A Founder’s mental approach is the greatest point of leverage in a company’s success or failure. We’ve seen time and again: the way you think determines how you do.

The best Founders we work with know that startups are a mental game, not just a series of tactics for you to execute.

A key Founder skill for navigating this mental game is learning from the lived experience of others. So we’ve compiled a collection of mental models from our experience building 10+ companies valued at $10 Billion+.

Today, we’re releasing 48 mental models we’ve found useful and want to pass onward to Founders:

Here’s the link to Part II of this article with our mental models for Idea Generation, Product-Market Fit, Fundraising, Growth, Defensibility, and Network Effects.

Founder Skills

Something that often goes unobserved is that world-class Founders embrace a common set of skills. When we see these skills in Founders, we take special notice.

Below are 12 mental models for sharpening these Founder skills – there are more, but this is a good list to start.

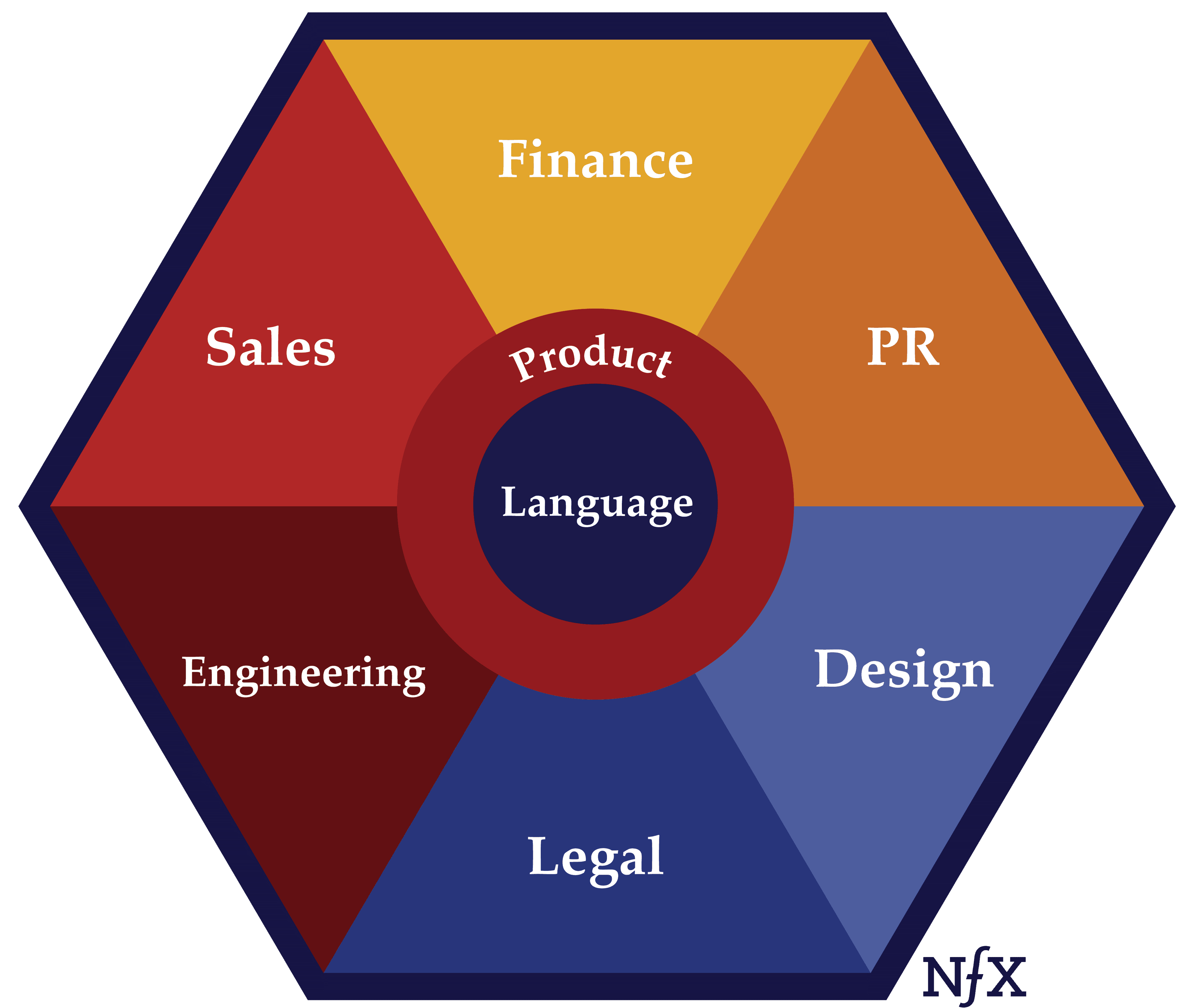

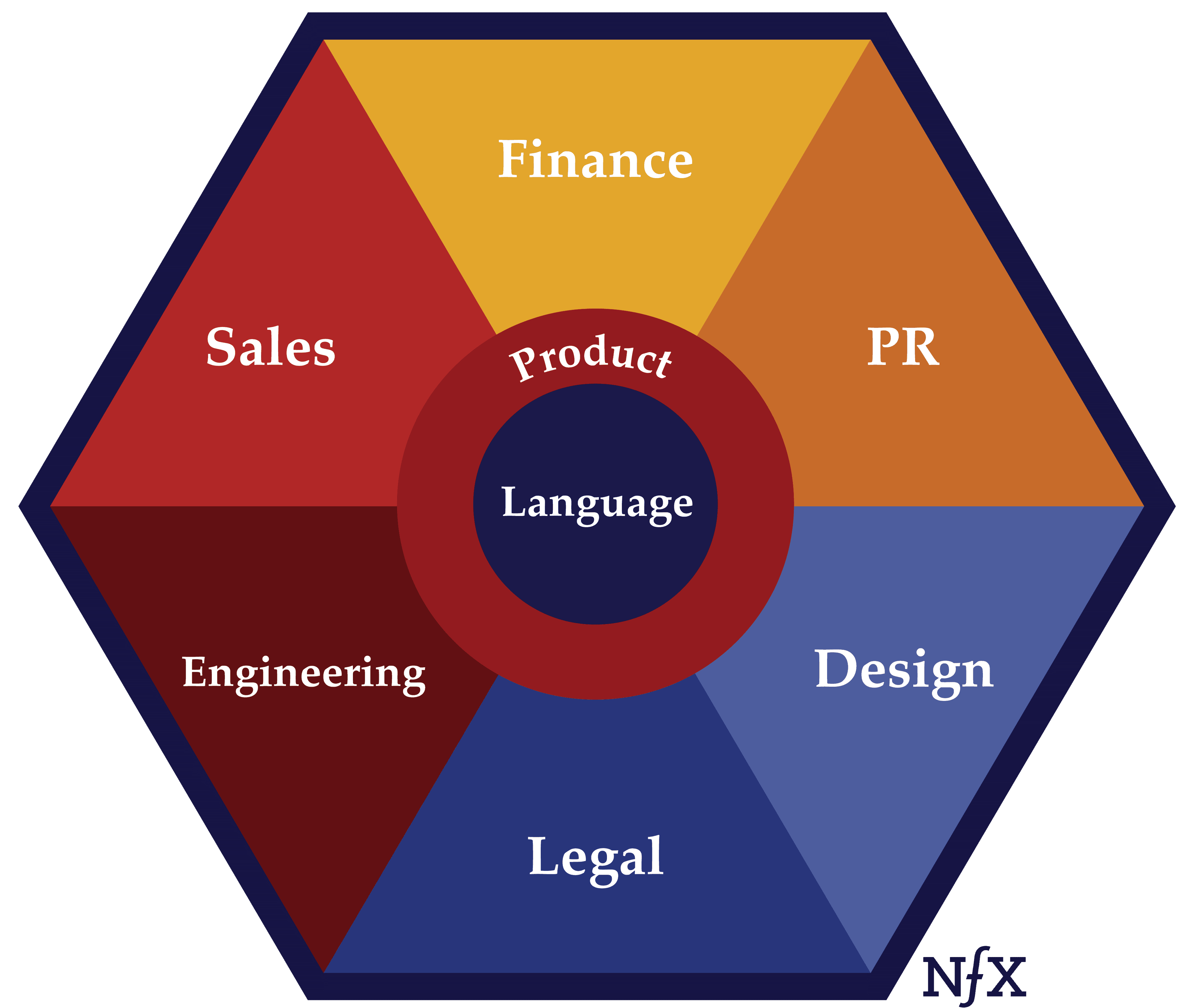

1. Start with Language

“Language is at the core of your company, even before product.”

Most people say “We’ll build a product, and then put language on it to explain it to people.” This is backwards.

Our reality is structured by language. Even if you don’t have a product yet, you can get a long way just with the right words. Language is the center of your company, it’s not something you add later.

The question is: What are you to your customer? For them, what’s the promise of what you’re doing? That is communicated with language.

2. First-Rate Product Intelligence

“Great product people must believe in their product — and be very critical of it — at the same time.”

The best product builders are both filled with positive faith in the product AND are ruthlessly self-critical. They have enough belief to fully commit themselves to the creative endeavor. At the same time, they have the strength of character to see exactly how their product is really quite lousy, and how it could be so much better. You have to have a strong character to keep the pressure on.

As F. Scott Fitzgerald said, “The test of a first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time, and still retain the ability to function.”

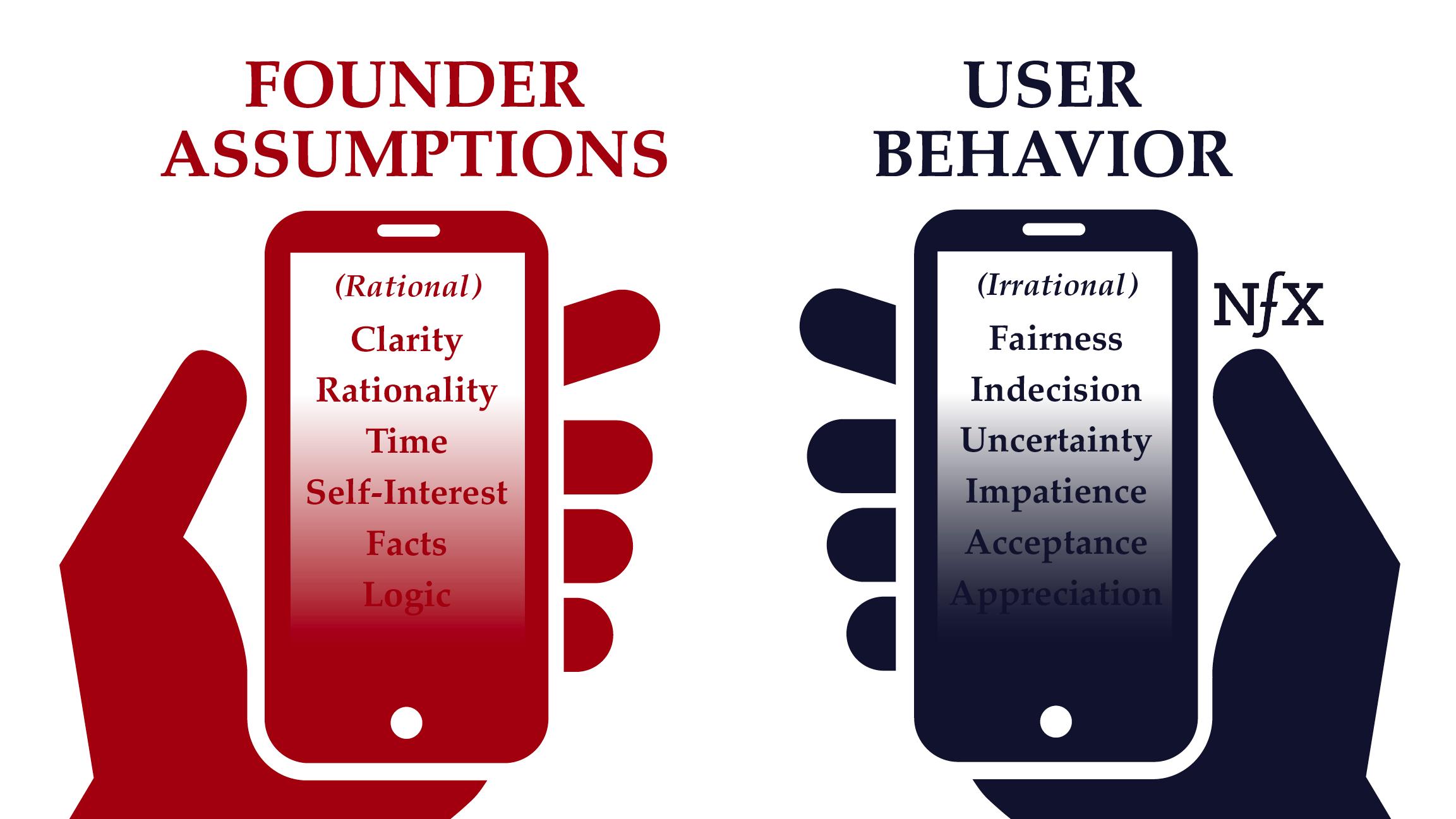

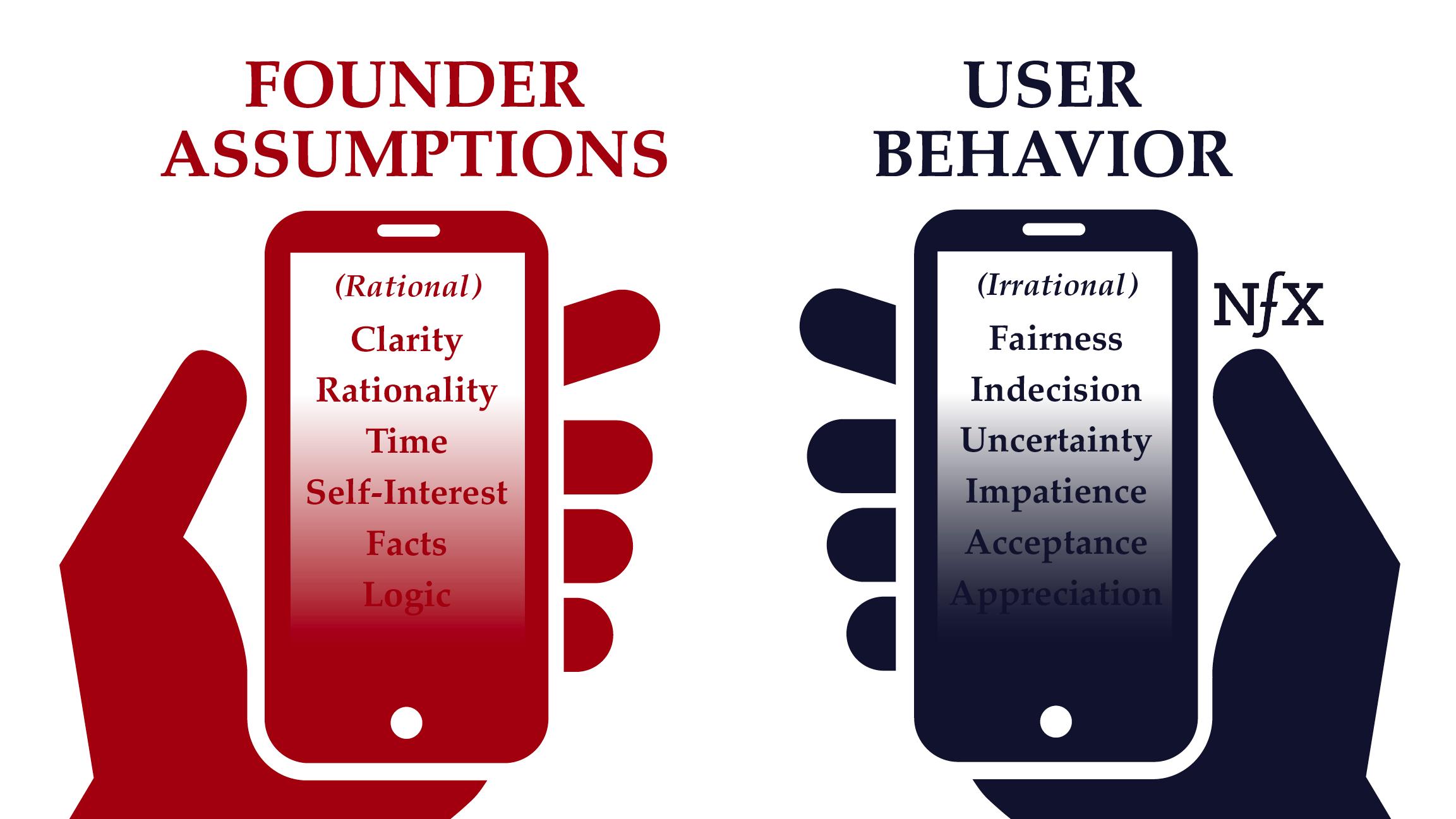

3. Rational Prison

“Founders consistently make rational assumptions about what their users want that are just not true.”

A big mistake many startups make is they don’t work enough on their user’s mental model of their product. Because we all think we know how our users behave. It turns out, we don’t.

Founders must accept that we are prone to living in a “rational prison” — we know our own products so well that we end up making rational assumptions about what our users want that are just not true. It’s a real skill to avoid this mental trap.

