If you were to look at my weekly calendar, you would see most of my time is allocated to Founder meetings and board meetings. As a General Partner at NFX where we lead a good number of early-stage rounds, I spend a lot of time in board meetings. I’ve also been in the CEO seat running more board meetings than I can count in the course of founding Trulia, taking it public, and then merging with Zillow.

Early-stage Founders often think board meetings are a huge distraction. Done wrong, that might be true. But board meetings done right are extremely high value for Founders. Running a good board meeting is a management and communication skill that, learned early on, will have compounding benefits for your company.

And yet, unlike abundant fundraising advice or pitch deck examples, there is not much published for Founders about best practices for running memorable, high-value board meetings. I suspect this is because the impact of effective board meetings is often underestimated.

Don’t wait until your Series A or B to take board meetings seriously. Start with principles on day one, keep things short and focused, and expand over time. The value you unlock, the communication muscle you build, and the relationships you deepen are immeasurable.

1. Finding Company-Board-Member Fit

More important than nearly anything else is who you have in the room during these board meeting conversations.

In the beginning, lead investors of Seed rounds often join the board along with no more than two Founders. From Seed through Series C, usually, most board members or observers are Founders and investors. This is just one of many reasons why we say that Founder-Investor fit is a crucial relationship to get right in the earliest stages. Choose your investors that you think can add value to your board meetings and support you as you scale.

As a company scales, it’s critical to get a diversity of backgrounds and opinions. There can be significant benefits in getting an independent, industry expert or former CEO as a board member. This makes sense post-product-market fit because you know more specifically who will be helpful and it will be easier to recruit.

At Trulia, we had Bob Moles join our board. He previously ran Century 21 and other big real estate brands. We as the Founders and our investors did not have extensive pre-existing experience in real estate at that time. That’s why Bob’s role was critical to the board.

When we merged with Zillow and I joined the board, there was a lot more discussion time in our board meetings. The combined Zillow and Trulia business was later stage and together they had highly sophisticated finance, marketing, and other domain experts on the board. As a larger public company, the Zillow Group board had selected individuals with specific roles that were called upon for specific advice.

As you scale, who you will recruit depends on the expertise of the Founders and investors. Map out the key areas in your business where you need to absolutely excel to be successful, and ensure you have a board member who can speak with authority on the critical opportunities for the business.

