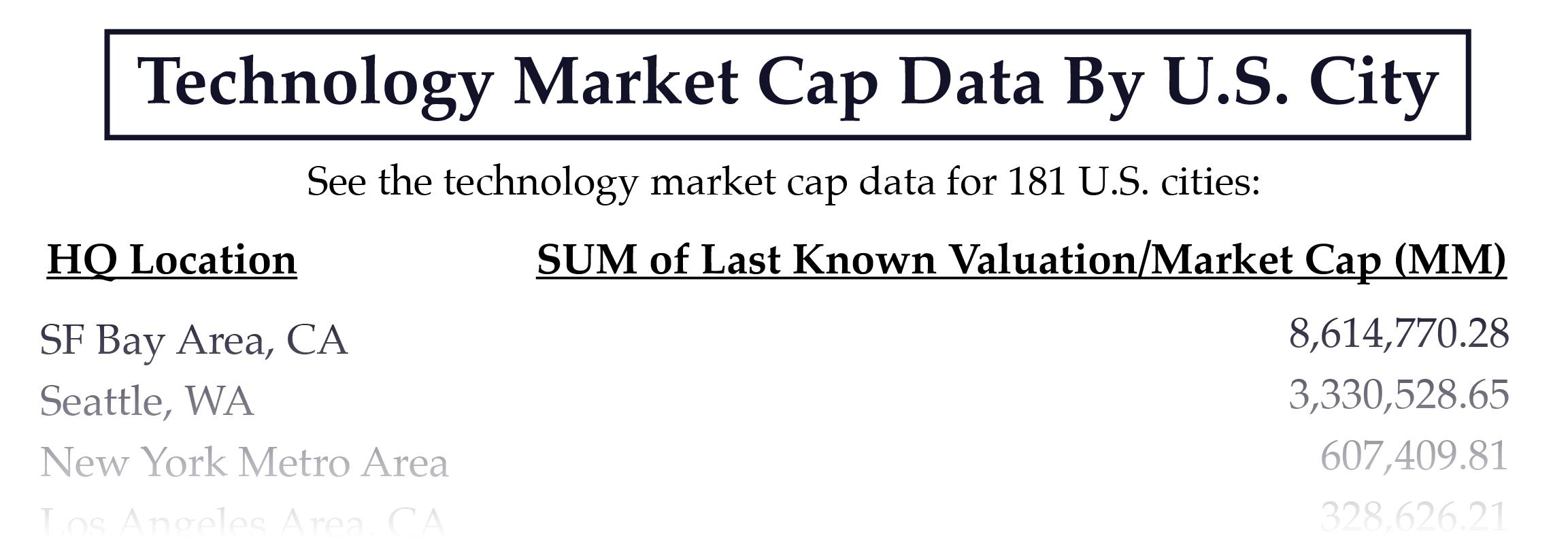

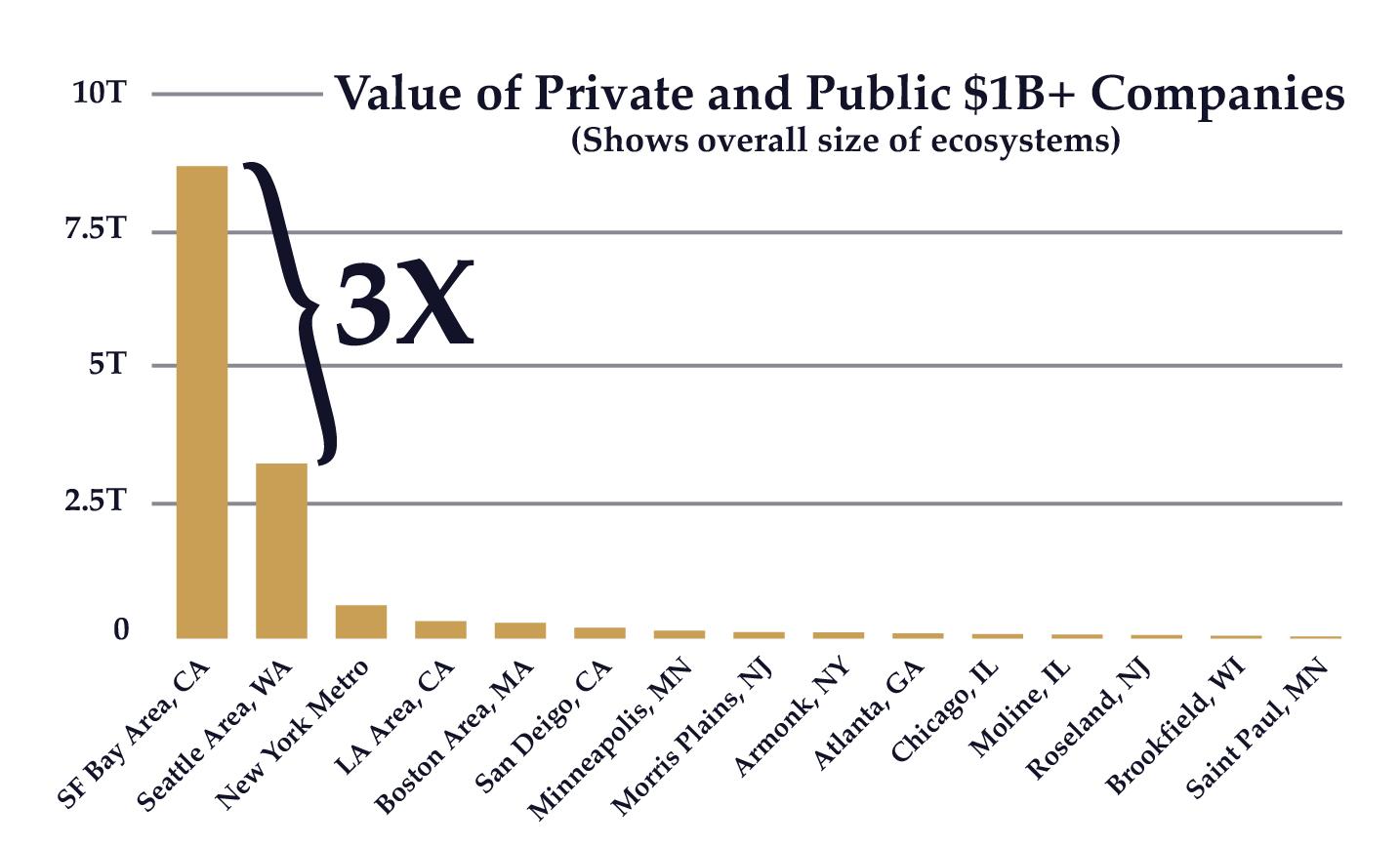

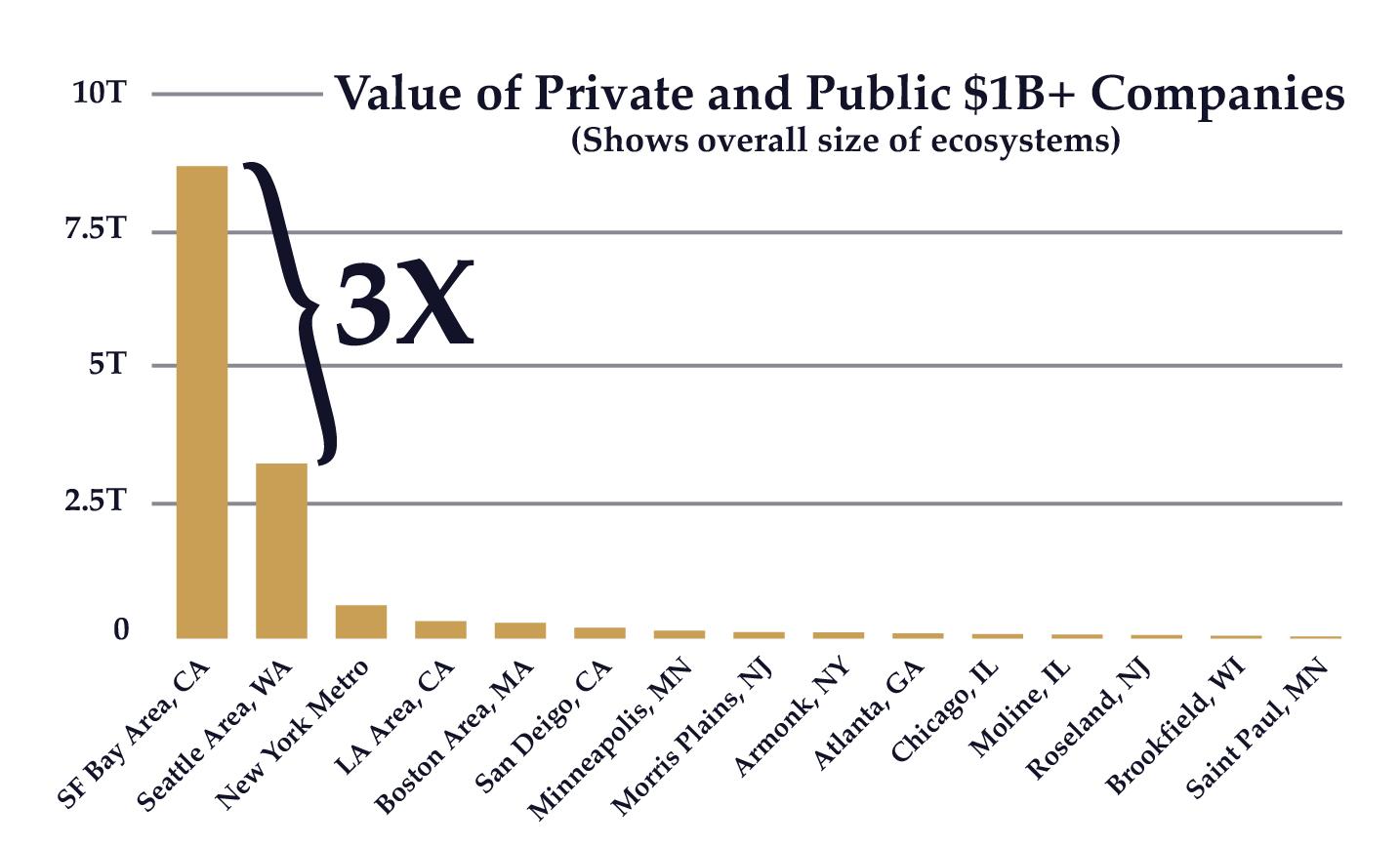

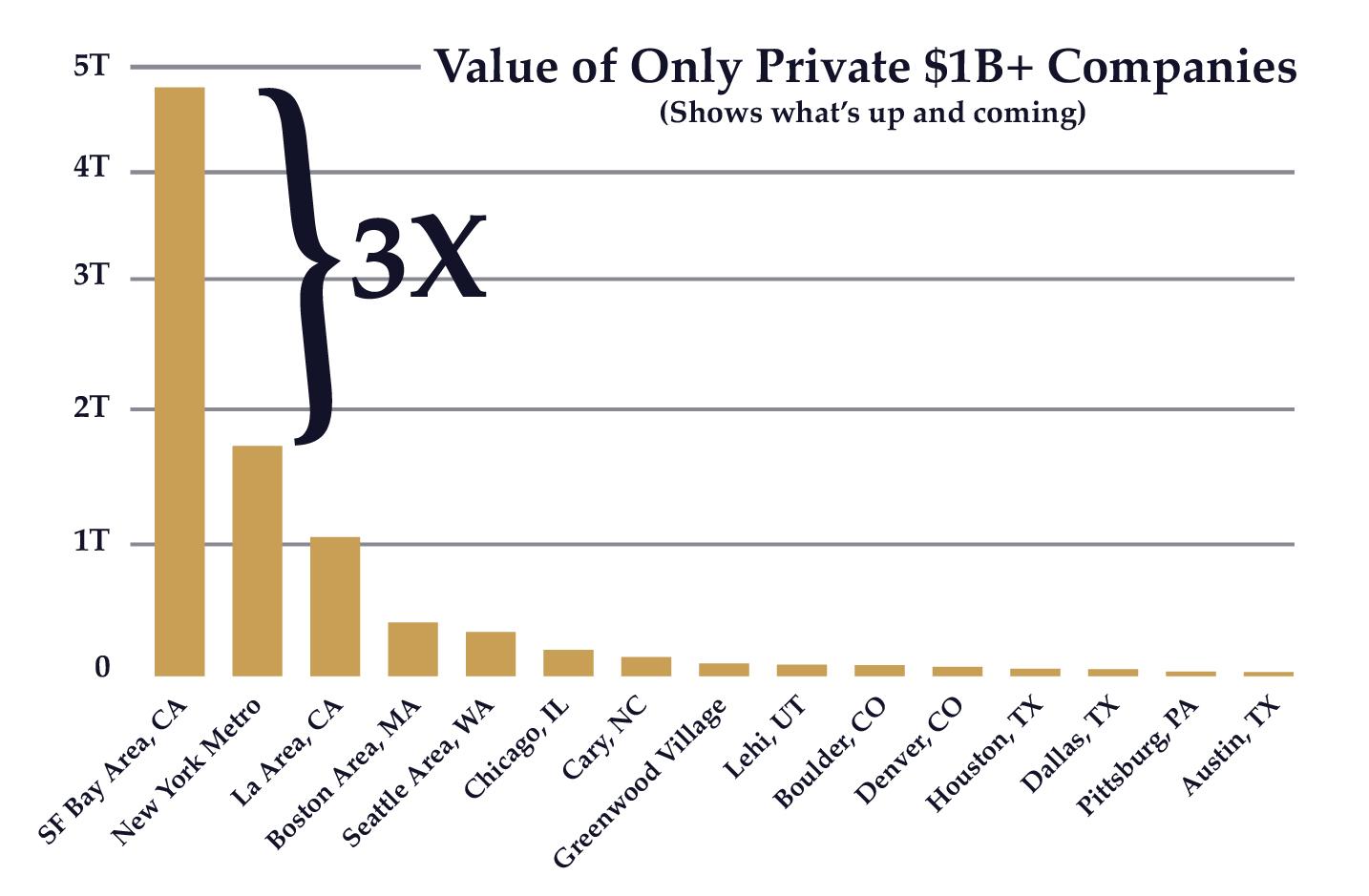

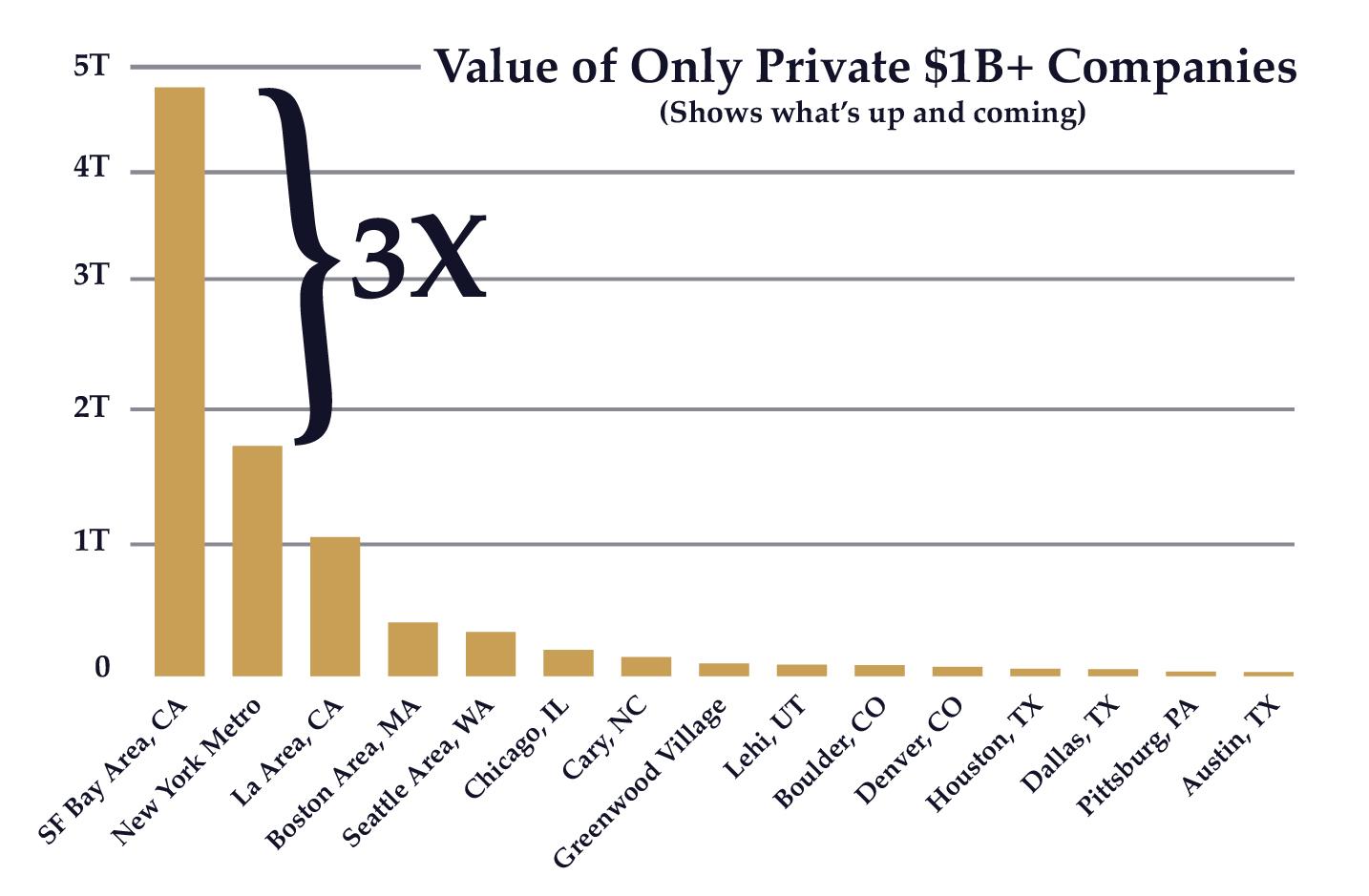

To show this empirically, we used the total value of tech companies founded and headquartered in various cities across the US as a proxy for the productivity of the local tech ecosystem. Specifically, we compiled the most up-to-date data on tech companies across the US worth $1B+ and where they were headquartered.