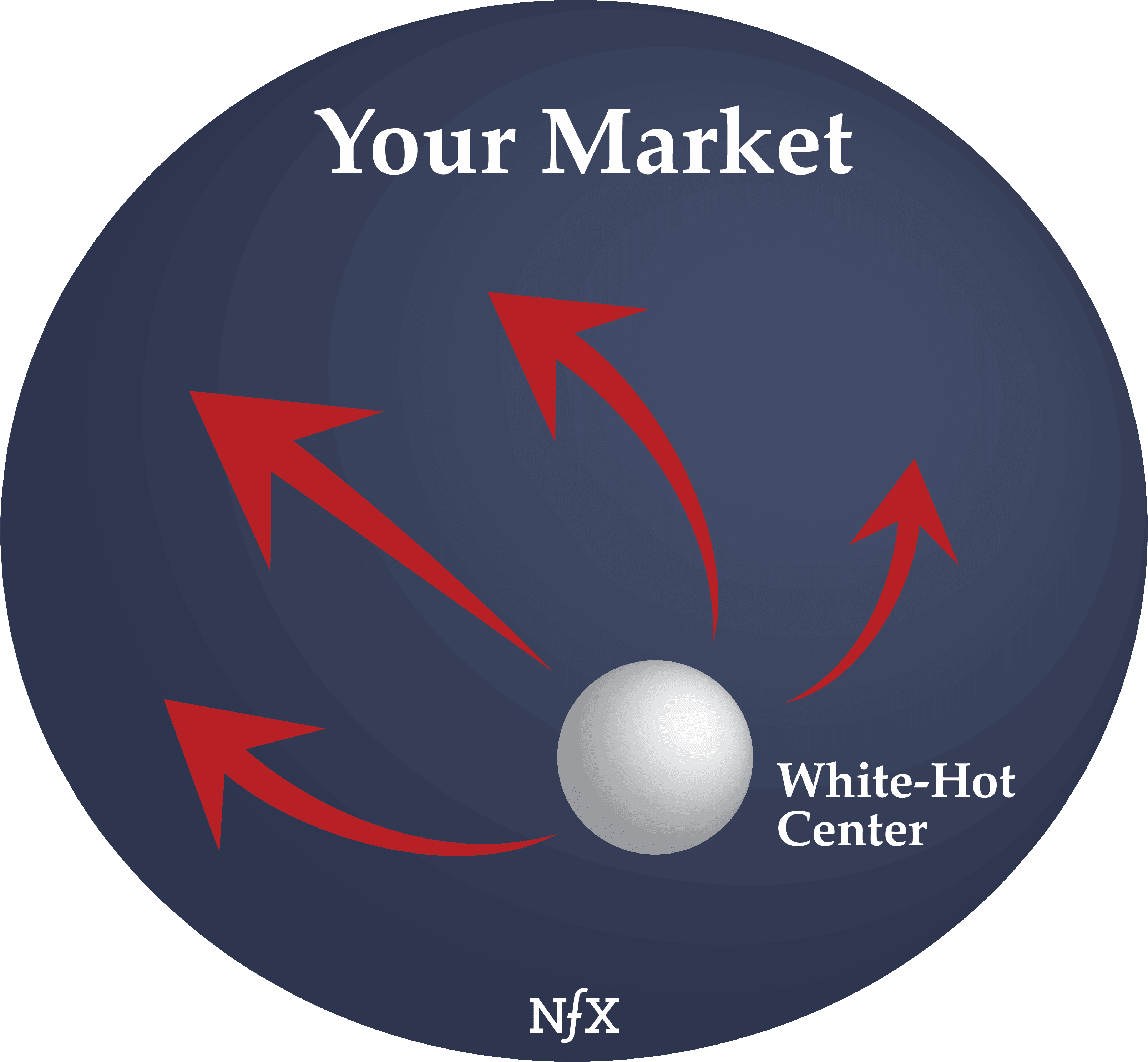

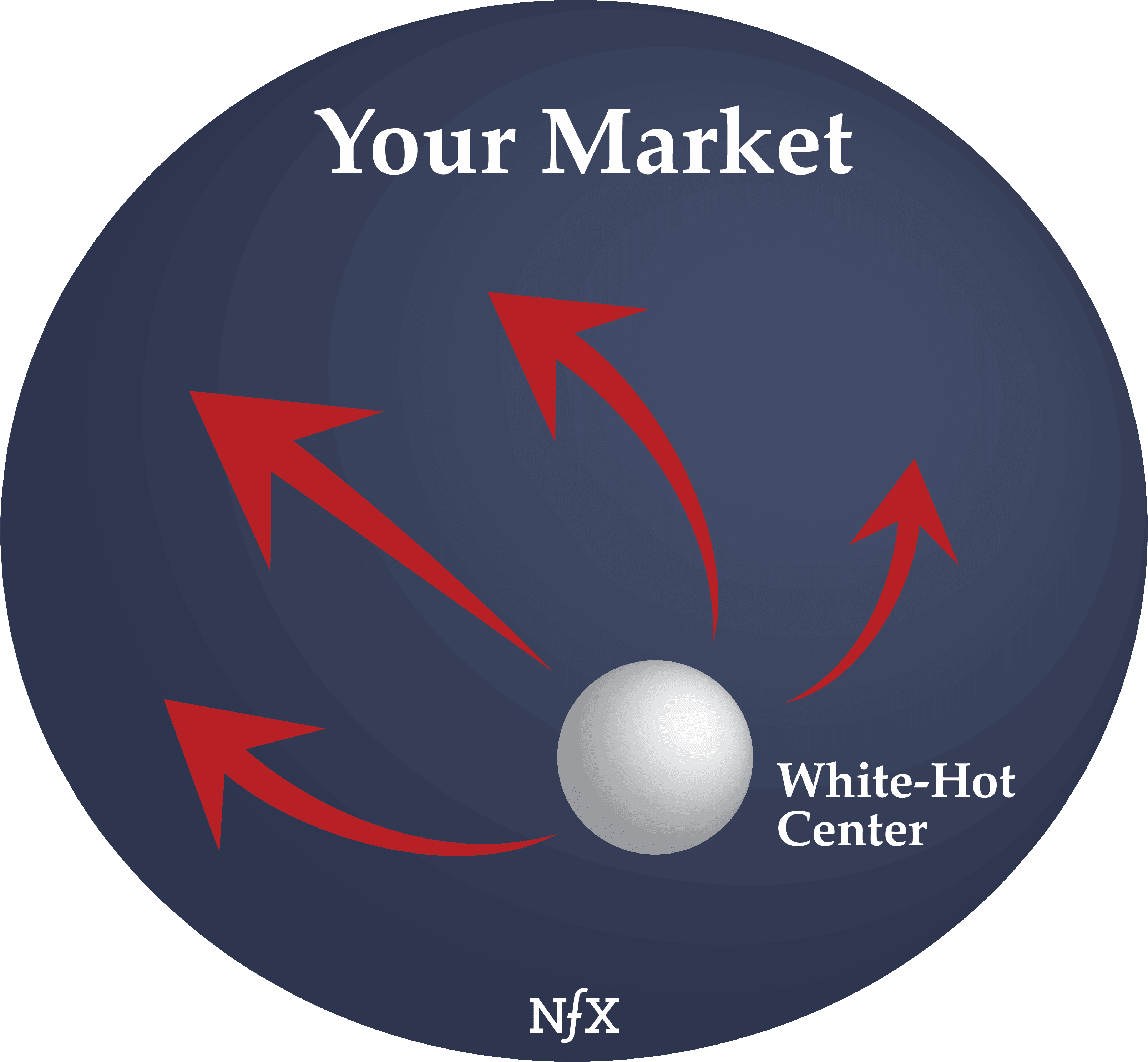

4. Start With The “White-Hot Center”

“In every market, you can find a subset of people who are much, much hungrier for your product. Start with them.”

There’s going to be an irregularity in every market you’re targeting. If you look rapidly and smartly enough, you will typically be able to find some subsection of people who are much, much hungrier for your product — a small group within your potential customer base that’s highly engaged/motivated. People who are burning white-hot for your product.

Sometimes those people aren’t necessarily who you thought your target customer was. In fact, they are often what we call “non-utilizers” — people who perhaps weren’t using anything before, but for whom your product enables something transformative — typically a) to get into business and start making money, b) to make more money than they were before, c) to look good to others, or d) to accomplish some other goal that they couldn’t if your product didn’t exist.

Once you find this white-hot center, you’ll be surprised at how fast it can bleed into other segments from there.

5. Go Full Speed

“Speed is your number one advantage. It is both the #1 and #2 indication of your eventual success.”

Speed is a formula for success because:

- Rapid product beats the competition

- Rapid results build team morale, leading to even more results

- Rapid results generate more interest (from the press, customers, prospective hires, etc.)

- Rapid results increase valuation

You could beat any grandmaster at chess if you could move twice every time he moved once. Speed gives you the edge. As a benchmark, you should be conducting 20-100 experiments per month at a startup.

6. 11 of 13 Rule

“There are 13 ways of doing anything. 11 of them will work. Just pick one and do it.” – Dennis Hightower, Former President of International Consumer Products, Disney

The best Founders avoid over-analyzing. At a startup, you don’t have time — and the result will most likely be marginal. Pick a way and do it. Be consistently decisive.

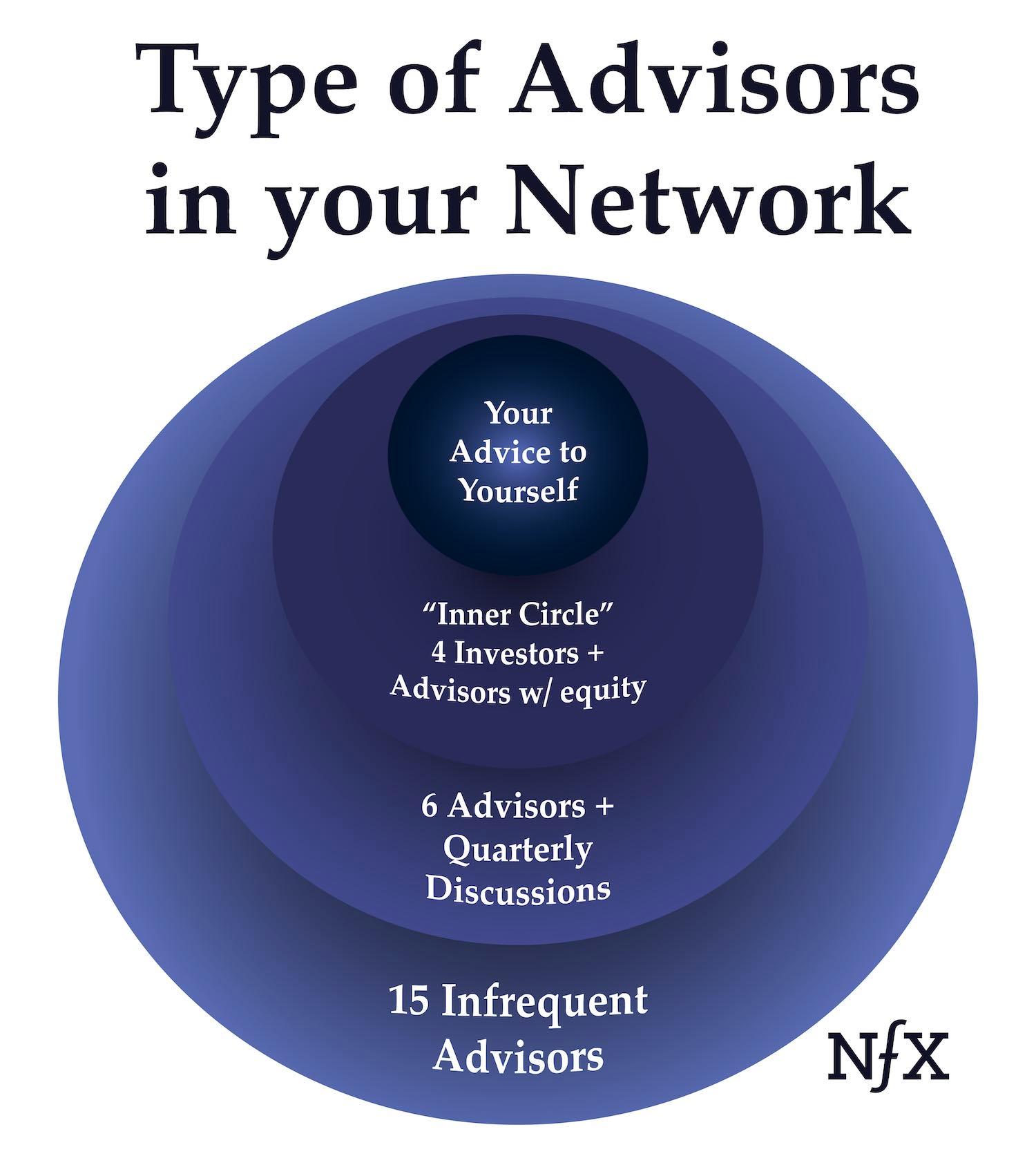

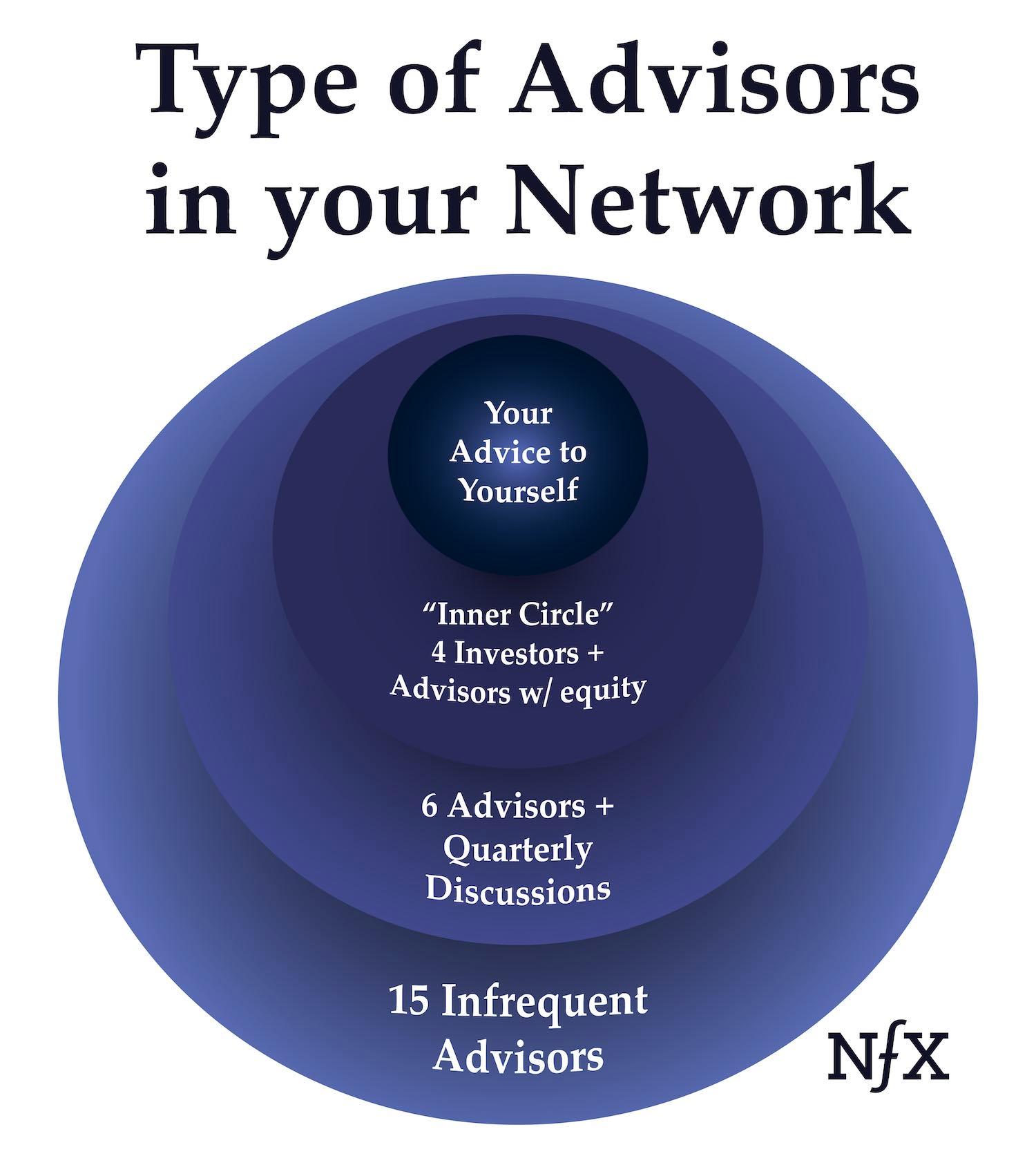

7. Taking Advice Is A Skill

“To think well and to consent to obey someone giving good advice are the same thing.” – Herodotus

Your network determines the quality of advice you receive. Cultivate it properly. You need to be brutal. Judge the quality of your surrounding network nodes and assess whether you should take advice from them.

Mapping Out Your Advice Network

The best Founders intentionally build their advice networks, making it an unfair advantage for them and their company. Use our NFX worksheet to map out your network of advisors.

We’ve prepared the worksheet in Google Docs, Notion, and Evernote. Enter your email below and you can select whatever source works best for you.

Here are four key areas to navigating advice from your network:

- First, choose carefully who is in the network of people giving you advice.

- Second, manage the psychology of advice — both your psychology and that of the advice givers.

- Third, differentiate the types of decisions you are trying to make when getting advice.

- Fourth, learn judgment about good advice vs bad advice.

In this NFX whiteboarding session, James Currier, 5-time Founder and General Partner at NFX, explains how to map out your advisor network from your inner-circle to your edge nodes and how to think about the advice you receive as a Founder.

8. Reality Distortion Fields

“Rare Founders are forces of nature who see what others do not. They convince others to join their reality even though it’s not, nor ever has been, realistic in the ordinary world.”

These “reality distortion fields” are necessary for the extreme sport of startups.

But here’s the danger: superpowers cut both ways. They may spur meteoric growth, but without enough self-awareness, they can just as easily lead to a startup’s undoing. From Uber to Zenefits, we’ve seen this play out time and again. You might have the ability to see the future, but if you don’t learn to see beyond your own B.S., you can destroy or impair the very company you’ve worked so hard to build.

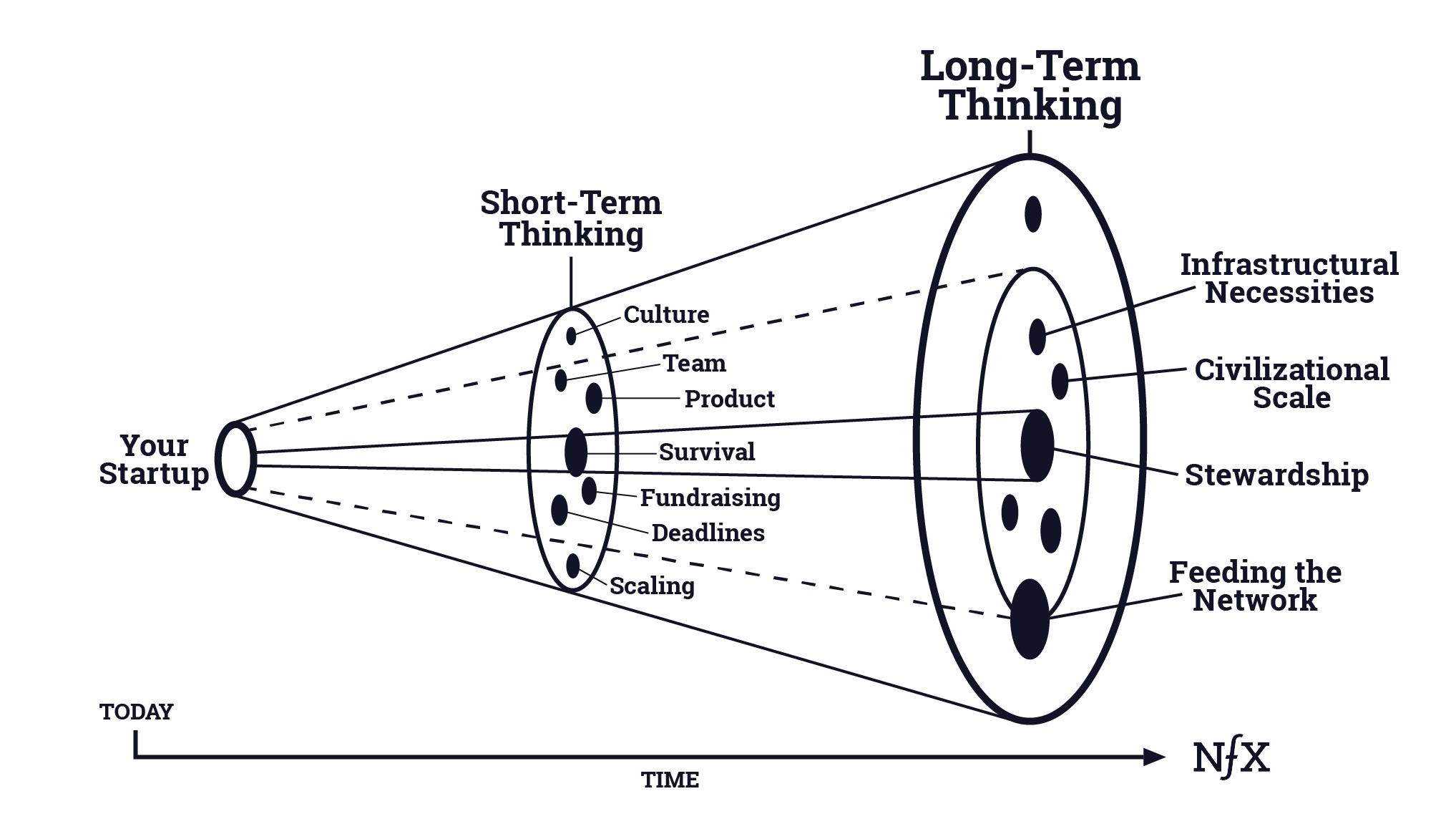

9. Paradox of Genius

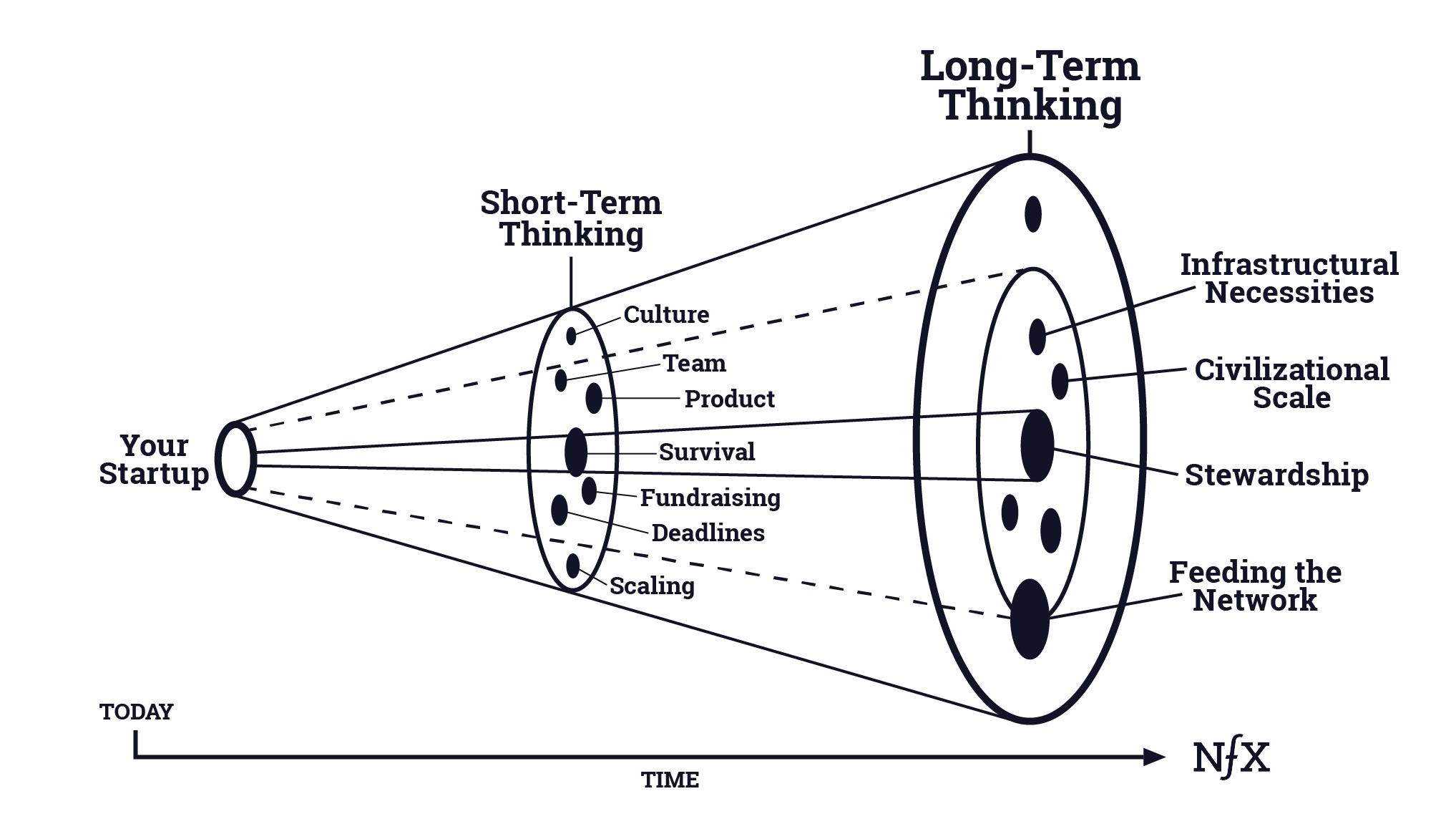

“Great Founders are rooted in the here and now but are also obsessed with what will endure 10 or 50 years from now.”

