Today, we’re sharing our perspective on the real meaning of Bitcoin, and then unpacking from first principles the various network effects and influences on Bitcoin that will help you predict its future.

Bitcoin’s Place in History

When we had metal technology, we made money out of metal. After metal, we had paper technology, and we made money out of paper. Humans do this. We create a store and exchange of value with whatever technology is available to us.

Now, we have software. We’re not just keeping track of money with software, we’re making money out of software. Bitcoin was the first to do it in a decentralized way. This is the reinvention of money yet again, but the fundamental truth about money remains, regardless of what it’s made with:

Money is simply a belief held by a lot of people. A collective trance. Money is simply the distillation of a shared confidence in the future.

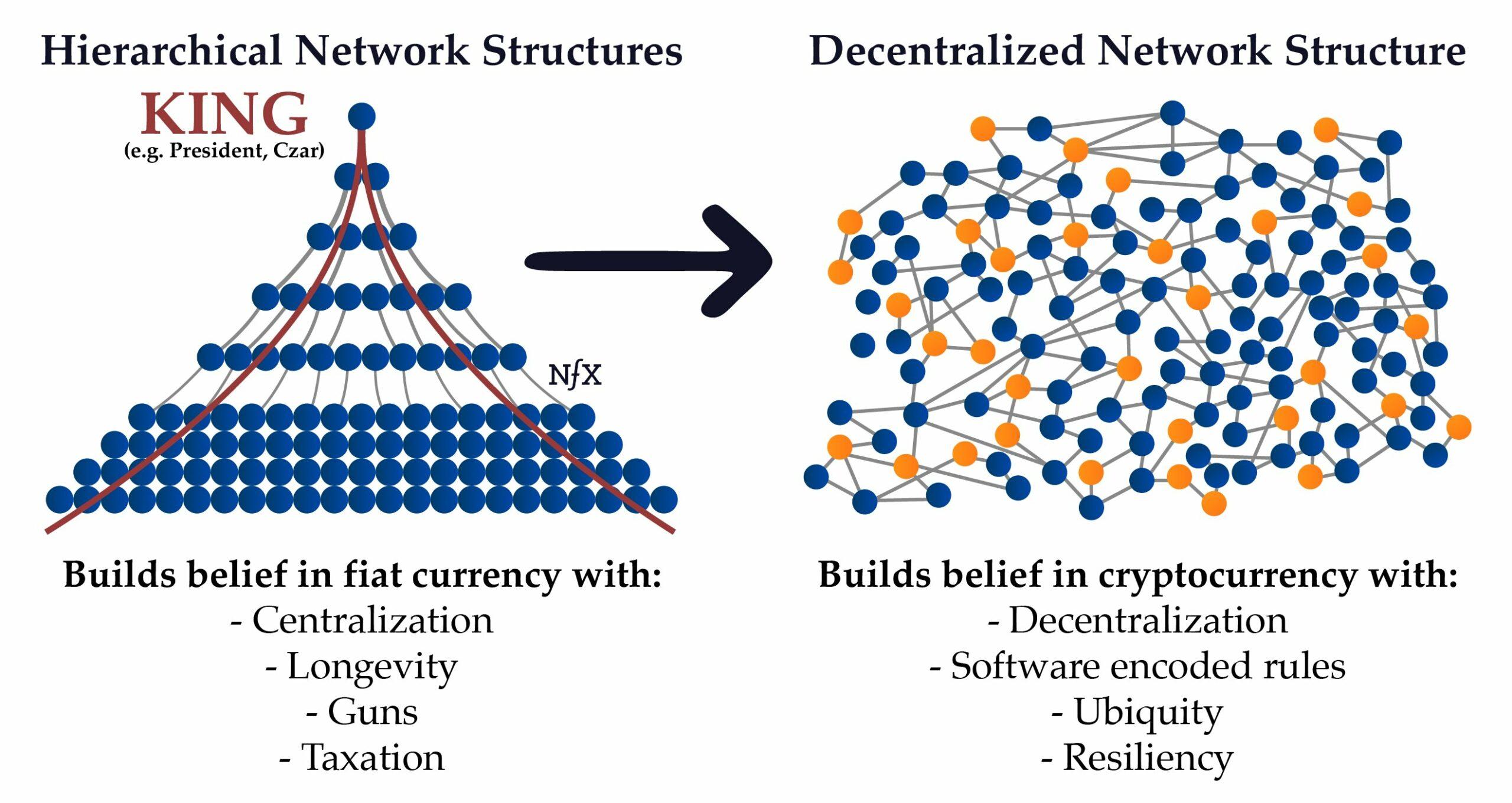

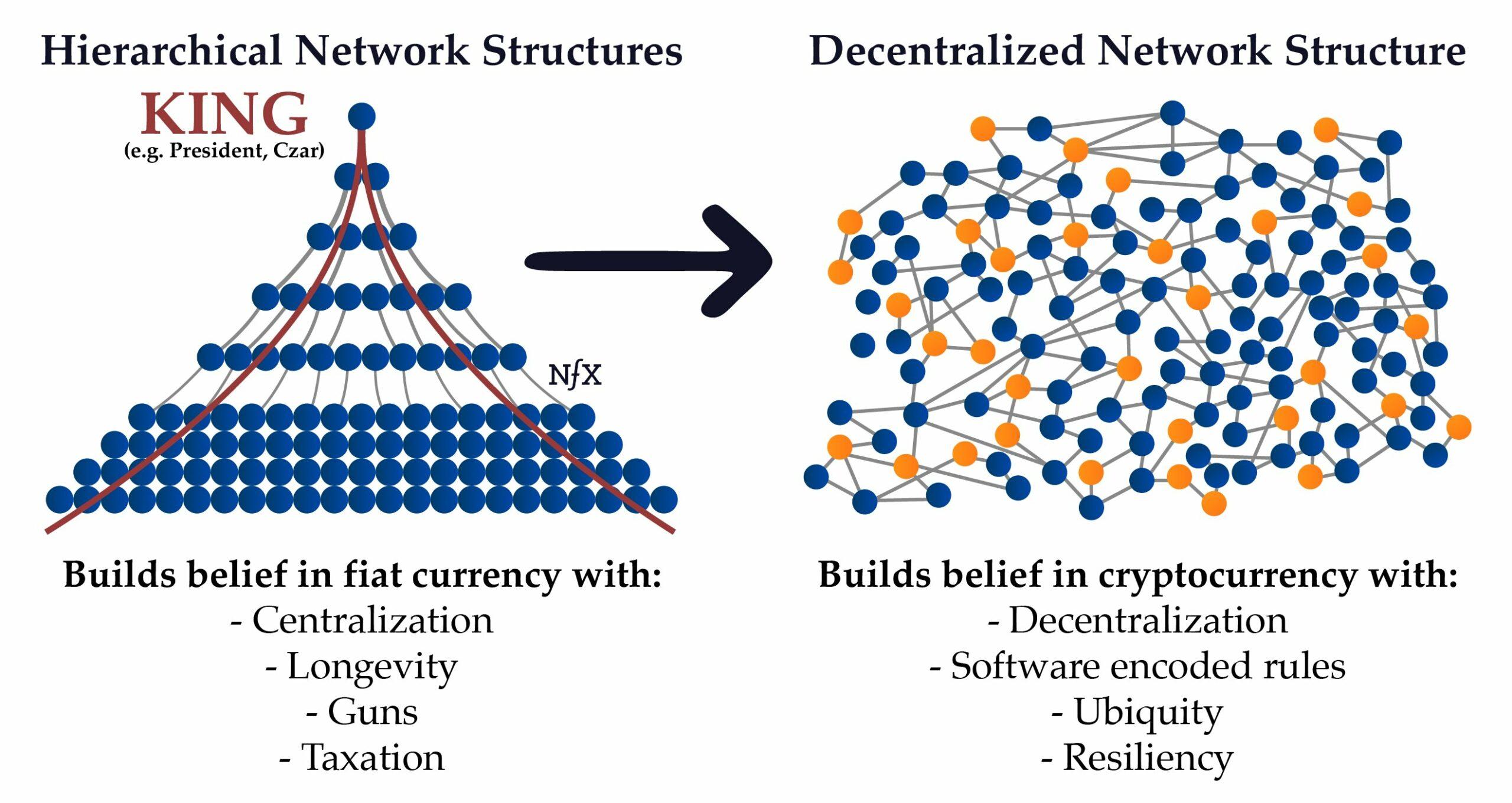

Always in the past, belief in a currency formed around a hierarchical network topped by a king/queen and his/her armies, a pharaoh, an emperor, a czar, a president. Prior to the US Civil war there were hundreds of regional currencies operating in the US, each centered around one strong man/woman or another with his/her hierarchy under them. Same hierarchical structure, but at a smaller scale.

