Blockchain is down, but not out

Isn’t crypto over? Wasn’t there a crash? Isn’t blockchain old news?

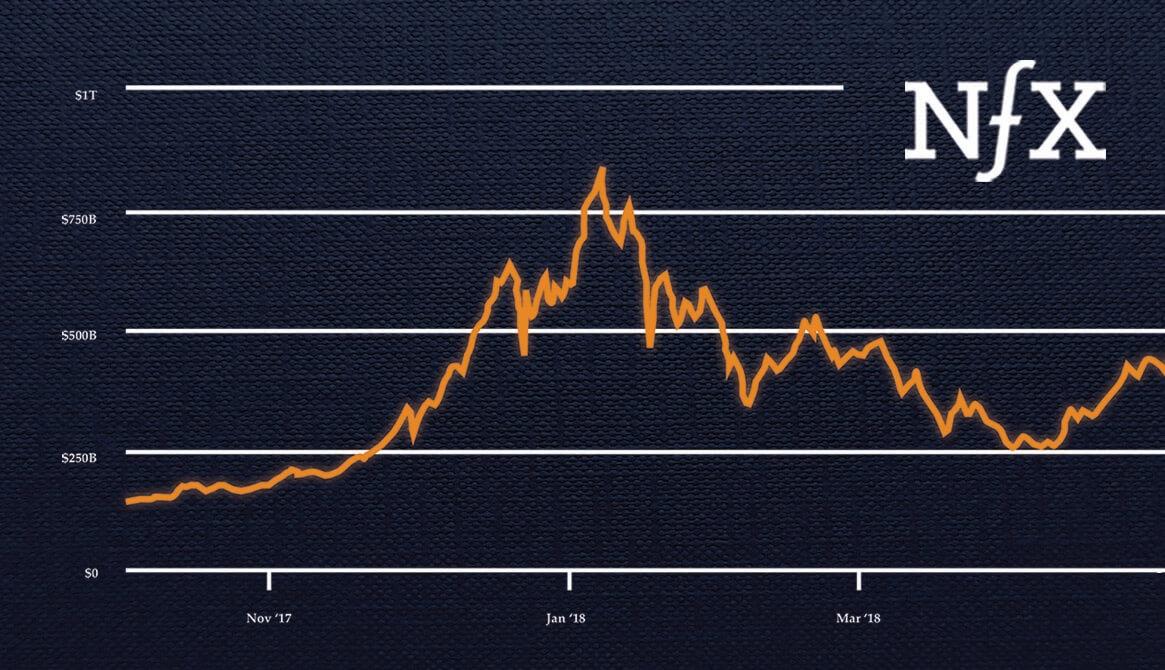

In December 2017, the market capitalization of cryptocurrencies surged to around $800 billion. In the next year, as we all know, crypto declined precipitously. About 12 months later in November 2018, that figure had sunk as low as $182 billion. But it’s notable that, even after this decline, prices would have still been on an upward trajectory year over year had it not been for the wave of speculation in late 2017.

However, it’s important to decouple cryptocurrency from blockchain when thinking about long-term investments. Cryptocurrencies may be subject to speculation, but blockchain technology and decentralization are more grounded. When we think about blockchain technologies and where they are heading, we pay the most attention to the actual decentralized apps (dApps) that are coming out.

The core of blockchain technology is that it allows us to build such applications, which are not centralized the way normal applications are. You might think of dApps as consumer-facing only, but enterprise and government applications of blockchain also fall under this umbrella. Looking at the state of dApps, there are at least 6 major reasons why we think blockchain is just getting started:

- Better use cases & UX

- Increasing resources and talent

- Rise of private blockchains

- Normalized funding

- Maturing blockchain ecosystem

- Friendlier regulation

Because of these trends, we are bullish on top teams in this space in the mid- to long term.