2. “Flip” the Board Meeting

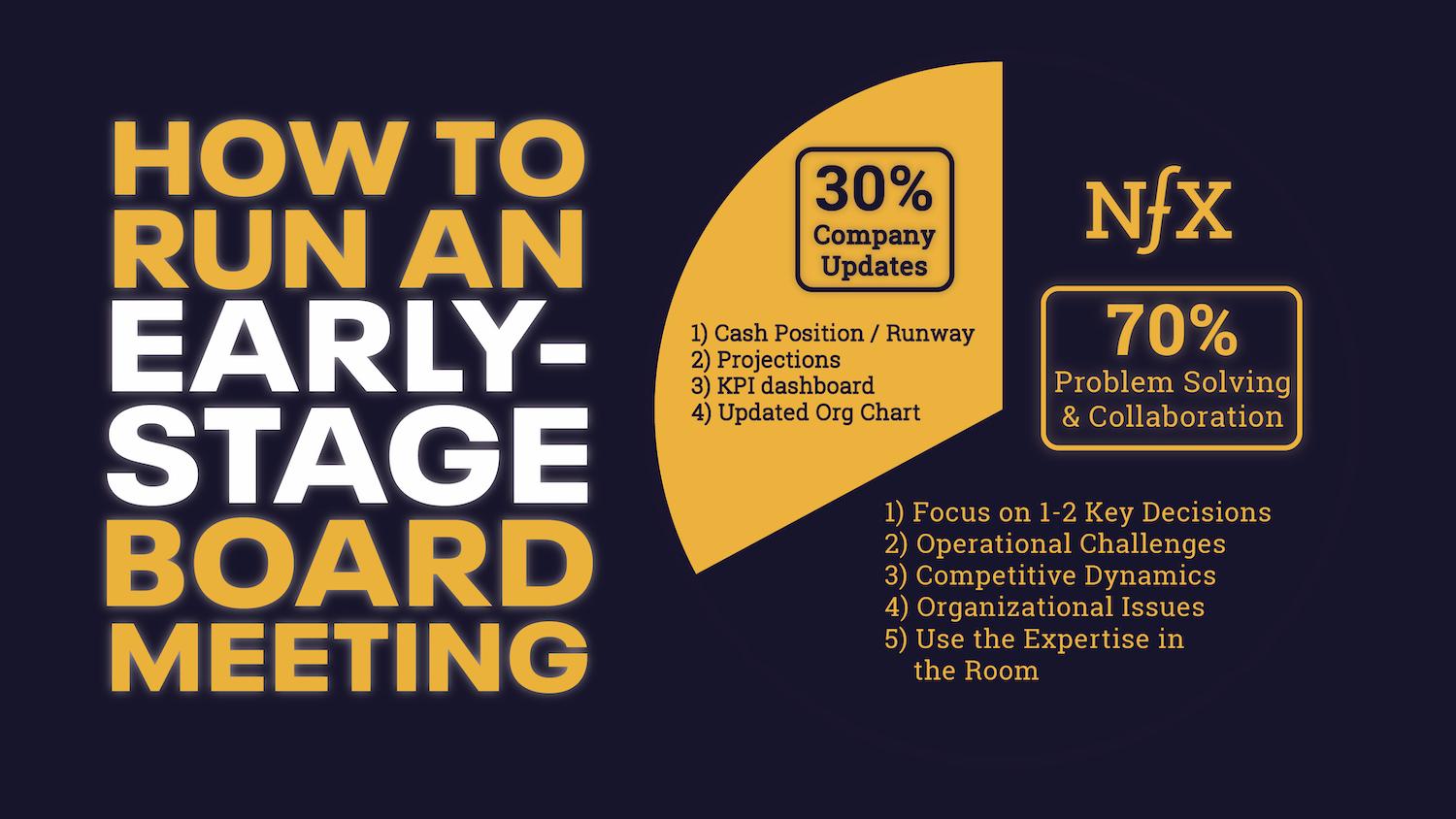

Many CEOs feel the need to use these meetings to justify their role to the board and explain the great job they’re doing. That’s a mistake, which often results in CEOs spending 90% of their time giving updates or running victory laps and then raising the strategic issues right at the end, when there is no time to really engage This is not high leverage for anyone.

Instead, “flip” the board meeting. Your role as CEO is not to inform and report, but to engage and gather perspective and move the company forward in the right direction.