For the hierarchical pack animal we are, hierarchy with an alpha King on top is a stable and understandable structure. That’s why when the King issues a currency and tells people to use it, people believe in it. And the currency works as long as there is that belief. The belief stems from: a) centralization of decision making and authority, 2) the longevity and predictability of the hierarchy, 3) guns and the ability to enforce behavior through violence which these hierarchies typically have, and 4) the tax base of the people within the hierarchy.

This strong-man-backed fiat currency approach has worked for ~6,000 years.

But this time is different. Instead of a king or central authority creating the belief and then controlling the currency, Bitcoin doesn’t have a hierarchical network structure with a “strong man” at the top. It’s a decentralized network structure.

This is the fundamental emotional barrier to most people understanding Bitcoin and crypto in general. They aren’t used to having currencies backed by a network. There isn’t a hierarchy with a believable person on top to define why they should believe in it.

Bitcoin killed the king, and is replacing it with a network.

The reasons to believe in Bitcoin are different than the reasons to believe in fiat currencies, but no less powerful. We believe in decentralized cryptocurrencies because of 1) Decentralization, there is not one person or council who can ruin the currency, 2) Software-encoded rules that are hard to change, increasing predictability, 3) Ubiquity means it will be accepted in many places, and 4) resiliency because it’s self-healing and can avoid efforts to damage it.

In short, to create belief network effects, hierarchical networks use power, while decentralized networks use ubiquity.

Both of these are network structures, and let’s take note: decentralized networks and hierarchical networks don’t like each other. They have always fought. Read Niall Ferguson’s “The Square and the Tower” to get a broad history. They don’t like each other because they are fundamentally different to live and work in. The mental models required to succeed in the different networks are different, so winners in one don’t like the winners in the other. Hierarchies fight with power and rigidity. They bring guns at the end of the day. Decentralized networks fight with flexibility and ubiquity. They sneak around.

So apply this to currencies. Moving to software-based, distributed network currencies is the core to the reinvention of money, and it’s inevitable. That process has been underway with the computerization of banking and trading over the last 50 years. Crypto/DeFi is likely a 10X accelerant of that change.

We’ve already seen with software giants like Facebook, Google, and Amazon that network effects win out, eclipsing old-world hierarchies. They just have to survive the inevitable resistance of the hierarchies. For example, China is now reigning in all the network effect threats to their power, both companies and cryptocurrencies. They are taking action while they still can. The timeless fight between hierarchies and networks continues, but this time, it’s unfair for the decentralized networks because of the Internet and blockchain technologies.

Crypto changes the nature of money in a historical way, because unlike gold or paper money, crypto is a native creature of the new global network. That gives it unfair powers from the future. Unlike fiat currencies, it isn’t constrained by geography or time. Unlike fiat currencies, it’s programmable and can be improved quickly in response to market needs. Most importantly, software-money more easily amplifies the “belief” network effect that gave older forms of currency power, since today the world is more connected and shared, beliefs spread faster in higher densities.

The fact is, the majority of the world is still skeptical of Bitcoin. For those of us who live crypto and know Bitcoin is here to stay, we have wholly different debates. We debate about Bitcoin’s relative place in the emerging pantheon of distributed currencies. Not whether it lives or not.

But to understand Bitcoin’s current and potential value, we need to think from first principles. We need to look at the network math.

Bitcoin’s future will be based on the future of its network effects. Understanding and then monitoring the health of each of those network effects will give you the first principles ability to predict the future of Bitcoin in the coming years.

Let’s dig in.

Consider Bitcoin as a Company

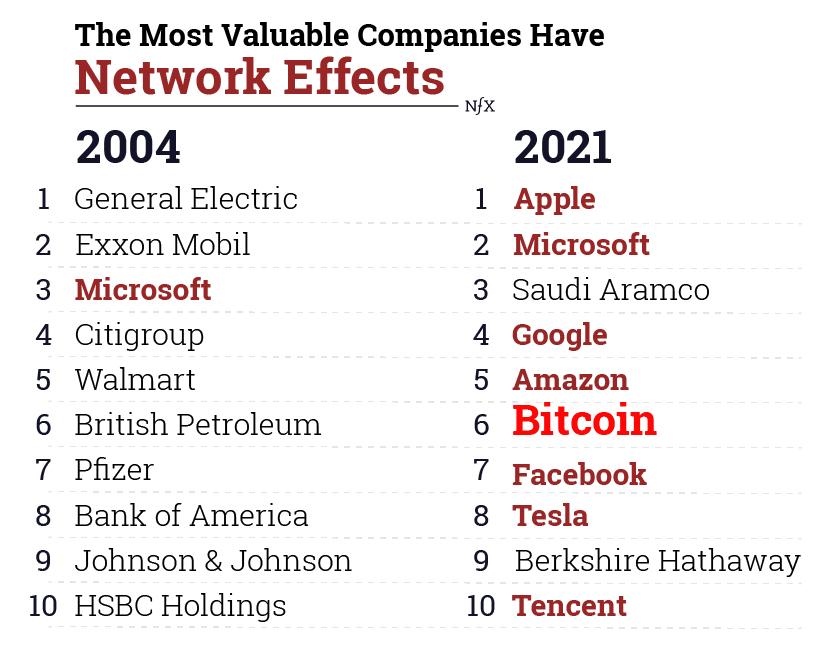

The Bitcoin protocol and distributed software runs without employees, but like traditional companies it has customers for its product, an ecosystem of companies that build products to work on its platform, a board that votes, and a market capitalization. Its product is a currency, and more specifically a store of value. Its currency doubles as shares, as we can all buy and sell the coins as we would traditional stock. Its market cap would put it in the top few most valuable companies in the world, like other network effects businesses.