1. Better use cases & UX

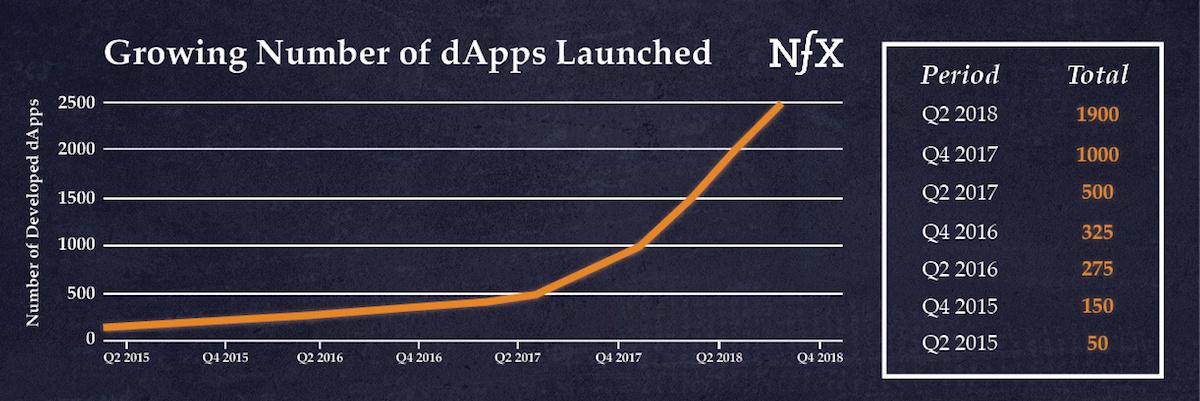

Blockchain is all relatively new — new science, new theory, and certainly new in practice — so the numbers are still small. Still, there are over 2,000 decentralized applications out there. And while none of them have yet reached the level of an Uber or a Facebook, in the long term, we could see some significant applications built on the back of blockchain.

As you can see in the image above, the number of dApps launched is increasing. But the problem up until now for dApps has been the choice of use cases, poor UX and a lack of infrastructure, and this will need to change before adoption increases.

Early on, the idea was that if you could build decentralized applications that mirror the same capabilities of existing centralized applications, there would be adoption. But it turned out that a decentralized application must outperform incumbents in some major way in order to attract a network of users. We believe that the winning dApps will be those which find use cases where decentralization is inherently better, and we are just starting to see ventures focusing on those use cases.

The other obstacle to dApp adoption was the poor UX. One thing contributing to the poor UX has been the difficulty of using dApps, which involves copying addresses, having to choose the right wallets and often having to pay Gas price with a different token than the one used by that dApp. Business models that surrendered to UX complexity have contributed even more to poor UX: what chance does a Facebook competitor have if you need to pay for every like? A Twitter competitor if every tweet costs you a token? It’s now clear that better UX and infrastructure is needed for adoption to accelerate, and in the last 12 months we started seeing top teams working on tools that make dApp usage much simpler and more intuitive. We are optimistic that these problems will be a thing of the past in 12-18 months.

2. More resources and talent moving into blockchain

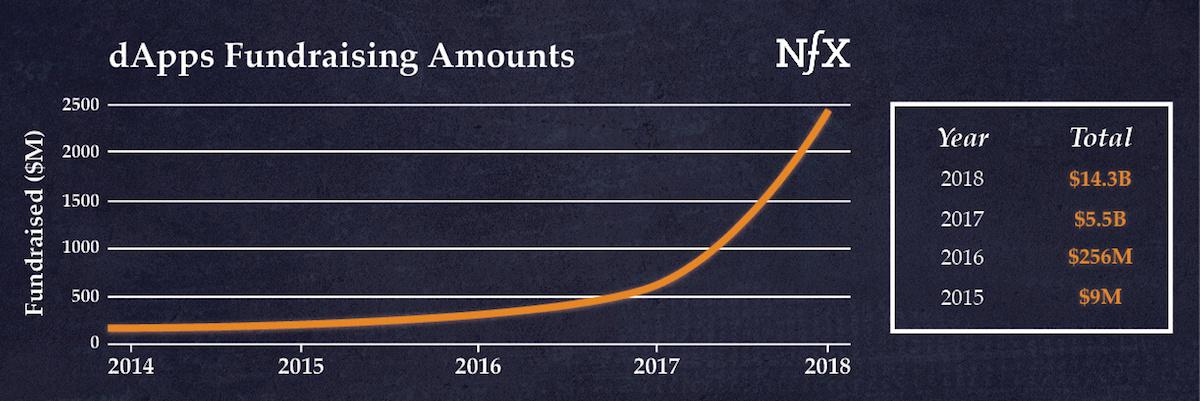

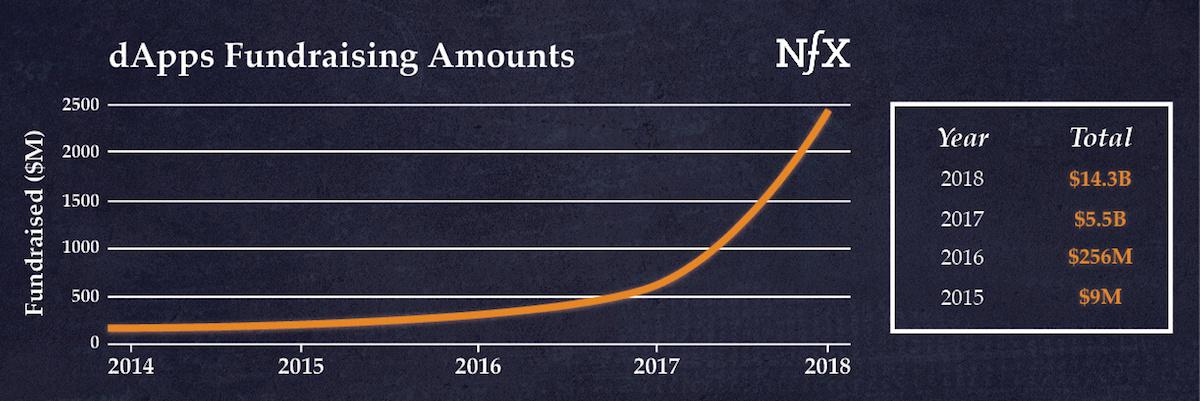

The need for better use cases, UX and infrastructure is becoming clear — but resources and talent are needed to meet that need. That’s why it’s encouraging to see the influx of capital flowing into dApps.