What we found is that despite being the fifth largest combined statistical area in the US by population, the SF Bay Area accounts for about $8.6 trillion — or about 55% of the total market value of all tech startups for all US cities.

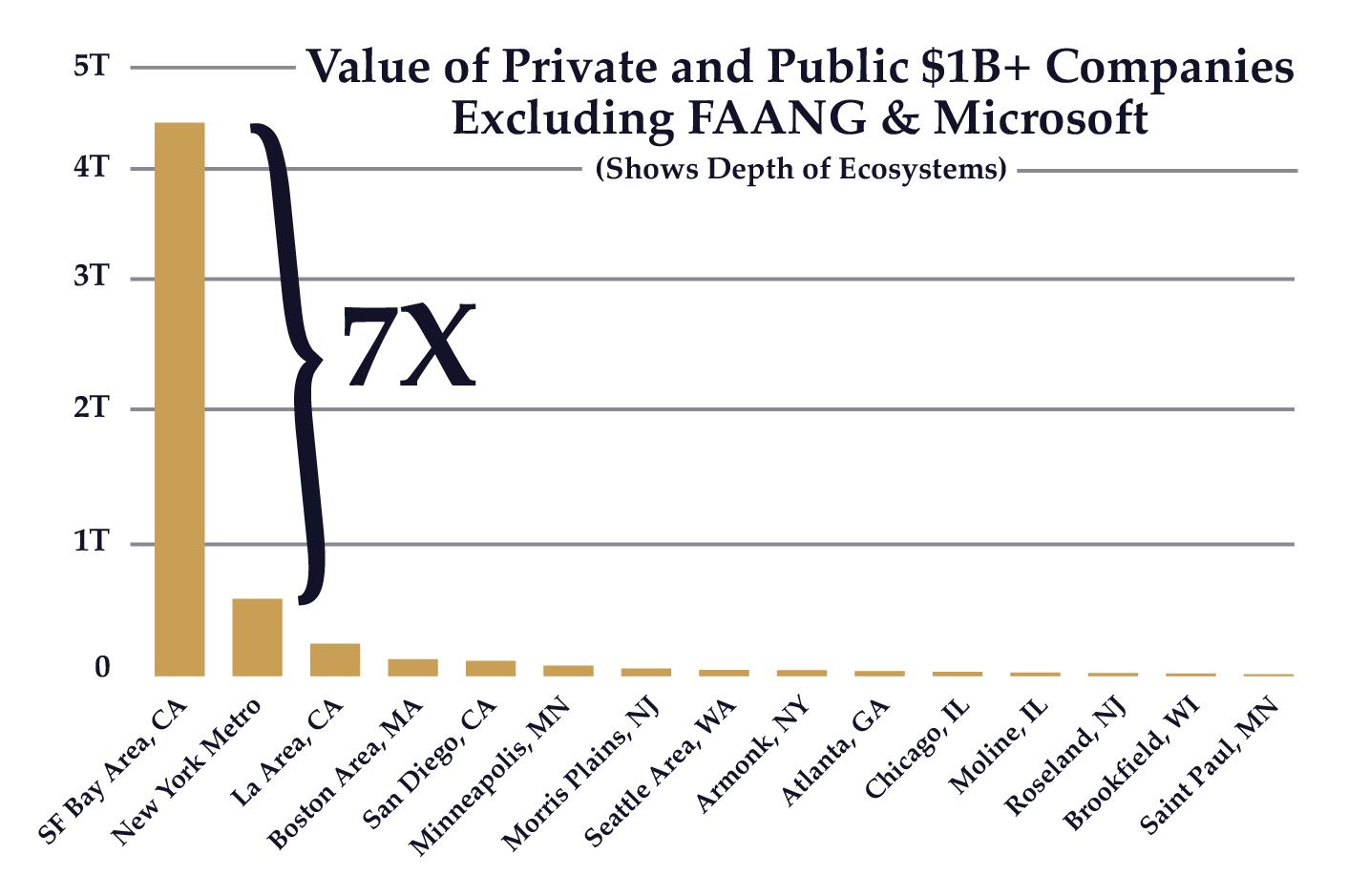

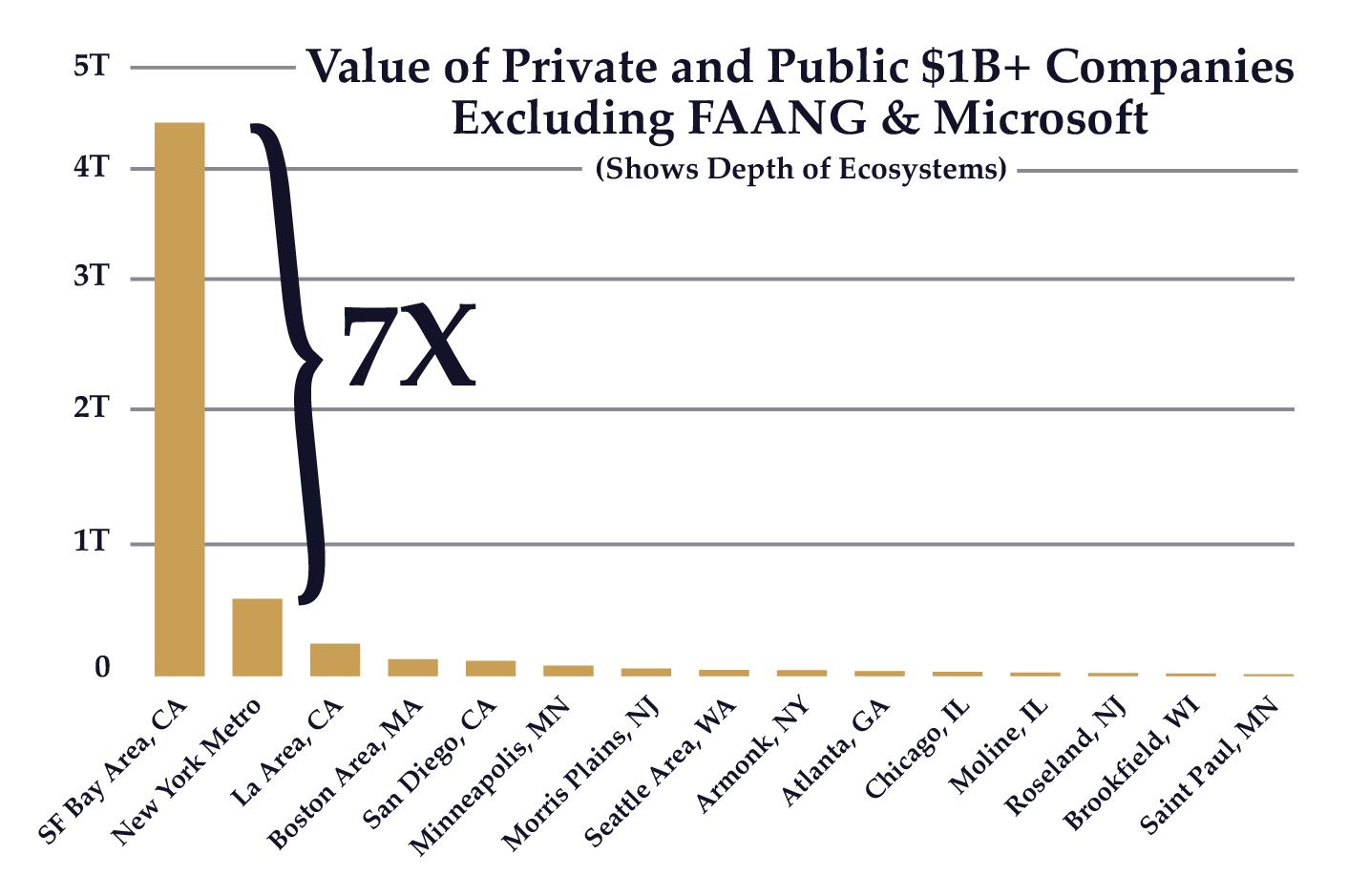

The value creation of the second-ranked tech ecosystem, Seattle, according to the market value of tech companies headquartered there, is about a 1/3 of that. But the tech giants skew this data because of the presence of Microsoft and Amazon in Seattle, which unfortunately hasn’t managed to spawn a relatively substantial startup ecosystem outside of these two extreme outliers.