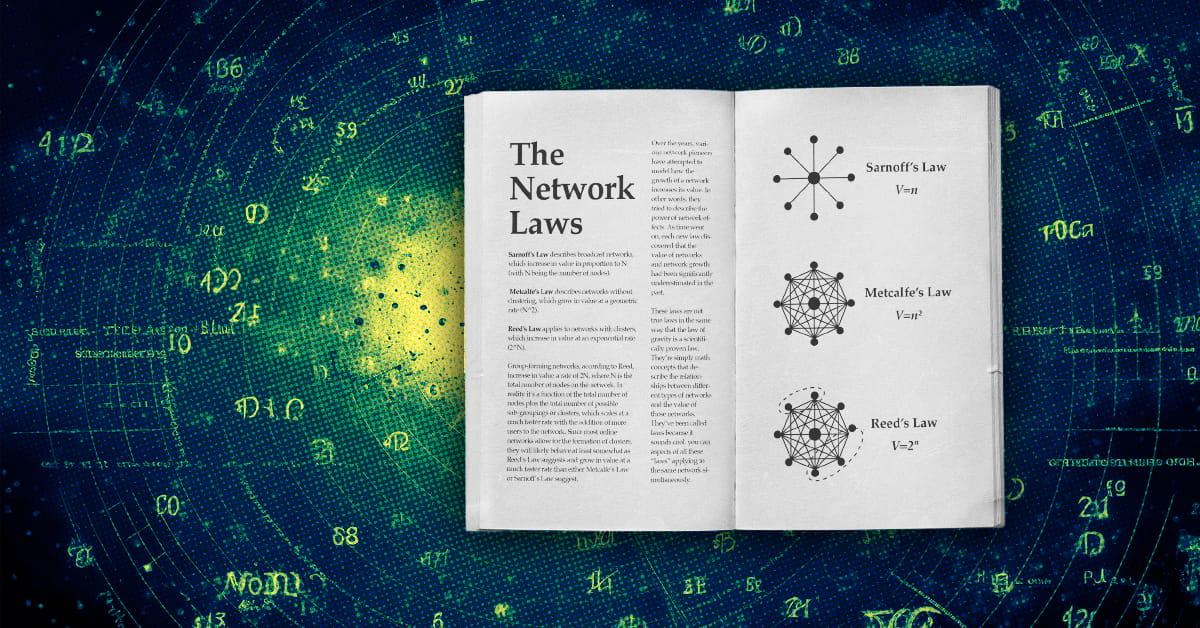

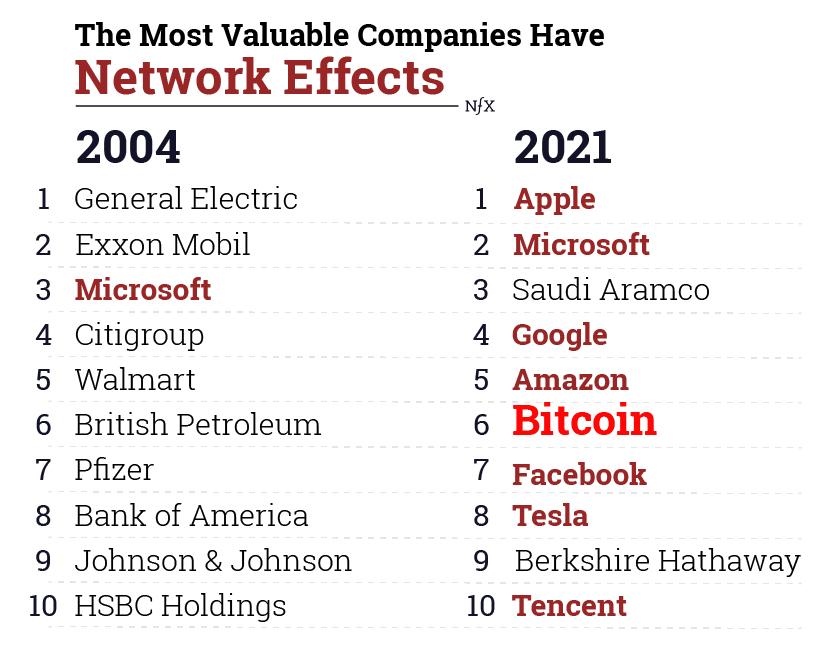

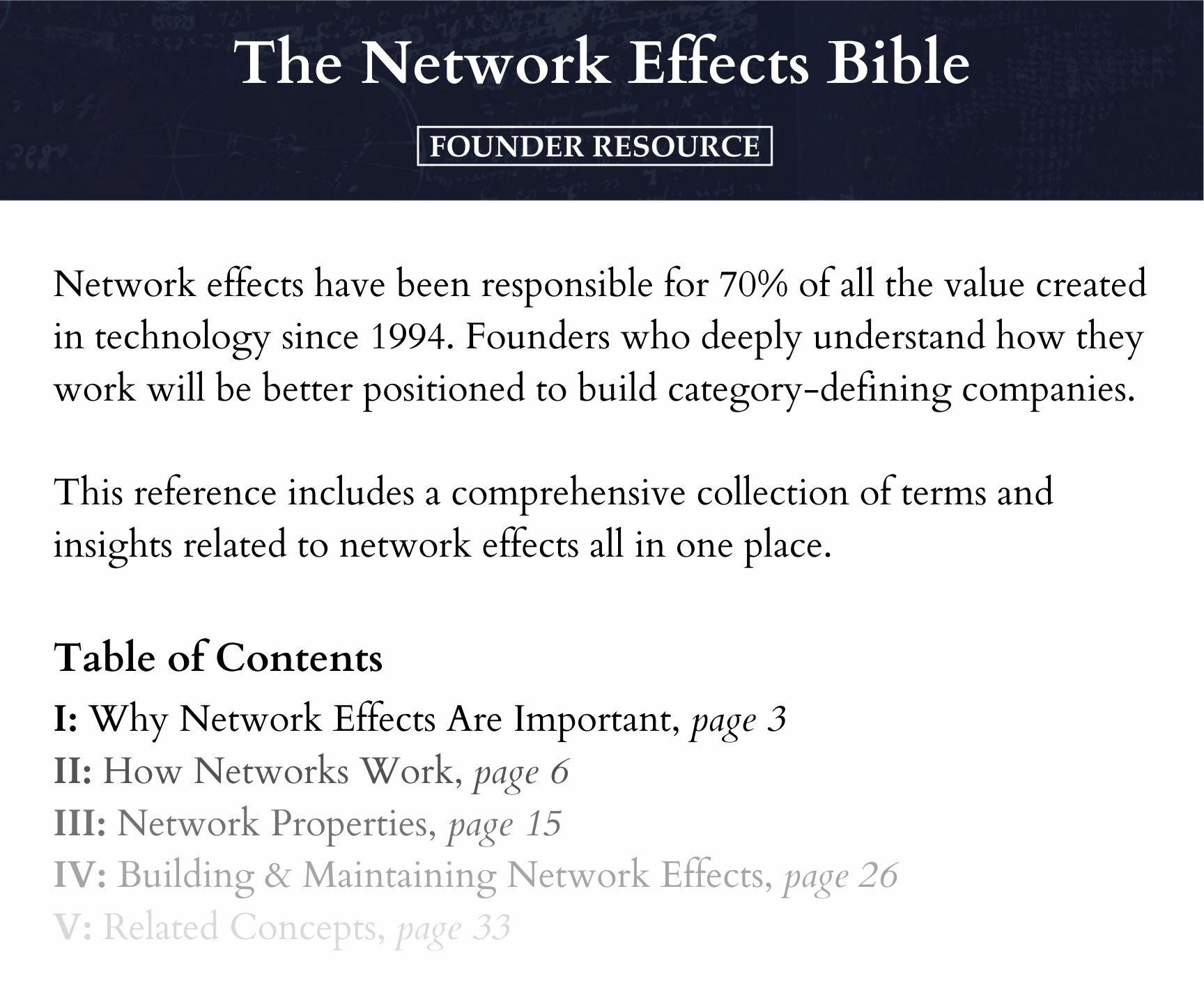

Network effects have accounted for over 70% of the market cap creation in the technology industries between 1994 and today.

Bitcoin’s Core Defensibilities

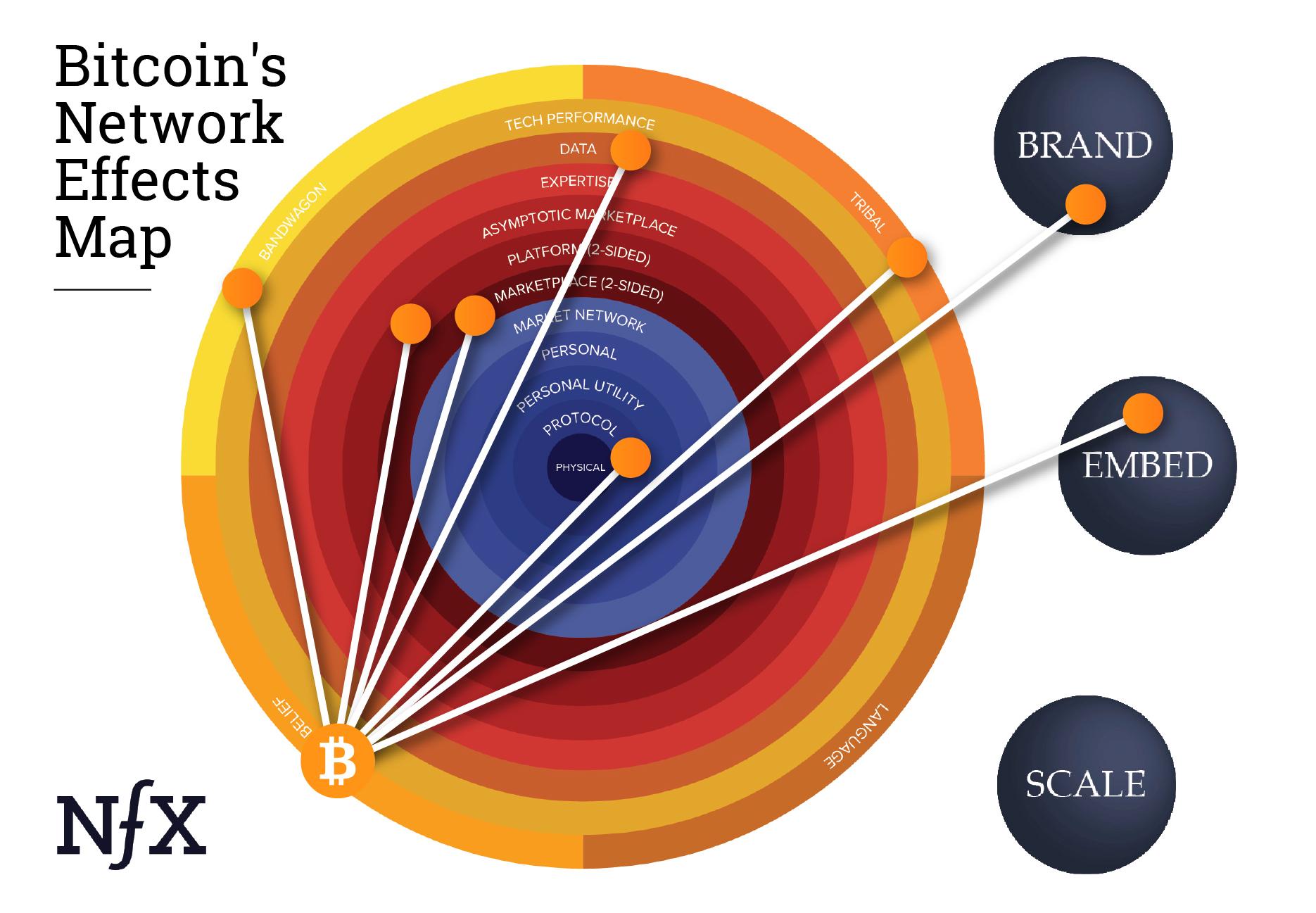

What will make Bitcoin persist and drive up the value of its coins? There are only four defensibilities native to the digital age that Bitcoin might use: network effects, brand, scale, and embedding. Network effects are, of course, the greatest of these.

