You’re a young techbio platform. You know what problem you’re going to solve and you’ve raised early capital. Now comes the hard part: picking your first indication.

We’re bullish on techbio platforms because they allow you to take multiple shots on goal. But you still have to be strategic about what your first shot should be. This decision is unique for platform companies, because you could go in any direction.

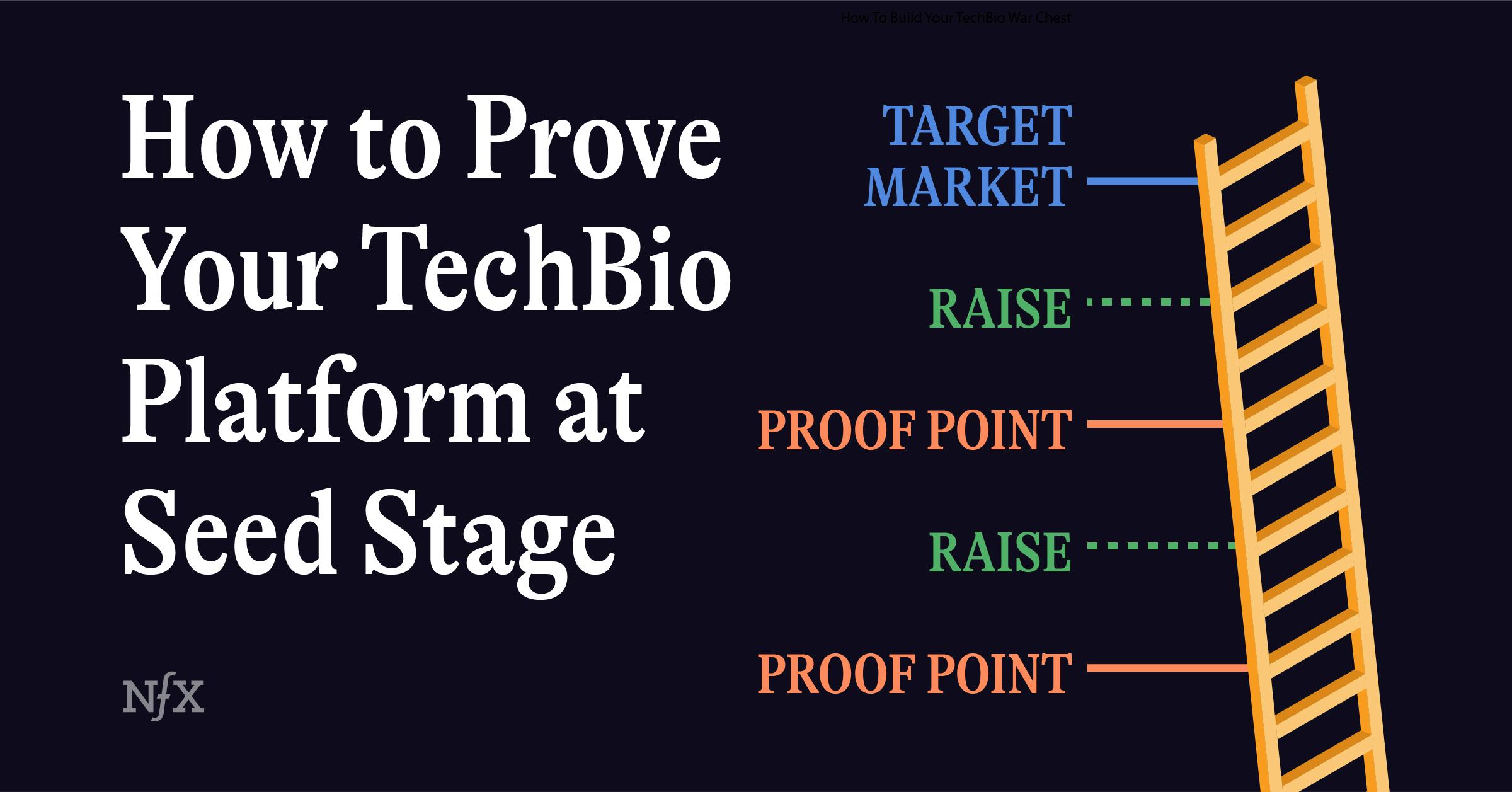

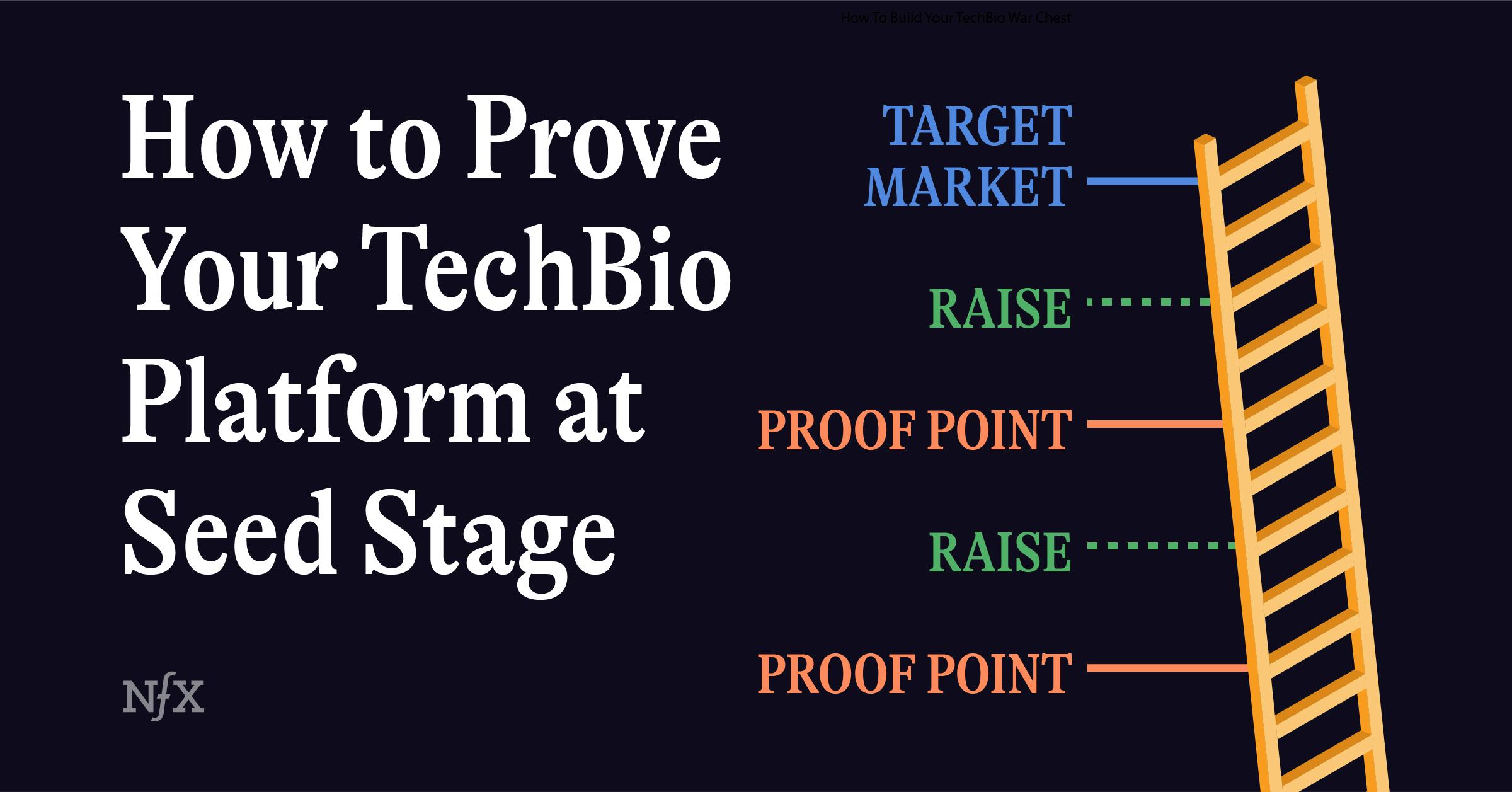

At this stage, you’re facing a classic chicken-and-egg problem: You’re trying to tackle a big problem without the resources of a big company. How do you prove that you can compete in big markets if you don’t have the funding to run (often costly) trials? And how do you get more funding without that data?

