As a Founder, you are the Chief Storyteller. You need to convince investors, employees, customers, partners, and journalists to give you the resources you need — you do that with your story, your narrative.

A story is not about tricking people into doing what you want. It’s about understanding your audience, empathizing with how they see the world and what they want, and then inspiring them using words that mean something to them.

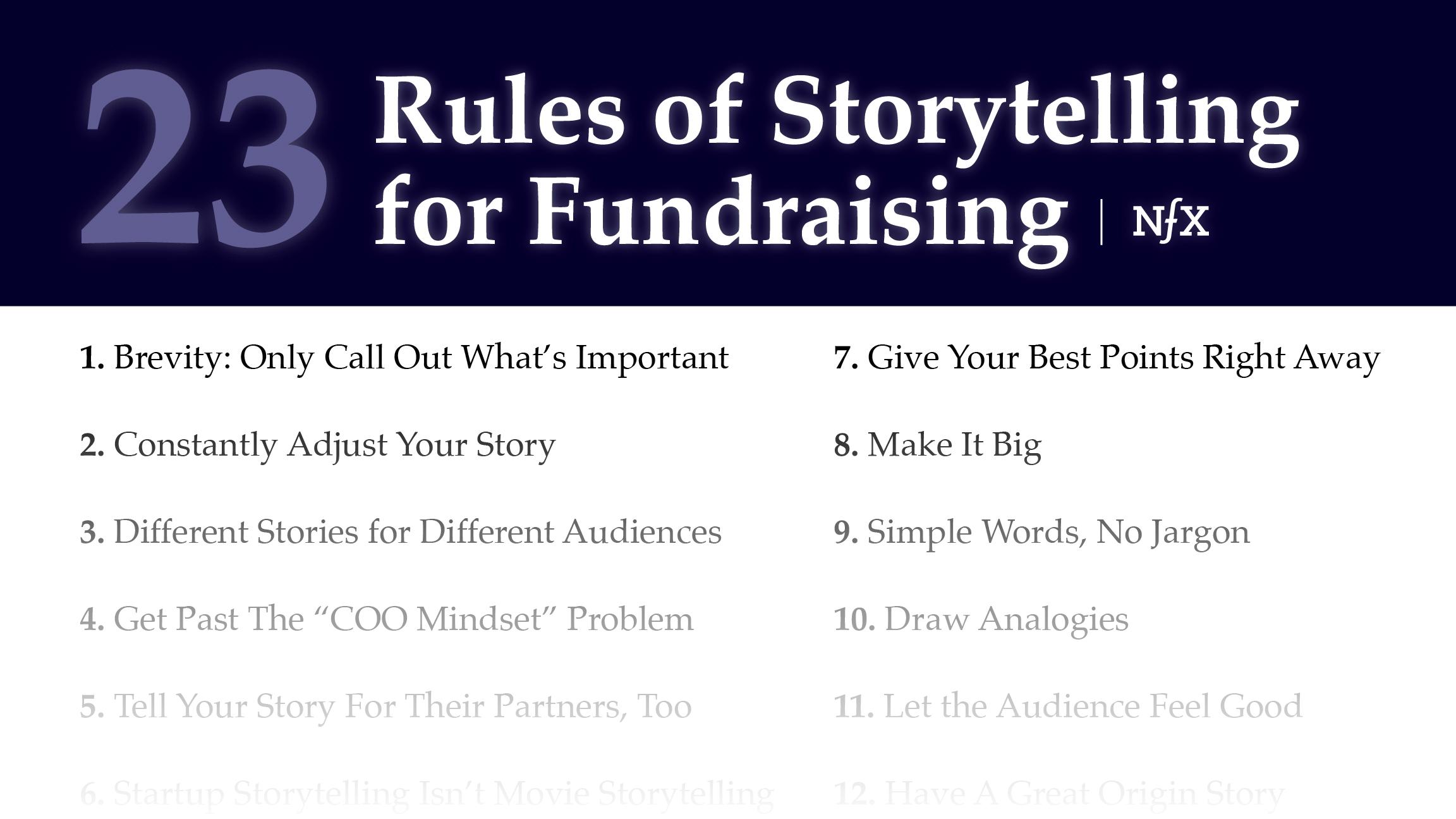

When you are fundraising, we have observed specific storytelling techniques that will motivate your VC audience to invest. To be a world-class Founder, here are our top 23 rules for great storytelling.

1. Brevity: Only Call Out What’s Important

Listeners can’t hear what’s important when you talk too much or put too much in your deck. Telling a good story isn’t about spewing out everything on your mind and letting them sort through the mess. It isn’t about bludgeoning the listener with so many sentences that they love you.