Bitcoin will need to use some combination of these defensibilities to carve out its place in the global ecosystem of value storing and exchange, and defend its position over time. It has competitors in all directions:

- Fiat currencies issued by nations, such as the US dollar and Chinese Yuan

- Other digital currencies like Ethereum, Solano, and Cardano.

- Gold

Here is the map of the defensibilities Bitcoin has built, after starting with the Belief Network Effect. You can see the various nfx types and categories (organized by color), with the strongest network effects at the center of the map. The other three defensibilities are shown on the right. For other examples of network effects map, here’s the Network Effects Manual which lays it out for the first time, and then the Facebook case study and the Uber case study.

Not all network effects are the same, however, understanding the nuances is essential for building network effects into your own products. Different types of nfx are stronger or weaker than others, and they each work differently.

Where Competitors are Attacking Bitcoin

Now that we have the map of the various mechanisms for Bitcoin’s defensibility and thus value, to think from first principles, we can consider the relative strengths of Bitcoin’s network effects, and where Bitcoin is being attacked.

We only cite a few examples per network effect, other projects may apply too.

Feature Benefits of Bitcoin vs The Competition

Again from first principles, it makes sense to lay out the benefits of the competing network protocols to see how they might play out in the market. Relative strengths can help us see the future.

Will Bitcoin and Ethereum end up like Facebook and LinkedIn, two competing network effect businesses that had value propositions that were similar but different enough that they both survived? Or will Bitcoin end up like Craigslist, with a network effect, but no progress in the product, so 100’s other companies will be built around it as it languishes but persists? Or will Bitcoin be like MySpace and Friendster, early to a network effect, but challenged by a subsequent competitor — Facebook — that was better in so many ways that the new competitor eventually destroyed the originals?

When you lay out the benefits this way, it becomes clear why we assume Bitcoin will function primarily as a store of value, and less as a means of exchange. But check periodically to see how things are evolving to adjust your predictions.

External Shocks to Bitcoin’s Network Effects

There are three forces external to Bitcoin’s network effects and inherent product benefits that could impact its success or failure in competition with alternatives.

- Faked transactions. We don’t really know how many of the transactions on the Bitcoin blockchain are “authentic” and actually creating a market for the coins and how much is “faked” or manipulated to give the appearance of real activity. As we found in 2017, a significant portion of activity on the Bitcoin blockchain may have been manipulation. The market may be efficient, but at least in 2017, it was generally agreed that approximately 95% of trading volume was faked by exchanges. If this continues and is revealed to be negative to the integrity of the currency, it could have a substantial impact on the price and belief network effects in Bitcoin.

- Responsiveness of the Bitcoin DAO. A key element to track about Bitcoin — or any distributed system governed by a DAO (Decentralized Autonomous Organization) — is how well and quickly it adjusts to needed changes. It remains to be seen how quickly Bitcoin’s governing community will respond to these competing networks, or if they will at all. Like with MySpace and Friendster, even a network effect business like Bitcoin can be supplanted given enough self-inflicted wounds combined with strong enough competitors.

- Government intervention. The leading fiat currencies, namely the US dollar and the Chinese Yuan, have the most to lose from the rise of cryptocurrencies. They are the incumbents. The winners of the old regime. Those two governments may decide that it’s in their best interest to prevent Bitcoin from operating in their countries.

Let’s say more about how government intervention might likely play out.

Reaction to Government Intervention

It’s too late for governments to stop Bitcoin. The network math protects it. Even if the US and Chinese governments were to ban Bitcoin, owners of fiat currencies #3-159 probably won’t ban it because it’s in their best interest to stay up to date with the evolution of money, and they have much more to gain than to lose, as we’ve seen with tiny El Salvador testing out connecting their currency with Bitcoin in 2021. Therefore, the network effects of Bitcoin would be slowed down by a US and China ban, but they will keep growing.

Could the US and China stop their citizens from using Bitcoin? Sure, they could. Bitcoin maximalists have a fantasy that the US government can’t prevent people in the US from using Bitcoin, but they can. It doesn’t really matter that Bitcoin is a decentralized protocol.

The suppression playbook has been written. The governments could run the same playbook they did with Kazaa, the distributed music sharing service, in 2000. They pass a law saying it’s illegal to use Bitcoin then have the FBI or FTC bang on people’s doors at night with red and blue lights shining in the street and guns in their hands, and arrest 15-30 citizens while the cameras from CNN and Fox News roll. Everyone will get the message.

You don’t want to be the person who gets taken away in handcuffs and sued for millions of dollars you don’t have. 95%+ of activity will evaporate, even if a ban on a decentralized protocol is not technically enforceable. “Fear will keep the star systems in line! Fear of this battlestation.”- Star Wars Episode IV. It’s the classic playbook.

So yes, the US and China could ban Bitcoin, but the rest of the world won’t fall in line, and Bitcoin will continue to grow. Eventually, new leadership will come to power and the US and China will again join the rest of the world in permitting Bitcoin and other cryptocurrencies. It might take 15 years to play out, but the network gravity will prevail.

Unpacking Bitcoin’s 7 Network Effects

To properly anticipate the future of Bitcoin, and to think in first principles, you should be able to recognize the specific network effects already at work in it. You should also get a sense for how those network effects reinforce each other, because 2+2=5 in this case.

#1: Belief Network Effect

This is the central nfx of Bitcoin. The belief network effect is something you can best see with gold, Bitcoin and religion.

Beliefs become more valuable to believers the more people believe. Bitcoin is valuable because we believe it’s valuable.

Look at gold. Why is it valuable? You can’t eat it or sleep on it. It’s pretty, but lots of things are pretty. It has some industrial uses, but not that many. It’s valuable because — after we were done believing salt was valuable — people decided to believe gold was valuable instead. And for 5,000+ years, it has always stayed valuable. The past gives us confidence that everyone will continue to hold this belief in the future. That belief strengthens over time.

Belief nfx are like sand. In small quantities, sand dissipates in a breeze. But if you layer enough sand down on top of itself, it becomes hard as stone.

The same is true of Bitcoin. The more people believe it’s valuable, the more valuable it gets for everyone. And we’re seeing that same “sand layering” with Bitcoin now. The more times its price crashes and then bounces back, the more people will believe it has value. And then when you layer some Ethereum “sand” on top of it, and the “sand” of the thousands of other cryptocurrencies in existence — all denominated in Bitcoin on the exchanges — the Bitcoin sand gets progressively more stable as a result of growing Belief nfx. What was once fluid and intangible transforms to something closer to rock.

Homo Sapiens is a pack animal. We want to be in the “in group” and be accepted by others, or our primitive brains tell us we risk our lives. Sharing common beliefs is a critical part of creating that in group. If people believe in something, others are more likely to stick with it and believe in it, too. As a result, there are big social consequences for not believing the things your friends believe, and perhaps worse consequences for ceasing to believe in what they believe. This is one factor that makes people stick with group thoughts, making them very resilient to contradictory information. That’s why people are resistant to leaving their belief in the USD, and why Bitcoin maximalists are so fervent.

How Bitcoin’s Belief Network Effect Started

In 2009, out of curiosity, a few people tried participating in the Bitcoin network: miners, investors, and developers. Like John the Baptist, or this guy, this small set of explorers demonstrated to others how to follow and spread Satoshi’s attractive ideology as well as a financial incentive to own Bitcoin or mine it. The more people who believed Bitcoin had value, the more value Bitcoin had, and the belief became self fulfilling.

This belief network effect grew at a time when the idea of a decentralized ledger currency was novel, so the network could grow without competition. It was “immaculately conceived.”

Ethereum seems to have pulled off the same trick, and Cardano and Solana are in the process of trying to hit the tipping point on their network belief. How big and how dedicated does a network of believers need to be to create a self-sustaining Level-1 protocol? It’s hard to measure. But certainly we know the threshold of that tipping point will get higher over time, as there is more incumbent competition from Bitcoin, Ethereum, and others.

The Belief network effect is still the main network effect animating the Bitcoin network, and tracking the level of belief in Bitcoin is thus important to predicting its future.