There is a very immediate now-oriented framework for startups — which is often that the startup is battling for survival. But if you can somehow operate on a longer-term perspective, you have an advantage because nearly everyone else is completely short-sighted.

What happens when you take a longer view is you think less about things like competitors, and you think more about civilizational scale, infrastructural necessities, and feeding the network. You focus on all of these other things that, in the long run, will be more important, and may liberate you in having an approach that others do not.

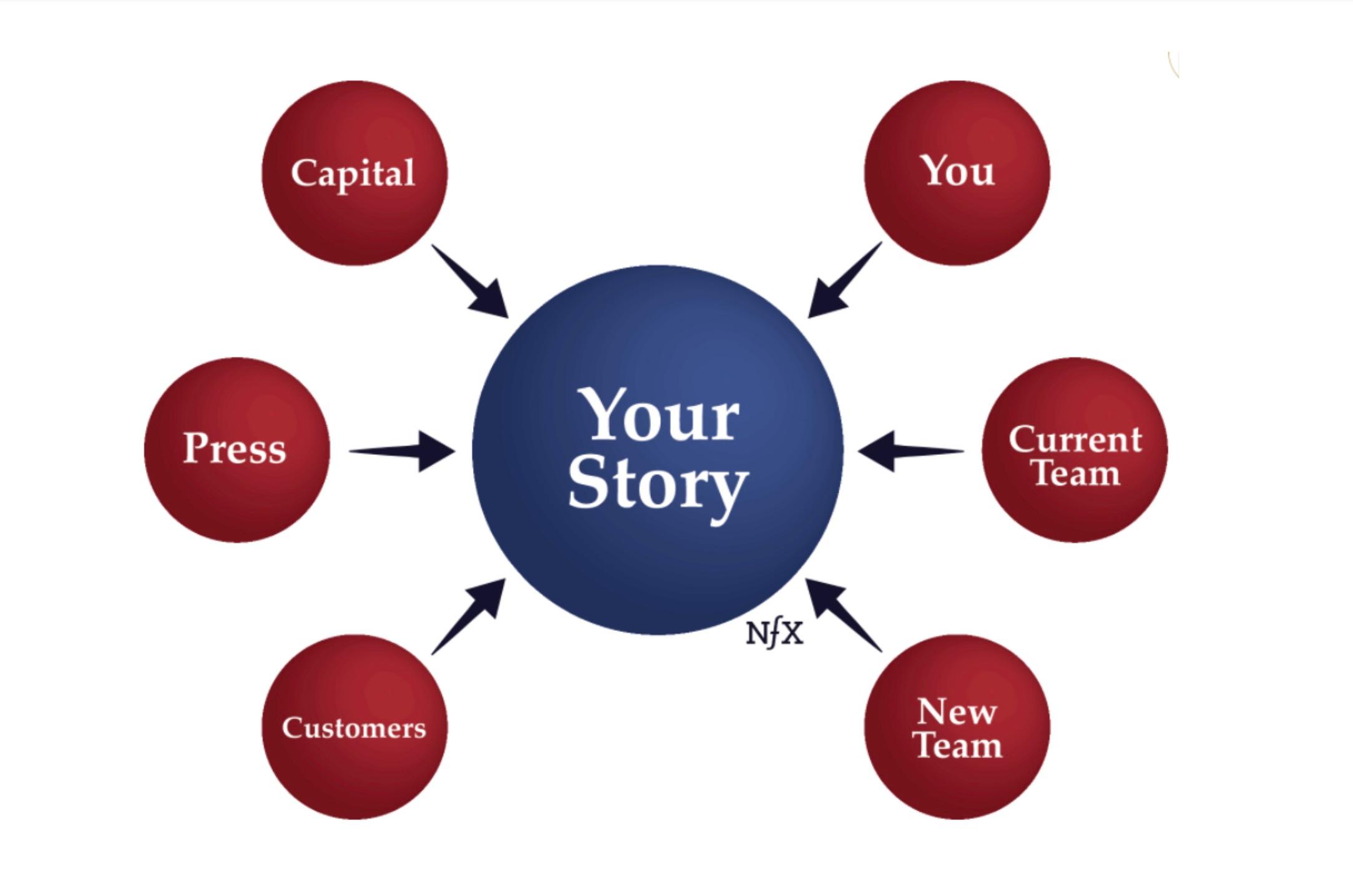

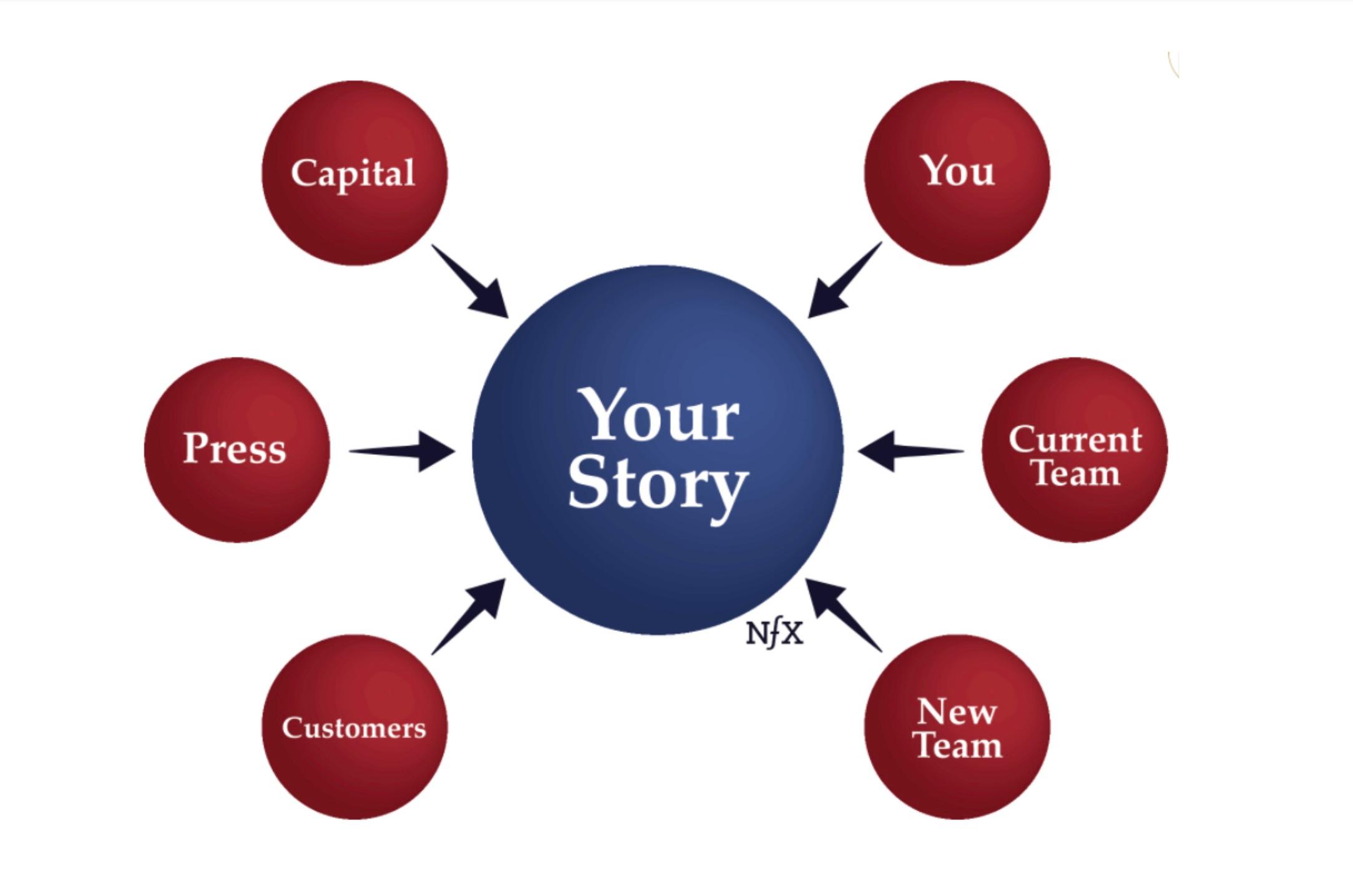

10. Storyteller-in-Chief

“Storytelling is the ultimate skill for resource building — capital, talent, customers, press, and more.”

Telling your story in compelling ways, and adapting that story to the audience and the moment, is your most important job. It’s what gets you all the resources to build your company.

Your story is a narrative that everyone wants and needs to hear. It tells your customers what you can do for them. It tells your investors what they’re investing in and what they can brag about. It tells your employees what they’re getting involved with — why they’re turning down a whole lot of other opportunities to join and stay with you.

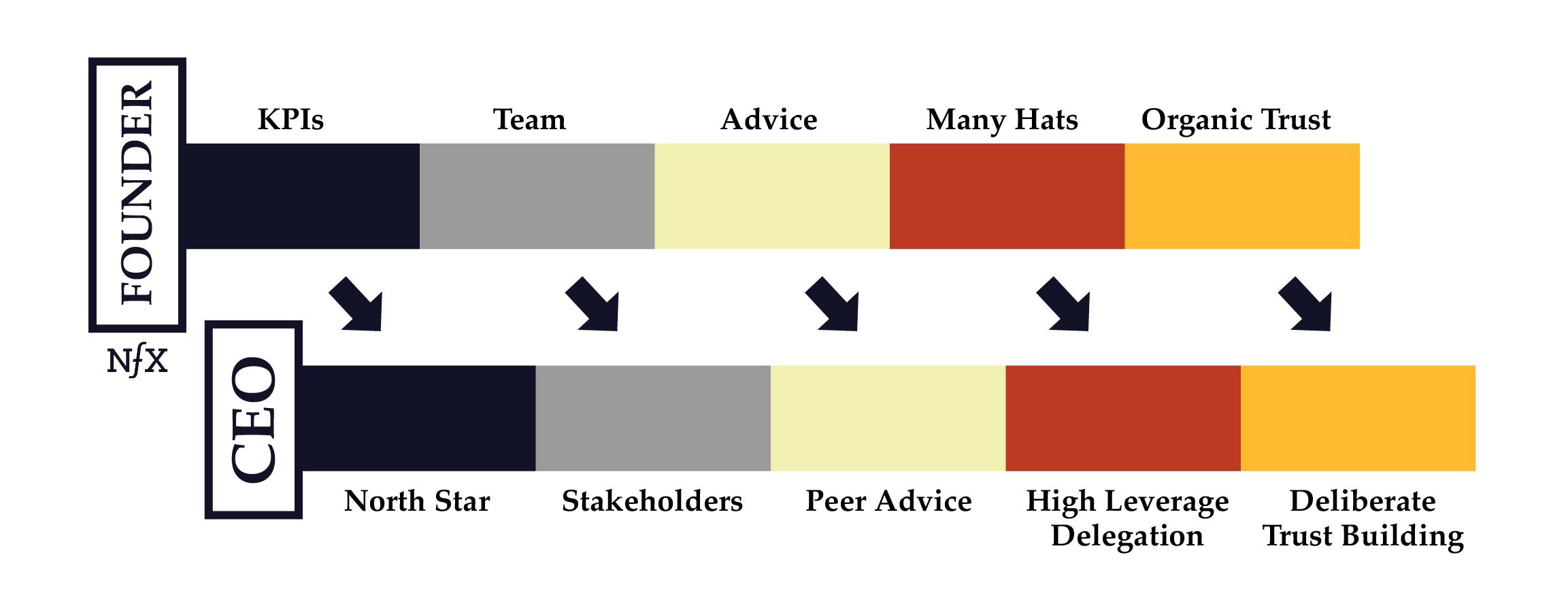

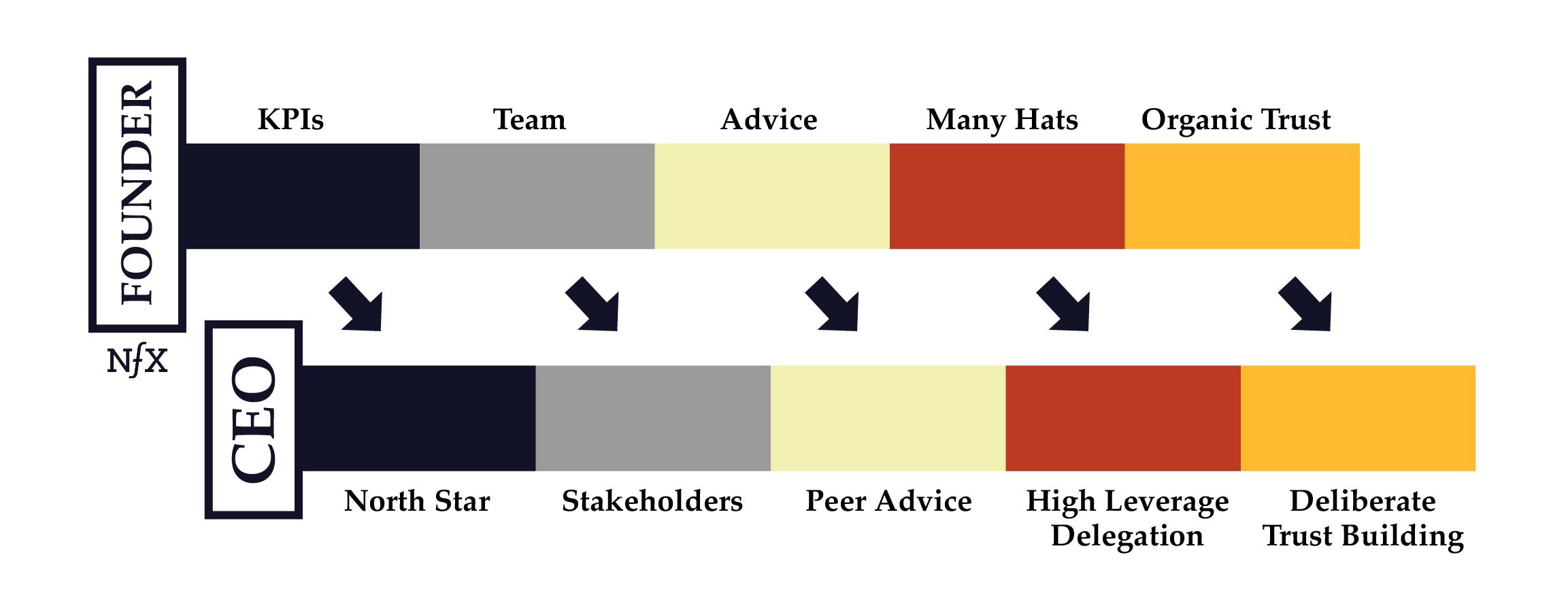

11. Founder-to-CEO Transition

“Every Founder that reaches real scale must navigate two distinct phases: (1) Founder Phase and (2) CEO Phase.”

- Phase One is all about building a great product and finding clear product-market fit.

- Phase Two is about building an enduring, sustainable company.

There are 5 mental shifts for Founders transitioning to the CEO phase:

- KPIs to North Star

- Team to Stakeholders

- Advice to Peer Advice

- Many Hats to High Leverage Delegation

- Organic Trust to Deliberate Trust Building

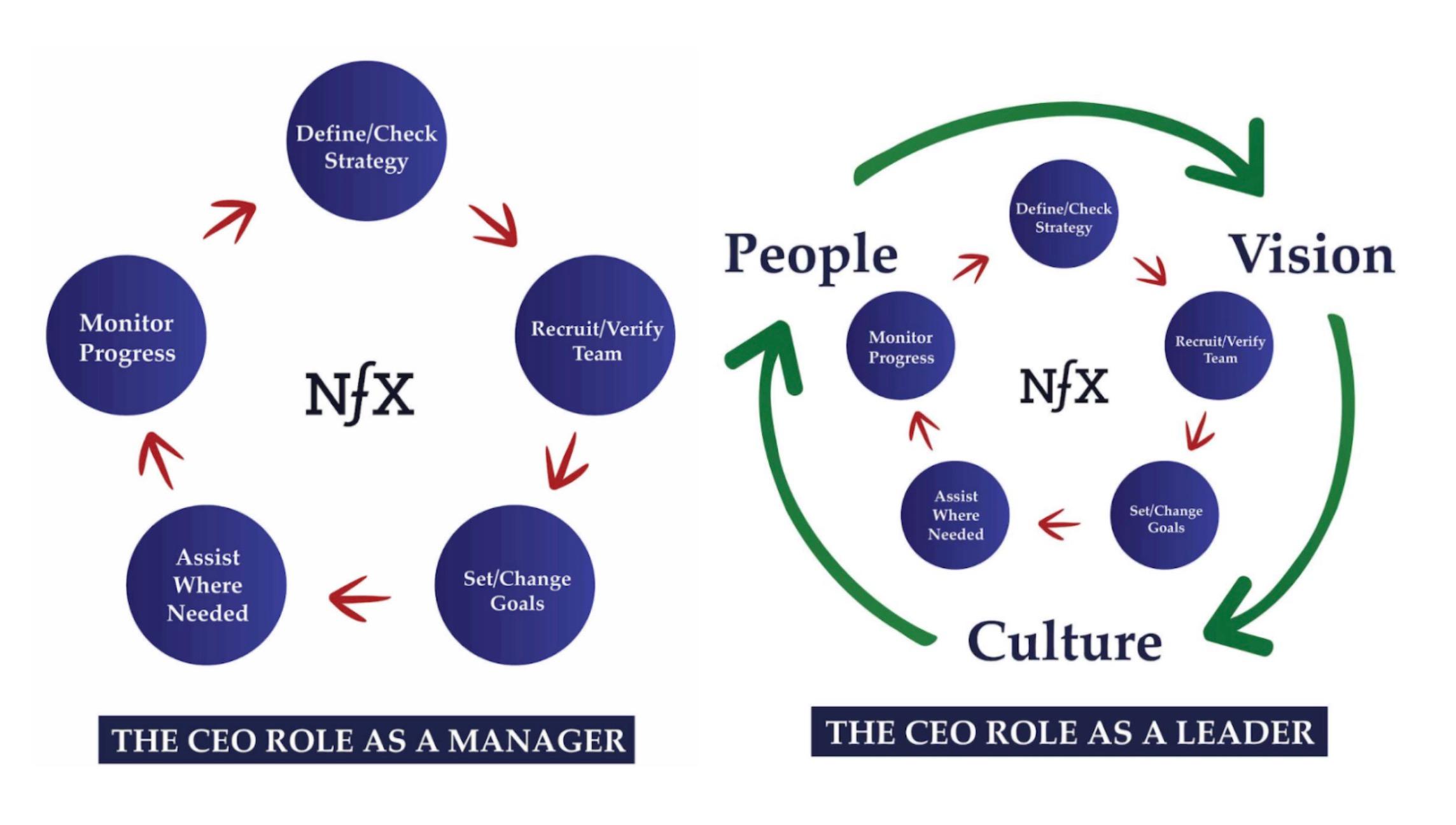

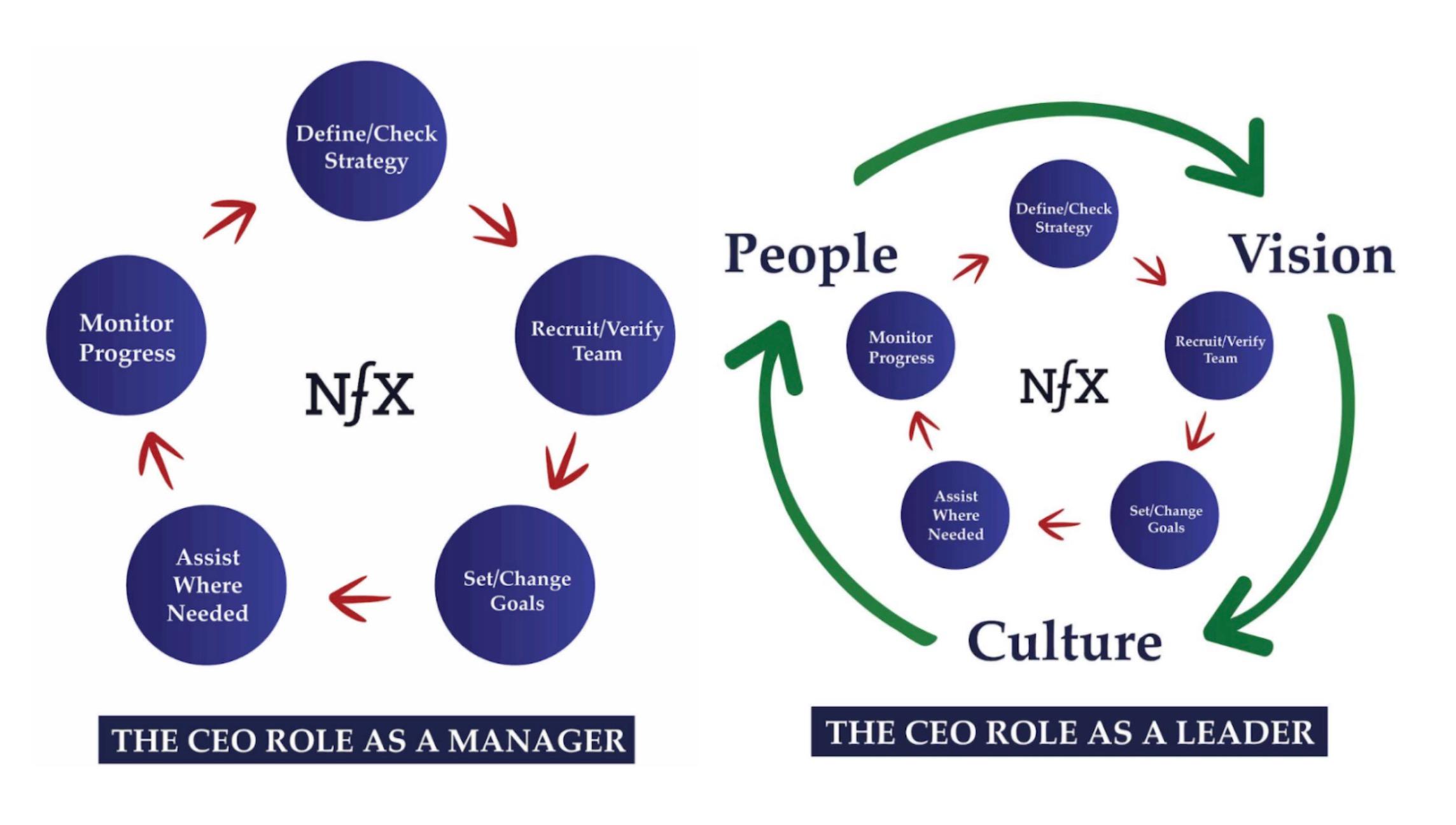

12. Manager + Leader = CEO

“Startup CEOs have two different tasks that may seem like one but are actually different – being a manager and being a leader.”

