If today’s billionaires invested just 1% of their wealth into longevity, we could give >10 years of healthy life to every human on earth.

We could eliminate the suffering of age-related disease.

And, we could generate some of the biggest returns in the history of technology.

It’s crazy to us that more billionaires haven’t realized this yet. (After all, they can’t take all that wealth with them when they die). And we need them to wake up. A better world is so close, if we can just close this funding gap.

People don’t realize just how close we truly are to extending human life well beyond the 100 year mark. The technologies are being developed now. The technology tree is unlocked. Founders see it. But institutional investors, and yes, billionaires, don’t see it yet.

A world where you watch your great grandchildren grow up is very real. Once you see what we are seeing, not investing in longevity now would be like not investing in the internet in 1990, or AI in 2015.

Thank you to our friends at the Longevity Biotech Fellowship and Adam Gries for this image.

How Technology Trees Reveal Opportunity

First, let’s look at the technology.

In strategy games like Civilization, technological progress follows a tree-like structure – one breakthrough makes the next possible. It’s the same in real life. You can’t develop the internet without first mastering communication technologies and computation, or achieve practical gene therapy without gene delivery systems.

The best time to invest is right before people realize that the tech tree has been unlocked. When most people say to you: “this is cool, but not possible yet” or “this is Sci-fi” or “you’re all crazy”…that’s when you need to look closer.

People were saying this about AI far more recently than they like to admit.

There was a great deal of AI research and funding in the 1950s. Then it tapered off in the 1970s, was re-invigorated by expert systems in the 80s, before entering yet another “winter” in the 1990s and early 2000s.

In those times, many VCs avoided the sector completely. But the researchers kept going. Researchers developed algorithms and frameworks that would later prove revolutionary. Computing power increased exponentially, and datasets grew larger. During winter, they kept unlocking the tech tree one branch at a time. By the early 2010s, it all came together. OpenAI was founded in 2015, right before everyone began to realize the tech tree was unlocking step-by-step.

AI is now unlocked, and we’re experiencing the boom today.

Longevity today is where AI was in 2010-2015. It’s unlocked, and very few people are paying attention.