If you exclude the 6 tech giants of both Silicon Valley and Seattle (FAANG + Microsoft) from the picture, Seattle drops to eighth place and the SF Bay area’s lead over the second largest ecosystem, New York, increases to about 7X. This reflects the depth of the various geographic ecosystems.

But maybe that data is backward-looking. Perhaps if we remove all public companies and only look at private startups, we will get a better picture of what’s coming in the future. When we do that, SF Bay Area still has a 3X lead over the #2 ecosystem, NYC.

What explains this?

We’ve observed two things in outlier ecosystems that Silicon Valley seems to share: 1) industry focus and 2) psychology.

First, it has an industry focus on tech. A large amount of residents work in tech. It’s a kind of a monoculture. So each node absorbs more curated, relevant information in each interaction than they would anywhere else.

Many people think that because we live in a digital age, everyone has equal access to information. But this isn’t really true. In a world of superabundant information, knowing which information to pay attention to — having your learning curated for you — is the hard part. And human networks are the best knowledge curation filters.

Further, the best stuff — the really useful insider information — isn’t published publicly. The information that really moves the needle is still transmitted in person. That’s why, even in the digital age, if you’re embedded in a network of people concentrated on tech, you’ll learn faster and know more than someone learning about it online from a cabin in the woods or a beach in Bali.

This specialized information exchange between nodes is part of what explains the long-term dominance of different cities in certain industries: LA in entertainment, New York in Finance, and Silicon Valley in tech.

But it’s not the full picture. The second reason why Silicon Valley has been such an outlier is the psychology that defines it.

Many people have looked at Silicon Valley and noticed the measurable infrastructure like VCs, universities, co-working spaces, incubator offices, law firms, banks. Or they noticed the physical manifestations of its culture like hoodies, sneakers, nap pods, catered lunches, etc. They often imagine replicating these measurable elements could create “another Silicon Valley.”

But “Silicon Valley” is just a mindset. A psychology. A set of mental models.

Or we might call them cultural network protocols — they are what really power Silicon Valley’s network effect by producing a higher network efficiency and density between nodes.

This psychology also “calls out” to people around the world with similar mental models to come join the network: ambitious thinkers, geeky personalities, data, and design lovers, They have been drawn to the SF Bay Area every year for 40+ years, leading to a self-reinforcing feedback loop.

Any tech ecosystem with similar cultural protocols and tech focus is also likely to develop into a robust capital of innovation. Clearly, however, it’s more difficult than most realize to intentionally engineer cultural protocols at scale in a new place.

Cultural Protocols That Powered Silicon Valley’s Network Effect

The mental models that have made Silicon Valley an outlier include:

You can read on for the full list and/or access an easy-to-reference PDF version below.

- Non-zero-sum thinking: The belief that someone else’s gain is not your loss, and can actually be good for you. There’s more than enough for everyone. We’ll make more together. This encourages collaboration and network connectedness.

- Anybody can be anything: Formal credentials and other status markers matter less in Silicon Valley. That’s not to say that they don’t matter. Of course, they do, it’s human nature. But in Silicon Valley, more than anywhere else, a person’s future potential isn’t judged completely on their past. This lessens the impact of preferential attachment and encourages interaction between nodes without undue friction from perceived status differences or past failures.

- Habitual speed: In “Always be Moving”, I wrote that the #1 advantage of startups and entrepreneurs is speed, so they must embrace what we call the “shrew mentality.” This restless mentality of always moving and making speed a habit is a mental model that defines the Silicon Valley network in general. When most of the nodes in your network are constantly moving and building something new, you unconsciously want to match their pace.

- Thinking Big: Thinking big is one of those things that sounds easy in theory, but hard in practice. Networks set the bar for success based on what the nodes in that network have previously achieved. In Silicon Valley, your next-door neighbor may have built a product with 100 million users, anchoring your expectations for what success looks like higher than they would be in a different network.

- Impact as the status marker: The way people signal status in SV is by “impact.” When people in Silicon Valley make a lot of money, in the past, they preferred to spend it on building the next new thing instead of buying flashy stuff. Status comes from the acclaim and friendships you build with other people who matter. Bling oriented money culture is anti-Silicon Valley. It’s anti-what works. Money is only a byproduct of obsessive focus and impact.

- Paying it forward: One of the most striking network protocols in Silicon Valley is the idea that you should pay it forward. That helping someone you may have just met by pushing information and resources to them will come back around one day, in an almost karmic sense.

- Sharing information: This norm of transparency of information stems from a belief that the idea is not the value point, competing on the execution of the idea is what matters. The free flow of information and resources between nodes with weak ties leads to higher interconnectedness in the network and higher utilization of each link in the network. More potential connections materialize into actual connections unconstrained by tit-for-tat thinking, creating a more powerful network effect.

- If you’re not weird, you’re weird. My Partner, Morgan Beller says this. Silicon Valley has created a norm of thinking outside the box. My co-founder Stan Chudnovsky and I always had the mental model while building companies that if everyone else was doing things one way, that’s a clear sign we should *not* do it that way. The mental model is to purposefully do things differently. If you do end up doing something like everyone else, it’s because you tried other options and arrived there from first principles.

- Drinking the kool-aid: The norm of drinking our own kool-aid is a good thing for an innovation network. Getting swept away with enthusiasm for a new idea and doing something “stupid” is a core operating principle for people in a high-performing innovative network. It’s why someone would give Jack Dorsey a few million dollars to have people share 140 characters on what they ate for lunch, or someone would quit a high paying job to join an 8 person company with a silly name like Twitter. It’s why Jim Bryer at Accel in Palo Alto would give a young Zuck millions of dollars for a college networking site with only a few thousand users when three firms in Boston had already passed on investing.

- The Concept of the Founder As a Hero: The way a network defines a hero or example of iconic success tends to produce more people trying to fulfill that role, and calls out to the people who it speaks to. In Silicon Valley, there’s a cultural perception that Founders are heroes.

This is not a comprehensive list, but it’s a good start. All these network protocols add up to a culture with a distinctive network flavor.

Tangible effects for Founders included better deal terms and more runway to build truly enormous companies.

Why? First, because there is so much competition among so many investors. Second, investors are part of the same network and have thus internalized network protocols like thinking big, getting their status from impact, and drinking the kool-aid.

Thinking big makes investors want to structure deals so the Founders can build something really transformative instead of angling for an obstructively big cut of a modest win. Swinging for the fences align investors and entrepreneurs who are hungry for long-term wins at a transformative scale. People in a strong startup culture understand that the outcome could take 7-10 years or longer, which contrasts with corporate innovators who often shut projects down prematurely because they have different time expectations.

Now that the world is increasingly going remote, we believe that one big opportunity is to find people that share these cultural protocols and this same mindset, independently of location. This is the secret of success for a startup ecosystem and the engine behind Silicon Valley’s network effects.

Today, these like-minded people are still much more likely to be found in the Bay Area than anywhere else, and that’s part of its enduring appeal for startups. Founders realize that the cost of not having people who share these cultural protocols can be detrimental to their company.

Within the SF Bay Area, an entire infrastructure has developed within this cultural paradigm. Everyone understands these unspoken protocols even if they’re not in tech — Bay Area service providers like lawyers, accountants, VC’s and landlords all understand it implicitly.

Since nearly everyone in the network has bought into the same cultural protocols, the chances of serendipitously meeting someone who shares your mindset and can connect you with their friend or roommate for a deal or a new hire goes up exponentially.

Though it’s increasingly possible to recreate this remotely, the value of that serendipity will be hard to replace without a lot of work to create a similarly dense network.

Build a Stronger Startup Network in Your City

If you want to build more of a startup ecosystem in your city, here’s a way to do it. Honor the math of a network. Build a tight core of 5-8 CEOs of your best tech companies. People who like and trust each other. Not institutions. Individuals.