The level of the entrepreneurs entering the industry is also much higher than before, and there’s been a dramatic increase in the number of quality Founders working on blockchain projects. A year and a half ago, only about 5% of startups that we’d talk to would be blockchain companies. Now, it’s more like 25-30%.

For now, some of the teams we’re seeing have been really good. We’re seeing more thoroughly developed ideas, as well as more infrastructure plays and development tools which make us feel the industry is maturing and focusing on customer experience.

3. Private blockchains and enterprise adopters are leading the way

Enterprise has emerged as a big driver of blockchain, even though public blockchains have attracted the most hype. We’re seeing innovation teams in all of the large corporations actively looking to identify where blockchain is going, and how it’s going to improve or disrupt their business.

While there is a wide variety of enterprise blockchain use cases, the 2 we are seeing almost every large company focus on are:

- financial systems, because the distributed ledger adds obvious value here

- supply chain optimization, where blockchain offers some interesting solutions for processes that are often analog and outdated

What’s surprising is that some of the earliest adopters are actually governments. For example, Sweden is moving its real estate registrar from traditional, central servers to a decentralized blockchain. Finland is using blockchain to manage the identities of refugees and provide them with financial services. Estonia has used a blockchain-powered digital ID program to become the world’s first ‘digital republic’. Canada is using Ethereum to provide greater transparency around government grants. Brazil is building a blockchain platform to enable regulation. The list goes on.

4. Funding is starting to normalize

Another thing that makes us more bullish on the industry in general (especially as investors) is the fact that fundraising for blockchain projects is becoming more normalized. In the past, we predicted that many companies will begin to issue security tokens in the coming years instead of “normal shares”. Recent trends support our prediction.

When we think about recent token funding rounds – ignoring outliers like Telegram (which raised $1.7 billion) or EOS ($4 billion) – most token raises are starting to behave more and more like traditional VC rounds. We’re seeing trends toward:

- declining valuations & smaller raises

- a lower percentage of projects getting funded

- more favorable terms to investors

- more institutional money, less public crowdfunding — the age of the public ICOs is mostly over

Here, it’s necessary to differentiate between security tokens and utility tokens when it comes to fundraising. Utility token raises, which were the main fundraising trend of the last 12 months, have steeply declined in number given regulatory pressure and low market interest. Security tokens, on the other hand, are the new thing everyone is focused on for fundraising — but regulation remains unclear and the numbers are not yet proven.

5. The blockchain ecosystem is maturing

Clearly, a lot of people are making a lot of money in this field. Binance, for example, reported $150 million in profit last quarter, while Coinbase is raising at an $8 billion valuation. But more than that, we’re seeing protocols starting to actually buy companies. One example: a protocol company called Tron recently acquired BitTorrent for $126 million to help them build supporting infrastructure for their nascent project.

We’re also seeing this from traditional companies. BitMain, a crypto mining company, invested $50 million into the traditional web browser company Opera, in order to incorporate BitMain’s crypto wallet directly into Opera’s browser. Blockchain companies — both protocols and exchanges — are starting to invest capital into other companies in hopes of improving the ecosystem and enhancing their network effects.

6. Global regulation is moving in the right direction

One thing that is very clear about global regulation around blockchain is that the trend is toward enablement rather than blocking this industry. A big milestone for the industry was the recent SEC statement on Ethereum where it was described as a utility rather than a security — the first time that an American regulator has publicly accepted the existence of utility tokens:

“Based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions.” – SEC Director of Corporate Finance William Hinman

Although the US isn’t even at the forefront of enabling blockchain with regulation, regulators around the world are moving in the same direction (even China has been investing in blockchain technology development despite their cryptocurrency ban.)

There’s a long way to go, but we’re bullish

Despite the damage done by the hype cycle last year, we think that blockchain is poised for near-term disruption of multiple industries. However, work remains to be done on all sides, from the core technology and the ecosystem of the developers to the users and financial inputs and, of course, the regulatory environment.

With improved layer 1 protocols going live, more developer and infrastructure tools, and established centralized players starting to launch their own dApps, we believe 2019 will see the first dApps that gain market adoption. In enterprise we will see more use cases for blockchain, and outside of enterprise we’ll see use cases in the financial services space. Meanwhile regulation, which has proven to be painful in the short term, will be positive in the long term.

No, blockchain isn’t over. It’s just getting started.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.