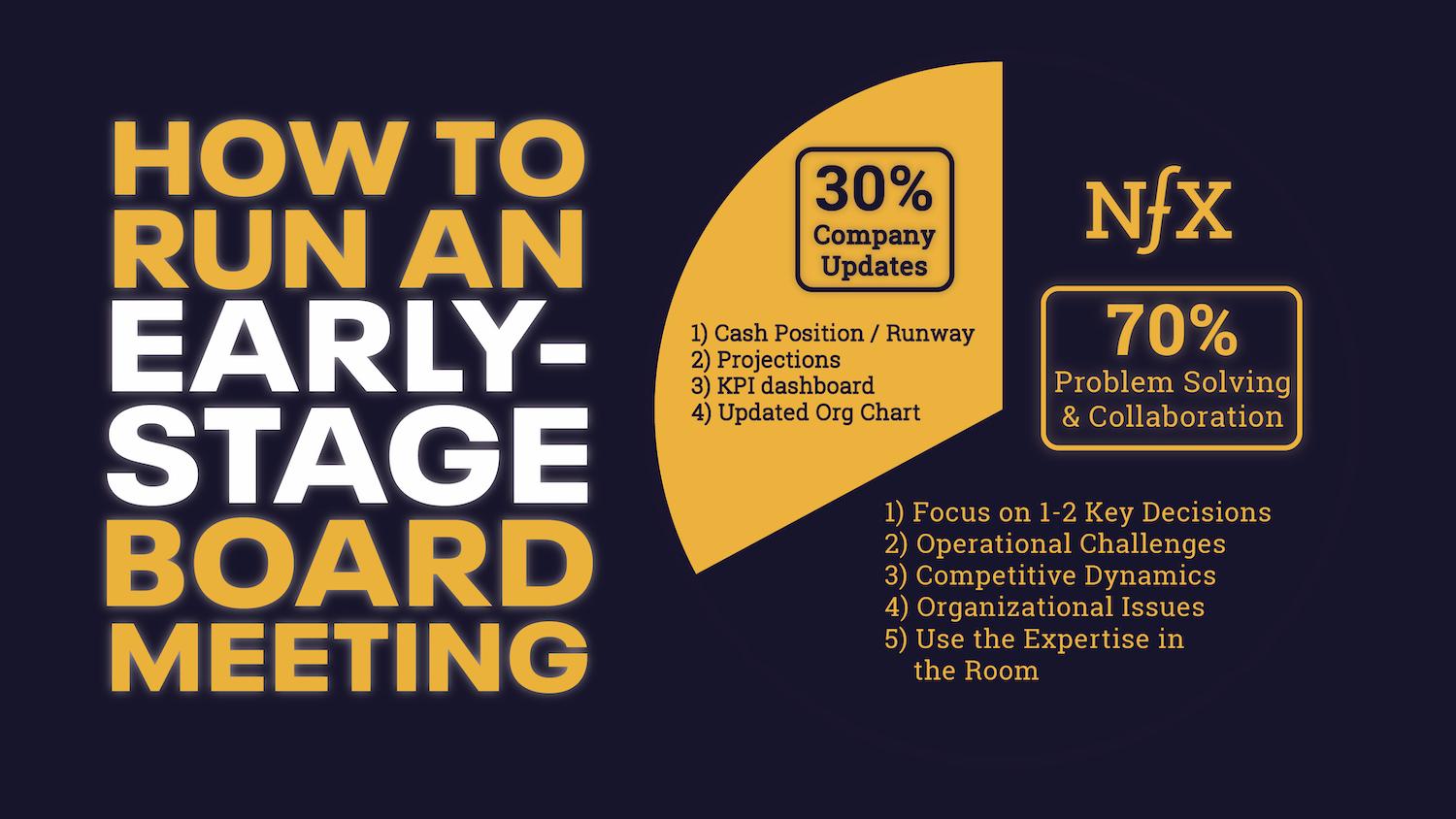

You should pick 1-2 bigger strategic items, either operational challenges or opportunities for the company, and dive deep. Spend 30% of the meeting on updates, and 70% on key forks in the road, operational challenges, strategy, competitive dynamics, and organizational issues.

Send materials to board members ahead of time such that they are well-prepared, start by clarifying anything on the state of the business, and then go straight into the strategic issues at hand. The best CEOs know how to use the expertise in the room. It’s a failure every time you don’t tap into that resource during a board meeting.

My favorite board meetings are those where the participants are all well-prepared and there is a collaborative discussion on a particularly thorny problem. Most of us find problem-solving very rewarding.

In the absence of a thorny problem today, use the opportunity to tap into expertise around the table to help “see around corners” and future challenges. One of the benefits of investors and board members is that they often have seen a lot of companies and can help you anticipate in order to mitigate challenges further down the line, so you can get in front of them.

3. Short & Frequent is usually better than Long & Infrequent

First, you should be sending updates to your board monthly at a minimum. If they’re easy, brief, and you are reusing internal work, you can send them weekly.

Then come the board meetings. Short and frequent meetings are generally better than infrequent and longer meetings. As a starting point at the Seed stage, board meetings should happen every 6 to 12 weeks and should last no more than 1-2 hours. These meetings generally become less frequent and longer over time.

In advance of a scheduled board meeting, it’s best to provide pre-read materials. This doesn’t mean you have to spend hours upon hours preparing. In some of the best board meetings, the pre-read materials require almost no significant additional prep time from the CEO. You can just send internal content from management meetings, a copy of the dashboard that the team looks at every day, updated financial models, an updated org chart, and two to three questions you want to spend time on with the board.

All board meetings need to include an update on current cash position and months runway (with and without hitting forecasted revenue). As the company scales, add detail on performance vs target on financial and operational metrics by month and projections for the next 6+ months.