Get them to build empowering network protocols among themselves like those listed above. Let them be a gang: the white-hot center of the community. Then slowly add another node onto the network. Then another. Keep the network integrity. Ensure it’s dense and high utility. In 5 years, you’ll be amazed at what it becomes.

The mental models form the network, and the network forms the mental models. They emerge together and they grow together. The state of mind is inextricably bound up in the network that gave rise to it.

Some have observed how central these cultural network protocols have been to Silicon Valley, but few understand how difficult it is to reverse-engineer these cultural traits and transplant them into another existing geographical network. That new place already has its own cultural network protocols. And those protocols change slowly. Start with a white-hot center and let it grow from there.

Why Remote Work Doesn’t Have to Mean Dispersed Work

The whole point of a city is to bring people together, to facilitate interaction, and thereby to create ideas and wealth, to enhance innovative thinking, and encourage entrepreneurship and cultural activity… This is the magic formula that we discovered ten thousand years ago.

– Geoffrey West, Scale

For most founders and their startups, remote work is unlikely to mean working in isolation from a cabin in the woods or a beach in Bali. Even with remote work, people will continue to cluster in cities because of their network properties.

Cities are some of the most durable networks in human history. Most of the big world cities today have been around for thousands of years.

The bigger and more interconnected the city, the more valuable it becomes to each resident. As Geoffrey West puts it in his book Scale:

The larger the city, the more innovative “social capital” is created. And consequently, the more the average citizen owns, produces, and consumes, whether it’s goods, resources, or ideas.