Being a CEO is more than just management. While that core of management is important, and takes a lot of your time and effort, it’s also important not to get so busy and caught up in that cycle that you lose sight of other big-picture responsibilities.

The big-picture leadership responsibilities — driving people, vision, and culture — are effectively ‘orbiting’ the core CEO role as manager.

What Makes A Strong Startup CEO

This framework is the essence of a CEO’s responsibilities in leading their company. In a large company, this cycle should be performed at least monthly given today’s fast-changing world; in a startup? Probably weekly. That’s the pace you want to aim for as a CEO.

Decision Making

The best Founders understand that clarity of thinking and decisiveness gives them an unfair advantage. For making decisions, taking risks, and deviating from the norm, these 4 mental models are especially useful.

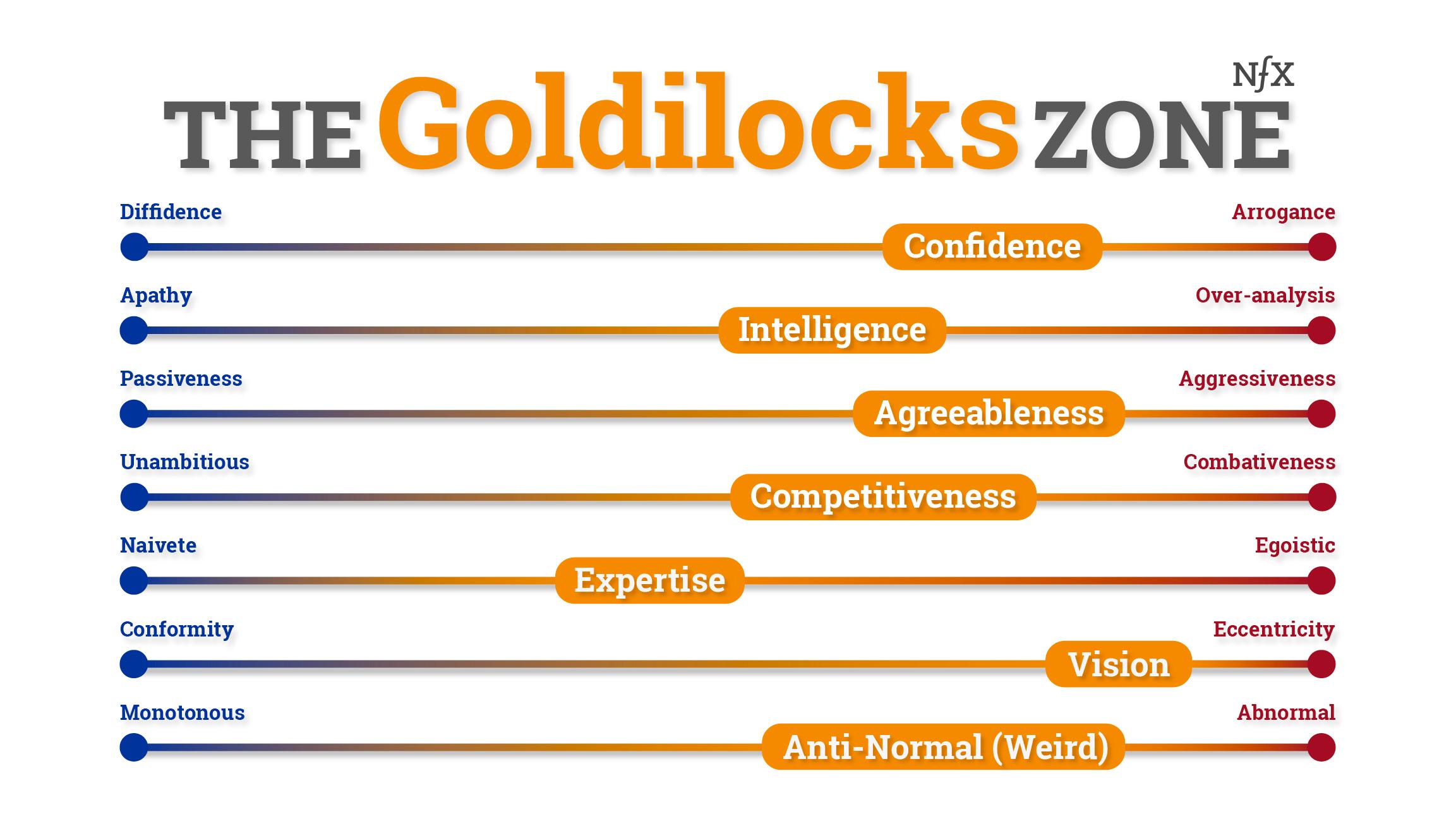

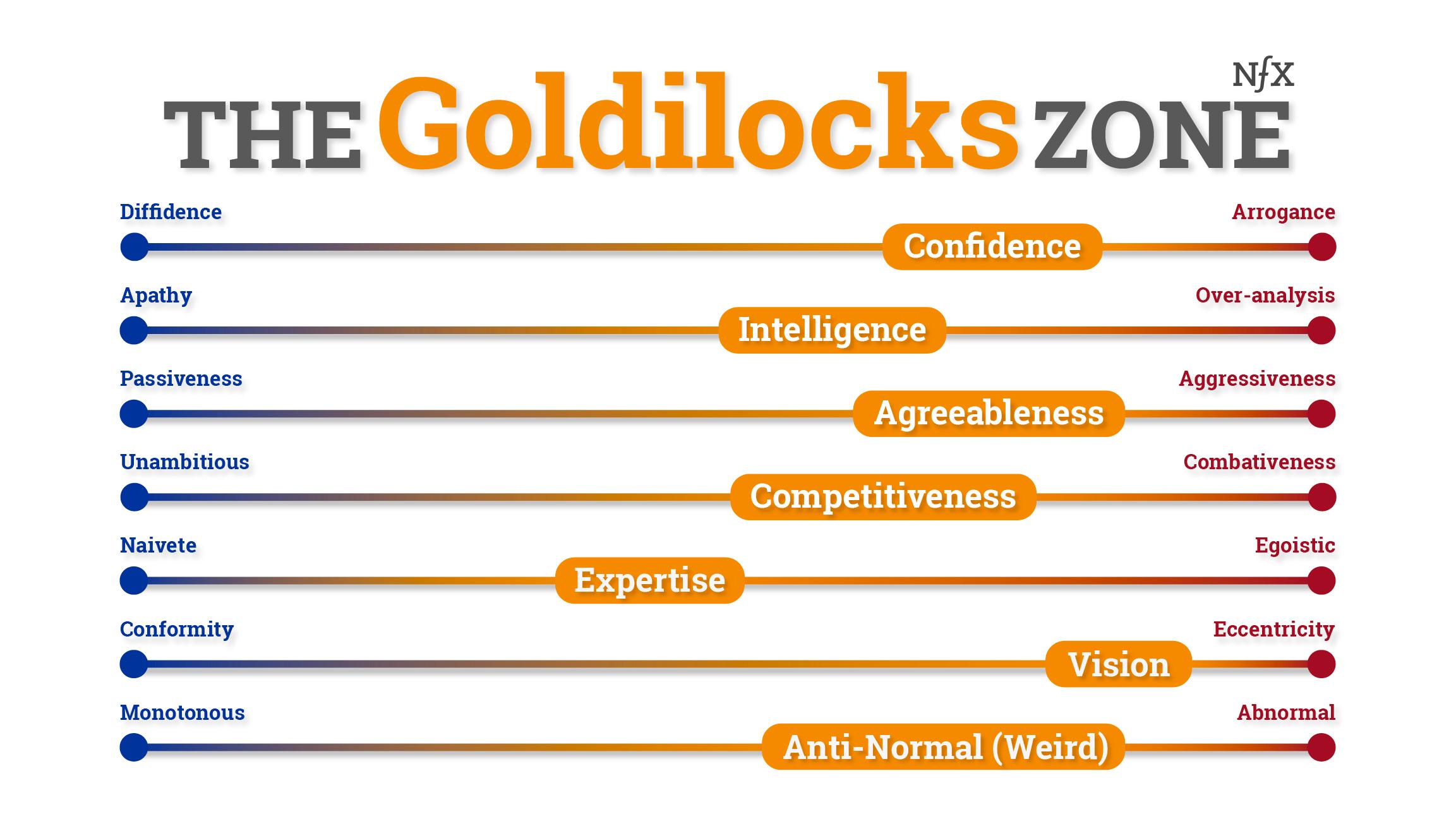

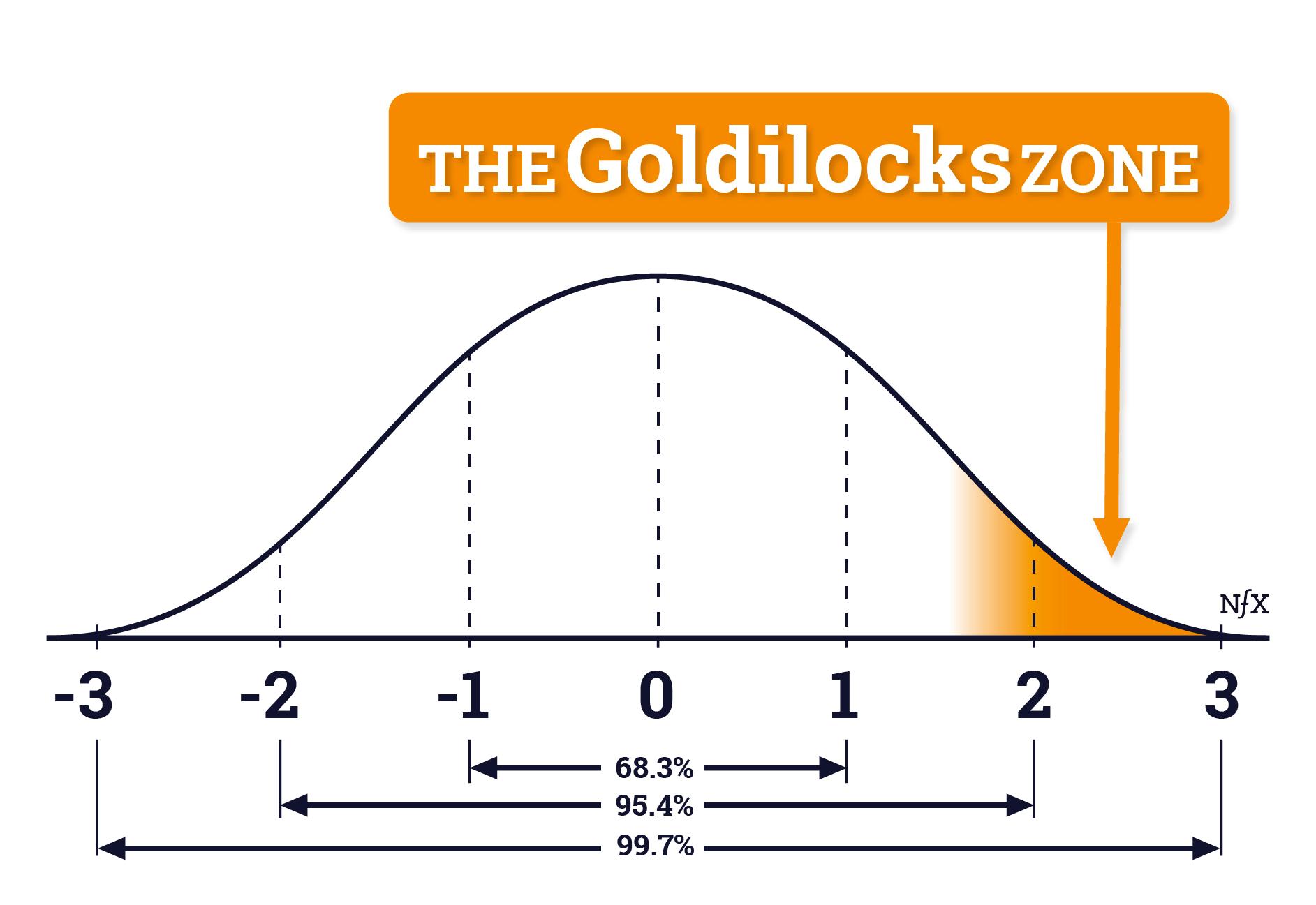

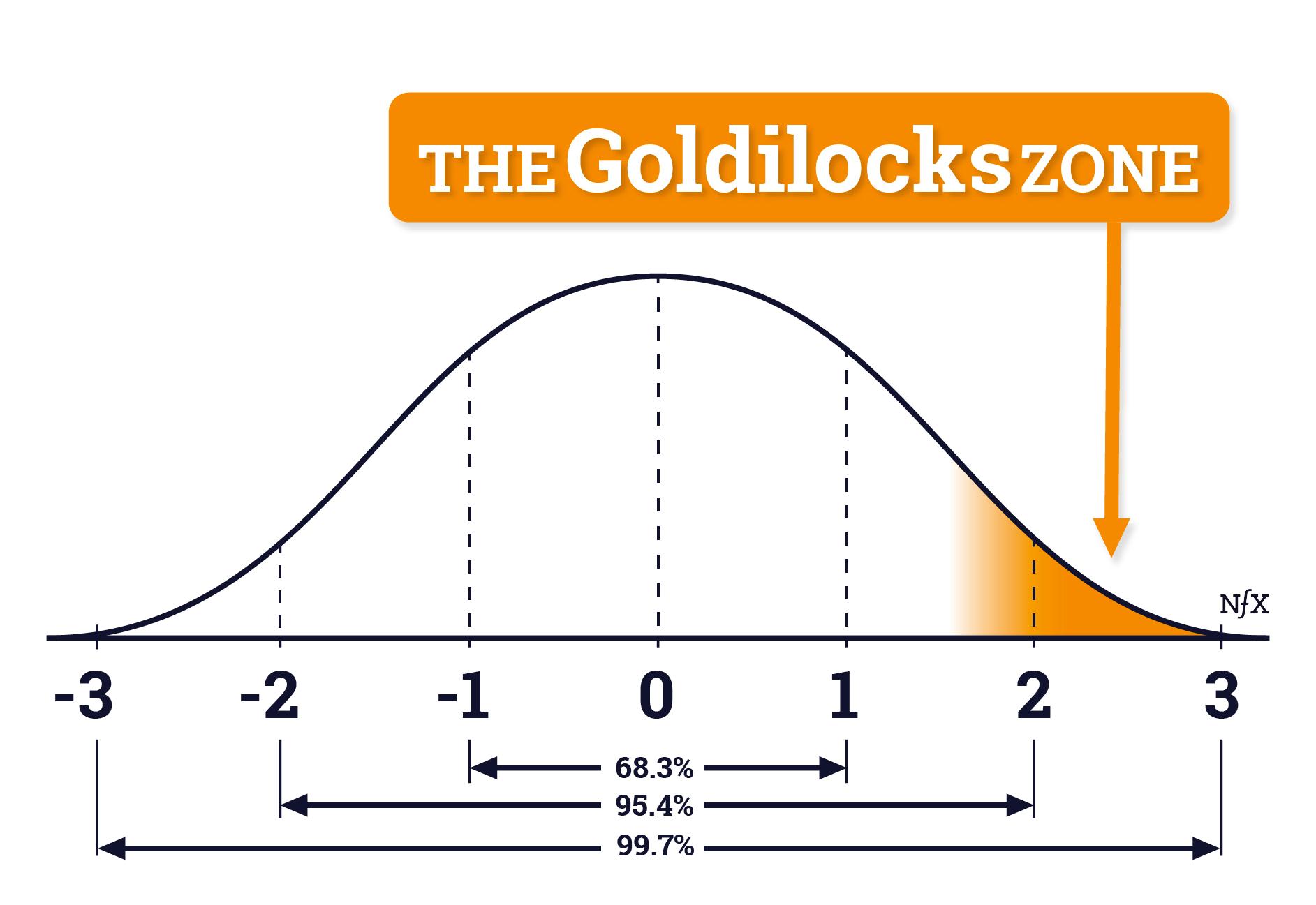

13. Goldilocks Zone

“The right answer in startups is rarely a simple choice between two opposites.”

In all the major areas of being a Founder — cultivating yourself, managing employees, communicating with investors, navigating the market — learning to recognize the Goldilocks Zone is a non-obvious skill that distinguishes world-class entrepreneurs from the rest.

“Middle” and “median” and “mean” — these words don’t often apply in your startup’s world. If it were as simple as finding the middle between two extremes on every question, then no question would be truly hard — and everyone could do startups.

People love saying about most things that “the right answer is somewhere in the middle.” But usually it’s closer to one end or the other:

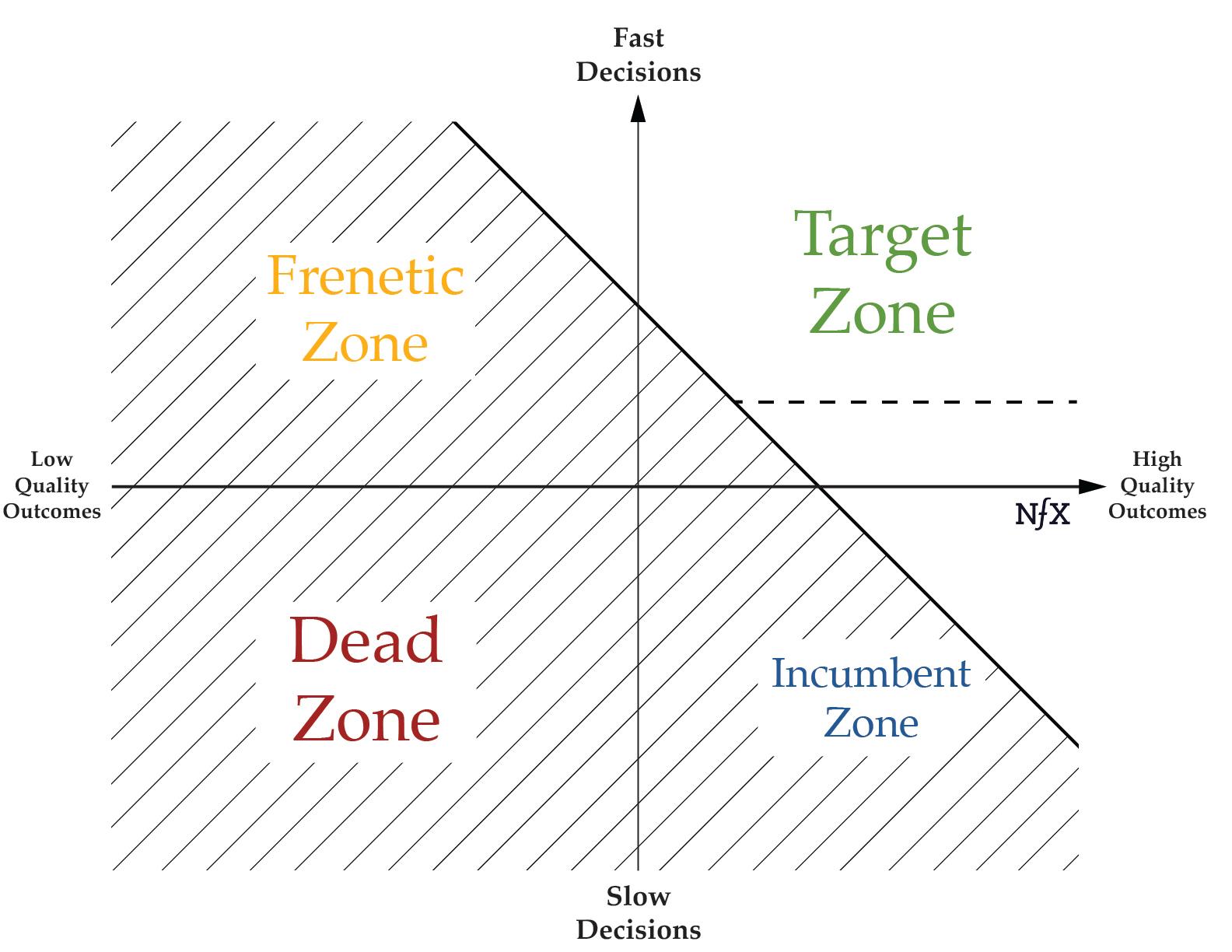

14. Speed vs. Quality of Outcome

“Speed and quality of outcome are two competing priorities that often come into conflict in decision making.”