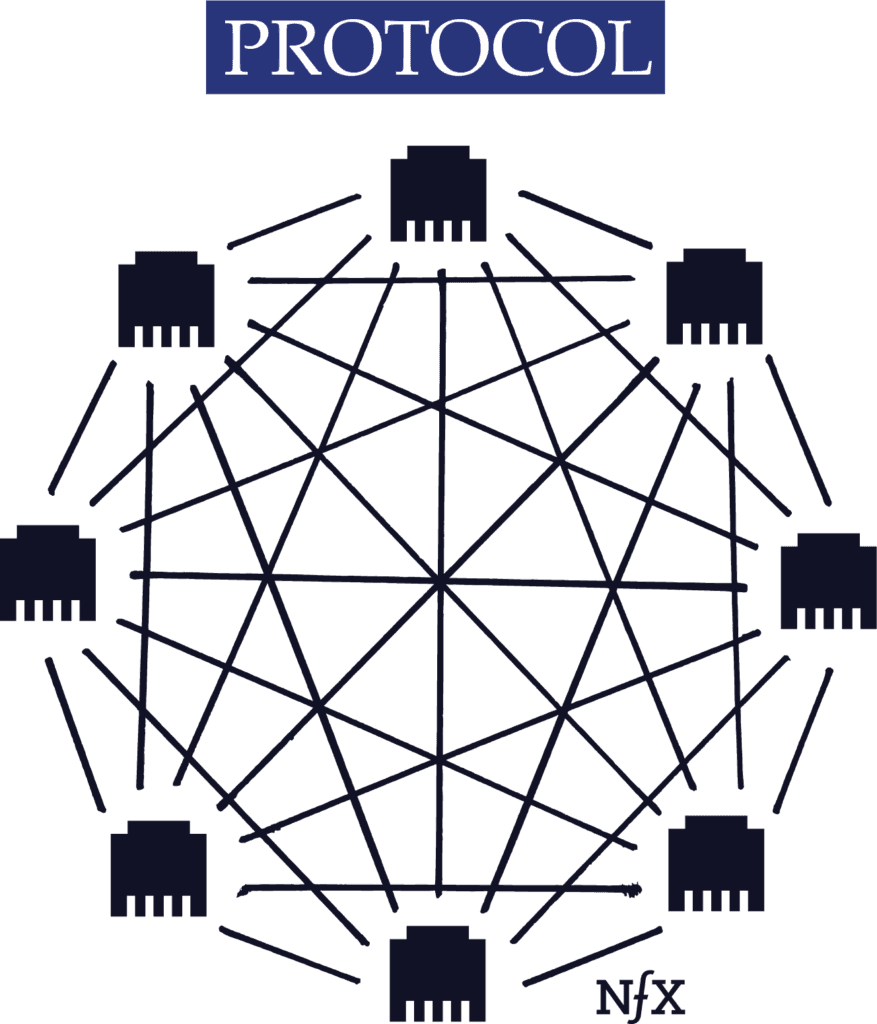

#2: Protocol Network Effect

A Protocol Network Effect arises when a computational standard is declared and all nodes can plug into the network using that protocol. Traditional examples are ethernet and fax machines. Bitcoin is a more recent example. The protocol setter can be either an individual company, a group of companies, a panel, or in the case of Bitcoin — and this was a first — a shadowy figure whose identity is unknown. Well played Satoshi.

As the number of nodes that connect to the protocol increases, the network effect gets stronger. To the extent that the protocol changes or doesn’t, it might improve or decrease the fitness of the protocol to survive long term among all the competition.

For instance, the Bitcoin protocol requires proof-of-work. Unfortunately, that approach is slow, expensive, and harmful to the environment. Competing protocols such as Tezos, Solana, Cardano, and now Ethereum use proof of stake, which is less secure, but superior to Bitcoin in speed, cost and environmental impact. If Bitcoin cannot move off proof of work, it may prove fatal… or it could be the thing that makes it secure in its position in the ecosystem. Time will tell. But realize that features such as proof of work vs proof of stake affects Bitcoin’s protocol network effect strength.

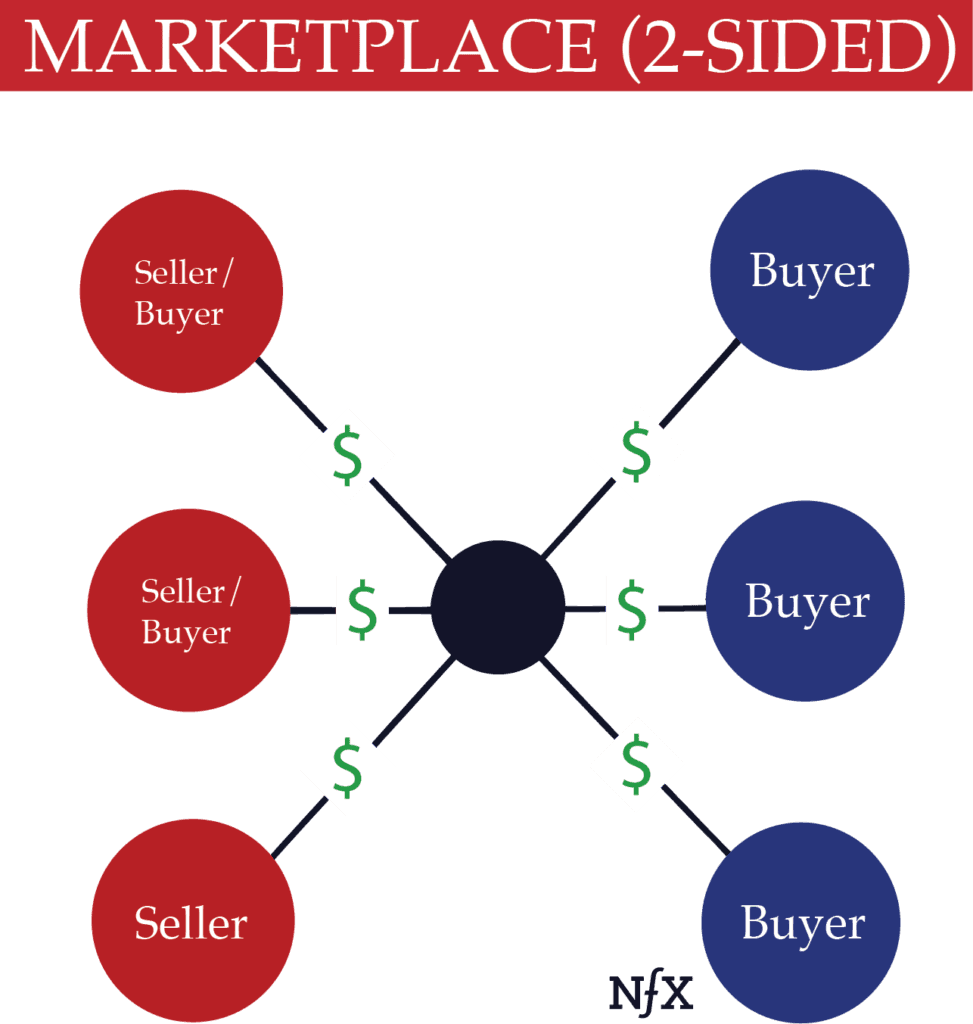

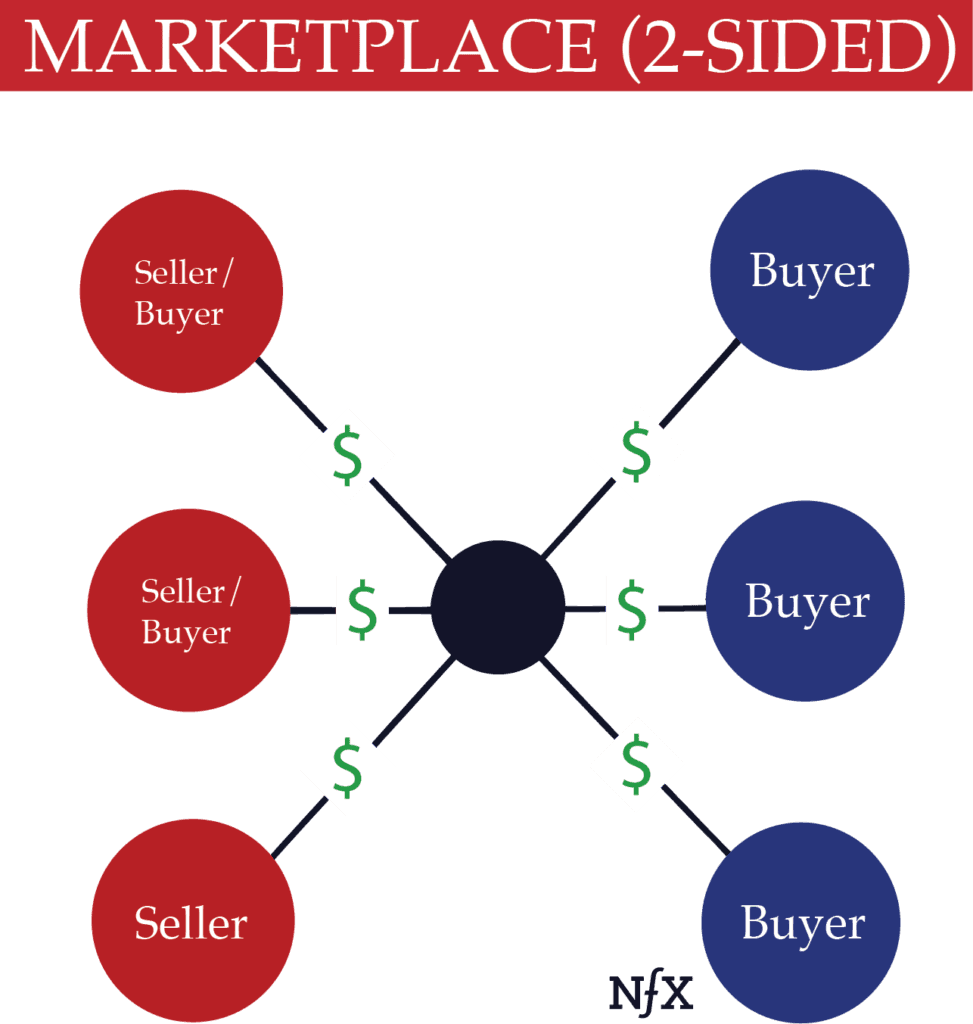

#3: Marketplace Network Effect (2-Sided)

This is the second most powerful network effect for Bitcoin.