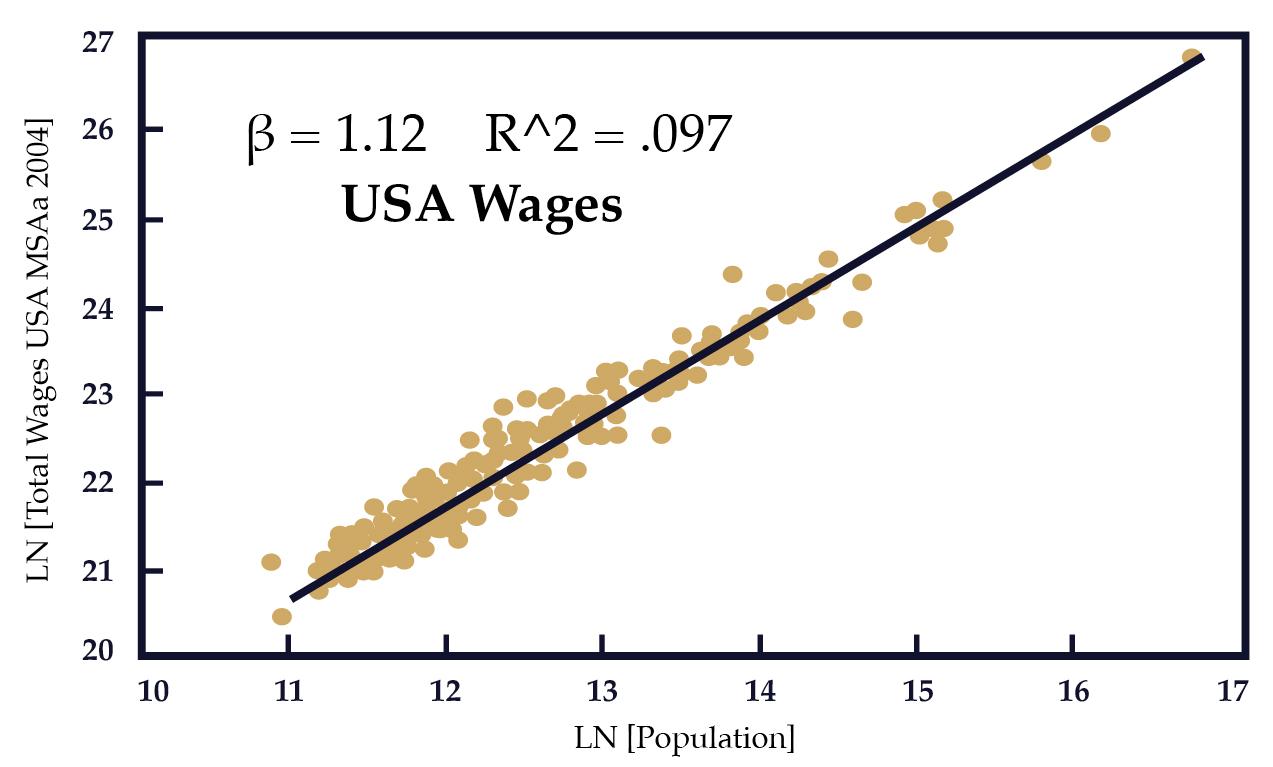

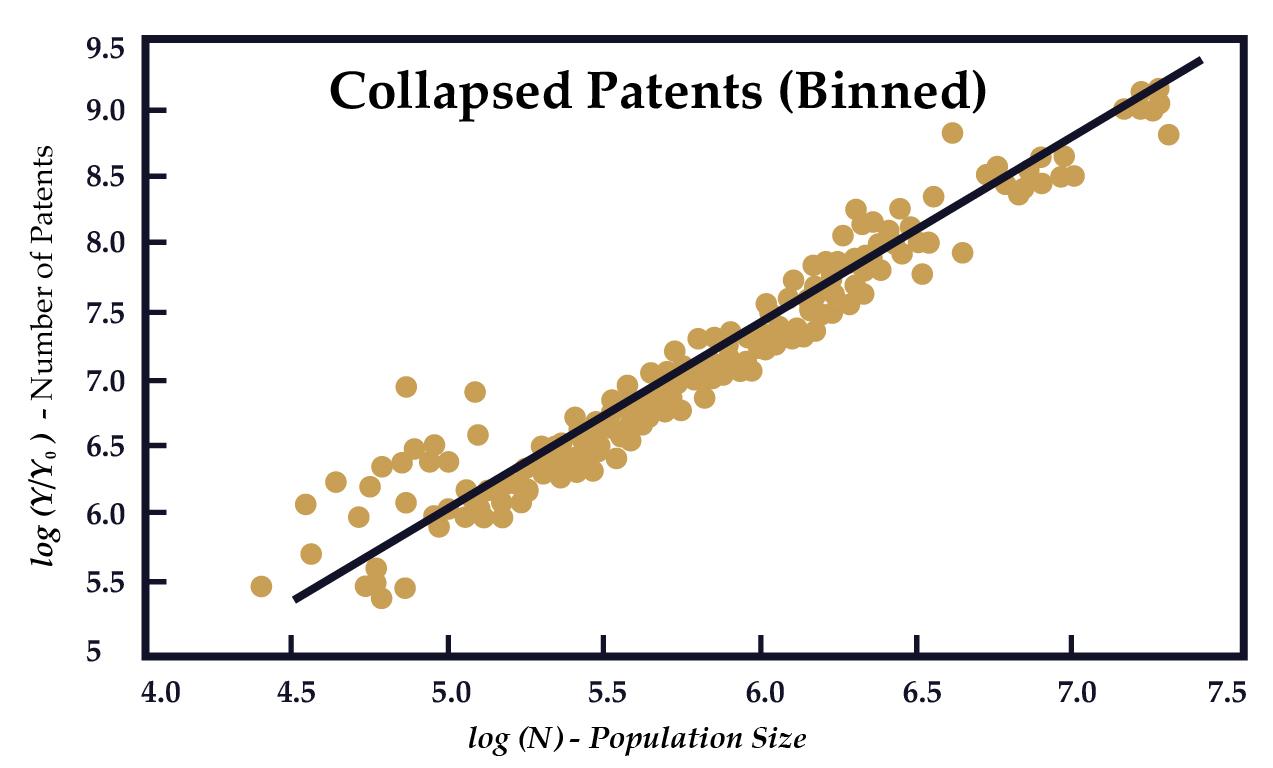

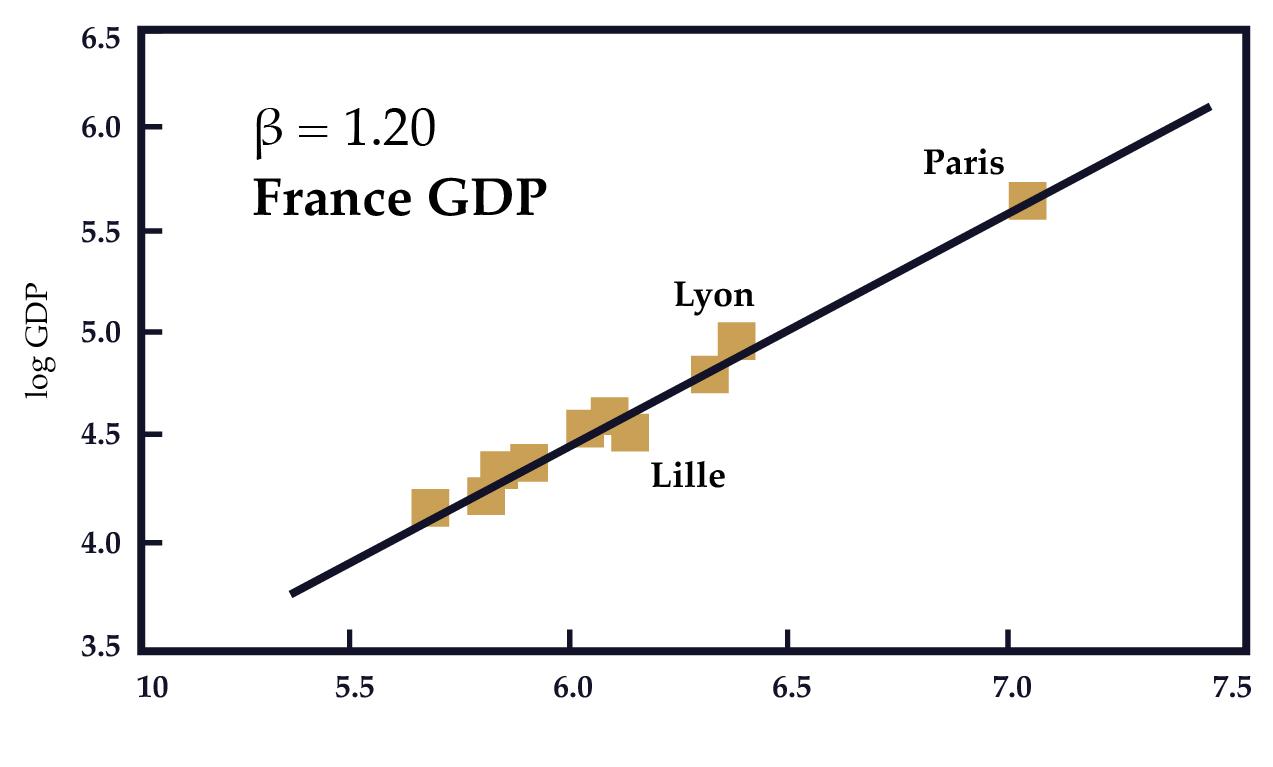

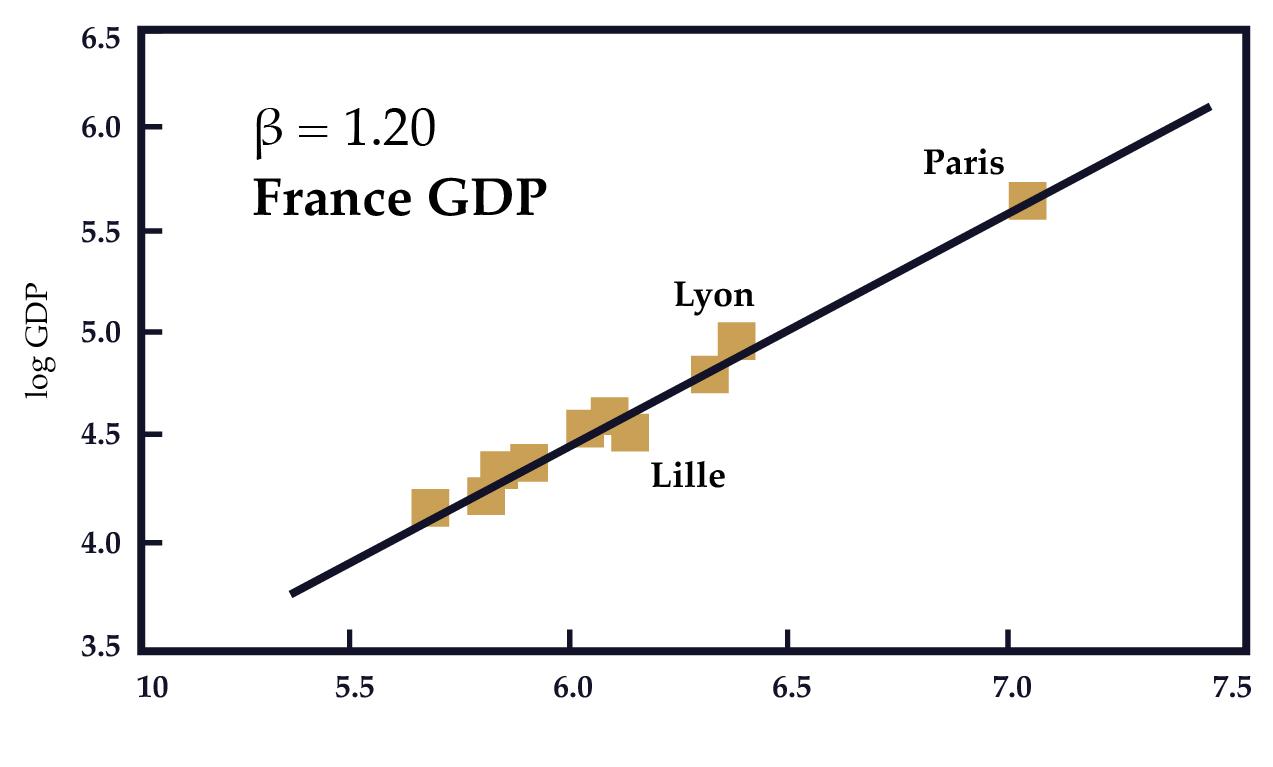

That value can be measured empirically. In fact, West identified a surprising super-linear scaling law of cities that was consistent for cities all over the world. Just by being told the size of a city in the US, you can predict with 80-90% accuracy what the average wage is, the GDP of the city, how many patents are produced there, etc.

These metrics increase by approximately 15% per capita each time the city population doubles.

For example, here’s what it looks like if you plot the average wages of an American city-dweller against the size of their city:

Source: Scale, pg. 276

The same superlinear correlation appears between city network size and innovation as measured by patents.

Source: Scale, pg. 276

Source: Invention in the city: Increasing returns to patenting as a scaling function of metropolitan size

If you plot GDP per capita against the size of a city in ANY given country, you get the same math:

Source: Scale, pg. 276

That’s striking. Think about how remarkable that outcome is. When we go to different cities around the US and the world, they look and feel very different but the network math operating beneath all cities is far more powerful than any other surface-level characteristic.

Cities are defensible and durable for the same reason companies with network effects are: they support value creation at scale through mathematical laws. Note that startup ecosystems aren’t always born in big cities initially. Sleepy academic towns can often serve as the original incubator of an ecosystem, like Palo Alto or Cambridge, MA. However, they do need access to a nearby world-class city in order to scale.