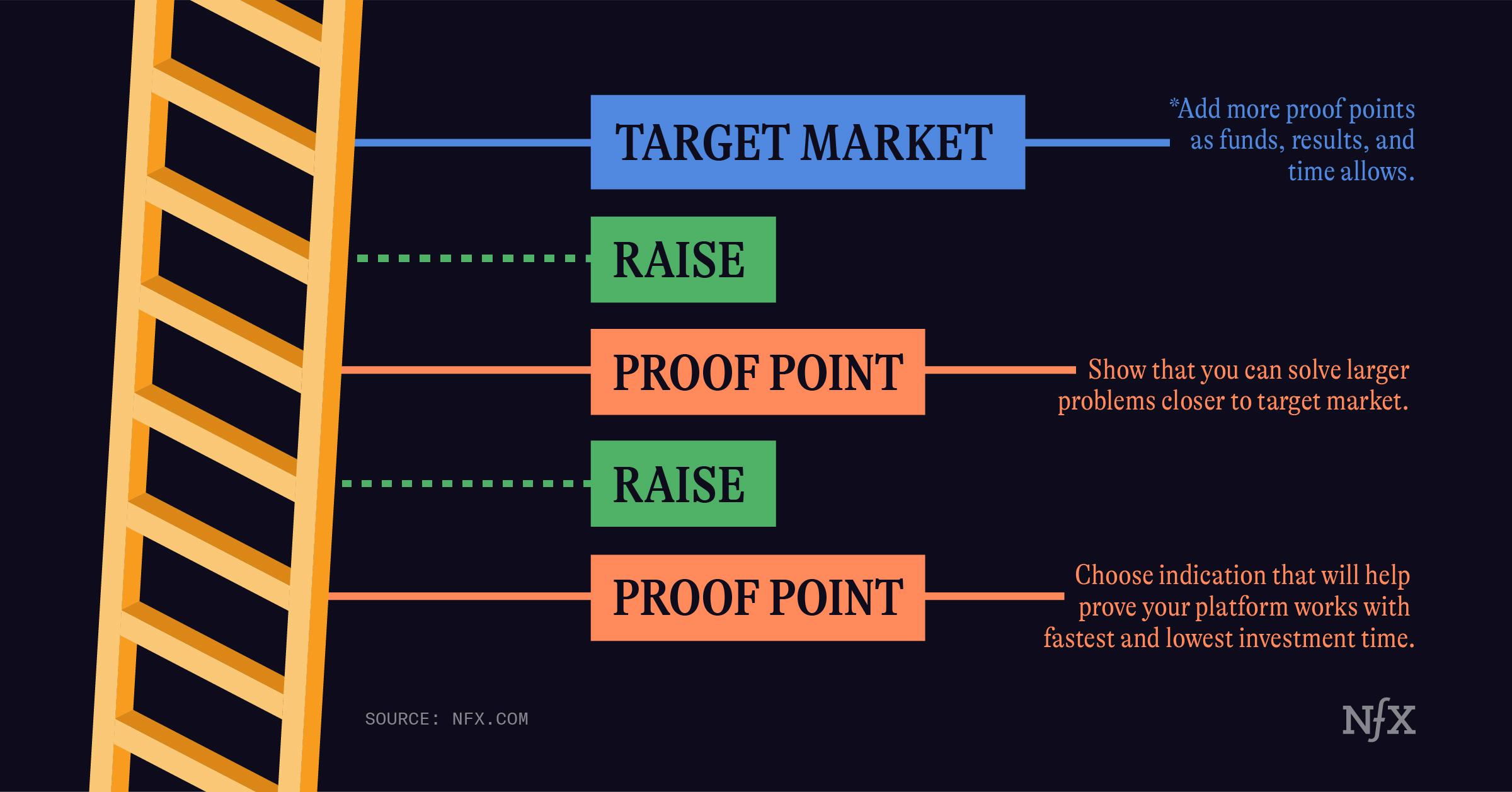

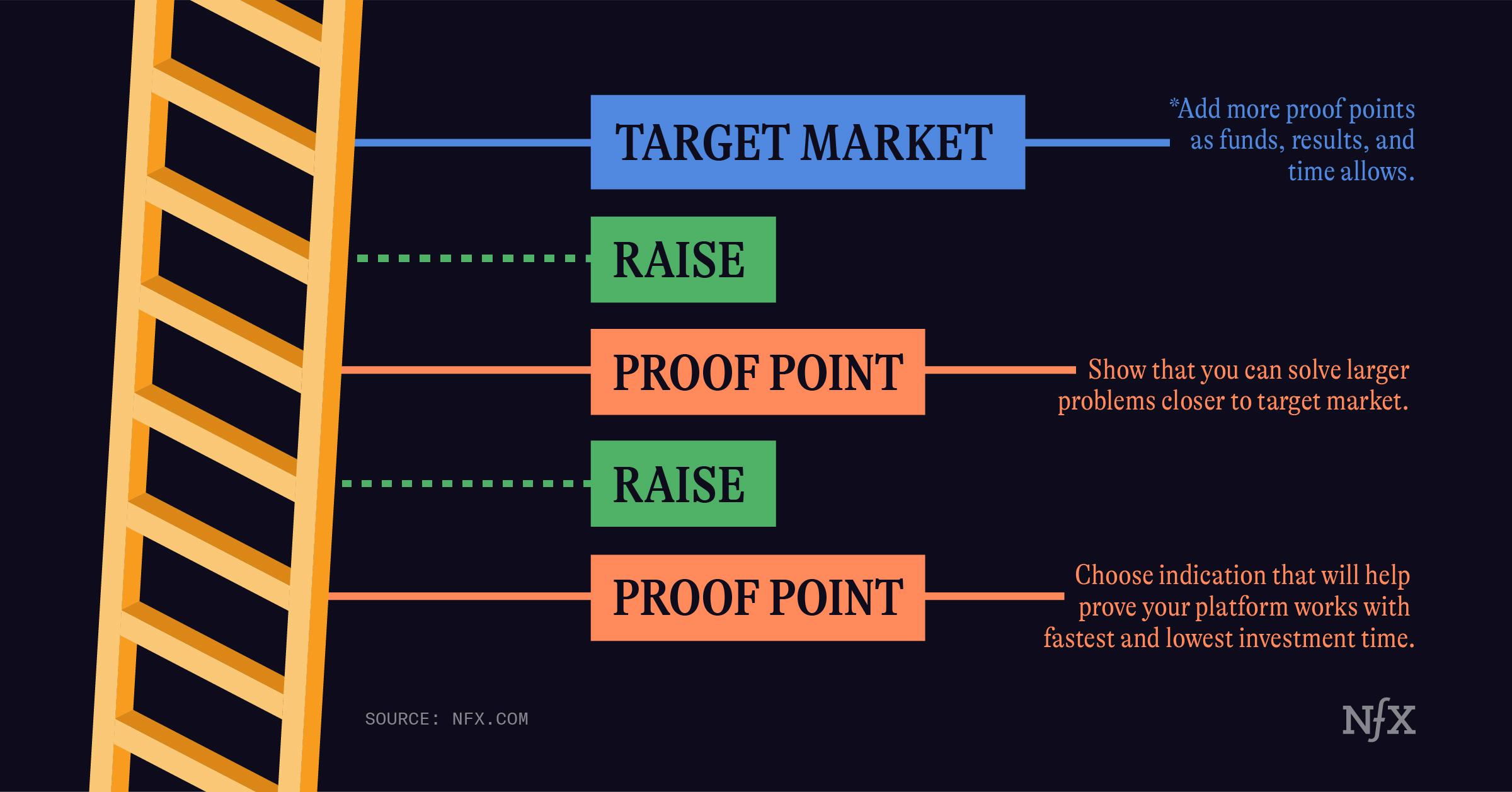

Here’s the secret: Break through by going smaller than you think. De-risk your tech before focusing on capturing the largest possible market. Do this by finding your Minimum Platform Proof Point.

Many founders think about building a war chest strictly in terms of funding. We want you to think of it in terms of collecting proof points. As many as you can get. Be greedy and build up your war chest of clinical results that indicate that your platform is working in the real world.

This is mission critical in the first 12-18 months of your company. It will be the strongest signal of traction when you go to raise your next round.

What’s Your Minimum Platform Proof Point?

If you’re a major pharma company, you can afford to go after your biggest markets right away, and run large, lengthy, and expensive clinical trials. If you’re a small techbio company you can’t always take that big of a swing right away. In fact, it can be harmful to try.

If you choose an indication that has a larger market, say Alzheimer’s, but much higher risk, and your initial pre-clinical trials don’t work, you will struggle to raise the next round. If that happens, you’ll end up selling your platform short: perhaps you could tackle that big market years from now, but if you lose momentum early on, you may never get the chance.