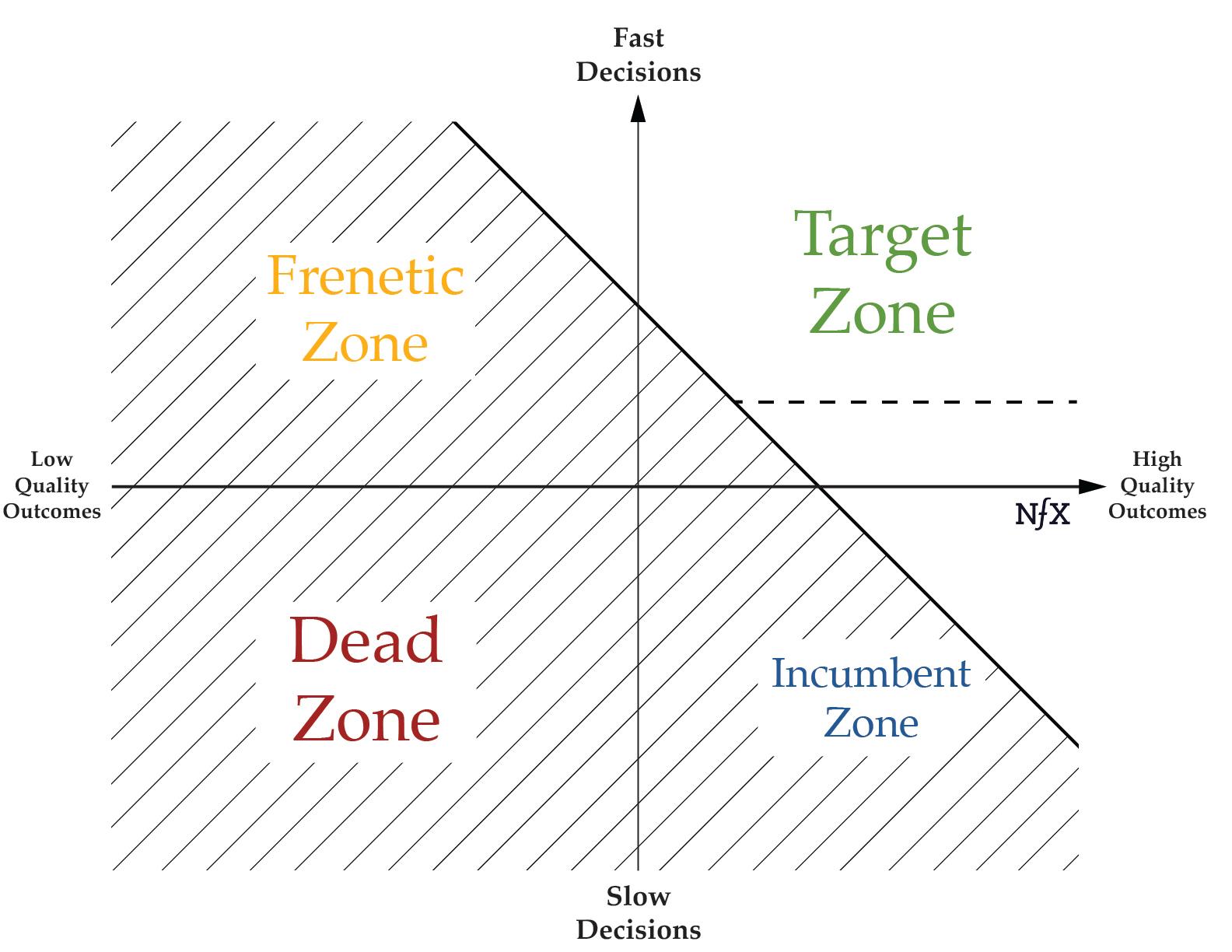

There are four basic “zones” which companies can fall in with respect to speed & quality of outcome.

A startup’s success will ultimately hinge on its ability to think long-term while keeping up a frenetic pace — the “target zone” depicted in the top-right of the graph above. This is often the most difficult piece: learning to keep an eye on the long term while sprinting to stay alive.

15. Founders Should Take More Risks

“Founders must take more risks (not less) to build truly iconic companies.”

As the startup ecosystem has grown, we’ve seen a decreasing appetite for risk and an increased emphasis on predictability and familiarity. Yet if you carefully study the most successful technology companies of our time, you’ll find something curious – not only are they born from risk, but they’ve survived and thrived because they knew how to evaluate risk itself.

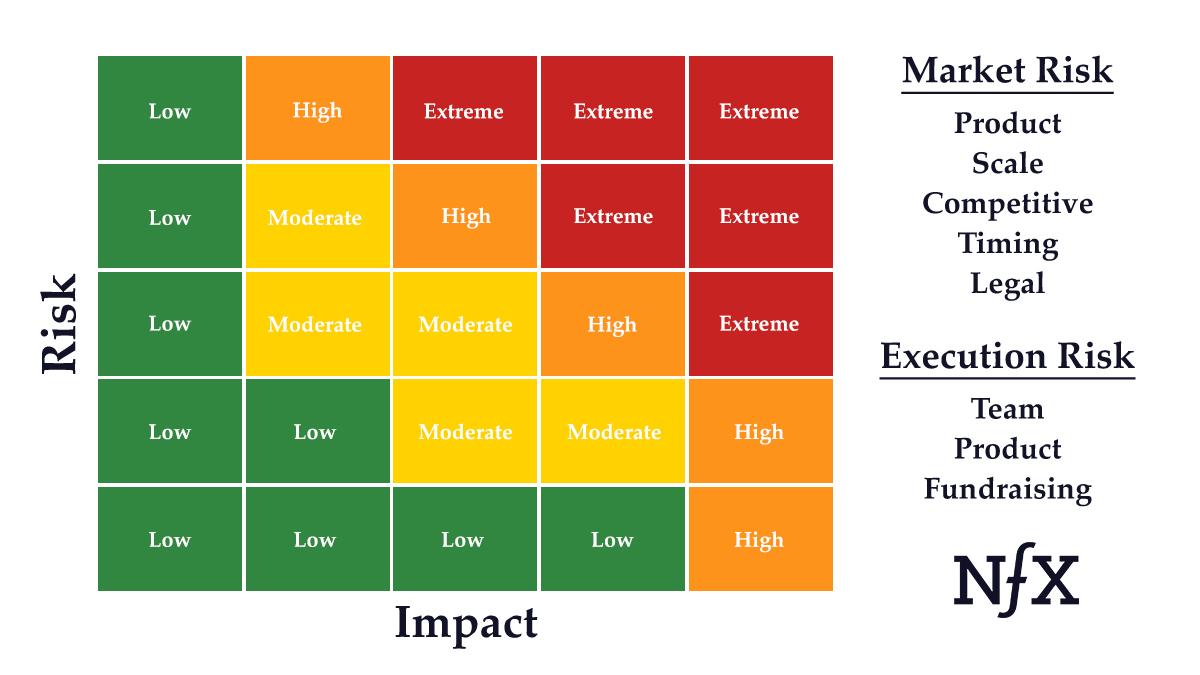

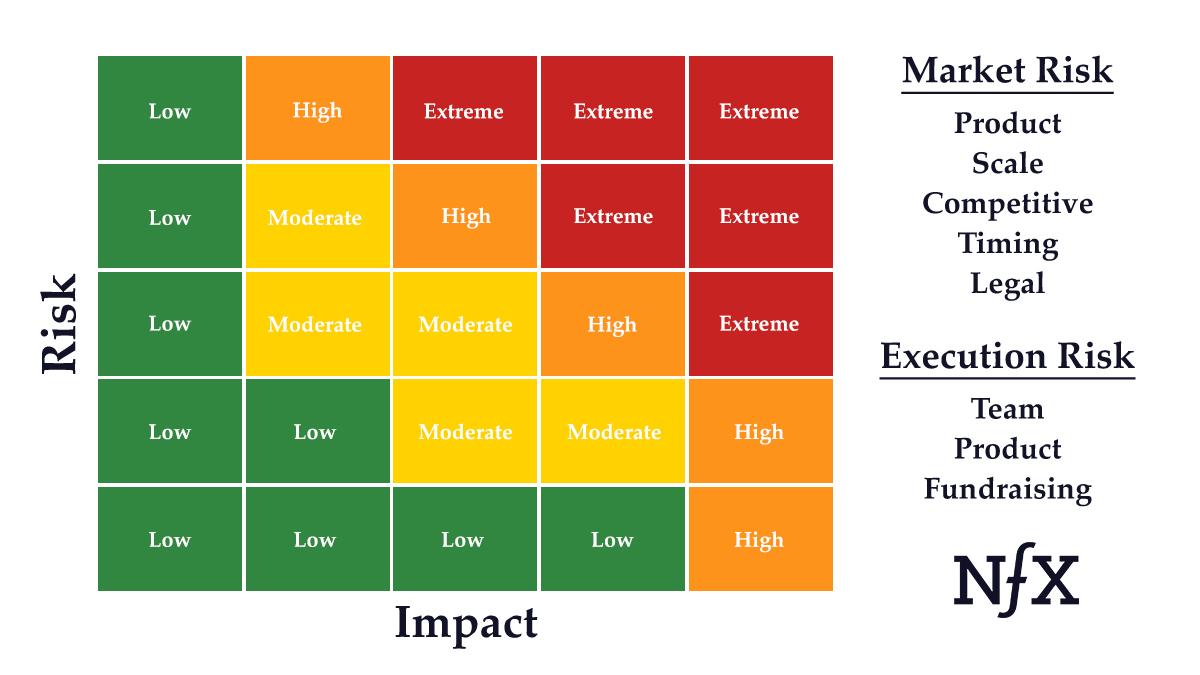

We have to be sure that the biggest risks we are taking are necessary, so we can have the conviction to take them. We also have to be able to identify and avoid unnecessary risks.

The two types of risk Founders trade-off between are market risk and execution risk. Market risk is the risk that people may not want what you’re building. Execution risk is the risk that you might not be able to execute your idea better than the competition.

Sources of Market Risk

- Product Risk — Do people want your product?

- Scale Risk — Is there a big enough market?

- Competitive Risk — What is the competitive landscape?

- Timing Risk — Is this the right time?

- Legal Risk — What is the regulatory environment?

Sources of Execution Risk

- Team Risk — Can you recruit world-class talent?

- Product Execution Risk — Can you build it?

- Fundraising Risk — Can you fundraise?

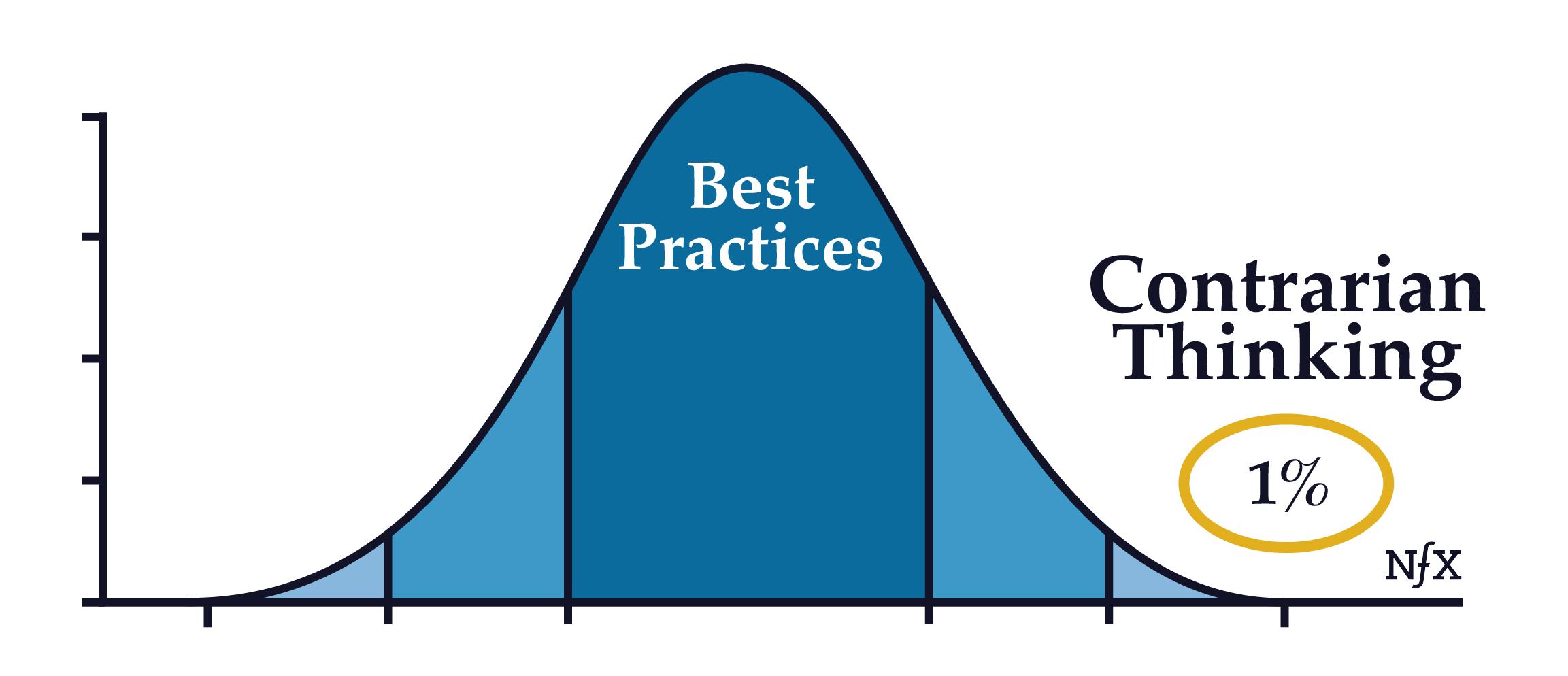

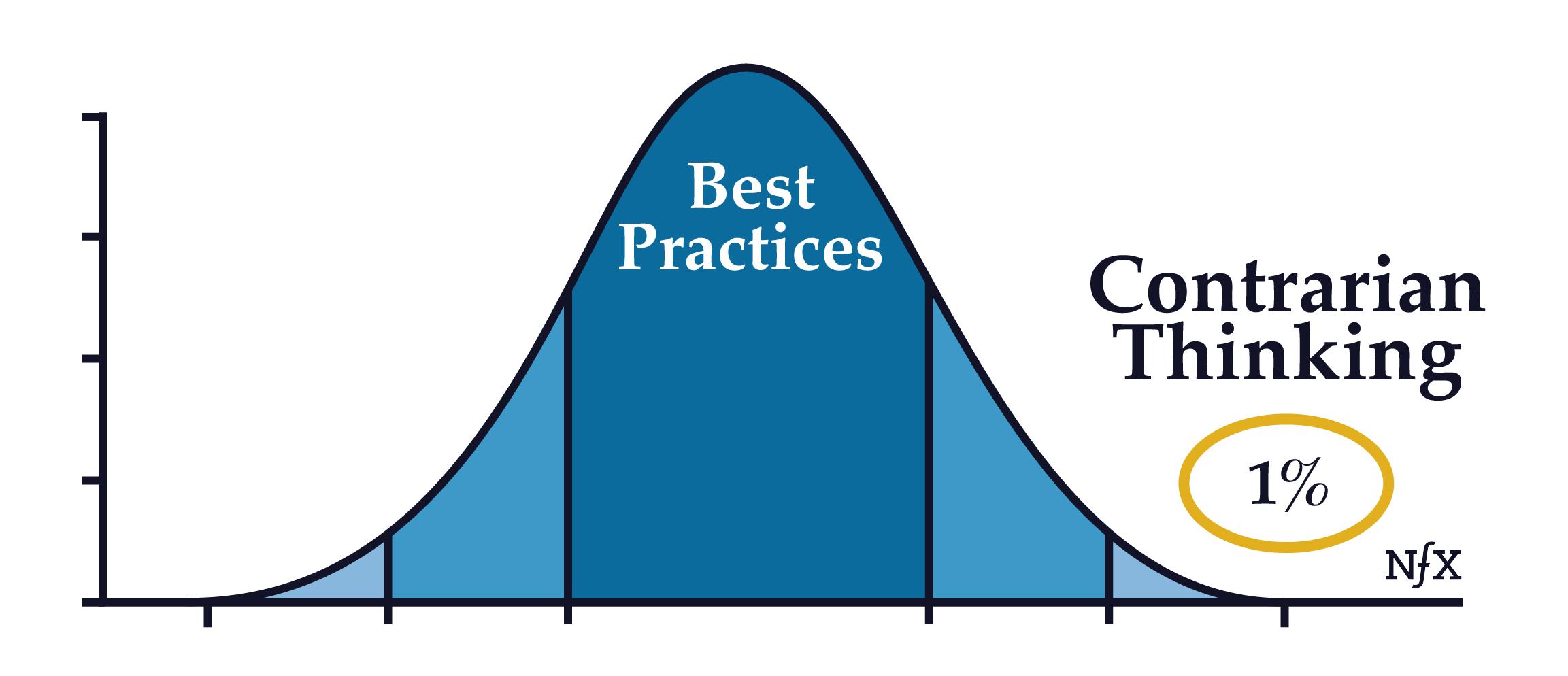

16. Rule Violation

“Great Founders do not study rules so they can follow them. They master the rules so they can break them.”

Your highest leverage is studying “best practices” as a starting point, but spending much more time on the psychology behind rule violation.

Underlying your vision should be mental models that get at the key question: Which patterns do you violate, and why?

KPIs

Most Founders we meet with think they’re data-driven. In reality, few are. Everyone knows that KPIs are critical, but often Founders are not looking at KPIs from the right angle.

Here are 6 KPIs mental models for tracking and improving the right metrics in your company.

17. S.M.A.C. KPIs

“Real KPIs are Specific, Measurable, Actionable metrics that are Consistently tracked – preferably with a dashboard.”

Unfortunately, it’s all too easy to make mistakes in choosing KPIs, and we often see Founders making the same kinds of mistakes repeatedly, like tracking vanity metrics or no metrics at all. It’s equally tough to set the right goals based on those KPIs. And tracking towards the wrong goals can be even more counterproductive than failing to track anything at all.

18. “North Star” Constituents

“Choose your North Star based on what creates the most value for your highest leverage constituency.”

Your North Star is often defined by which of the different groups of stakeholders in your company you consider most crucial to the success of your company. You can’t do everything, and you can’t make everyone happy, and as a company, you need to manage and prioritize with limited resources.

So when things get tough or when there’s pressure from different constituencies of your company to change course, your North Star will keep you from getting distracted or being led astray.