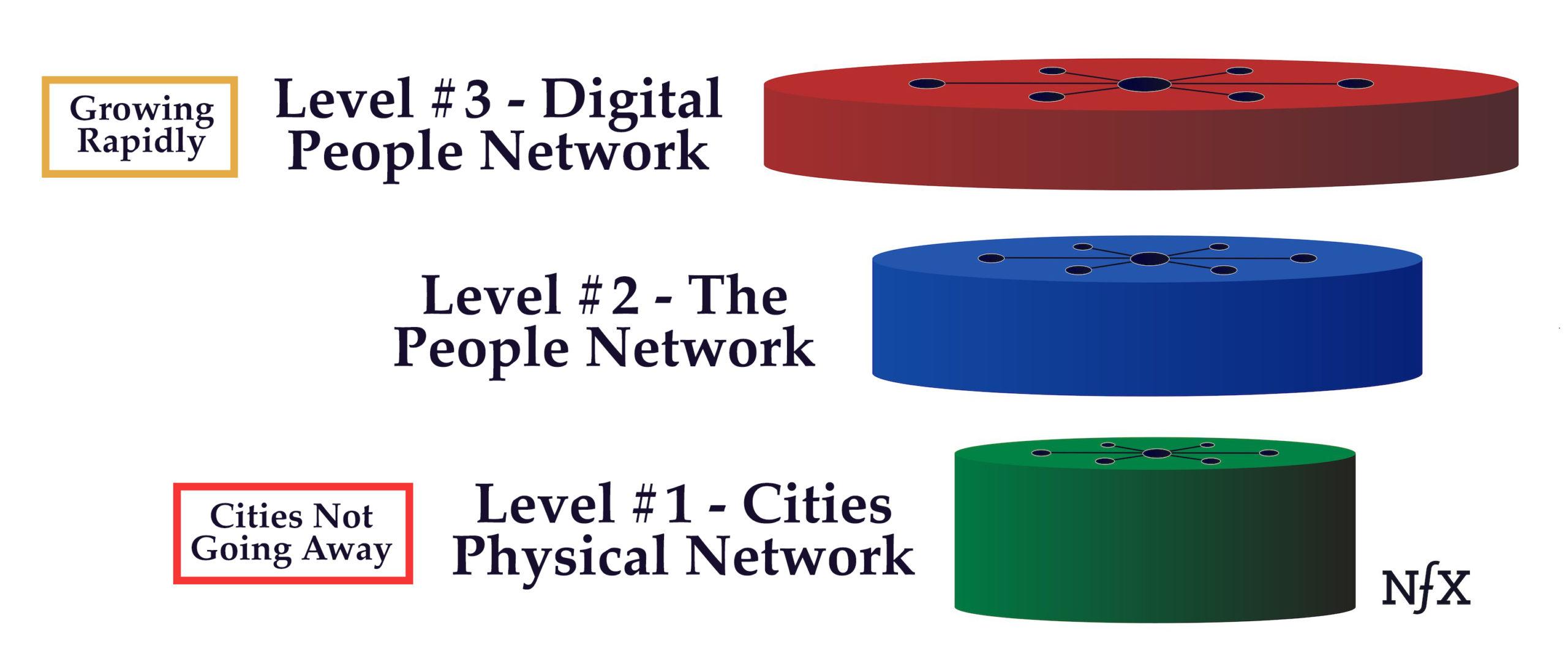

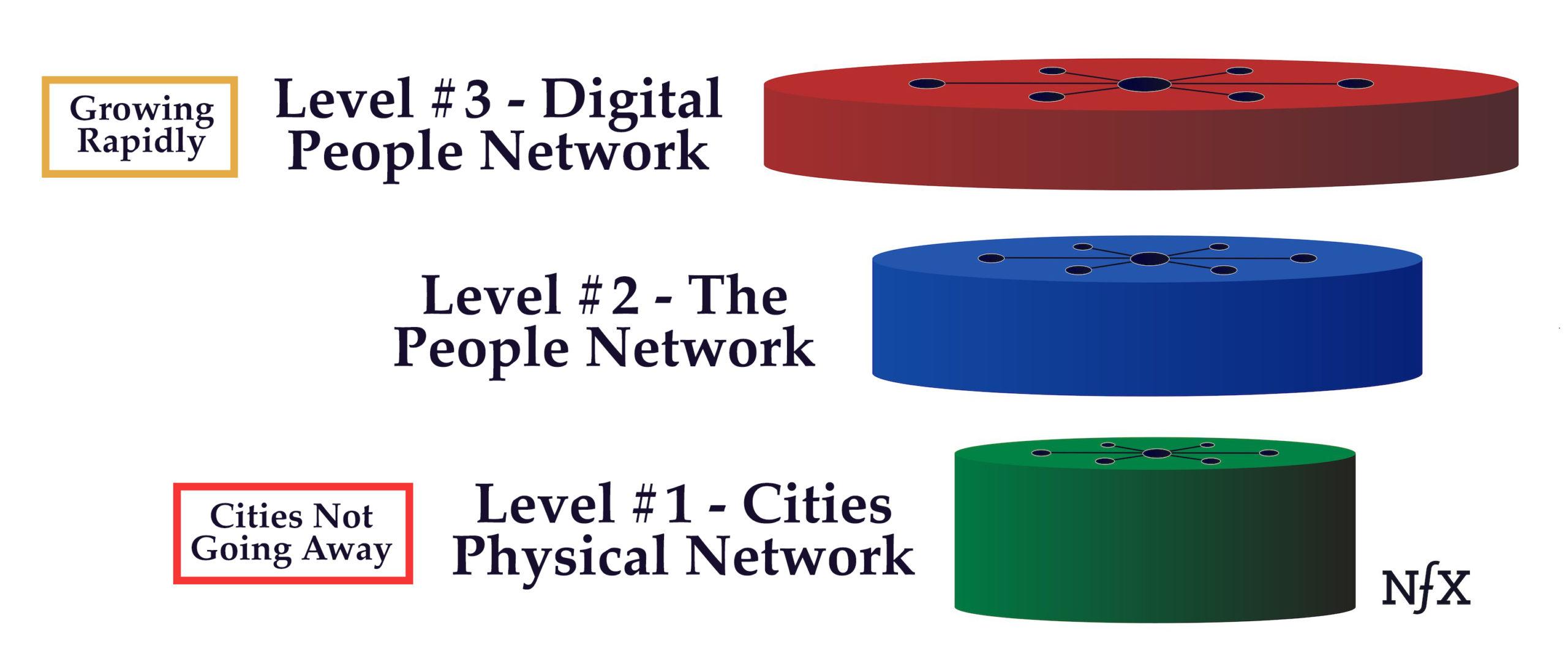

Tech companies connect nodes in a digital space. Cities connect nodes in a physical space. Cities fulfill 3 of the 5 critical factors in network formation that we’ve previously identified:

- A context for frequent, repeated interaction: Serendipitous meetings that happen among people living in the same city accumulate in subtle, unintentional ways to encourage information exchange, leading to network power.

- A high degree of overlap between relationships: This leads to clustering, which Reed’s Law shows produces more powerful nfx.

- A high density of people in geographic proximity: This means a lower friction of interaction. This friction differential compounds across the network, leading to higher values of every network metric.

Will this 10,000+ year trend of cities reverse itself because digital infrastructure like Zoom is becoming more advanced and widespread?

We think it’s unlikely. The bandwidth difference between online and offline interaction is still too great, given the way the human brain is structured and optimized for offline.

All that said, there are always exceptions. The value of access to talent from a distributed workforce could theoretically exceed the value created by network density, although this is rare in practice. This is more likely to be true for companies at large scale working on hard technical problems, who may need to resort to a distributed workforce to amass enough technical talent.