That’s why finding the right minimum platform proof points are so important. It’s about de-risking your platform early.

Minimum platform proof point (MPPP) is a “sliver of a sliver” of a larger market – a segment where your technology is needed right away, or can solve a very clearly defined problem. This is about finding a problem where your technological risk is low, even if the market isn’t as big as the one in your pitch deck.

When we’re working with tech startups, we call this finding the “white hot center.” The concept begins by finding irregularities’ in every network. For example, there are people who want to travel, but don’t want to stay in hotels. There are people who love movies, but hate going to the theater. Irregularities are unexpected twists and turns within the larger network (or market).

Once you find that irregularity, you’re likely to find a small but motivated group of people who are eager for your solution. Often, they’re not people who you considered your target customer. Butthese market subsets can be the white hot center you need.

In Biology, There Are Irregularities Everywhere

There are ultra rare diseases with an n of 1. There are sub-conditions where there are approved drugs available, but don’t reach the right areas of the body. There are researchers using software or hardware tools that work great on their own, but don’t integrate well together.

Finding irregularities is a matter of doing deep research. Cast a wide net across fields to find gaps. See where your platform fits.. Talk to people from diverse fields at conferences. Read literature from patient advocacy groups and see what solutions are needed.

Your technology should be able to tackle a huge market in the future (otherwise don’t work on it), but it can also solve a problem in a microcosm no one has thought about yet.

Those segments are where you’ll find your minimum platform proof point.

How TechBio Companies Found Their Minimum Platform Proof Point

How do you spot irregularities and find your MPPP? Stick to 4 general rules:

- Don’t worry about market size at first

- Cast a wide research net to find your platform-indication fit

- Find key opinion leaders likely to become advocates for your technology

- Give higher preference to markets where you can make a difference right away

La Jolla Labs has done this well. La Jolla Labs (NFX-backed) can discover and develop potent antisense oligonucleotides (pieces of DNA or RNA capable of altering the function of a protein). The potential for a technology like this is vast, and ASOs are being investigated for numerous high-impact indications.

Instead of diving directly into a big market, La Jolla recently announced a partnership with the n-Lorem foundation – a nonprofit dedicated to treating patients with ultra rare diseases. In some cases, these diseases are totally unique and only affect one person in the world. La Jolla has committed to providing personalized experimental ASO medicines to between 1 and 30 patients for free, for life.

Here, La Jolla has found a market to put their discovery and customization process to the test. If you can treat a unique disease, it’s a good sign that you have the right processes in place to tackle a well-funded and well-studied one. And, importantly, the process is quick. After running toxicity and safety studies, we can start testing for efficacy right away. La Jolla can start helping people immediately, and validate its platform in the process.

Repeating this process again and again is a great indicator that a platform works. It’s an attractor for investors, who will look for evidence that a platform is more than a collection of smart people, peer reviewed papers, and IP. And, it’s a good signal for top talent who wants to see momentum in a company before they join.

Nonprofits or foundations are a good place to start looking for MPPPs because they advocate for people who are actively seeking new solutions. But there are other approaches that work well too.

Nanocarry, another NFX-backed company, developed a platform designed to carry biologics across the blood brain barrier. This technology has big implications for CNS diseases like Alzheimer’s. But in the short-term, Nanocarry has developed a pilot program targeting breast cancer brain metastases.

Brain metastases occur in 10-16 percent of breast cancer patients (likely there are more undiagnosed cases), and are linked with increased morbidity and shorter overall survival time. Many breast cancer treatments have improved enough to prolong patient survival, but there has also been an increase in the rate of brain metastases in the past two decades. One theory is that because available therapies can’t pass through the blood brain barrier, the brain has become a preferential site for metastases.

That’s where Nanocarry, a company with aspirations to potentially cure CNS diseases and address much larger markets, can play a pivotal role in helping cancer patients who need to shuttle medications into the brain. It’s a microcosmic version of the problem Nanocarry wants to solve, and they can get to work right away.

Fast Results from a Small Market Will Build Up Your War Chest of Results.

You’ll find that you attract more investors, more press attention, more employees, and hit more milestones when you de-risk your tech before focusing on capturing the largest possible market.

And as you accumulate small wins, you’ll build momentum for the bigger ones.

This is how a new generation of Davids can tackle markets that have long been Goliath’s purview.

If that’s you, then reach out to us at NFX Bio.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.