If you have a BTC wallet, you can send and receive bitcoin from other buyers/sellers. In Bitcoin’s case this creates two forms of marketplace nfx: 1) a speculation or “store of value” marketplace, and 2) a payments marketplace. The more nodes on the network buying, selling and holding, the better for all.

Thus, the more exchanges, countries, banks, family offices, and individuals add themselves to the network by holding BTC, the better for all BTC holders.

I think we can agree it’s not a great payments marketplace yet. It’s mostly used for store of value.

The value to everyone in the store-of-value marketplace increases with more buyers/sellers, because every additional user increases the liquidity, or the ability for users to convert bitcoin to cash without affecting its price.

But even the store-of-value marketplace network effect is weak for two reasons. First, plenty of layer-1 protocols can achieve a level of liquidity where big trades don’t move the price by themselves if they are done properly. We say that the liquidity effect is asymptoting, the network effect reaches diminishing returns after a certain size. Second, this kind of marketplace is easy to multi-tenant on, meaning I can hold lots of different currencies as a store of value. Look at Coinbase, they support over 80 tokens, most of which could be used as a store of value. So buyers and sellers of BTC aren’t locked into that currency and can defect to another quickly.

#4: Platform Network Effect (2-Sided)

The most common example of a platform nfx is Microsoft OS or Apple’s iOS, where there are developers on the platform that get distribution to users as compensation for building and adding value to the platform.

Satoshi’s 2008 Bitcoin whitepaper created a new playground for developers to build decentralized applications (dApps) on top of the Bitcoin platform. Since 2008, thousands of developers have built software and businesses on the Bitcoin platform. Bitcoin was a mental and technological breakthrough, a huge jump from what had come before.

But let’s admit it, Bitcoin was a Version 1.0 for blockchain, and has several flaws which make it hard for developers, and that left the door for competing networks. In late 2020, Bitcoin had 400 monthly active developers and Ethereum had 2,300. Developers are a valuable, scarce resource. The more of them you have developing on your platform, the stronger your network effect.

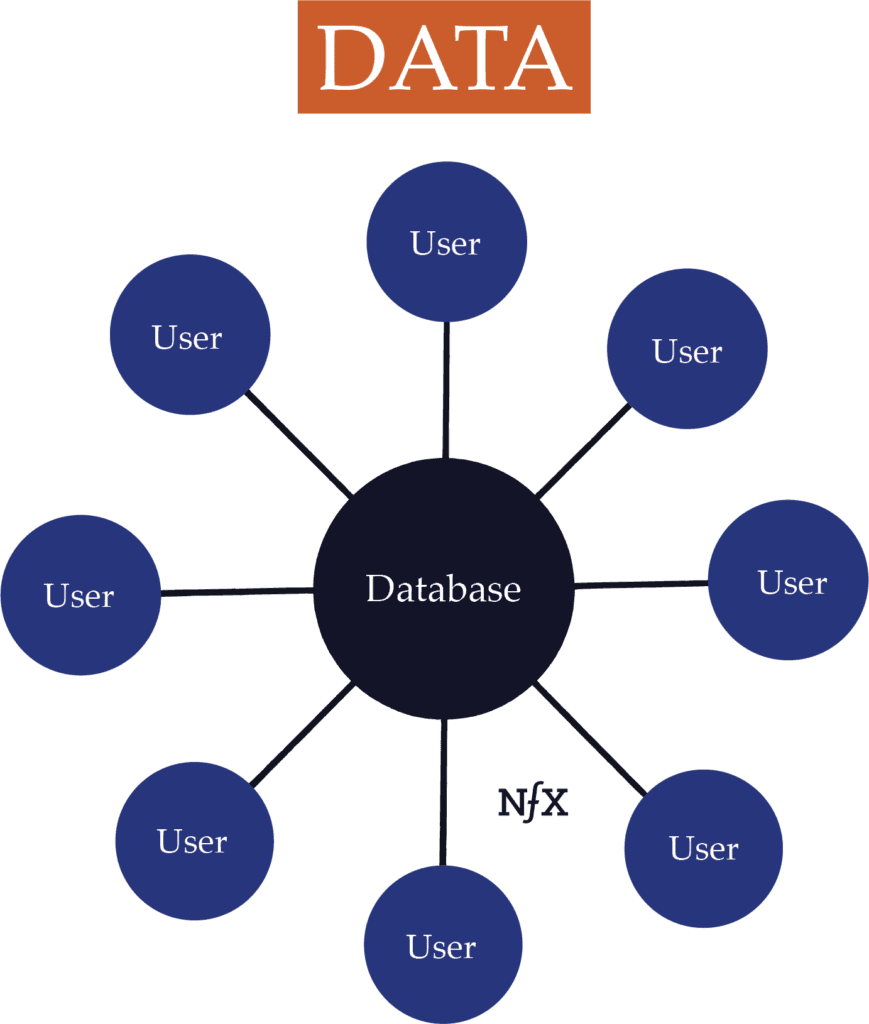

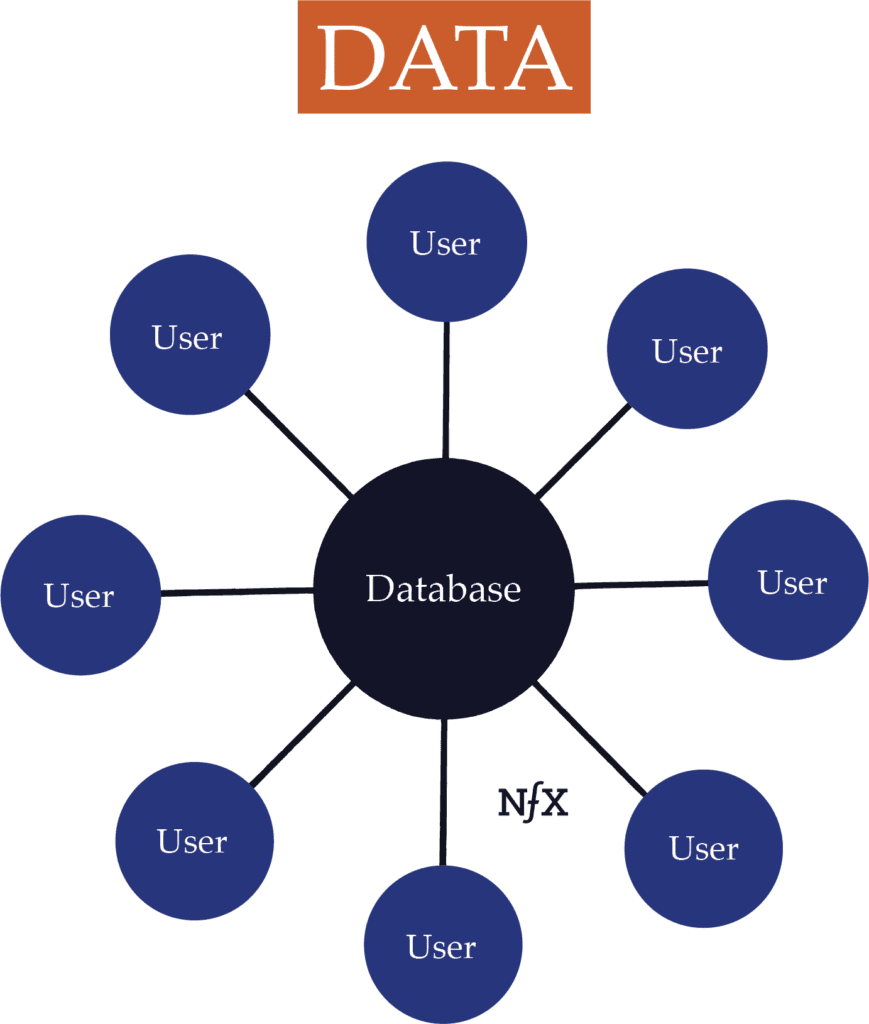

#5: Data Network Effects

A data network effect occurs when as the aggregated data of the network accretes, the value of the data for each user grows.

Bitcoin (and Blockchain) creates a new understanding of data network effects. Users of a network typically contribute data back to a central database. However, in Bitcoin’s case, the data is getting sent back to a decentralized database/ledger.

