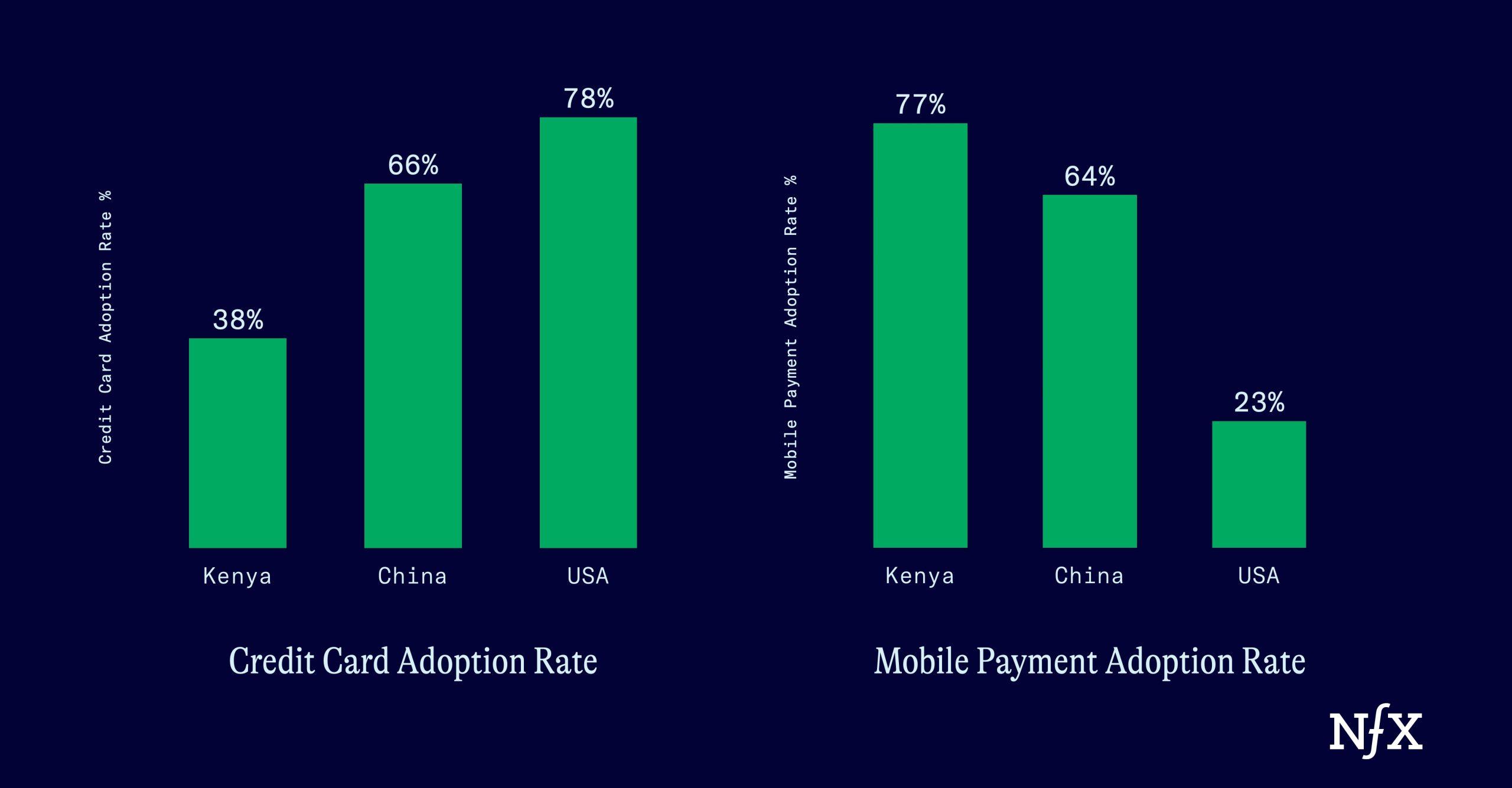

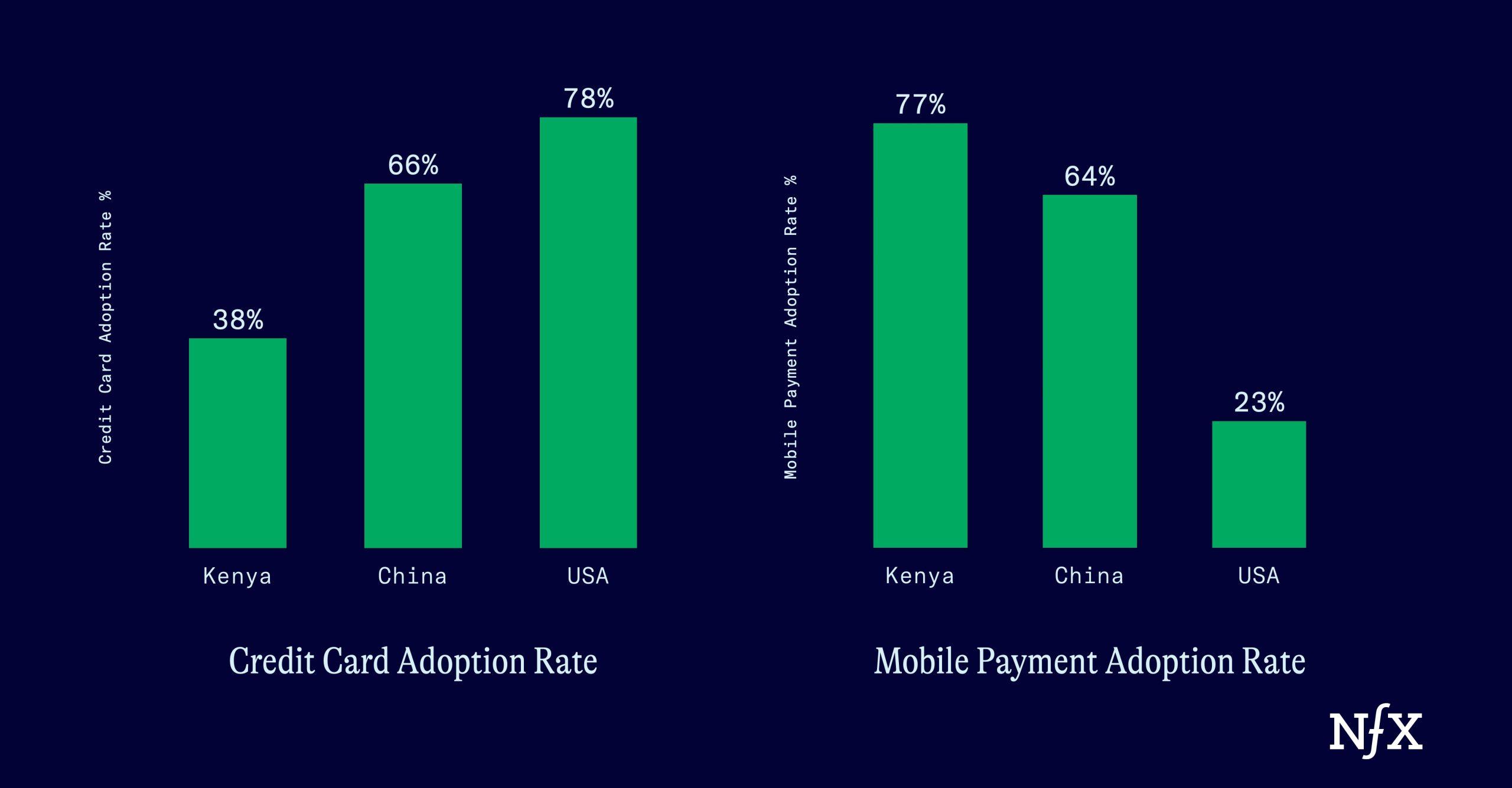

African countries were among the fastest in the world to adopt mobile payments. In the U.S., we were still swiping credit cards while they were creating faster, borderless, and intuitive payments infrastructure. Why?

Mobile was several step functions better than what they had – it felt like magic compared to the status quo. Meanwhile, the U.S. had such things as credit cards and digital bank accounts, which were totally adequate, and we had little incentive to close the gap from good to great.

Where are we going with this?

AI, of course.