Ask your board to read about updates ahead of time, so you can just talk about a couple of the big issues in the meeting. Aim to give 48 hours to review for pre-read materials to enable board members to review it in sufficient time, but not so long that it becomes stale. This communication can be in the form of a slide deck with supporting data or as a memo/Notion doc which can be useful in providing the commentary to the data. I’ve seen both work well.

It’s critical that the CEO acts as an effective time manager during the sessions and balances time spent on healthy discussion with covering the critical issues. It’s okay and expected for the CEO to “park” a discussion now and again to cover it in more detail outside of a board meeting to move on to the next topic.

4. “Only the paranoid survive”

It’s critical at all stages to talk about the negatives more than might be comfortable. You’ll have a feeling of wanting to give the presentation through rose-tinted glasses, but give equal or more weight to the negative.

When I was running early board meetings at Trulia, I fell into the trap of only highlighting the positive in the company. I remember in one meeting, a board member just called out: “So, absolutely everything’s going really well, then?”

I thought for a minute, then said: “No, actually, there are probably a dozen things that are challenging or broken or we need to fix.” After that board meeting, I made it a habit to write on a single page, with a line drawn down the middle, the things that were going well on one side, and in an equal, dedicated space on the other side, I put the things that were going badly or need to be improved.

It’s a helpful construct to split your thinking so you can dedicate time to the good and to the bad and share it with your board.

I then developed this into a matrix I used at Trulia. It was a matrix by department, with positives and negatives. Another method I’ve seen that I like is “Traffic lights” — showing what’s on time, ahead of schedule, and behind. This helps to focus quickly on the challenges and direct energy there.

Today, if a Founder is only talking about what’s going well, I don’t disbelieve them, but I hope they are paranoid enough to know that there are a million things that can be done better.

You’ll be respected much more for presenting challenges. Everyone knows startups have a myriad of challenges. And having a great board can help you see around corners for good and bad surprises and prepare you for them.

5. Expose the Board to your Team and Vice Versa

Everyone on your team knows when there’s a board meeting happening, but if nothing is mentioned about it, people tend to get suspicious. Big meetings behind closed doors just do that to people.

You don’t always want to show the board deck to your entire company, but I have found it efficient to share commentary and report to your team how it went, plus any key learnings.