Startups Are Networks Within Networks

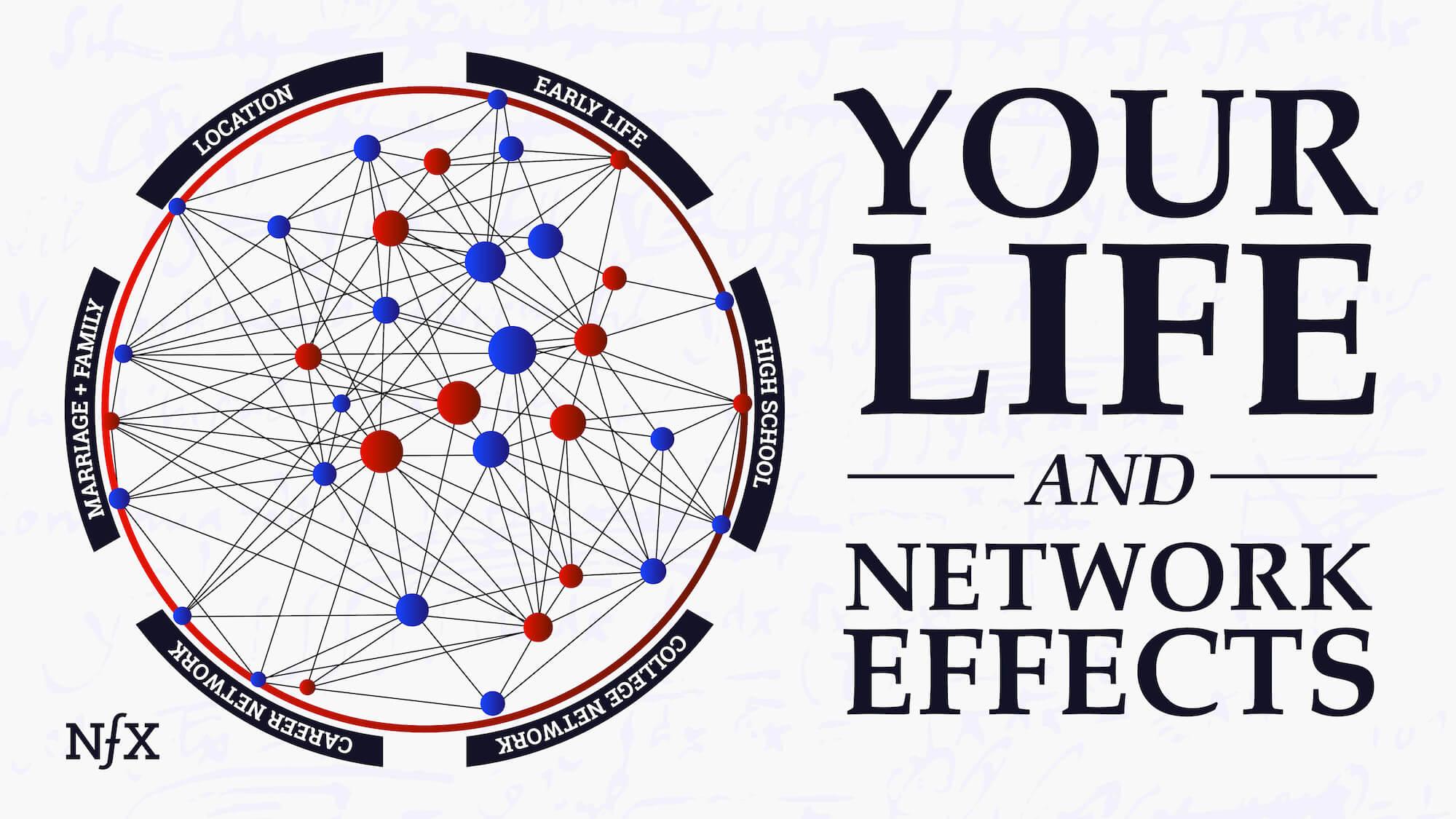

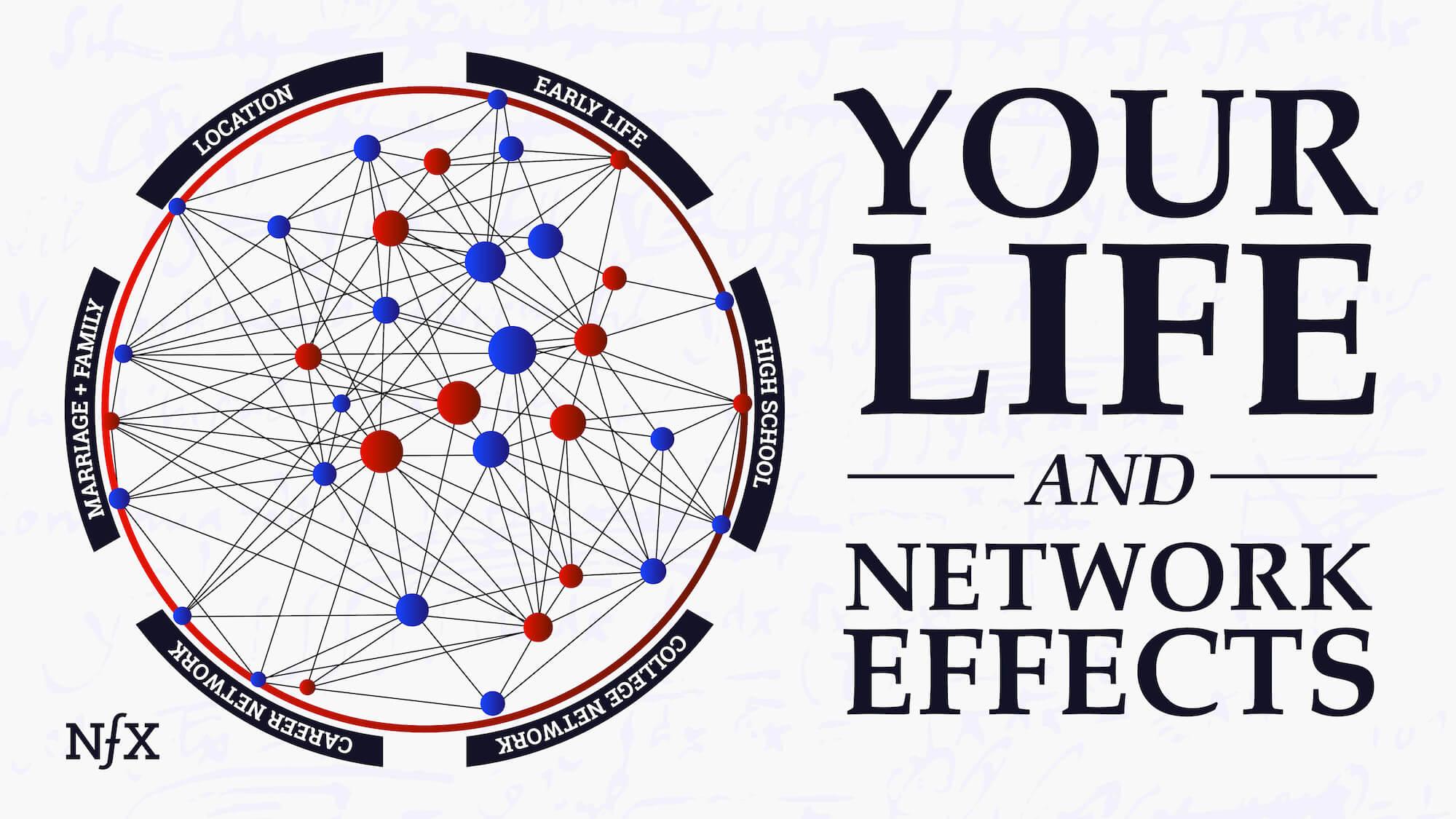

Startups are best seen as “new networks” — of employees, investors, business partners, customers, and other stakeholders. Everything about a startup’s future success is influenced by its ability to position itself in conditions favorable to network formation.

Small differences in how they grow their network have outsized impacts on their outcomes. When you grow your fledgling startup network within a powerful existing network, it flourishes 3X or 7X or more than it would elsewhere.

The same is true of Founders. Entrepreneurs don’t operate in a vacuum. They borrow heavily from the new ideas and discoveries of people in their peer groups and networks. The speed of learning for a Founder in a town with a small tech network is geometrically smaller than how fast that same Founder would learn in a top tech city.

Founders who visit, for instance, the SF Bay Area from out of town report that they’ve learned more through sheer osmosis in a few days of coffee and dinner conversations than they had in the last year at home. What they experience firsthand is the accelerated pace of innovation as a mathematical law of network scale.

Where should Founders locate their companies?

With Zoom and remote work becoming more viable, you could in theory build your next startup anywhere. But you shouldn’t unless you want to fight the network math. You want to give yourself the best chance you can — and that means being immersed in a large, vibrant, urban network with powerful geographical network effects.

Fixating on costs of living, municipal challenges, and the other negative externalities of network size is the wrong way to look at it. Those costs are negligible for a startup. What really matters for building a transformative company is access to the compounding abundance of talent, capital, and innovation that disproportionately accrue in big cities.

One big lesson of the Internet so far has been that online networks tend to transpose and reinforce networks that are originally built in the real world. The big social networks — Facebook, LinkedIn, Snapchat, Instagram — are largely online recreations of relationships that you initially build in real life in one of your major network crossroads (family, school, work, etc). This is one reason why Real Identity Networks became so dominant in the history of online social networks, despite expectations of Internet pioneers to the contrary.

The shift to remote work will mirror the same trend. Most valuable relationships will continue to be built in proximity.

One newer model of success we are starting to see is what has been called “The Mullet:” a small presence upfront (in SF or other hubs), and a large remote workforce elsewhere. This lets the startups access the best ideas and capital of the larger ecosystem while also letting them have armies of engineers to build features for web, iPhone, Android, iPad, etc. Speed of technical iteration as a defensibility strategy. We’ve seen the same trend recently in film and TV, where the screenwriting and financing still takes place in Hollywood, but much of the production takes place in regions like Atlanta, Portland, and Canada.

Startups Will Continue To Cluster In World-Class Cities

If you’re a Founder, what you have to understand is that when you’re building a startup, you’re building a network within a network. The ecosystem and network that you’re a part of is a multiplier of your natural skill and expertise. As we come out of the Covid-19 pandemic, network math will reassert itself.

So while you could build your next startup anywhere, you shouldn’t. You want to give yourself the best chance of success you can, and if you’re in a world-class tech ecosystem, the network math is on your side. A lot has been made of cost of living and other concerns that will supposedly reverse this math for Founders in Silicon Valley. But we think this is the wrong way to look at it.

The startup game is not about saving $20K per year on your office, or saving $50K per year per engineer. Worrying about costs is “playing not to lose.” Building a startup should be about “playing to win.” Winning a ruthlessly competitive game that will define your life if you succeed.

So even as the digital network layer becomes a bigger part of people’s networks, the physical layer still matters. And Silicon Valley, Beijing, and Israel will continue to be the best overlay between both for Founders looking to build world-changing, iconic companies.

Because of network effects, our guess is that you could be reading this in 2040 and it’ll be just as applicable.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.