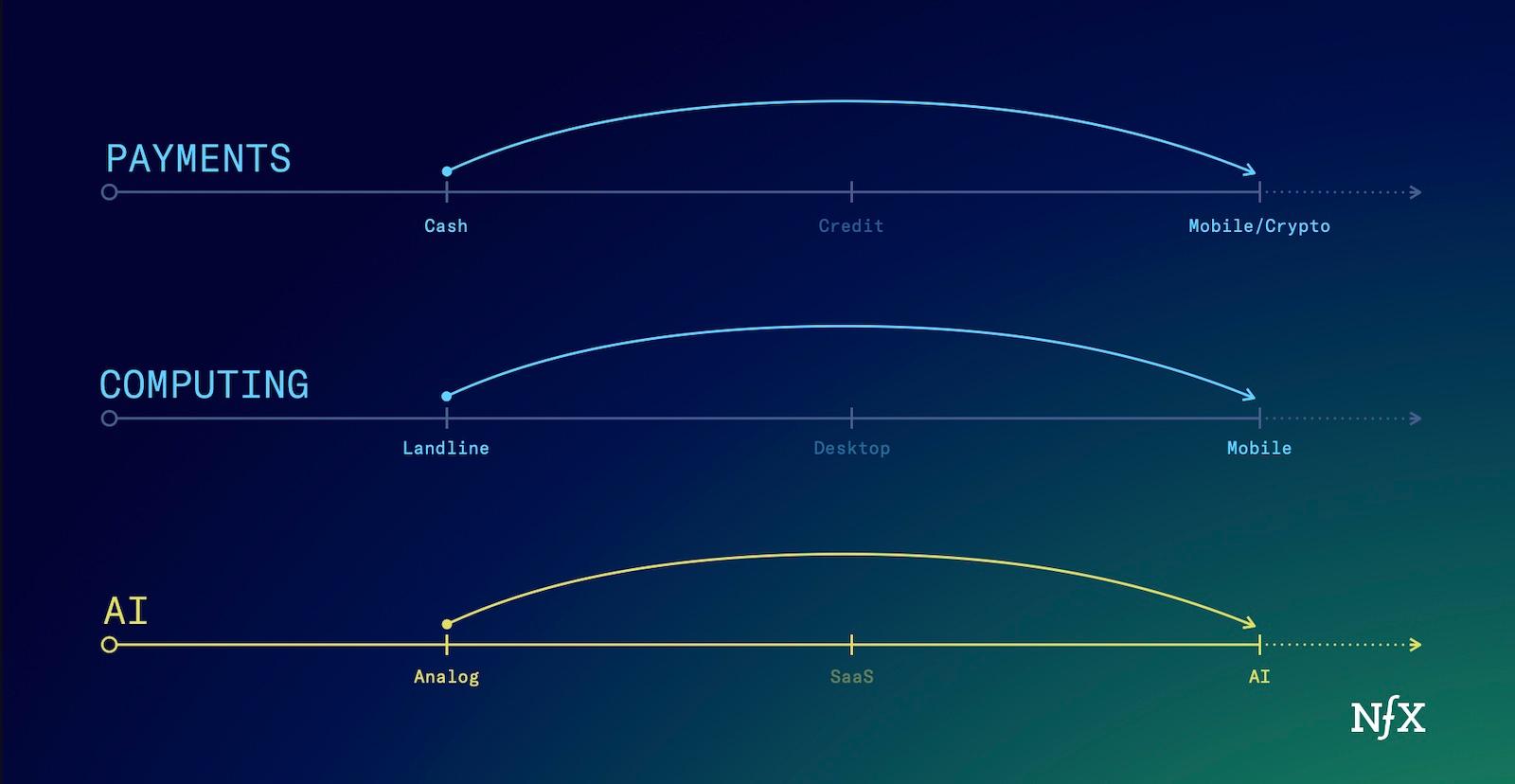

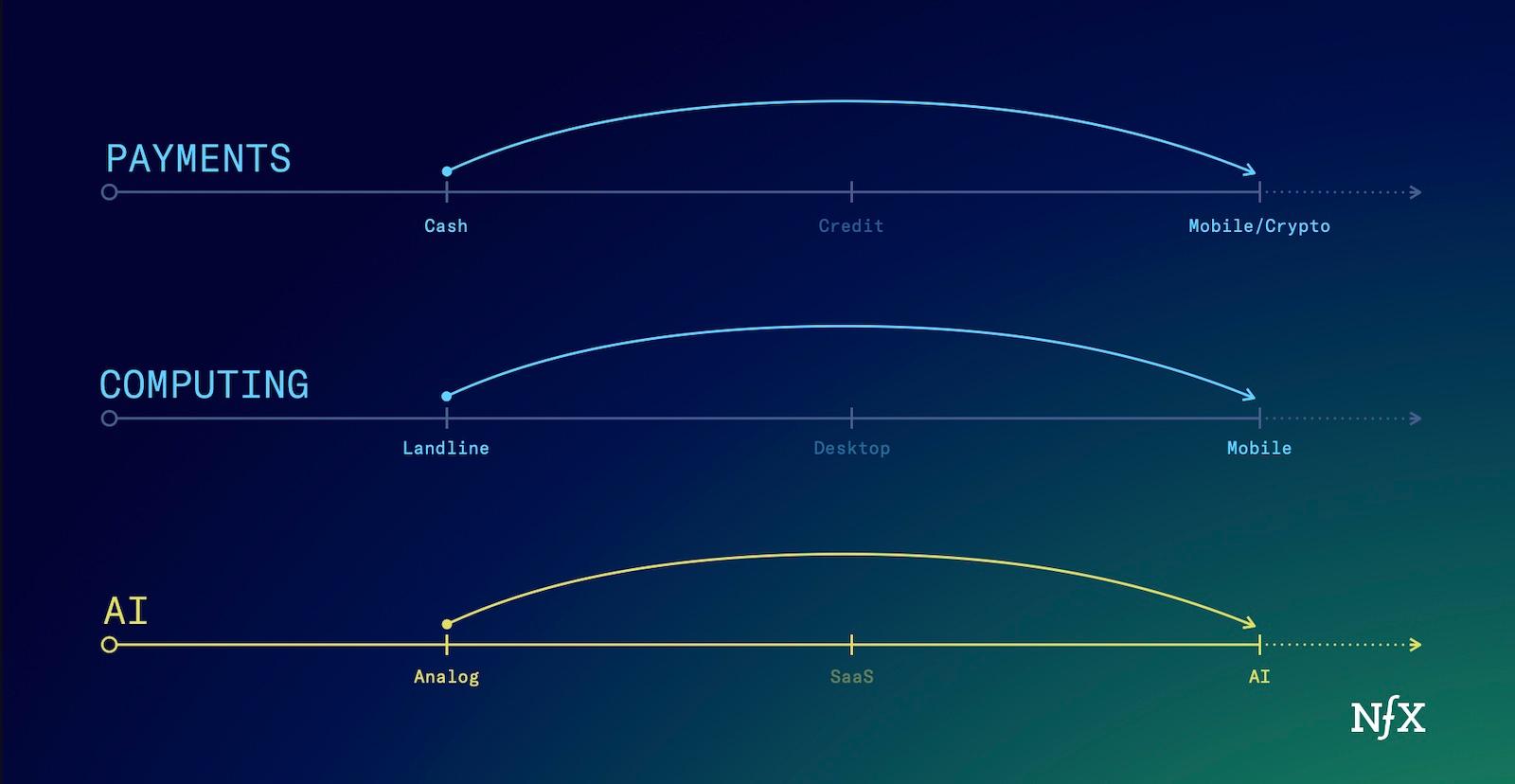

We believe that the same way mobile payments leapfrogged credit cards in some markets, and mobile phones leapfrogged desktop computers in developing economies, AI too will (at least initially) leapfrog more legacy technologies that don’t have a “good enough” palliative (I mean alternative) in place.

Founders are eager to apply AI to digitized industries that seem ‘the most ready for it.’ But that’s not where we’re going to make the biggest impact.

Where will this happen? The majority of the productivity gains from the past decade of digitization were realized by a few major verticals (tech, media, and finance). But there are still many verticals where protocols and software haven’t changed much in 20+ years, and the SaaS revolution didn’t leave a mark. There are still industries that, quite literally, still use pen and paper.

Spaces like agriculture, hospitality, education, legal, construction, and manufacturing are primed for what we call “AI leapfrogging.” If executed correctly, AI has the potential to reach new demographics of users who were bypassed by the previous software revolutions.

If packaged intuitively, AI can go where no software has gone before.

What is leapfrogging?

Technological leapfrogging occurs when an industry or market (usually an outmoded industry or emerging market) skips a step along the technology transformation chain.