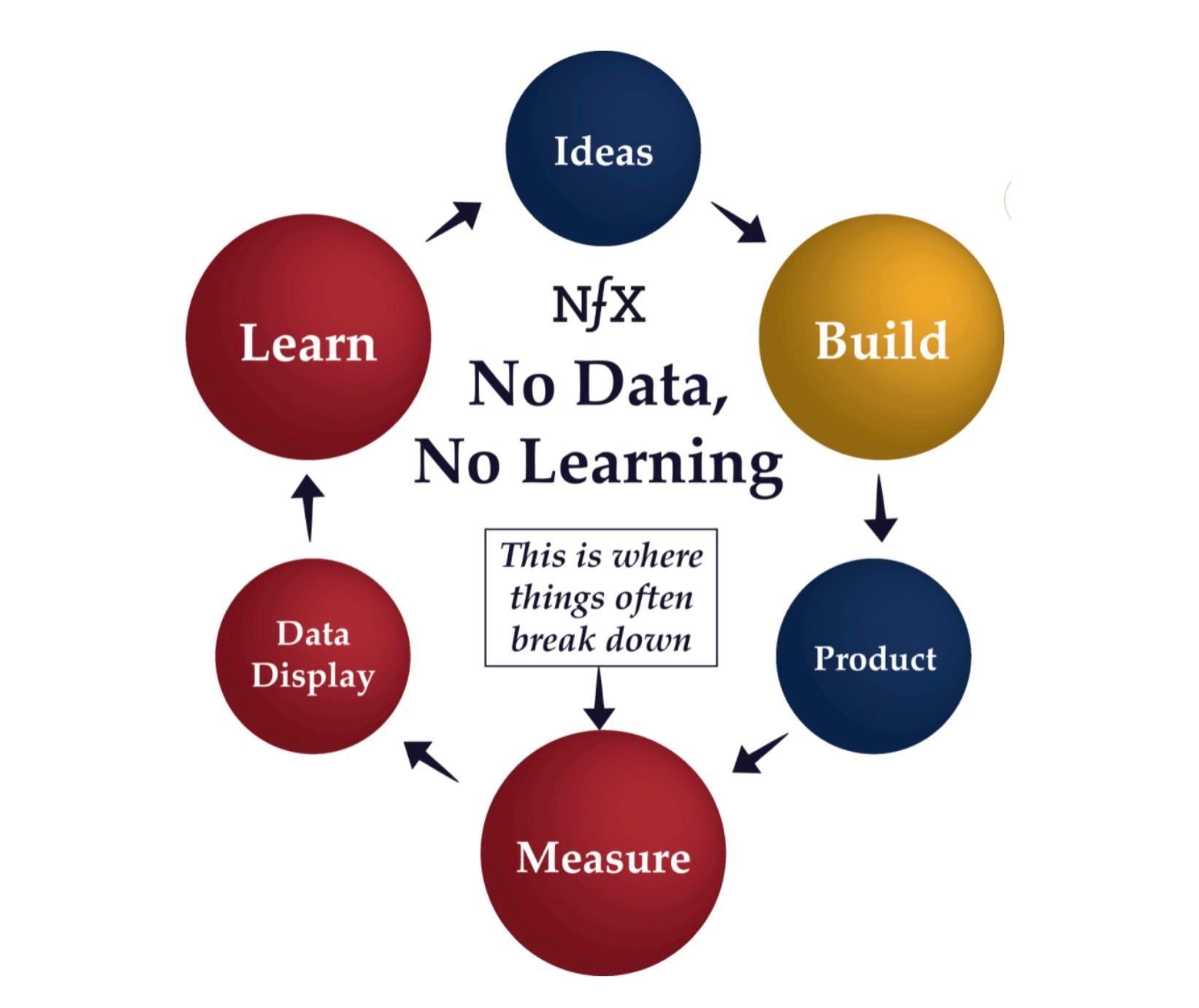

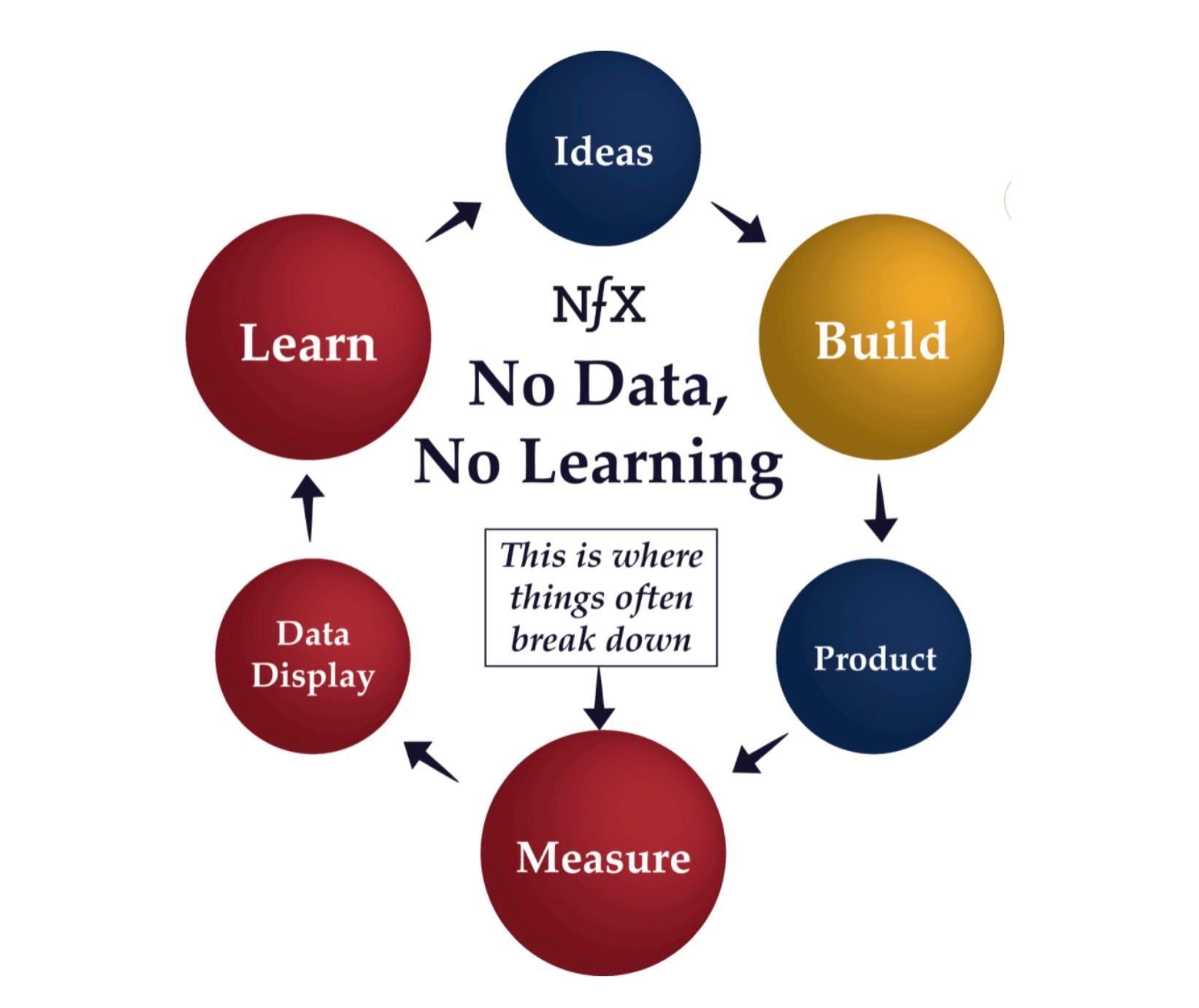

19. No Data, No Learning

“A startup is supposed to be a learning machine. In order to learn, you have to love your data.”

Once you’ve identified the right metrics to focus on — metrics that could change what you do — use them to continually test and iterate.

Early-stage CEOs should obsess about metrics. You must be committed to measuring and analyzing everything. 20-40% of engineering time might be spent on measurement and reporting systems.

20. Learning Loops

“Startups are learning machines, constantly improving themselves to deliver better results with every iteration.”

Since startups work in iterations, the biggest question you can ask yourself is how can you make sure that your organization and team is a learning one and your next iteration is going to be better than the previous one.

21. Look For 10,000% Changes in Important Metrics

“Don’t settle for incremental changes. Always be looking for the 10,000% changes in important metrics that can take your business on a breakthrough growth trajectory.”

Most of us want to feel good at the end of each day, so we lie to ourselves and say that improving a metric by 5% or 20% was a good day. But for world-class Founders, that’s not nearly good enough. Have the character and drive not to settle. Keep pushing for 10,000% every day.

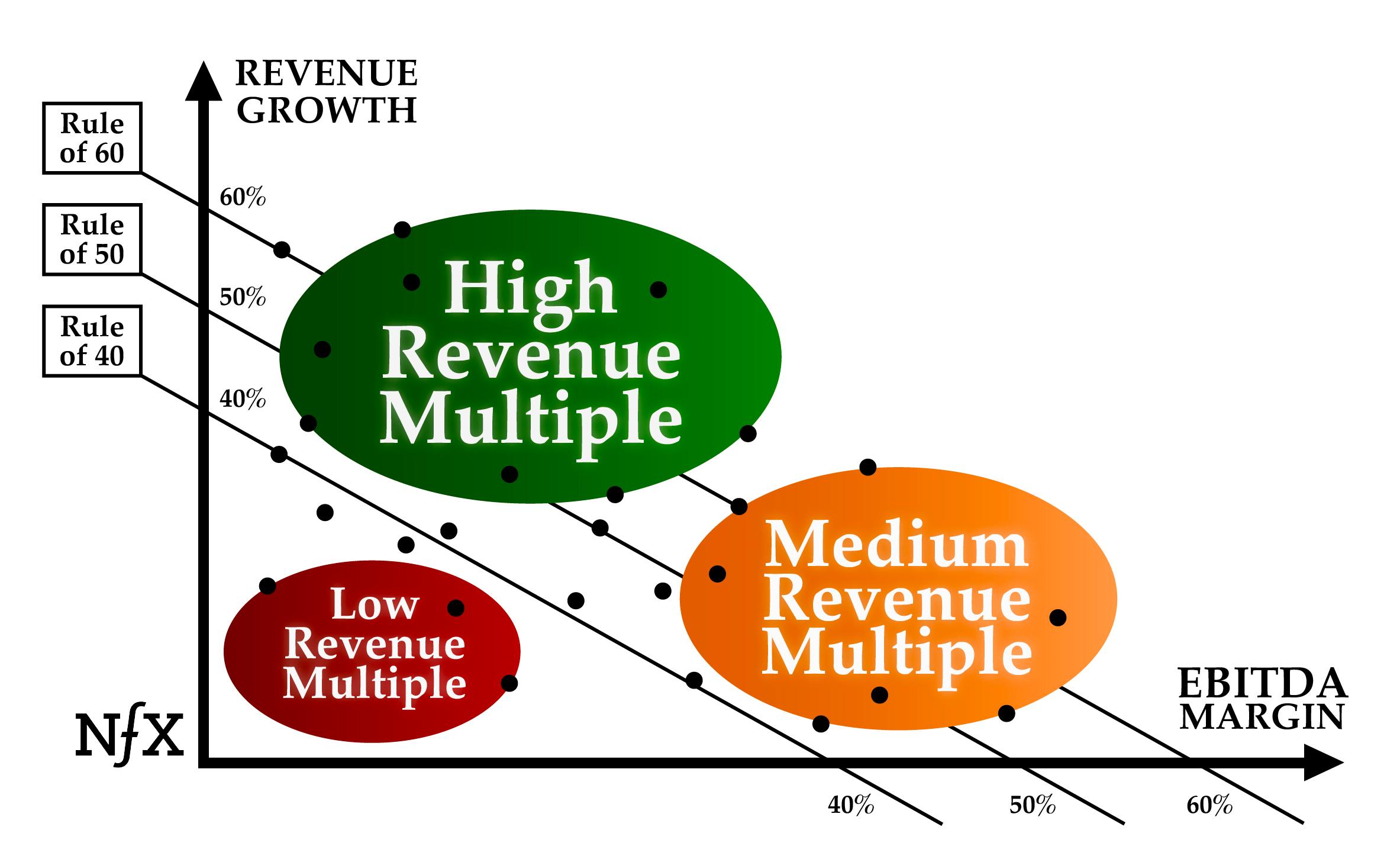

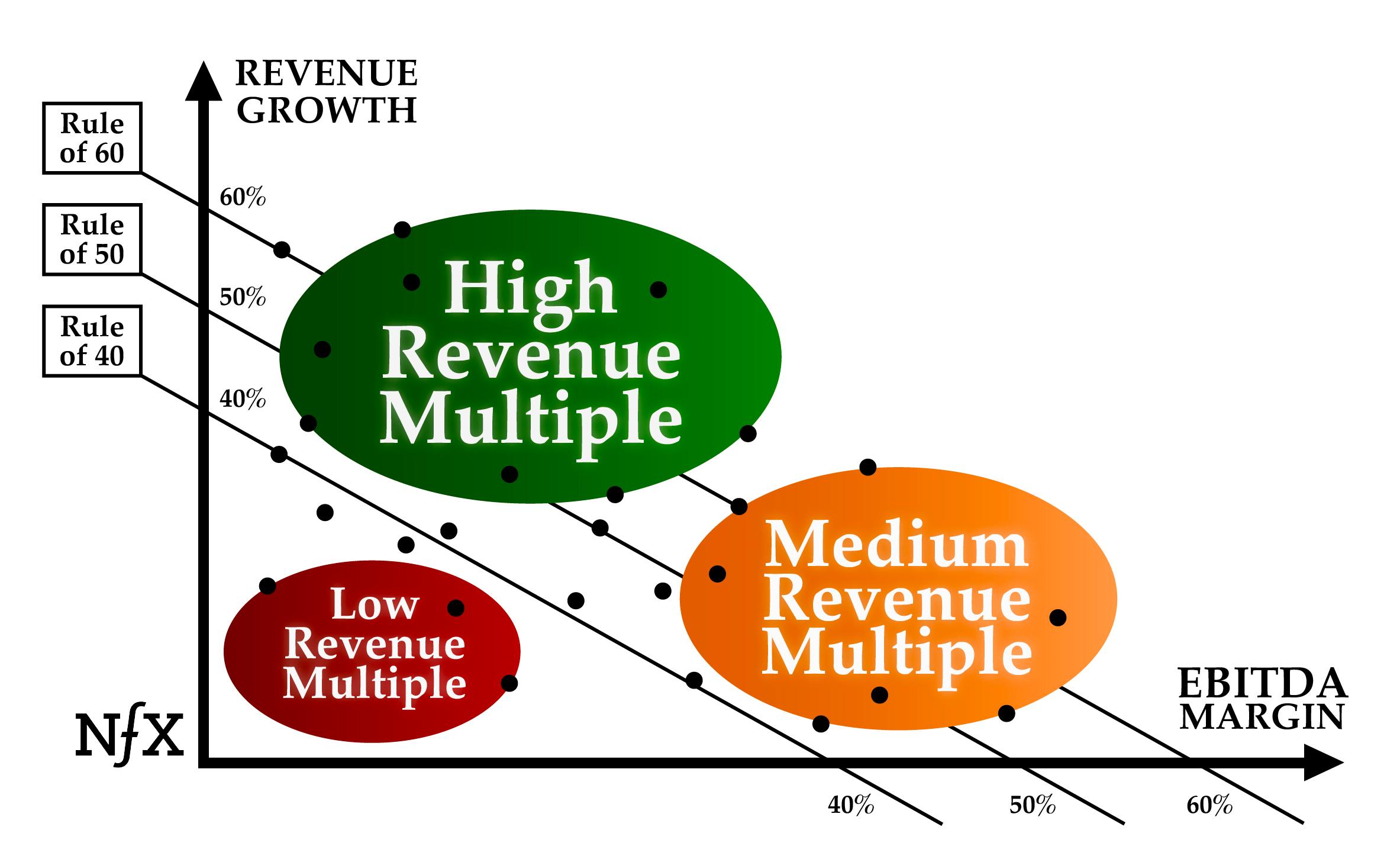

22. Rule of 40

“The combined growth rate and profit margin of a top-performing software company should be greater than 40%.”

The Rule of 40 is specific to software companies, but the lesson applies more broadly. High-value, publicly traded companies rarely drop below a certain floor of combined profitability and growth.

Public companies tend to have the highest revenue multiples when they are high growth while still remaining profitable, whereas public companies growing more modestly with high EBITDA margins have relatively lower revenue multiples. Startup Founders should design their businesses with this in mind.

Culture

When we were first building companies, we knew culture was important, but it wasn’t clear what that meant or where to start.

We found or wrote playbooks for growth, sales, product, engineering, testing, and so on. But we’ve never found a go-to resource for building high-performing cultures.

Like other parts of your company, culture starts with a mental approach. We’ve found these 9 mental models are useful for building strong cultures.

23. Culture Is Scalable

“Great culture reduces coordination costs as you grow and scale, enabling companies to defy the odds and achieve remarkable results as they grow.”

Most companies atrophy at scale — with increasing coordination costs and a collective organizational drift from their shared mission, vision, and values. But strong cultures achieve remarkable results at scale since every new employee effectively multiplies what they can do.

24. Culture Is Like Flossing

“The more time you spend on culture upfront, the less time you’ll spend trying to fix it in the long term.”

Participating in culture is like flossing: a few minutes of attention each day will save you from painful, costly, and time-consuming crises down the line.

25. Ship Your Values

“To make your cultural values real, you must ‘ship them’ like a product — to your employees and your customers.”

Founders often feel they are communicating their values ad nauseum. Yet top startups grow by over 100% headcount every year, so many of your employees are hearing your articulation of the values for the first time. Encourage everyone at your company to err on the side of over-communicating values. This is time that will never be wasted.

We’ve compiled a list of tactics we’ve found useful for effectively disseminating your company values throughout the organization.

Have you communicated your values across the following spaces? If not, plot down a quick plan for each.

- Communal spaces (including bathrooms)

- Meeting & conference rooms

- Website

- Social sites (LinkedIn, AngelList, Facebook, Twitter, Instagram, Hacker News etc.)

- Job postings

- Interview questions

- Company-wide emails

- Email signatures

- All Hands meetings

- Appendix slides

- Investor slides

- Conference slides

- Onboarding Handbook

- Annual review process

- Marketing materials

- Desk arrangements

- Business cards

26. Values Are Not A Sacred Cow

“Values can and should evolve as your business matures.”

Startups change their direction. Business models change, strategies change, and markets change. As your business matures, it may make sense for some of your values to follow suit. It’s okay to tweak your values every few years to keep them working in tandem with your business objectives.

27. Culture Is Rituals

“If people aren’t hearing, seeing, or feeling the culture, it’s difficult for them to live it.”

The most effective way to spread, deepen, and maintain your values, even as your company grows, is through rituals that directly support your values.

The strongest cultures often distinguish themselves through small yet powerful sets of unique rituals. It’s best to create your own rituals rather than borrowing those of others. Observe events or activities that go on in your company – rituals that are occurring naturally and support your values – and scale them up.

28. If you can’t measure culture, you can’t manage it.

“Track company culture the same way you would track customer satisfaction and customer experience.”

The best way we’ve seen to do this is a quarterly, anonymous survey. Track the data longitudinally. When you observe a negative trend, make it someone’s responsibility to reverse that trend. Iterate accordingly.

29. Strong Cultures Have Strong Onboarding

“New hires’ experiences should be sequenced with as much care as new users’ experiences.”

Highly successful companies move fast and grow fast, so having a repeatable plan for onboarding new hires is critical. Use this as an opportunity to tell your company story: personally explain the origin of each of the company’s values and its significance to you and the company.

Strong cultures have strong employee onboarding practices, period. Make sure new hires feel seen, known, and a part of something.

30. Power Differential

“As the power differential in your company gets bigger and bigger, people stop telling you the truth.”

Saying things like “I’ve got this covered or I don’t admit any mistakes” creates a bigger and bigger power differential between you and others in the organization. They are less likely to tell you the truth, the bigger your power differential becomes. There’s a real mathematical structure there.

This ties into disclosure too because the more I disclose, the more vulnerable I make myself, the lower the power differential, and the harder it is for you to make up stories about me.

31. Shine Daylight Through Your Organization

“Expose to daylight any comment or idea that seems like it’s political.”

The fundamental particle of politics is the simple act of saying different things to different people.

In our experience, there are typically 3 main reasons people don’t say something to one person that they will say to another: (1) I’m scared of his/her reaction, (2) it’s not going to do any good anyway, and (3) it doesn’t help me and it may hurt me if I say something.

To overcome those fears people have to be honest with each other, and leaders have to show people that it turns out OK when ideas are exposed to sunlight. You have to do it over and over again for it to be natural because it’s easy for all of us to fall out of genuine, open communication.

Thus, having No Politics starts at the top of your organization. Look for CEOs who shine daylight through the organization.

Company Building

Every company makes a set of choices that form its conditions for success (or failure) from its name, headquarters, and more. Here are 9 mental models for creating the best condition set for your company.

32. Your Company Names Matters

“The name of your company is what gets passed between people, it speaks for you when you’re not there.”

Why does a name matter so much?

It’s psychological.

People often aren’t aware of the impact your name is having on them. What emotions it evokes in them. Whether they think you’re strong or trustworthy or friendly or expensive. It sets expectations of your company in the blink of an eye. And first impressions are hard to change. Both positive and negative.

How to get your company name right: We have five guidelines you should know.

- Memorable

- Spell-able

- Avoid being “descriptive” like HipChat, DailyBooth, Excite, or MySpace.

- Do be friendly, like WorkDay, SurveyMonkey, PayPal, and Google.

- Being a little controversial is OK. A great name might hit 10% of the people wrong, like Tickle, Banana Republic, Monster or Virgin.

33. The Team Is The Product

“The team is the product… and the best product will win.”

You can have the best strategy or market opportunity in the world, but getting the team wrong results in stunted growth at best — failure at worst.