Saying less is better. Figure out what’s important and what’s not. Emphasize what’s important. As a listener, I just want the important pieces from you.

It turns out that there are only a few elements of your story that are important in motivating an investor to invest. Here’s a quick list. You should emphasize these:

- Sector. Explain clearly what the company does and for what customer.

- Business model. How do you make money? Who buys, for how much, and how frequently?

- Traction numbers: Revenues, retention, unit economics, CAC, LTV…

- Team. What makes your team unique for this opportunity?

- Timing. Why couldn’t it be done before? What changed recently?

- Unique insights you have. What others don’t understand about the customer or the technology.

- Competition. Why you will win, or why both you and your competition can win.

- Business design. Why your network effects or other defensibilities will make you win.

- Market. The massive hidden market you’ve found (Total Addressable Market or TAM)

- Go to Market. How you get to $100M+ in revenue with a bottoms-up calculation.

These elements are emphasized in a tool like BriefLink, which helps Founders craft their story.

2. Constantly Adjust Your Story to Your Audience

Some Founders think, “I’ll write down our story in a deck or a Brief, and then I’m done, and we’ll go tell that story to everyone. ”

That is not the case at all. You have to adjust your story and tell it slightly differently every time.

Each time you start to tell your story again, you’ve got to be able to judge the room and speak to what they’re interested in, only including only the key details that are relevant for that audience. You need to adjust your story so that they can understand from their perspective – using their language – what you are doing and why it’s interesting for them.

When you can, take the time to research your audience before you meet with them. There are great tools like Signal, Twitter, and investor blogs. Find out what their key phrases are and how they see the world. There are no excuses for not doing this, yet you’d be surprised how many Founders don’t do it. You aren’t world-class if you don’t.