Instead of learning to use a personal computer and then a mobile phone, you skip right to mobile. In many emerging markets, mobile is the dominant computing paradigm. It started as early as 2010, just three years after the iPhone’s debut. By the end of 2010, the number of broadband subscriptions for mobile overtook the number of subscriptions for fixed technologies in many emerging markets.

Leapfrogging has also happened in the mobile payments space. While the US still struggles to adopt mobile payments and digital currency, Kenya and China have gone directly to mobile, bypassing the credit and debit step. Just four years after digital payment technologies were developed, 70 percent of Kenya’s population was using M-Pesa, the SMS based mobile payments platform. (This was a big inspiration for Libra… but we’ll leave that box closed for now.)

Between 2013 and 2018, China’s two major mobile payment platforms, AliPay and WeChat, completely bypassed credit cards as the dominant payment scheme. AliPay’s active users increased from 100 million in 2013, to 900 million in 2018. WeChat grew from 350 million to 1.1 billion.

This was a mobile eclipse of the credit paradigm – a leapfrogging event. By 2020, 90 percent of people in China’s largest cities used WeChat and AliPay as their primary payment method. Cash was second, and credit third.

Kenya and China jumped from A to C with mobile payments. And it’s no surprise that they were also first to really embrace crypto too. Decentralized finance was a perfect fit for countries that had already sidestepped the issues of a traditional, centralized financial system.

In 2021 Kenya led the world in P2P crypto trading – a hedge against inflation of local currency, and a way to avoid remittance costs. Non-bank wallets continue to perform in markets (Kenya, Ghana, the Philippines) that bypassed traditional payments infrastructure and went straight to digital.

Leapfrogging is a one way door. That’s one reason we’ve seen so many crypto founders rediscover the problems of traditional finance. Often, they’re trying to use a new technology to recreate a bypassed step in the tech transformation chain (Think: “Plaid for EMs”). It’s like trying to re-create a credit card when the whole population is already using mobile. Instead we need to be thinking about how we move forward from C to D.

Despite these recent examples, leapfrogging isn’t common across the history of technology, but when it happens, it’s seismic. And the conditions for AI to leapfrogging traditional SaaS are especially clear in many “lagging” industries right now.