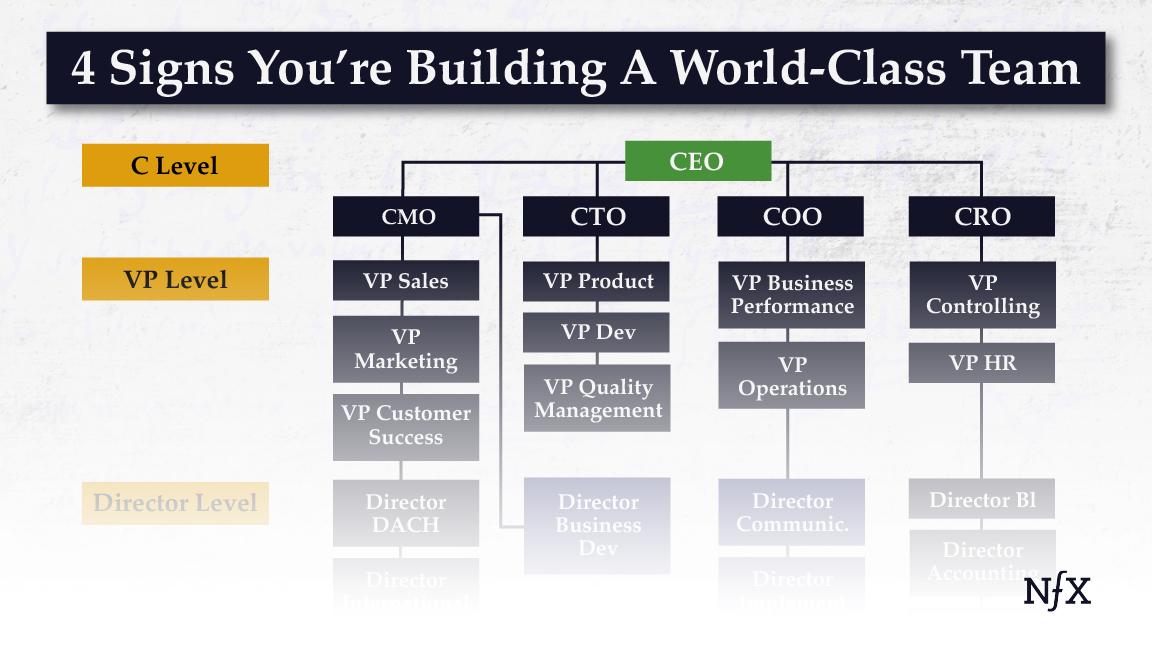

I learned later on at Trulia as the company scales to invite the senior team to board meetings. In one meeting you can invite the VP of Sales, then invite the CTO, then your Head of Product. Rotate individuals so they can have exposure.

This practice is beneficial in a few ways. First, the board gets to see and hear from more people in your company and get a greater sense of your culture. Next, the senior team is usually highly motivated by access to the board. Any VP or Director is thrilled to present to them, and they can get feedback from people other than you on their work and direction.

It can also be very helpful as a calibration of the quality of people you want on the team. At one point, I had only ever hired one VP of Sales who helped to scale revenue 20x which created a new set of challenges. As the role expanded, I didn’t have a great framework for who would be world-class in that role. But my board members had been interacting with dozens of VPs of Sales of larger companies, so they had a much better understanding of how to calibrate talent in that position.

Another comment on being transparent about the team is that HR and the team org are rarely discussed, but should be. It is good practice to include in the board deck an updated org chart and mention relevant recent additions, departures, and new hires you are looking for.

6. Find Your “Business Equation” To Help You All Navigate

When I was at Trulia, we ran it like a public company for 4-6 quarters leading up to our IPO. We had clear monthly and quarterly targets that we measured with high accountability. We understood the levers of the company. There was full instrumentation of the business ahead of being a public company.

The journey to that point took many years and was achieved by understanding and refining the key levers and interplay between operational and financial metrics that gave us scale and success. We referred to this as our “business equation.” Post-product-market fit, once you figure out your business equation, you can rapidly scale. It also serves as a constant in board meetings for directing your company. It’s like a shorthand for your company’s health, that everyone can see and understand quickly.

The best Founders create models to understand from the bottom up that if you do more X, you get more Y. Knowing these levers in a business, especially in multi-sided networks, is highly valuable.

For example, if you’re a marketplace like Trulia was, you might have a supply and demand side business equation. Facebook, for example, also has two business equations, (1) one for the consumer growth group, and (2) the second for the ads sales execution.

A simplified version of Trulia’s business equation for the B2B side of our marketplace was:

(Number of Active Salespeople) X (Sales Conversion Rate) X (Average Order Value) X (Customer Retention)

Here’s how we used it:

- The first component was HR’s job. How quickly could we hire top-performing salespeople?

- The second was on sales execution. How can we increase our conversion rate?

- The third was product selection. Could we increase the average order value to a sufficient number?

- And lastly, product efficacy. Were we able to retain users?

Breaking down each of the components of the business equation and having clear goals, evaluating where you are — expected performance vs actual — is key to understanding the levers of your company. That will give you a “reality check” for adjusting course when necessary.

Your business equation can serve as a constant in your board meetings to demonstrate the challenges, progress, and opportunities in your business.

Early Board Meetings Are Simply An Extension Of Your Team Meetings

Running a great board meeting is like building up a muscle. Start early and keep it up.

There’s a perception among CEOs that running a board meeting is a huge lift, requiring some kind of Herculean effort. But actually, in the early days of your startup, board meetings are simply an extension of Founder team meetings.

When the team is small and revenue is small, you can have board meetings that are only 30 minutes long. It can be as simple as the Founder-CEO saying: “This is the stuff that is on my mind, and here are 1 or 2 key decisions I need to make.”

This “communication muscle” will benefit you in all your relationships. Not just with your board, but also when communicating with other investors when you’re raising future rounds, speaking to prospective employees, and more.

Running a board meeting is an essential management and communication skill that all Founders would be wise to develop as early on as possible.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.

Try ChatNFX