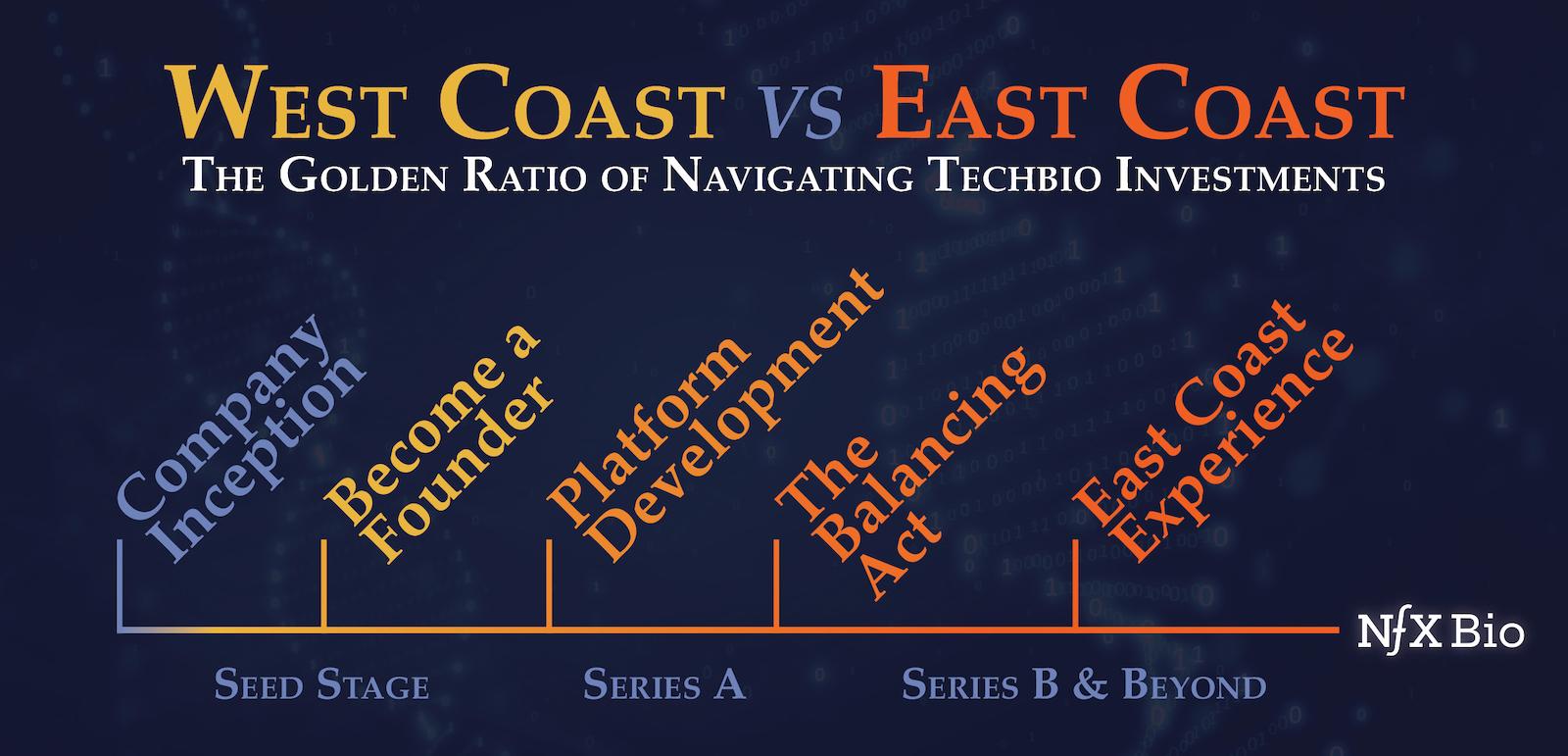

We’ve seen a tech tree develop that looks something like this:

(Shoutout to Foresight for developing a very complete longevity tech tree).

The Longevity Tech Tree is Unlocked

How do we know the technology tree for longevity is unlocked?

Decades of basic research have added up to a more comprehensive understanding of aging, and we have the technologies to unpack how aging works, and design real solutions.

For example:

- High-throughput biological data collection and analysis

- Advanced genomics and precision gene editing (CRISPR)

- Generative AI’s ability to synthesize new, bespoke proteins etc.

- Cellular reprogramming techniques that can restore youthful function

- Replacement therapies that allow us to literally replace aging parts of the body

- Multi-omics platforms revealing aging’s complex molecular signatures

- Novel delivery systems for targeted therapeutics

- Constantly improving automation

All of these systems (and many more) are building upon one another to help us tackle aging itself. They’re coming together to create real, investable ideas like:

Replacement Biology: Rather than repairing damaged cells and tissues, companies like Renewal Bio and eGenesis are creating entirely new replacement parts through synthetic biology. This category includes lab-grown organs, synthetic tissues, stem cell therapies and “stembroids”—synthetic embryos created from pluripotent stem cells that can generate genetically matched replacement tissues.

Cellular Reprogramming Platforms: Companies like Altos Labs, New Limit, and Retro Biosciences are developing techniques to revert cells to more youthful states. This approach represents one of the most promising categories for founders, as it addresses multiple aging hallmarks simultaneously.

Novel Delivery Systems: Even the most groundbreaking treatments fail if they can’t reach their target destination in the body. We’ve seen many new delivery systems emerge that improve precision, versatility, and reliability of therapeutic interventions.

Emerging innovations include viral vectors engineered for specific tissue targeting (exemplified by Dyno Therapeutics’ platforms), genetically modified T-cells for cellular precision medicine (such as Edity Therapeutics‘ approaches), and next-generation lipid nanoparticles for enhanced bioavailability and organ selectivity (like those developed by Mana Bio). As these delivery systems continue to evolve, they’re unlocking entirely new indication spaces and therapeutic modalities.