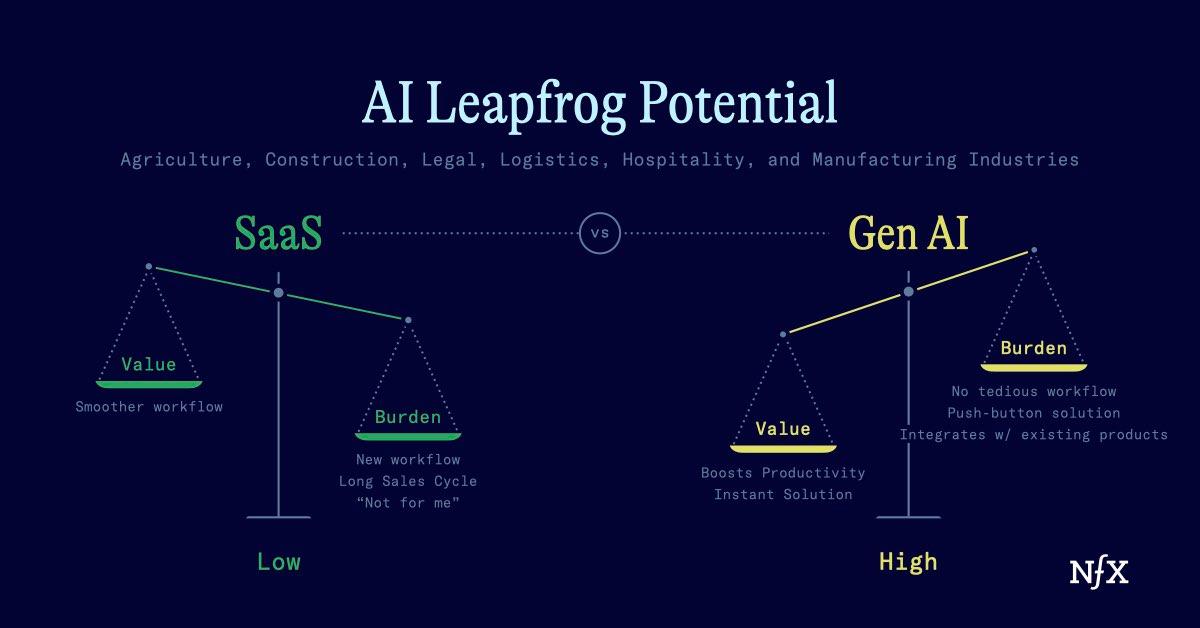

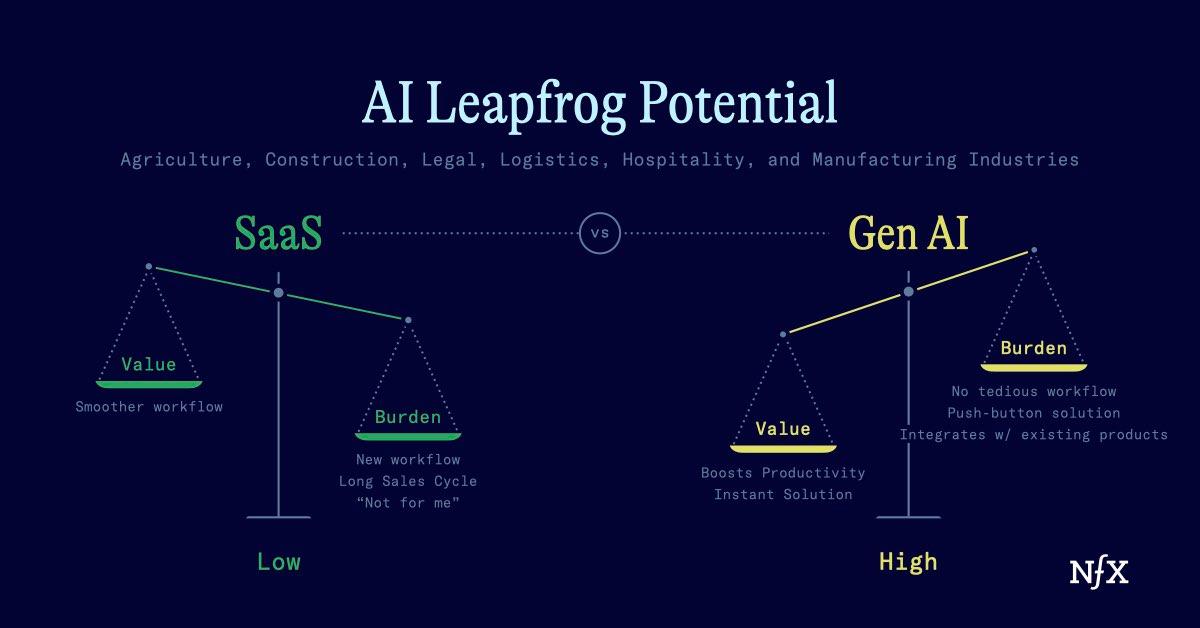

The value of the change must greatly outweigh the burden of the change.

Our NFX colleague James Currier recently outlined a mental model for massive technology revolutions: take someone who is a non-transactor, and through the right tool, turn them into a transactor.

Uber and Lyft wouldn’t have been transformative for cab drivers. That’s incremental. Instead, it made anyone with a car into a potential cab driver. That’s transformative.

In China, there was an laggard social credit system that opened the door for mobile – only about 20 percent of people over 15 had credit cards. In emerging markets pre-mobile, desktop computing wasn’t accessible. In both cases when seamless mobile payments or ubiquitous internet access became possible, it was a natural fit.

The overarching idea here is that switching costs must be as low as possible to facilitate a major leapfrog event. Think of it as two sides of a balancing scale. On one side you have the burden of change. On the other, the value of the change.

The value of the change must greatly outweigh the burden of the change. You can tweak this balance by:

- Creating huge value with a change

- Lightening the burden of the change itself

Ideally, you want to do both.

Non-transactors have very low switching costs because they have a zero on the burden side of the scale. There’s no existing system to displace. It’s all upside.

If we apply this model to the AI space, we have to ask ourselves:

- Who are the current non-transactors in the current software space?

- How can we tweak the switching cost scales?

The AI leapfrogging opportunity

The first step to creating an AI leapfrog event is to identify our non-transactors. In this case, we’re looking for places where there are historically low levels of SaaS adoption: construction, legal, manufacturing, hospitality, agriculture are good places to start.