Exceptional Founders have the ability to think long-term, even while sprinting to stay alive. This is especially true in company building, as Founders every day must focus on these 4 long-term principles for building out a world-class team:

1. Plan for the future, then start with the burning issues of today.

2. Become an exceptional developer of talent.

3. Be uncompromising and set exceedingly high standards when hiring.

4. Double down on onboarding to set your new hires up for success.

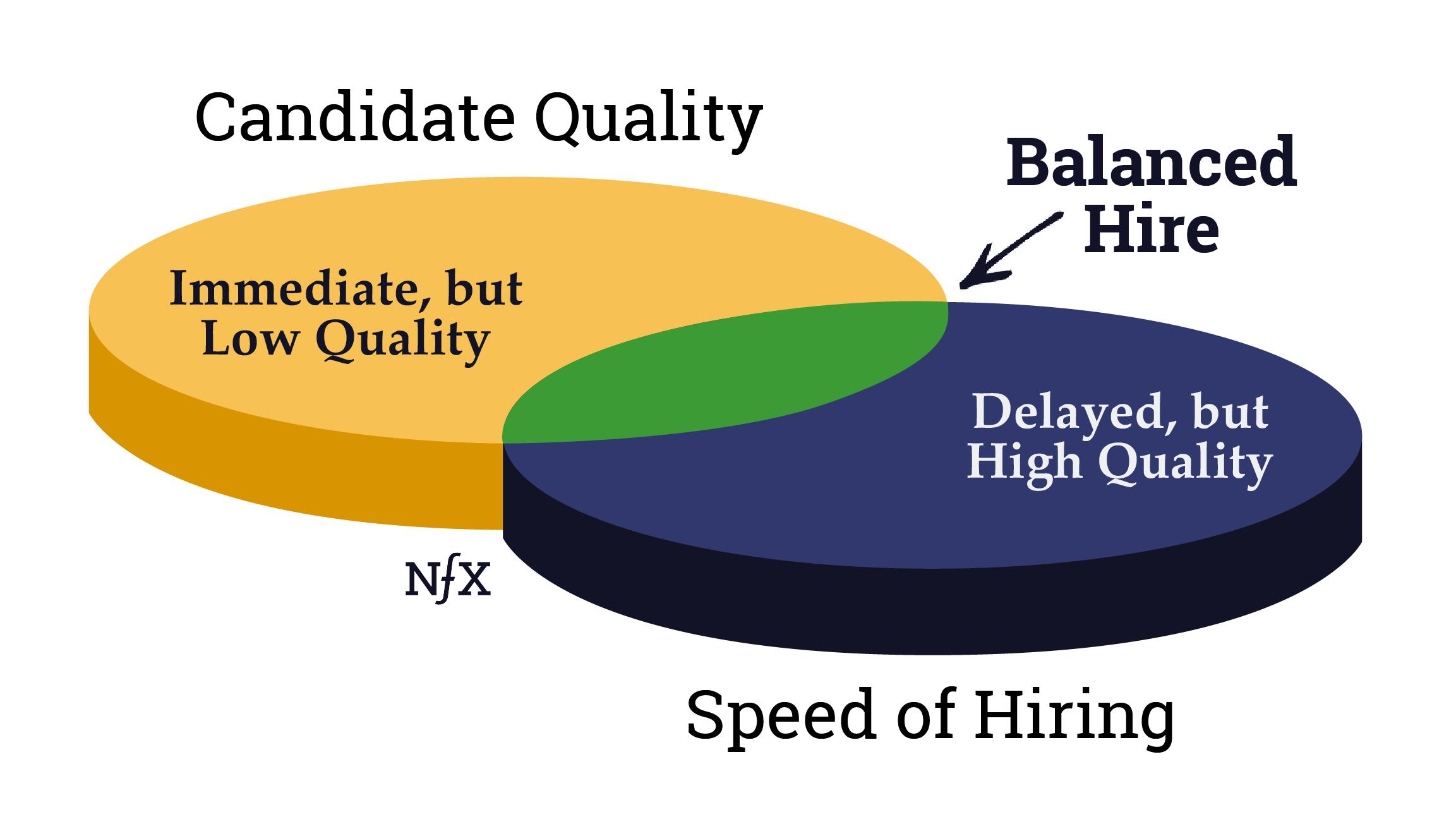

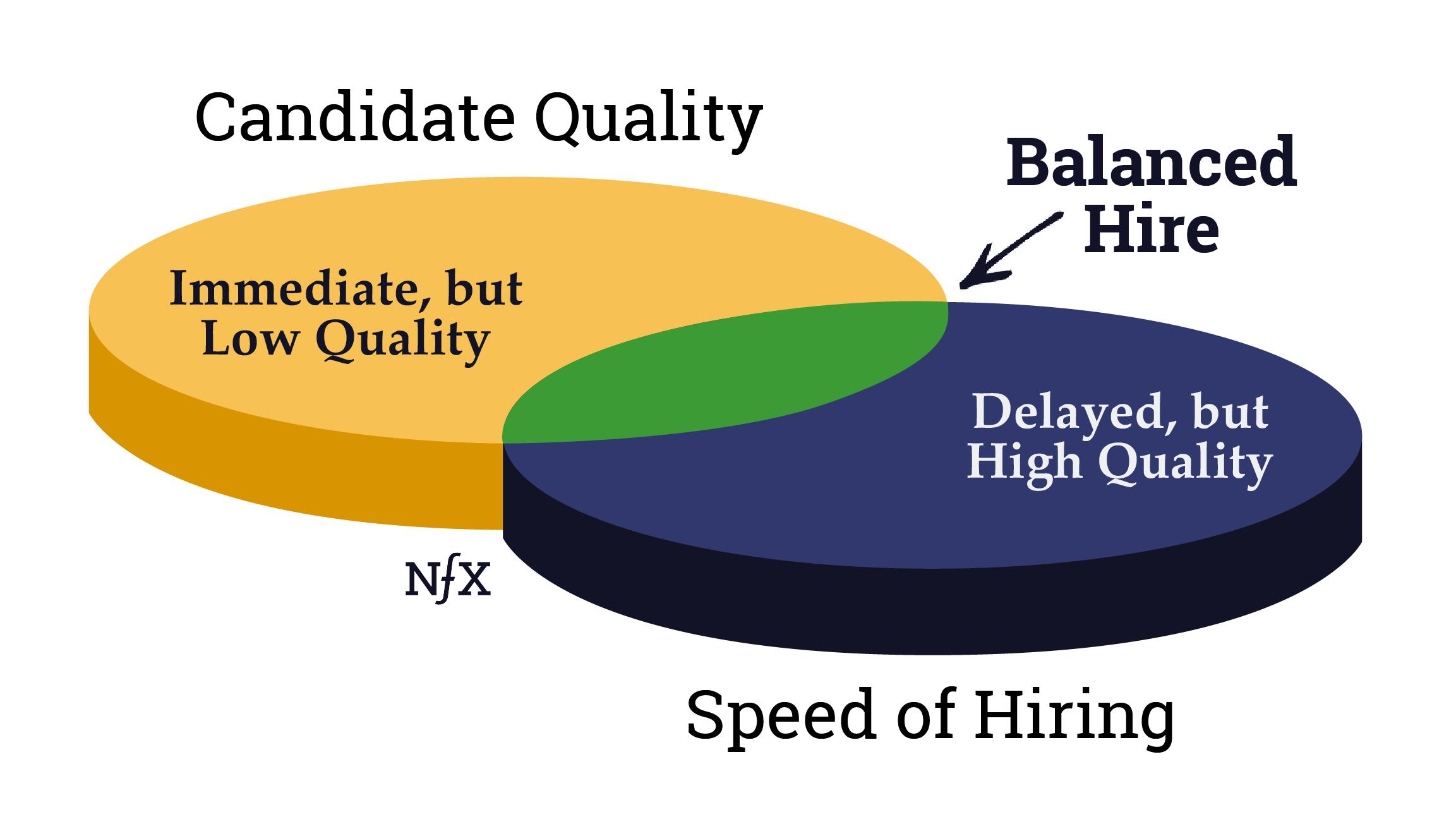

34. The Infinite Conflict of Hiring

“Great Founders strike a balance between speed and quality, in order to make confident hiring decisions for their company.”

Hiring too slowly can kill your startup. But hiring too quickly can also be a dangerous mistake and a too common failure mode for startups. This is the infinite conflict of hiring: How do you hire the best people you can find, as quickly as possible?

35. Startups Are Networks Within Networks

“Everything about a startup’s future success is influenced by its ability to position itself in conditions favorable to network formation.”

Startups are best seen as “new networks” — of employees, investors, business partners, customers, and other stakeholders. Small differences in how they grow their network have outsized impacts on their outcomes. When you grow your fledgling startup network within a powerful existing network, it flourishes 3X or 7X or more than it would elsewhere.

Founders don’t operate in a vacuum. They borrow heavily from the new ideas and discoveries of people in their peer groups and networks. The speed of learning for a Founder in a town with a small tech network is geometrically smaller than how fast that same Founder would learn in a top tech city.

36. “Silicon Valley” Mindset

“Silicon Valley is just a mindset. A psychology. A set of mental models.”

There are 10 mental models or cultural network protocols that really power Silicon Valley’s network effect by producing a higher network efficiency and density between nodes.

- Non-zero-sum thinking

- Anybody can be anything

- Habitual speed

- Thinking Big

- Impact as the status marker

- Paying it forward

- Sharing information

- “If you’re not weird, you’re weird.”

- Drinking the kool-aid

- The Concept of the Founder As a Hero

These mental models also “call out” to people around the world with similar psychology to join the network: ambitious thinkers, geeky personalities, data, and design lovers. They have been drawn to the SF Bay Area every year for 40+ years, leading to a self-reinforcing feedback loop.

Any tech ecosystem with similar cultural protocols and tech focus is also likely to develop into a robust capital of innovation. Clearly, however, it’s more difficult than most realize to intentionally engineer cultural protocols at scale in a new place.

37. Startup Science

“Doubt what you know, be curious about what you don’t, and update your views based on new data.”

This is the general maxim underlying the classical scientific method. It is also the one mental model universal to most successful startup Founders. Thinking from first principles, treating ideas as testable hypotheses, and cultivating a challenger network is what the best Founders do.

38. Failure Avoidance

“Avoiding failure patterns may have an equally important role to play in finding success.”

Most of us engineer success by trying to replicate success patterns. That’s good, but nearly 90% of startups fail, so for Founders, avoiding failure patterns may have an equally important role to play in finding success.

There are 6 patterns that account for the vast majority of startup failures, both early-stage and late-stage, according to Harvard Business School professor Tom Eisenmann.

Early-Stage Failure Patterns:

- “False start” – good founders/team/investors, but they start building too quickly and waste a cycle and their capital on a bad first product.

- “Bad bedfellows” – a good idea that never gets traction due to poor founder fit, weak team, and poor investor fit.

- “False positive” – you get off to a good start with early adopters and then it turns out that mainstream demand doesn’t share the same needs and you’ve actually mobilized the wrong resources to pursue the mainstream market.

Late-Stage Failure Patterns:

- “Cascading Miracles” – many unlikely things have to go right and if any one of them doesn’t, the venture fails. It’s a math equation where you multiply a bunch of outcomes and if any of them goes to zero, the whole expression goes to zero.

- “Help Wanted” – this occurs with late-stage ventures that still have product-market fit, the customers love the product, the basic formula in terms of LTV/CAC is on track, but something on the resource front goes awry (e.g. capital, talent, supply chain).

- “Speed Trap” – VCs buy into a company that’s growing fast at a high share price and expect more of the same. You then step on the gas and the customers that arrive later aren’t nearly as attractive as the ones who came in the beginning.

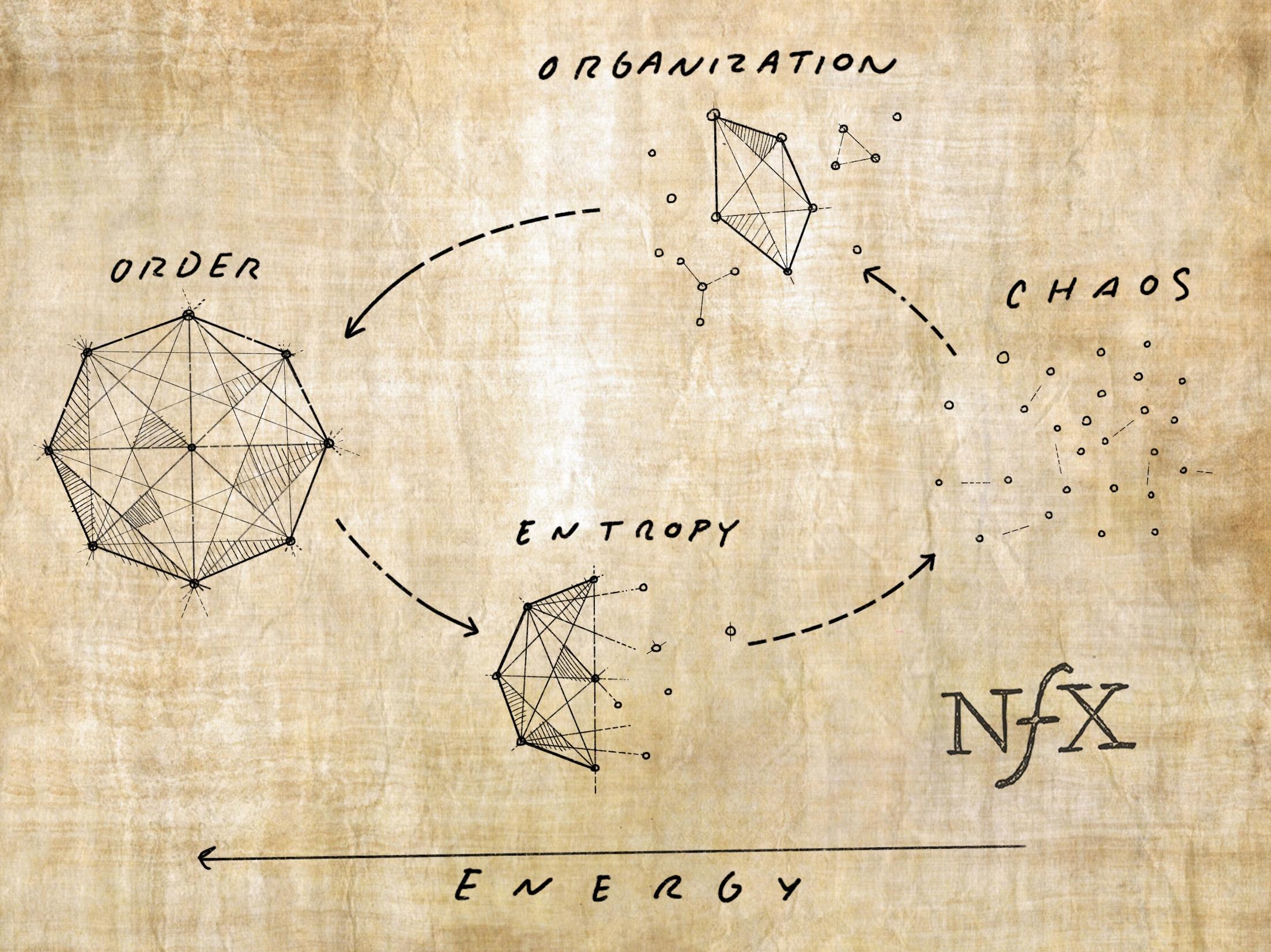

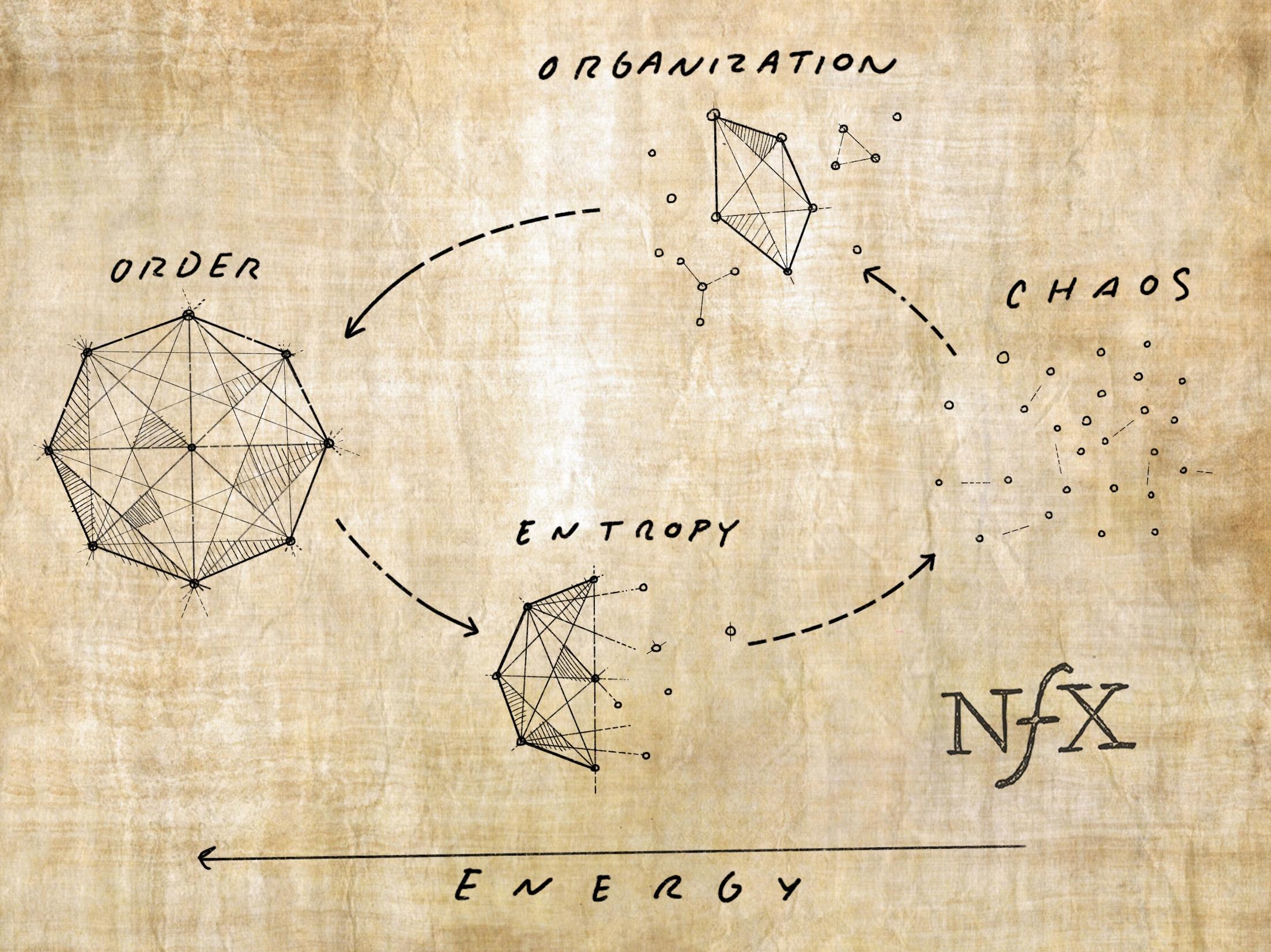

39. Startup Entropy

“Disorder, or entropy, always increases with time.” – Stephen Hawking, A Brief History of Time

Entropy is the tendency of ordered systems to move towards disorder if left unattended. All organized systems are like this, from startups and societies (systems of people) to your sock drawer. You have to continually work to maintain them or they’ll fall into disarray. Chaos is the natural equilibrium.

As a Founder of a startup, it’s very easy to overlook the build-up of entropy, but ignore it too long and you invite catastrophe. When you’re building companies, you can’t just “set it and forget it”.

Startups tend to be vulnerable to entropic drift in three critical areas:

- Role-employee fit

- Building rituals

- Product focus

If noticed too late, entropy sinks startups. It has a way of building on itself since disorder breeds greater disorder. Understanding and guarding against entropy, especially in the areas mentioned above, can prevent things from getting out of hand.

40. “Lone Founder” Myth

“Despite how the media likes to hype the ‘lone founder’ archetype, long-term success in startups is really only driven by teams.”

Not only have Founders been programmed to be individualistic, but they are also extremely, abnormally good at it. Nothing breeds repetition like success.

Without realizing it, you can become what we call a Founder-Dictator. Founder-Dictators tend to believe they are egalitarian, but in fact if one looks under the hood, your company appears more like central planning. You retain control in areas you shouldn’t. You set the roadmaps. You unintentionally disempower the team along the way.

Adding fuel to the fire, because you are a stellar individual contributor, you tend to experience early success operating in this way. And though it appears to you like things couldn’t be better, a rude awakening is potentially just around the corner.

Market Disruption

Transformative companies can unlock tremendous value by disrupting markets with new technologies, changing regulations, clearer ways of thinking, and more.

To increase your chances of success, we’ve compiled 8 mental models for startups taking over a market, new or existing.

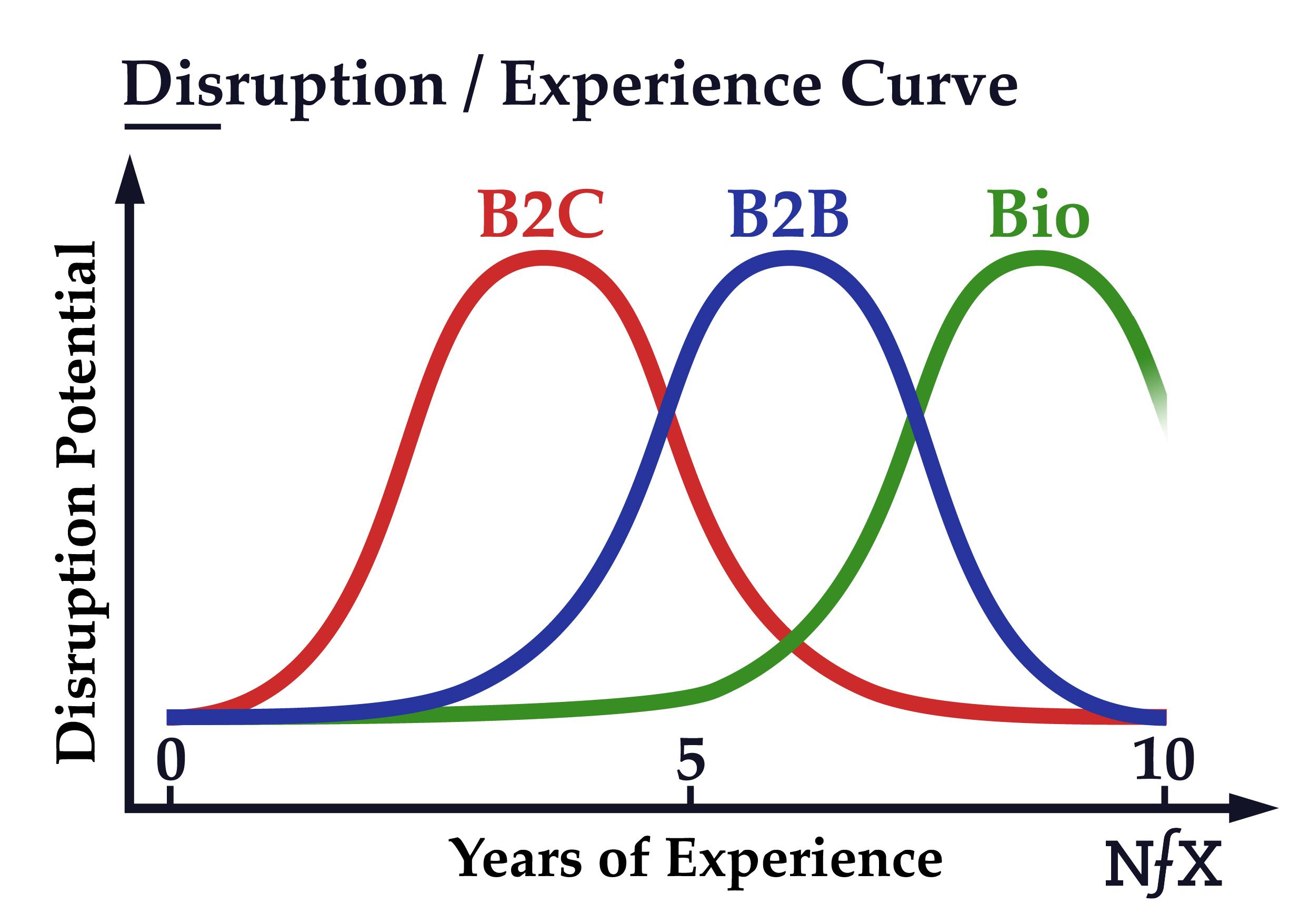

41. The Curse of Knowledge

“Too much knowledge is a blocker of innovation.”