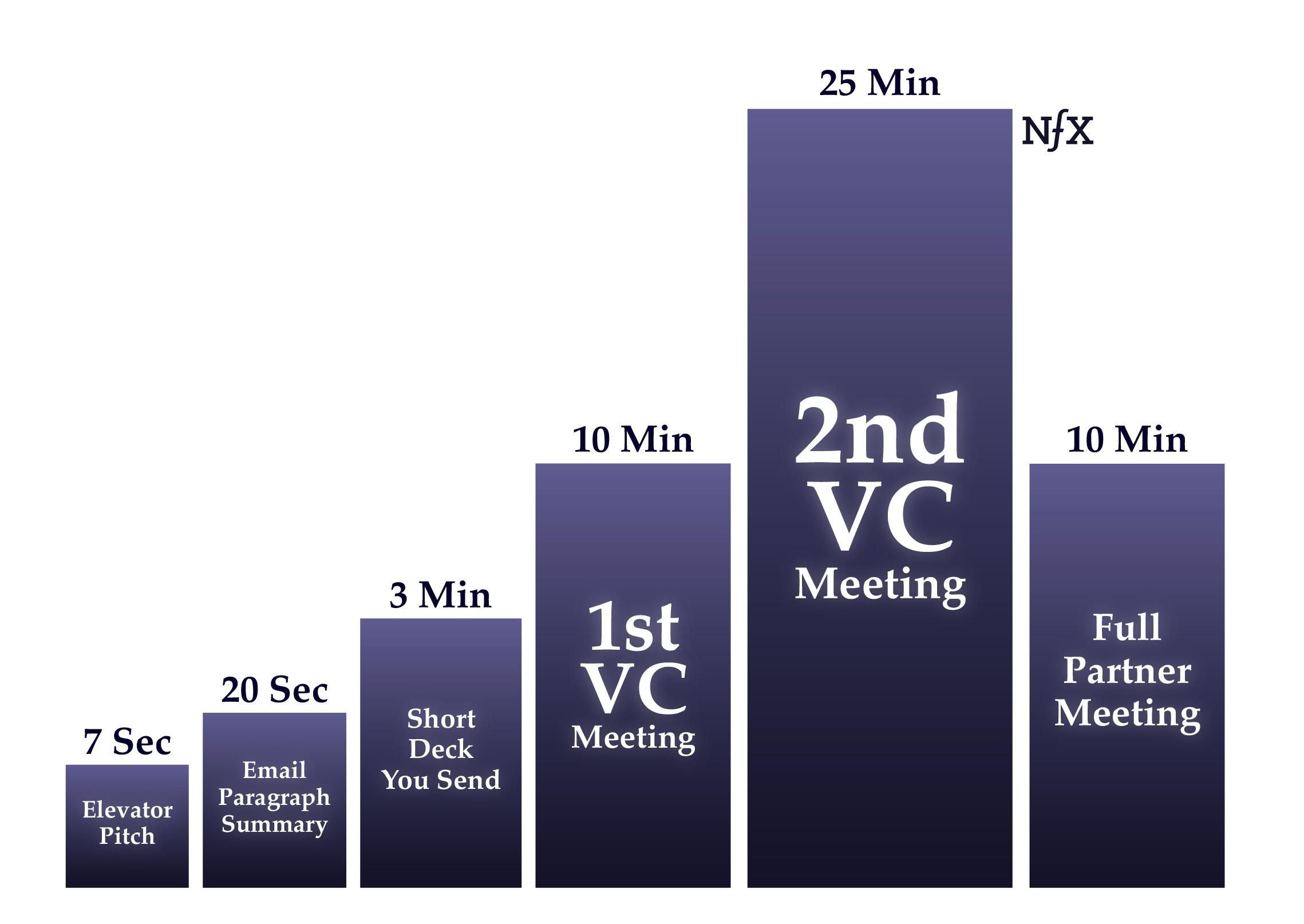

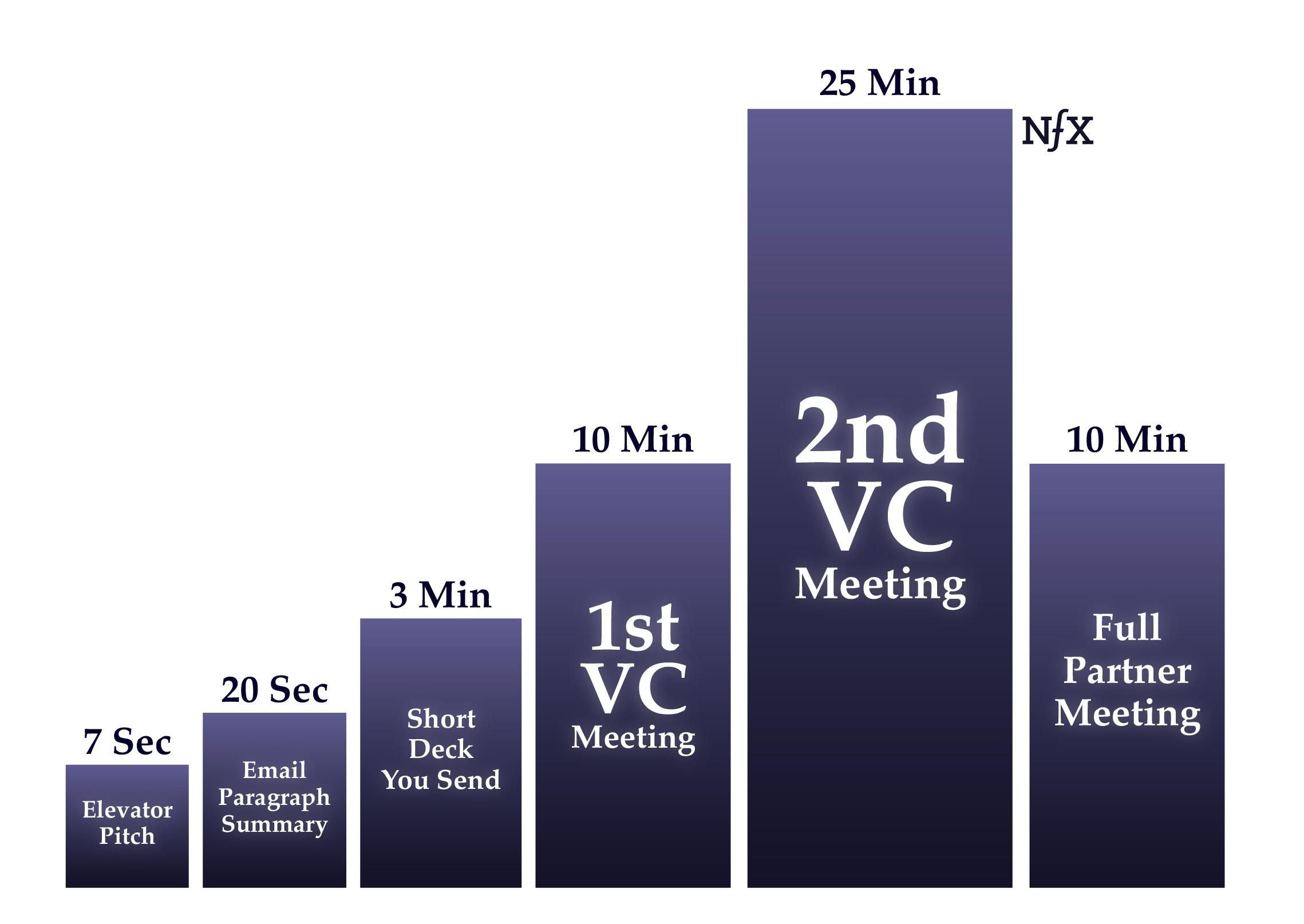

3. Have Different Sized Stories for Different Audiences at Different Times

If I’m in an elevator with you and ask you what your startup does, you don’t have time to pull out a Company Brief and walk me through it. You have 7 seconds to give me the basics. I really don’t want any more. That’s an elevator pitch. Can you do an effective one?

Different contexts require a different size story. Be aware of which context you’re in and adjust the length/depth of the story.

4. Get Past The “COO Mindset” Problem

Every day you operate as a COO in an early-stage startup — details, spreadsheets, personalities, bills, ups and downs. But investors aren’t going to be that interested if you talk about those things. They want to hear the big picture: the vision of the future, who the team is and why you care, the key insights, the competition, and just a few key metrics. In other words, they want a CEO, not a COO.

One of the things I’ve seen many Founders have a hard time doing during fundraising is shifting their language from the detailed daily activity to the big picture. It’s understandable. They spend 10-14 hours per day as COO. It’s hard to switch.

But you have to become a CEO when you tell your story. I cannot express this strongly enough.

5. Tell Your Story For Their Partners, Too

Everyone has “partners.” People who help them decide.

Partners at the VC firm who meet on Mondays. A spouse of someone you’re trying to hire. Bosses or CFOs of the customer you’re trying to sell.

You have to anticipate their partners’ concerns and then arm the person you’re speaking to with what to say to get past those concerns. Your listener needs to be able to retell your story. And typically, they have about 30 seconds.

Arm them to be your champion. Find the language that resonates with them AND their partners. Don’t forget the second sale that happens when you’re not in the room.

6. Startup Storytelling Isn’t Like Movie Storytelling

Movie storytelling has an audience giving you two hours to take a ride on a three-act story arc. And they are curious to see what elements you include in that story.

Investors and potential employees, conversely, will give you just a few minutes, and they are looking for very specific pieces of information. You want to hit those pieces of information as quickly as you can.

The first thing people have to decide is if they want to spend time learning about your startup or not, given all the other things competing for their attention. You have to earn the 2 hours.

7. Speak In Numbers