Blockchain is a database with unique properties. It creates two data network effects. First, it creates an immutable history of interrelationships in the network that would be hard to replicate by a competitor. Second, as the chain of blocks gets longer, the amount of computation required to high-jack the network increases, increasing security and thus value for all participants.

Social Network Effects

Networks are nodes and links. With a landline telephone system, it’s easy to see the physical phones and wires connecting them.

There is the unseen network among people, where our physical bodies are the nodes, and our words and behaviors with each other are the connections. These are the original networks, if you will.

Like digital network effects, these social nfx can help create more value in your product for users the more people use it. People add value to each other by influencing them to think or feel differently. By providing triggers and confidence to use your product. By reinforcing their choice to continue using your product, they are psychological by nature, but no less real.

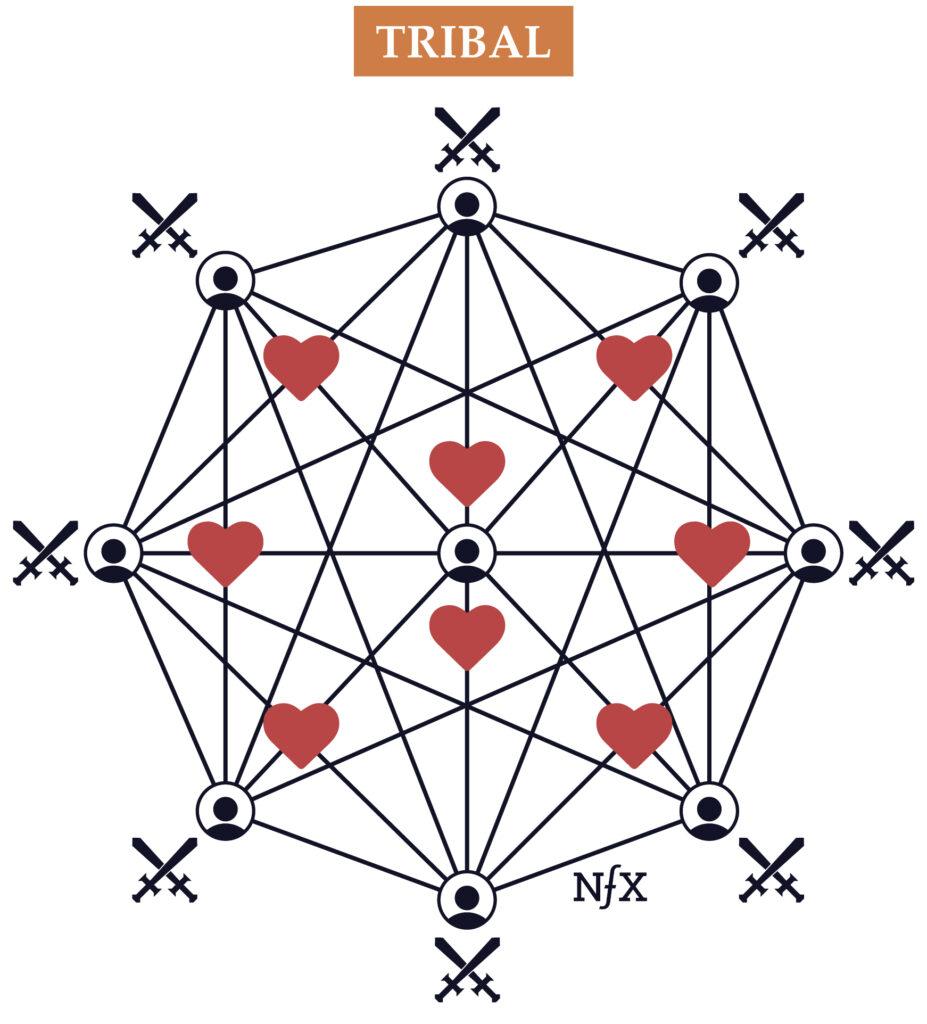

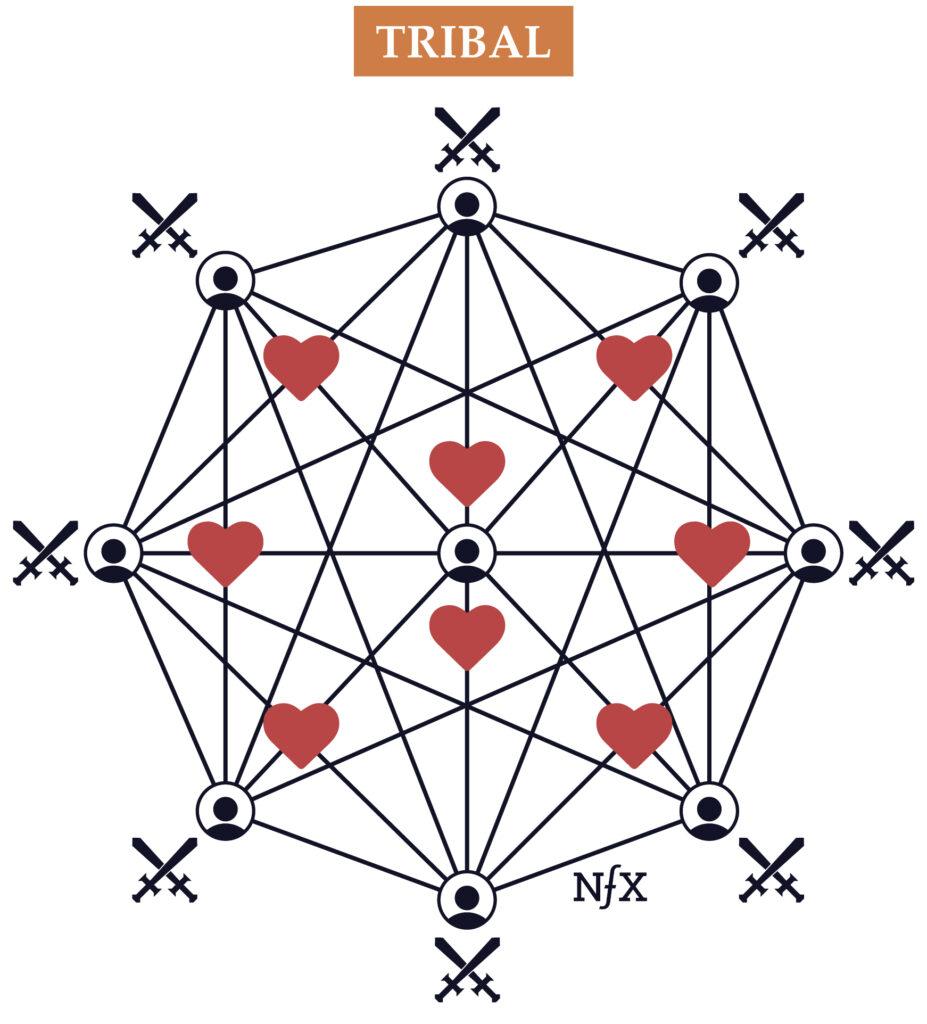

#6: Tribal Network Effects

Tribal network effects occur because of how people form their identities around tribes. Read all about them here.

We suspect the tribal nfx was historically the very first network effect, as Homo sapiens evolved as a pack animal, trying to survive. The ones that built the best tribes survived to procreate, so we are all descendants of the best tribe builders. Those who weren’t good at building or joining tribes died off. Thus, our brains are wired to join tribes.

Our tribal networks add value to our lives by giving us an emotional sense of belonging and identity, and by helping us form useful connections.

The main mechanism by tribal nfx is an in-group and an out-group so you can know who to help and be loyal to. The out-group typically turns into an “enemy.”

Thus it’s no surprise that like with religions, which are also primarily based on (#1) belief network effects, we are now seeing the growth of real tribalism around Bitcoin. There are now the Bitcoin maximalists who believe that Bitcoin will be the only digital asset we’ll need in the future. Not only do they believe in the superiority of Bitcoin, they also believe every other project is inferior, and thus no support should be given to them, their crypto cousins. Thus, anyone who doesn’t exclusively believe in Bitcoin is not helpful to their tribe, is a rival, an enemy, a force to be fought.

Network members within the Bitcoin maximalism tribe are taught to be intentional about building the value of the tribe by:

a. Adding value to other tribe members

b. Defending the tribe’s reputation against competing protocols

d. Growing the tribe

This conscious, intentional defense of a network is distinct from other types of network effects, where nodes largely contribute value and drive network effects without thinking too much about it.

With Bitcoin, the tribal effects are a powerful nfx defensibility.