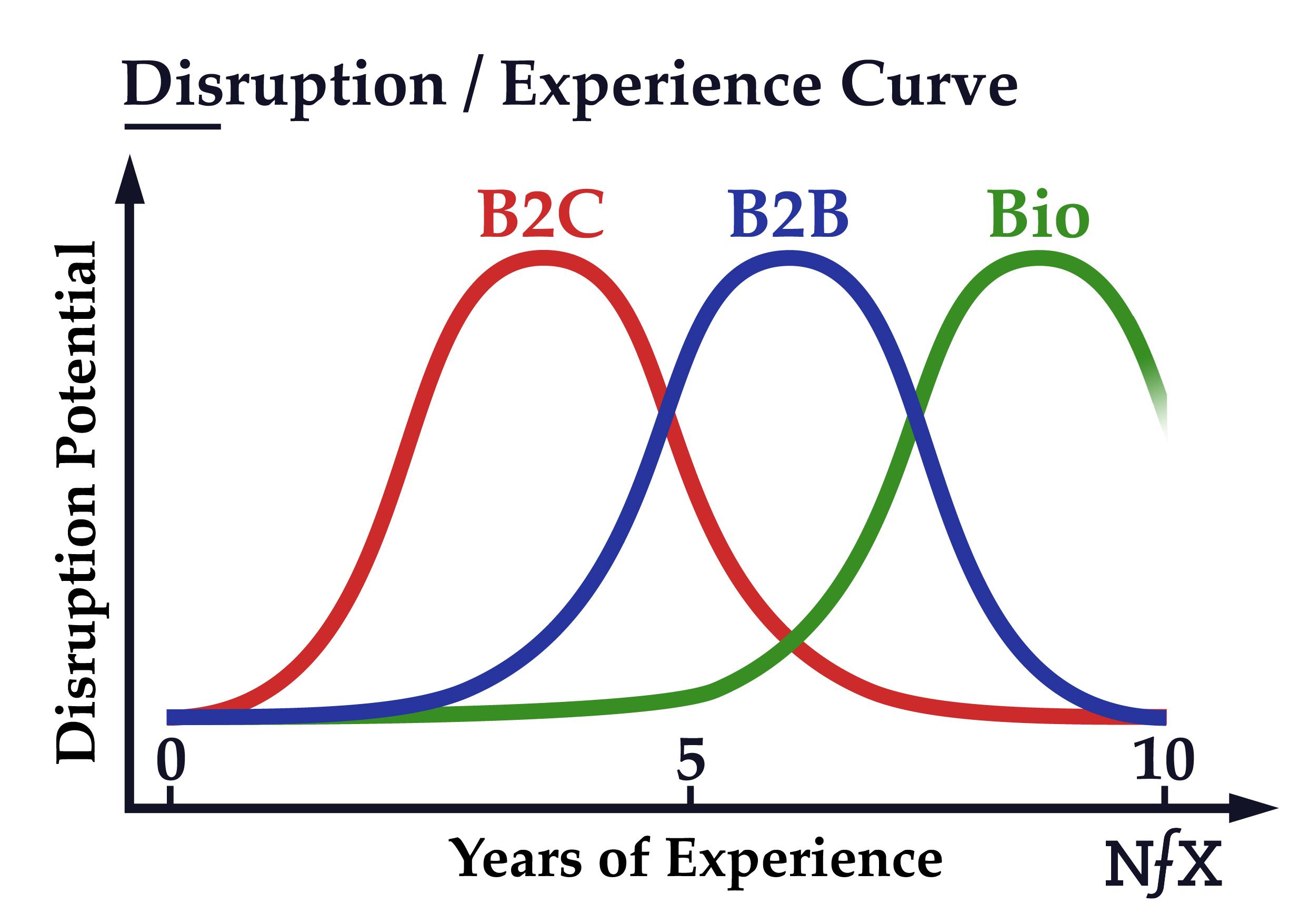

We do look for Founders who have enough industry experience that they understand the market. But not so much experience that they don’t have any disruption left in them. At some point, if you stay in a sector too long, you get the curse of too much knowledge, and you stop being able to see fresh or new ways of doing things.

Generally, we’ve found the more regulated and enterprise-facing the space is, the more you need a ton of experience and credibility to have a shot.

Experience seems to matter the least in consumers.

42. Think Again

“Rethinking the assumptions that everybody else has made about an area, technology, or market unlocks breakthrough thinking that can make the seemingly impossible, possible.”

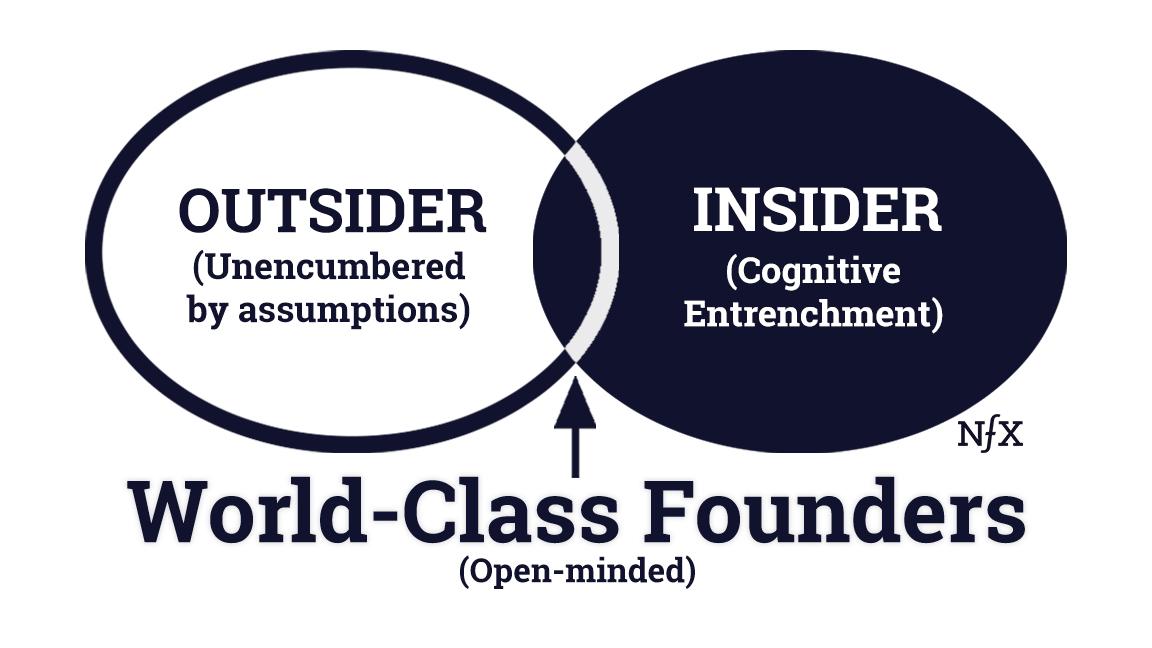

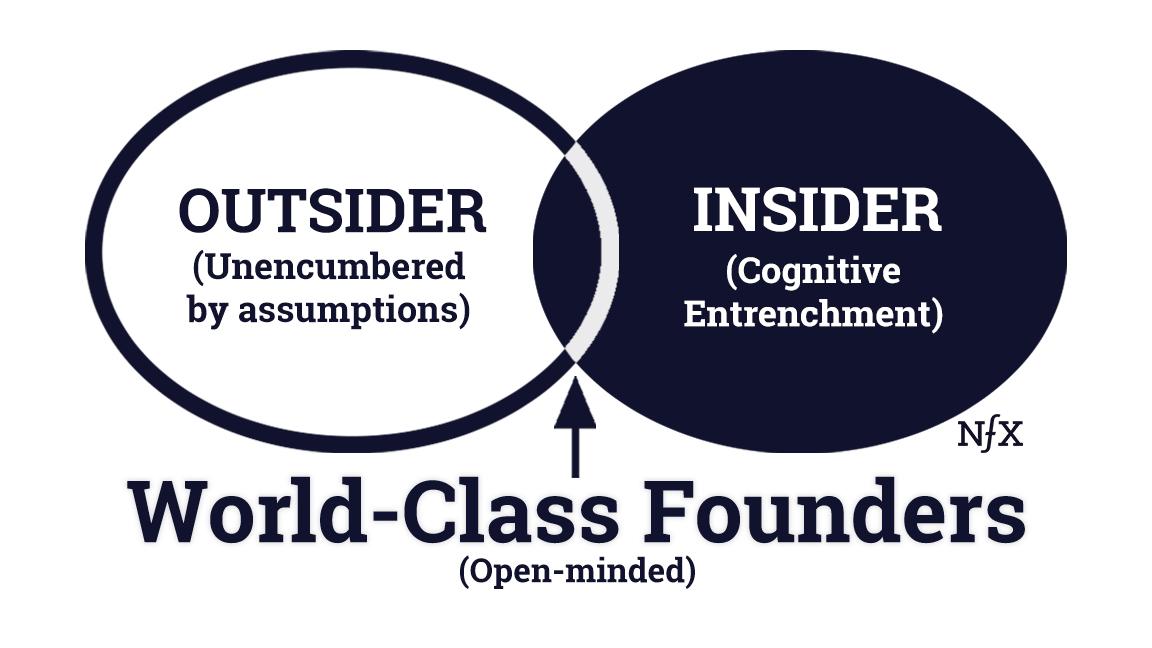

Founders and VCs tend to over-index on experience, missing opportunities because of their cognitive entrenchment.

Experience is a double-edged sword. On one hand, it’s difficult to have good ideas when you don’t understand the problem well enough to try to solve it. But on the other end of the spectrum, if you have extensive experience or expertise, you run the risk of cognitive entrenchment.

Be careful not to lose your ability to think with an open mind and rethink basic assumptions.

43. Don’t Become What You’re Trying to Disrupt

“Startups copying incumbents can often be an even bigger danger than incumbents copying startups.”

This is a danger you should be aware of if you’re a startup reinventing an existing market. You might start out with a disruptive model, but end up getting pulled in the wrong direction to do things the same way as the market incumbents — which is less innovative and more about capturing pre-existing revenue.

44. The Formula for Market Reinvention

“The formula for reinventing markets is to take a compelling new technology or approach and apply it to a specific industry.”

One of the biggest trends we are seeing is that offline behaviors are permanently shifting to online behaviors at an accelerating pace, and this presents continuing opportunities for startups reinventing new markets.

45. Advertisers Beware

“Large advertising spend often signals product atrophy and opportunities for disruption.”

Usually, advertising signals that existing players are competing for significant revenue, but they can’t rely on product differentiation and therefore they compete on ad spend.

46. Under, TAM

“Real TAM is nearly always more than what you expect.”

Whether a startup is reinventing an existing market, or creating a new one, the TAM opportunity tends to be underappreciated. In new markets, this is because it’s consistently difficult for people to visualize the value created by something new, especially when it comes from exponential growth or exponential collapse of prices.

With existing markets, many don’t see that when you digitize something and add network effects, your potential market share can be much higher and your margin structure can be much more favorable. So you can’t just look at the offline equivalent and extrapolate from there.

47. Timing Is Everything

“Being ahead of your time is the same thing as being wrong.”

Enter a market too early, no matter how strong the founding team, and you could be stuck waiting for a day that never comes. Enter too late and you’re fighting an uphill battle against incumbents with greater scale. In startups, timing is everything.

To help better understand startup timing, we’ve developed a framework we call the Critical Mass Theory of Startups. It’s the tipping point for when a product or market goes under rapid transformation, seemingly overnight. A critical mass point for a startup opportunity arrives when there’s a minimum threshold of three preconditions:

- Economic impetus

- Enabling technology

- Cultural acceptance

What’s important isn’t whether you’re earlier or later than your competitors on an absolute basis – rather, it’s all about who enters the market closest to the critical mass point.

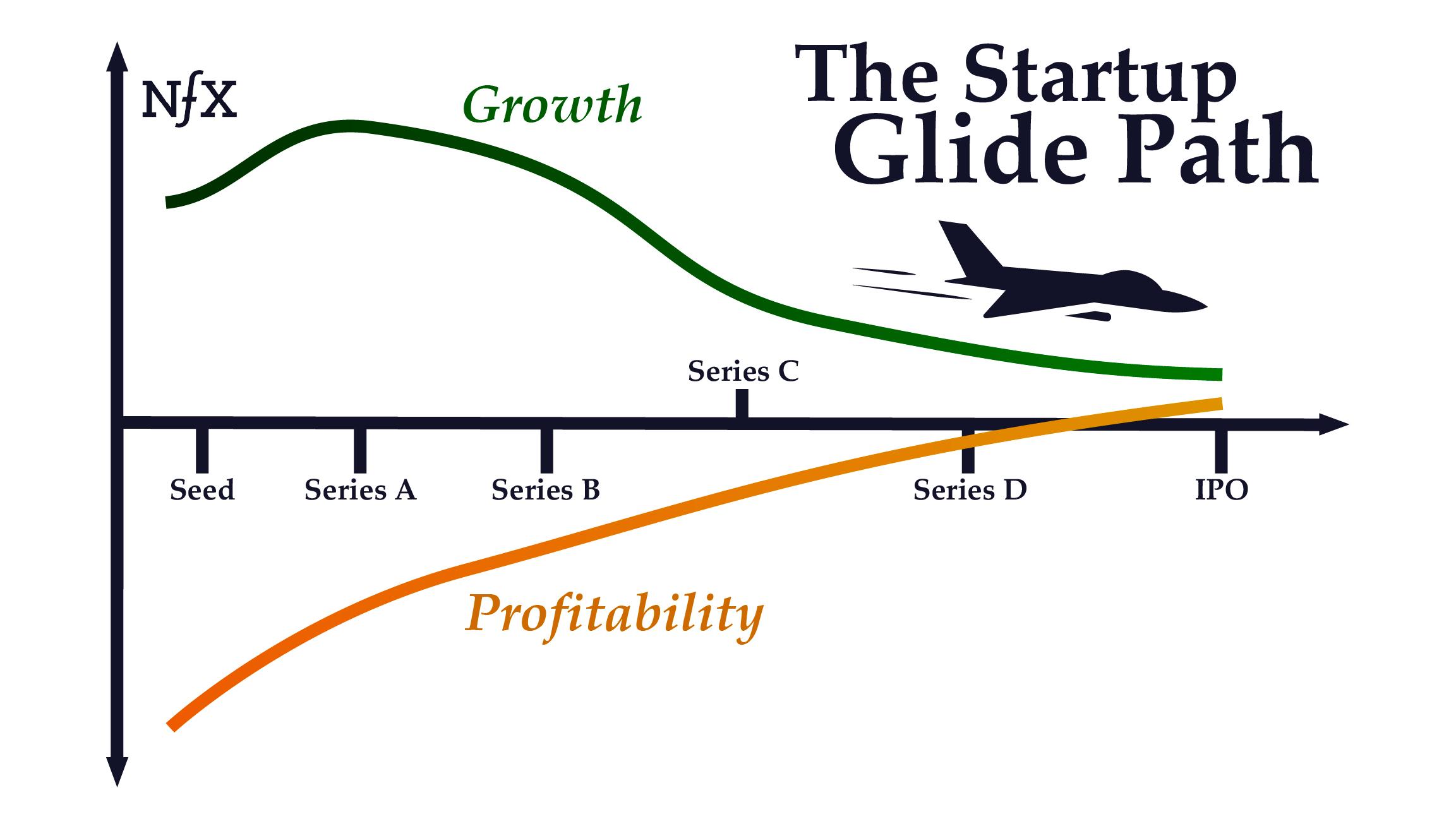

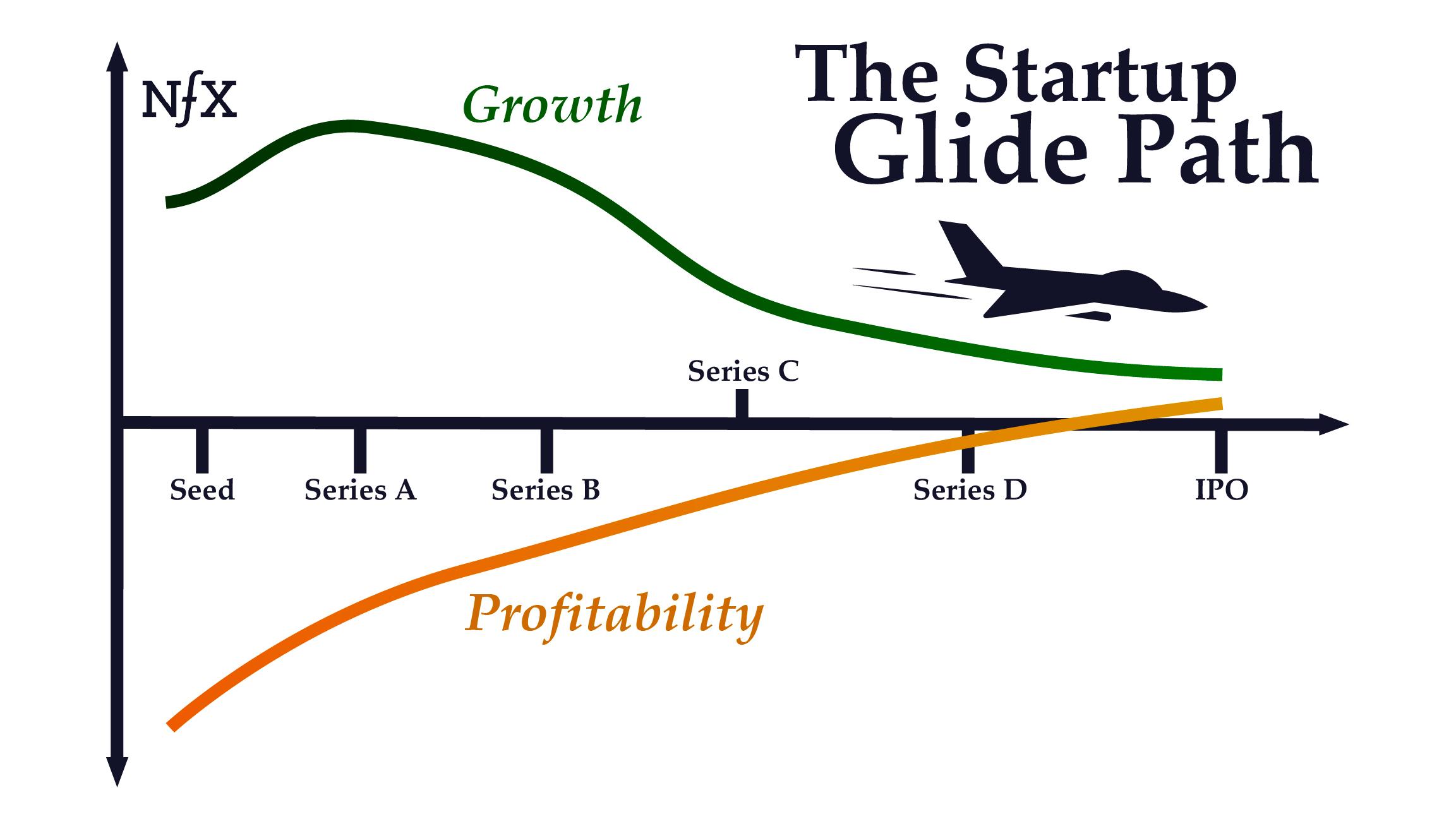

48. The Startup Glide Path

“Startups should chart a path ‘gliding’ towards more moderate growth and profitability across the entire business as the business matures and scales.”

Priorities between growth and profitability change at each stage of a startup’s life, from seed to IPO.

The basic idea is that startups in the early stage should be high growth and the priority is on unit or cohort profitability, not overall company profitability as the company invests in product development and scale. However, they should chart a path “gliding” towards more moderate growth and profitability across the entire business as the business matures and scales.

Winning Mental Models

Underlying the success of Founders are the mental models they employ to understand, prioritize, and execute the key objectives in their business. Studying them is the highest point of leverage for Founders because it can change your mental approach — your ultimate asset.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.