I can’t emphasize enough how effective this is. When you’re pitching, use a number in 100% of your sentences. People who build big companies are data-driven. Think in data, speak in data.

So many people say “we’re growing really quickly,” or “it’s getting so much better,” or “this is a giant market,” or “we’re so excited and passionate.” These are wasted opportunities and distract the investor from the actual important information. They are also your editorial. Let the listener decide their opinions. It’s always more effective when they participate in the creation of reality rather than you forcing it on them.

Always use numbers when you’re speaking. Examples: We grew 40% per month for the last 6 months and are now at $100K MRR. The number of customers in our segment is about 4,000 and we landed 2 of the top 30 in the last 3 months. We have 4 employees, 2 in SF, 1 in Israel, and 1 in Costa Rica.

8. Stand Up, Move Around

When you’re telling your story, stand up, move around, point to the screen, get out of your seat, touch the images on the screen, lean against the wall when you’re pitching to the investors, be a live human. Storytelling is a full-body experience.

Embody the energy of the startup you’re creating. Show listeners that you have vitality.

Most Founders sit talking like they’re in a classroom. They just talk and wave their hands. It’s a huge missed opportunity.

This is one of many non-obvious lessons on pitching we’ve observed.

9. Give Your Best Points Right Away

Investors get five pitches per day. They say no to 95%+ of pitches they hear. They’re tired of getting pitched. You have to grab their attention right away. You have 5 minutes. No more.

Lead with the most important things. What are they going to use in their minds to decide they want to invest in you? Start with those things to get their attention, then fill in the rest of the background. If your traction is the most important thing, lead with that. If your team is the most important thing, lead with that.

So many Founders are enamored by their own stuff and they expect the listeners to hang on to every word for 20 minutes and only THEN do they give the punchline. Don’t make the mistake of building up to your punchline. Get to the good stuff right away. If not, there are 4 more pitches coming today.

10. Make It Big

Make your story believable. Make it inevitable. Make it big.

Investors, employees, journalists, and anybody who is listening to your narrative wants excitement. They want to believe. They want to be part of something that matters. And whether you build something small or something big, it will take 100% of your time. So go for something big. Tell that big story.