These are just a few of the larger ideas enabled by the tech tree. And yet, no one outside a small community of talented founders and inventors seems to realize it.

No One Realizes The Tree is Unlocked

The problem is not the technology. It’s not the founders. It’s the money. Aging affects everyone, and yet, many who can invest barely invest in it at all.

Look back at history, and you’ll see that funding is the fuel behind lifesaving breakthroughs.

In 1967, the World Health Organization launched an intensified smallpox eradication campaign that cost approximately $300 million over 11 years (about $2.8 billion in today’s dollars). By the end of it, we had eradicated smallpox from most of the world. This has saved millions of lives, and billions in costs. The entire investment needed for this world-changing achievement was roughly 0.05% of today’s billionaire wealth.

We can do this for aging. Now is the time. If 0.05% of that wealth could end smallpox, even just 1-2% of that wealth could end aging.

We just need more billionaires or institutional investors to step forward with courage, and take on aging the way the WHO took on smallpox in the 60s. We must aim to end it.

It’s not just a moral imperative, but an enormous financial opportunity. Right now, we have market inefficiency. The market for youth and health vastly exceeds the current market capitalization of all longevity companies combined.

Stepping up now will yield huge dividends down the line. You can save lives and literally make billions!

In a few years, everyone is going to realize that the tech tree for aging is unlocked, and the potential is huge. Investors will trip over each other to invest in the next hot longevity company, and many more companies will be founded. But by then the SpaceXs, OpenAIs, Googles, of the longevity world will already be off and running. Funded by people who understood the space before everyone else.

People who invested right now.

Why Don’t Billionaires Invest in Longevity?

I see five common reasons:

First: for all of history, rich people were sold snake oil and they have their guards up (as they should – there are many charlatans in the space).

Second, they don’t think aging is a solvable problem. They don’t see the tech tree unlocking yet.

This is understandable. There is a right time to invest in certain things. For example, if you took Elon Musk or Sam Altman back to 1800, they wouldn’t have had the world infrastructure or basic technologies needed to create SpaceX or OpenAI.

We have the infrastructure and technology needed to end aging (or are very very close). Now is the time.

Third, some perhaps don’t realize how powerless we are against many diseases. No matter how much money you have, or how good your access to the best healthcare and top doctors is — you won’t be able to stop aging and age related diseases when it’s your time.

Fourth, we have gamified being rich. People are trying to flex their wealth and status on the Forbes 500 list instead of doing something with it.

Fifth, longevity definitely has a PR problem. Many out there see this space as a tech bro billionaire side-quest. No one wants to be a part of that. Instead, we see longevity as a moral imperative. A pathway to end disease, suffering, and allow people to get the most out of life, but that perspective is often drowned out in the media.

Finally, one of the reasons I became so passionate about this space is that I’ve learned first hand just how little your money can buy. Going from broke to not needing to work will change your life. However, after a certain point, more wealth doesn’t mean more happiness. (In some cases, if you’re too rich, your happiness actually goes down).

Money without purpose is empty. It cannot create a fulfilling life.

Investing in longevity – for both yourself and for humanity – gives you purpose. You can affect the world and buy more of the one thing money can’t buy today: time.

Creating a Trillion-Dollar Industry While Solving Humanity’s Oldest Problem

Time, health, and vitality are ultimately more valuable than any amount of money. But the market doesn’t realize it.

People are barely investing in one of the important problems humans face. This funding gap—this market failure—presents a huge missed opportunity.

The founders who successfully translate our growing understanding of aging biology into effective interventions will unlock a trillion-dollar industry while solving humanity’s oldest problem. The investors behind them will alter history.

Or, we could just keep dying. It’s up to us.

To me, the answer is easy. I don’t want to reach the end of life and wish I had directed my time, knowledge and money away from the one thing that matters: life itself.

The race to 160 has begun. Join us.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.