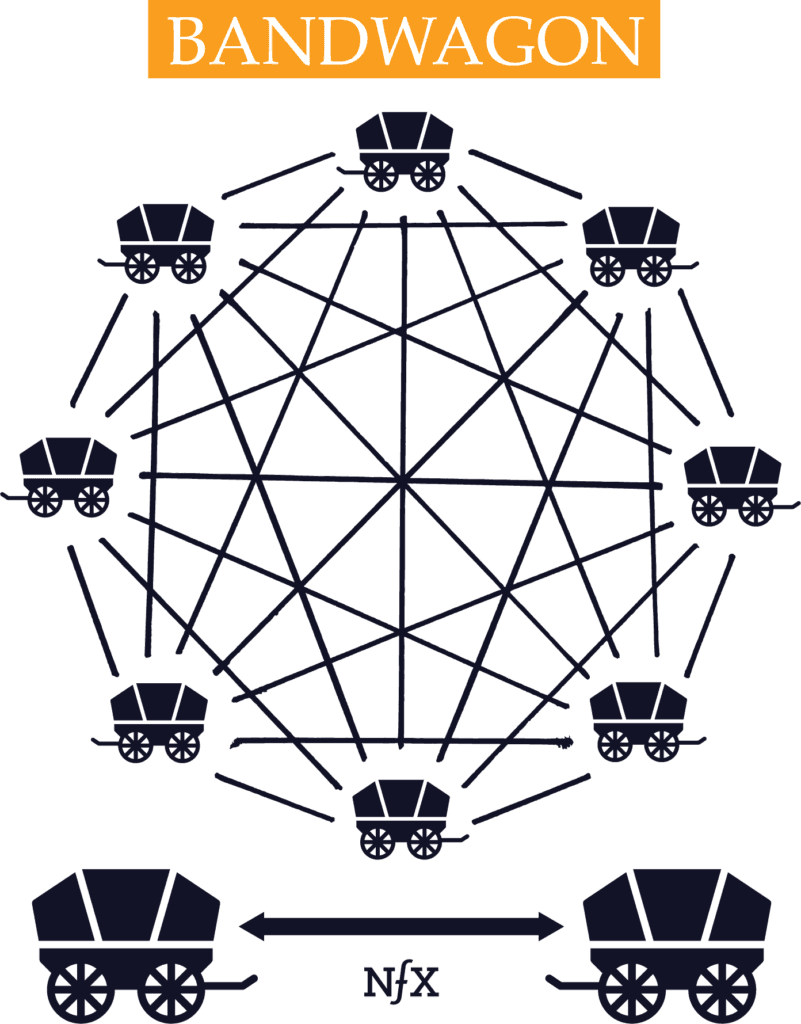

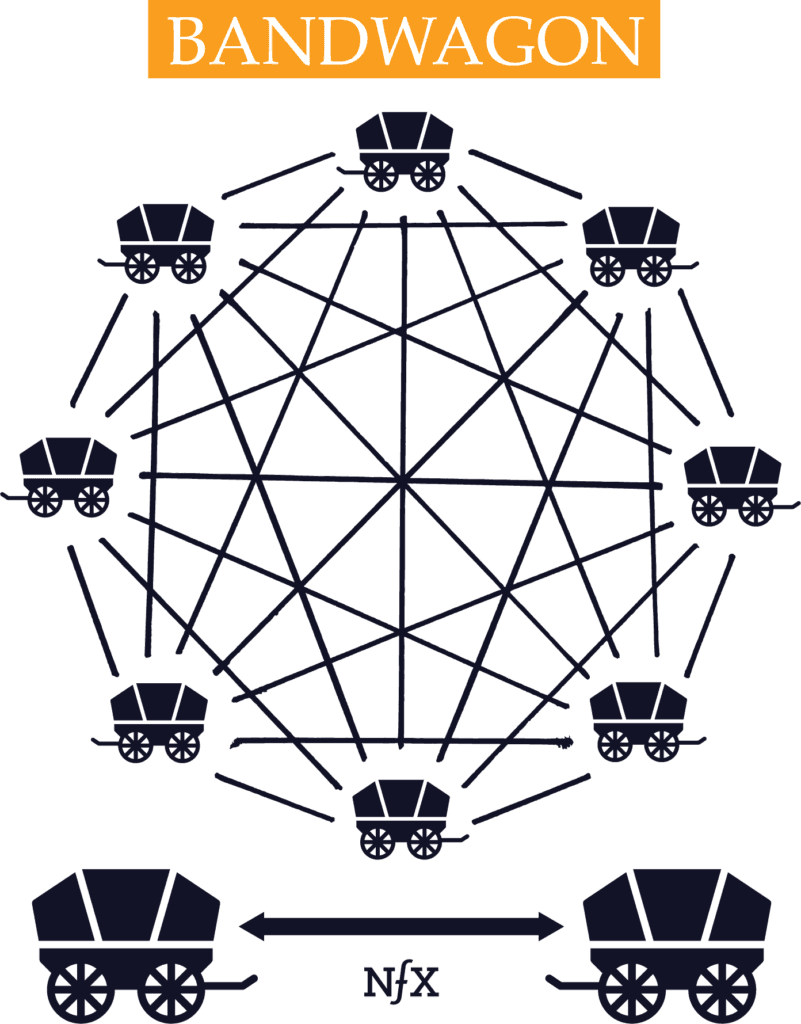

#7: Bandwagon Network Effects

Bandwagoning happens when social pressure to join a network causes people to feel like they don’t want to be left out.

Bandwagon network effects typically arise when a network first begins aggregating, when people are jumping on early.

In Bitcoin’s case, these early supporters were financially and ideologically rewarded for joining early. They were financially incentivized to encourage more people to join, because that would increase the value of their bitcoin. That process continues to this day, although at a lower intensity. People around the world who have not yet bought BTC have seen the rise in value of a BTC and read about the Bitcoin millionaires and ask,“Should I join in? I don’t want to be left out!” and they get a BTC wallet and put some money in. Then, when at parties, they exaggerate how much they bought, so they can socially communicate that, yes, indeed, they are on the bandwagon and didn’t get left behind.

Because Bitcoin has the biggest worldwide brand in crypto and has the biggest market cap, the bandwagon effect is strongest compared to lesser crypto brands.

Eventually, this nfx will wear off as everyone will have heard of Bitcoin and decided to buy or decided it’s OK to be left out.

Two Other Defensibilities

There are three other defensibilities other than network effects. Bitcoin has two of them.

1. Embedding

Embedding is accomplished by integrating your product directly into customer operations or other ecosystem players so they can’t rip you out and replace you with a competitor without incurring significant cost in time and energy. Embedding directly heightens switching costs.

Bitcoin has huge embedding effects being listed on Coinbase, CoinMarketCap, Binance, and others, first by being listed at all, but more importantly because of where they’re listed on these exchanges… at the top #1. Think how much people pay to be listed as the #1 search result on Google. Think of the brand effects, and the marketplace effects, and the bandwagon effects that come to whoever is listed #1.

This embedding in the exchanges helps reinforce the marketplace network effect: since the largest number of people own and follow Bitcoin, it’ll be costly for these exchanges and sites to remove Bitcoin or not list them #1 if they are #1.

Further, as sites like CoinMarketCap chart all other cryptocurrencies against the US Dollar and Bitcoin, which means Bitcoin is embedded in how they calculate and present value, which has significant branding impacts for Bitcoin.

Another way that embedding could work is that in the future, if more merchants start accepting Bitcoin as a form of payment (e.g. Tesla, PayPal), or if more governments (El Salvador) do, Bitcoin will get embedded in their product experience and operations. Over time, it will be costly to rip this out or switch to something else.

2. Brand

A well-established brand creates psychological switching costs. Most people tend to be risk averse and avoid the unknown so they are less likely to switch to an unknown or lesser-known brand. Psychologically they will default toward what’s familiar.

As the old saying goes, “You don’t get fired for buying IBM”… or Bitcoin.

Crypto is still unfamiliar to most people, which gives Bitcoin a significant advantage in bringing people into its network as the #1 best-known cryptocurrency. Also, Bitcoin is regularly conflated with the entire cryptocurrency space.

This level of psychological switching costs keeps many people locked into the network and gives them more value to stay than explore.

Negative Scale Effects

Note that the design of Bitcoin creates some negative scale effects which hurt Bitcoin rather than help.

As the network grows, it gets more expensive and slower for miners to validate the transaction history, because (1) there are increasingly more transactions, and (2) there are more miners competing to validate the transactions.

There is a scenario where if the bitcoin price drops too far, and if the transactions continue to increase in cost, miners might be unwilling to support the network, and the network effect could unravel.

Rarely in the internet age are software companies penalized for growing. Bitcoin’s value would likely increase if the DAO could come together and make changes to alleviate this effect.

Conclusion

Belief was the original force in the Bitcon network. Bitcoin created, and is now embedded into, the crypto ecosystem and the world’s consciousness. After reading this essay, we hope you can see the various mechanisms that are acting to create the real value in Bitcoin. By being able to think in first principles, you should now be better equipped to predict the future of Bitcoin and other cryptocurrencies.

Crypto is here to stay. The reinvention of money is underway. Bitcoin will continue to be a big part of that story. Hats off to Satoshi and his intuitive understanding of network effects.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.