And you’ll be surprised that a great telling of that story will cover a significant distance toward bringing it into reality.

One of the mistakes we’ve seen Founders make (often they are from outside of Silicon Valley) is only telling a reasonable story about their startup. It’s rational, it’s manageable, it’s doable. And that’s good because you need to execute. But their stories sometimes miss the bigness that breathes unreasonable energy and momentum into a project. There’s obviously a goldilocks zone between big vision and reality. But it’s undeniable that you should think big, and have a part of your story that is big.

11. Simple Words, No Jargon.

Keep it simple, so easy that you can explain it to a five-year-old. It’s too easy to fall into jargon.

Like Square says, “Sell on the go.” Venmo, “Make and share payments.” And Evernote, “Remember everything.”

12. Draw Analogies

Draw analogies to things that the listeners already know or think they know. This could be something as simple as, “We’re like Snowflake for X.” You might even quickly give the listener several analogies. All you’re trying to do is reset their thinking from the last story they heard, and move them into the ballpark of where you are.

They might have been just listening to a pitch about a medical device, or a space company, or an enterprise healthcare company. Now they are talking to you. Give them a high-level shorthand, to bring them into the zone of where your startup lives.

Then you can get into the “first principles” discussion of the specifics of your startup. Some say that thinking in analogies is lame, and you should only think in first principles. First, that’s not true. Both are good. And second, analogies are really useful for storytelling. It’s a shortcut. A cheat code.

But be careful with the analogies you choose. You don’t want to use an analogy that’s out of date or overused, like “Uber for X.” This will signal that you’re not current, and you will get an eye roll as the listener is tired of that analogy. They’ve heard it too many times. It will get the reverse reaction to what you’re looking for.

You have to keep your analogies fresh to start the conversation with excitement. To keep fresh, you need to talk with up-to-date people. That either takes making the right online connections or living in a tech center where these things are discussed regularly. You see the same evolution of analogies with people pitching fresh ideas for screenplays in LA.

13. Let The Audience See How They Look Good for Being Involved

The easiest way to sell something is through ROI — Return on Investment, how does the listener make more money? — or EGO — ego, how does the listener look good to others.

By helping the listener understand their benefit in these two ways, your story will be more effective at drawing people in.

14. Have A Great Origin Story

How did you come up with the idea? What is it about you? When was the moment where you came up with the idea? Having a good origin story helps humanize you and the idea. A great origin story is shockingly effective at galvanizing resources and momentum.

Here are some classic examples:

Google: “Two Stanford PhDs with a patented algorithm interested in the math problem of searching files.”

Slack: “It was just an internal tool we built for ourselves, and now we’re letting other people use it.”

Uber: “I was standing in the rain in Paris and waiting 20 minutes to get a cab.”

eBay: “My wife wanted to trade Pez dispensers, and it really started to take off with beanie babies.” (This turned out not to be true. It was made up by their PR person. But it was a great origin story that they used for about 10 years before it was revealed it wasn’t a true story. The story was very effective at explaining a lot about eBay.)

15. Don’t Always Start Your Narrative With “The Problem”

Most people will tell you that great pitches always start with, “What’s the problem?” I think this is bad advice for Founders. Most startup stories aren’t told best that way, despite good movie stories being told that way. It’s not the same thing.

I often suggest to Founders that you are better off simply describing a change investors will see in the world as a result of your company.

What was the problem Facebook was solving? Or Twitter? It wasn’t a problem. Rather they had an opportunity to create a new experience, some change in the world. The biggest companies create a change in the world.

The problem with talking about the problem is that the listener might not agree with you about the problem and they’ll get hung up before you can get to the positive change you’re going to make in the world. The listener might disagree that it’s a problem at all, or the size of the problem, or the immediacy of the problem, or they might use different language to describe it to themselves, so they will get hung up.

16. Four Narrative Templates

Founders who get storytelling right during fundraising often run one of four narrative templates. You can either choose one of them, or you could use more than one in a pitch if you’re skilled about it.

- Industry Story: Competition, industry changes, and where your company fits in. This is typically how an investor looks at the world.

- Customer Story: How a customer finds and experiences your product. Making it about real people makes it tangible.

- Hero Founder: Why you’re special and how you will bring something new to the world.

- Company Journey to Insights: The story of the pivots and learnings of your company that got you here. We tried X, we realized Y. We tried Z, and had insight A. Now we do B and it’s working.

Most Founders choose #3, but they chose it because they like to talk about themselves, not because it’s the most effective. Don’t be that person. Choose wisely. All four templates are powerful for explaining your startup.

If you pick #4, don’t give the listener a chronological account of what you’ve done. Recounting your experience since you began your startup is probably not that interesting. What’s interesting is the key 1 or 2 learnings that have led you to insights that are the foundation of your current and future business.

17. Talk About Your Past Proof Points AND Your Future

I’ve seen many Founders only talk only about what they have accomplished so far — their past. That’s great. That’s where we get the traction numbers and proof points from, so we know you’re not crazy.

But the fact is, an investor is buying your future. So, also talk about your future in an honest way, and get them excited.

I’ve seen some Founders only talk about the future with rosy projections, but they don’t anchor that excitement in proof that they can execute. You have to do both.

18. Use Visuals. Show, Don’t Tell.

Visual images can be 5X more effective at communicating information than oral communication alone. That’s why Founders have been creating business plans and decks for 50 years. These charts, graphs, images, numbers make their dreams more real, more tangible, and the listeners absorb information much faster.

Make a good deck and Brief. Use the whiteboard. Draw on paper. Then point to those visuals during the storytelling. Point to what you mean in any given moment. It’s easy to do, and it’s quite effective at bringing energy into the storytelling.

If you’re going to a VC firm, ask if there is a whiteboard in the room where you will be telling your story. You’re going to want to use a whiteboard.

If you’re having a meeting at a coffee shop, bring 2 pieces of white paper and a pen in your pocket. Draw images and write on the paper during the storytelling. Like a whiteboard in your pocket, it’s significantly more effective for communication.

19. Make an Effective Deck

If you’re thinking about a deck, which is one piece of your storytelling, here are some benchmarks.

Think 10 to 14 slides in the main deck with 10 to 40 slides in the appendix to quickly answer specific questions live.

Take great care with the titles of your slides. They are the core structure of your story.

Try to communicate one concept per slide. You don’t need any extra elements on the slide except for the concept. You don’t need your logo on every page, you don’t need colored lines underlining the title near the top. You don’t need stock photos. Listeners don’t need any of that. Less is more.

Use giant font size. We’ve seen thousands of decks, and I’ve never thought once, “Wow, that font size is too big.” But I’ve thought the font is too small in about 80% of decks. Don’t use a font smaller than 24 pt in a deck, and 144 pt font is not too big.

Use charts and numbers when you can, and make sure they go up and to the right. Some Founders, if they don’t have charts that go up and to the right, they don’t include charts. You have to include charts. That’s part of the story of growth in these startups. You need at least one chart, if not three, showing up and to the right. That’s just part of it.

20. Make A Beautiful Deck

Obviously, having a fancy deck, if it’s too fancy, is going to be perceived by me and many others as being a waste of time. But having at least a quality deck, not a fancy deck, but a quality deck, shows that you like to do things right.

21. Your Decks Will Always Be Changing

Your deck is always going to be changing up until minutes before you pitch, and you might end up with 50 different decks during a fundraise.

No need to panic. That’s the way it always is. It’s ok to make changes.

And when you’re done pitching, you’re going to get into your car, sit there on your laptop and make more changes for the next one. That’s not unusual or wrong. You should actually be doing that.

In fact, for every person you pitch, you might end up with a different deck. And you can store it, August 21st, NFX, August 28th, Sequoia, so that you can keep track of what you pitched to whom as your deck evolves. Each investor has companies where they made a high return, or particular language they use to make sense of the world, and your decks would be smart to include those companies and phrases to help anchor the investor.

After I was done raising money, I would end up with 50 slightly different decks and that’s normal. It’s ok. Your deck should always be changing and adjusting. You can also make as many BriefLinks as you want on your account for that very reason.

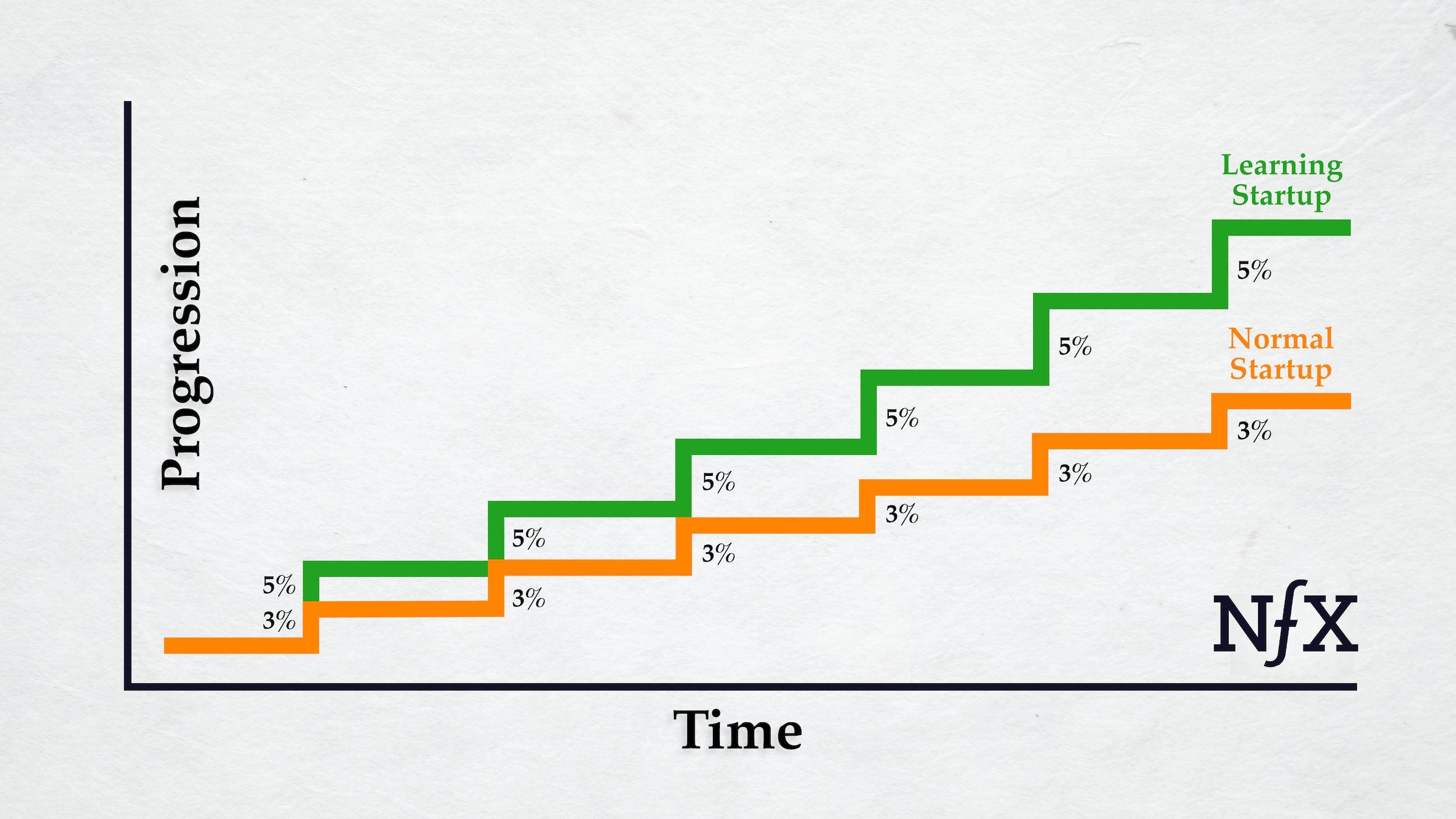

22. Always Ask the Listener Something That Will Help Make You Better For the Next Pitch

VCs are free consultants. They’re smart and they get to see more than you. They’ve probably seen competitors of yours that you haven’t. Don’t just try to raise money. Try to raise your game. Use the meetings as learning opportunities.

We’ve written a whole post about this subject here with 40 questions to ask VCs, but here are a few questions you can ask investors and other listeners to your story.

“Is there anything you like about this business?” Get them talking positively about your business. They might highlight something that you can emphasize in another telling.

“How would you describe this to your partners?” This causes the investor to boil it down to the essence of what they’ve understood. If they’ve got it right, you’re going to learn an elevator pitch that could be very helpful to you. If they’ve got it wrong, you’ll have a chance to correct them.

“What do you see that concerns you?”

“What opportunities do you see to make this a better business?”

“What do you think I might be missing that would cause this to fail?” They’ll use their pattern recognition to help you see through your own blind spots. And it will also reveal to you how they’re going to think about the risk involved with investing in this and how it compares to other startups they are considering.

We often forget that investing is not just about whether you have a good business or not, or whether your team is good or not. But, is your team better than other teams? Is your business better than other businesses?

You need to ask open-ended questions so that you can find out where you rank. If you’re not at the top, then you need to find out why, and then go change parts of your business or change the pitch so that you can move forward with the next investor.

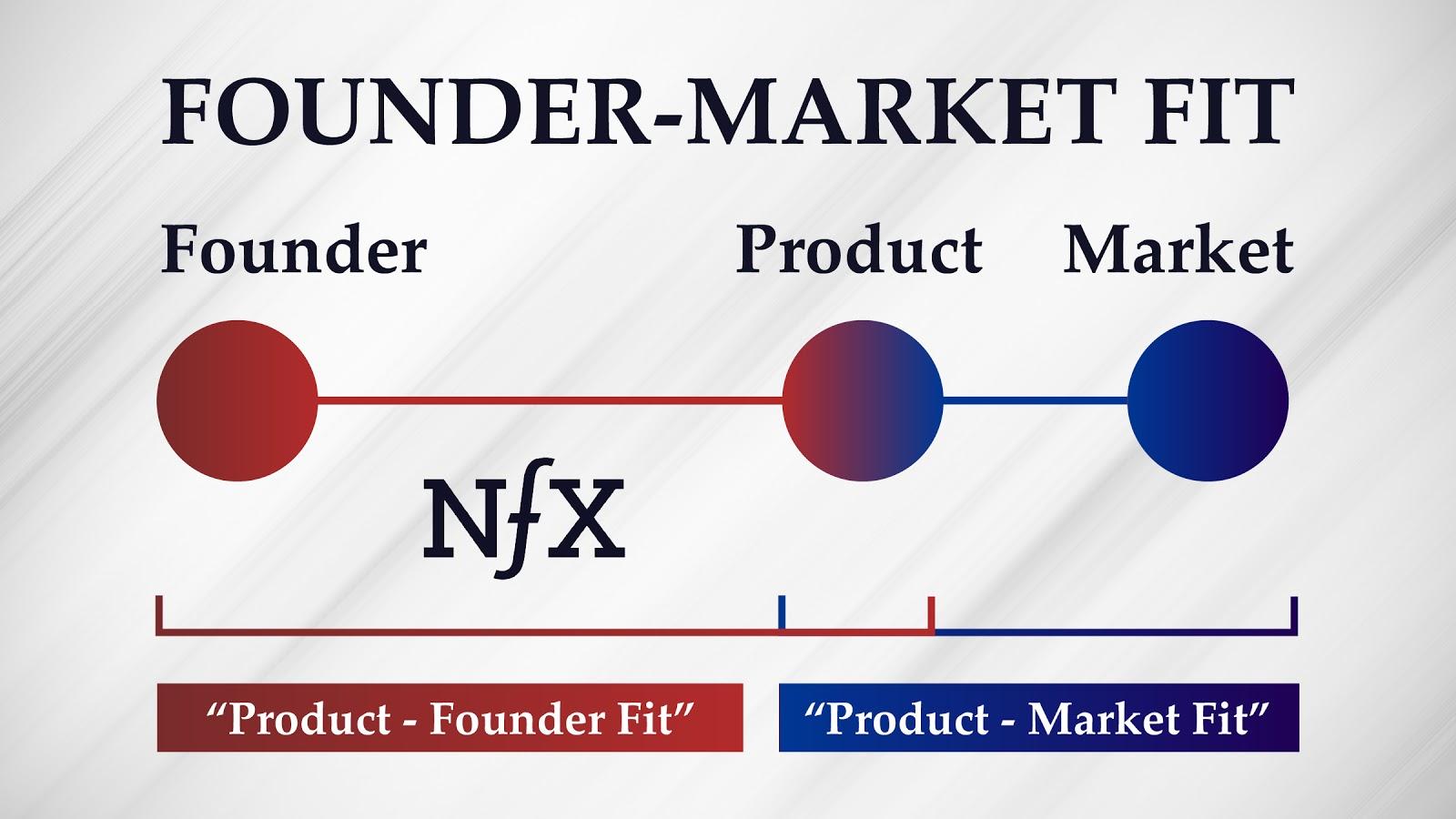

23. Align Your Story Elements

Lastly, I want to emphasize that for your story to be eaten up by investors, customers, employees, and for your company to be big, you need to line up all the elements of your story, starting with:

- Who are you as a Founder? What’s your background?

- What’s the origin story of the business?

- How’d you come up with the name and the logo?

- Who are the customers/users?

- What do you do for people? What does the product do?

- How does the product look and feel?

- How do you make money?

- How big is the market you’re going after?

- What future are you creating?

All that needs to line up in one cohesive narrative. When you line that up, backward and forwards, starting anywhere in the line, it’s a great story you can tell quickly and powerfully, and you’re already a substantial way toward creating a big company.

In Closing

You are the Chief Storyteller. To be a world-class Founder, you need to be great at this. Study it, practice it, enjoy it.

Don’t let the world form your stories, let your stories form our world.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.