Let’s look at agriculture as an example. Agriculture employs between two and three million workers in the US alone. On-farm activity alone contributes about $164.7 billion to US GDP. But there’s still a labor shortage on American farms. H2-A workers could fill this gap, but the application process is arduous, predatory, and fragmented across many different workflows.

Seso, an NFX portfolio company, jumped into this space from a SaaS perspective and has created a system to streamline the H2-A visa process.

Seso found a group of non-transactors who had been underserved by SaaS, and used it to solve a core problem for this group: a shortage of farm labor.

But there are still many “non-transactors” in agriculture. And in construction, legal, manufacturing, hospitality, etc:

- Construction is one of the largest industries in the global economy. But it’s highly fragmented, and is one of the slowest to digitize.

- Legaltech was notoriously lagging and slow to take off due to technological, security and cultural barriers (but is now racing into a leapfrog event).

- Negative sentiment is high in the hospitality industry, leaving lots of room for improvement of CX via seamless digital products.

- And the digital transformation of manufacturing processes has been stalled in “pilot purgatory.”

The conditions are right. Which means we need to ask ourselves: How do we lower switching costs enough to turn these people into transactors?

At this point, any industry that lacks a SaaS solution probably lacks it for a reason.

For years, we have underestimated the burden that changing to SaaS platforms represents for many technologically outdated verticals. For years, SaaS has been too expensive for many of these companies. The onboarding has been complex and unintuitive.

If you’ve run your books on pen and paper or a legacy software system for decades, why would you switch to a new system unless you would guarantee a huge change in productivity or return? If you have always written your briefs in Microsoft Word, why would you switch to a system that didn’t integrate seamlessly?

Remember: the value of the change must outweigh the burden of changing. The value proposition of semi-automation isn’t strong enough to justify the switching costs for industries reliant on entrenched, analog processes.

Members of these industries know that they’re way behind when it comes to automation. Generative AI is the first time we have had an opportunity to package full automation in a way that is efficient, cost-effective, and intuitive.

Generative AI is an instantaneous push-button solution. It generates a legal brief or construction plan from scratch. Interacting with software is like chatting to a friend. You don’t have to re-learn your whole process – you simply remove tedious tasks from your to-do list.

Packaged correctly, Generative AI will be the end of complex onboarding processes and unintuitive workflows that have kept switching costs high.

It sweetens the value prop immensely. It has created a tipping point by both reducing the burden of a shift to digitization, and enhancing the value of that change 100x.

EvenUp + delivering instant value

We’ve called this approach “AI inside.” Your selling point is not the “cool factor” of AI technology, but the ease of use, and the value that AI brings to your organization. It’s about delivering instant value, seamlessly on day 1.

“AI inside” is the technique that will allow generative AI to “leapfrog” SaaS in archaic industries.

We’ve seen this happen with NFX portfolio company EvenUp.

EvenUp is an AI-driven platform that uses medical records and legal data to speed up the process of personal injury law.

The whole personal injury law process is kicked off by the submission of a key document: a demand letter that outlines injuries and makes the initial demand for compensation. Lawyers spend years perfecting the process of drafting this formulaic, but key document.

EvenUp offered lawyers a push-button simple solution: use generative AI to create an instant, near perfect demand letter.

EvenUp’s selling point isn’t its workflow. It’s the demand letter itself. EvenUp takes at least five hours off of the demand letter writing process, and reduces the costs of generating that letter by 50 percent.

EvenUp is a masterclass on the power of AI leapfrogging. And there’s plenty more opportunity out there.

Recap: The advantages of AI leapfrogging

Leapfrogging doesn’t happen often. And it’s not easy to execute. Many of the industries we’ve highlighted (construction, agriculture, manufacturing, etc.) are the ones that scare people away because of burdensome processes.

You may face high CAC initially as you look to displace multi-generational operating systems. But the rewards for doing so will show themselves in long-term value. Ultimately, these are industries with very low churn. Customers in these spaces only switch operating systems every 5, 10, or 20 years.

That’s because once you become a dominant paradigm, the value proposition scale recalibrates: you need another extremely big technological change to lower switching costs enough to justify another shift.

This is one reason the US continues to lag behind many EMs when it comes to mobile payments. For places like China and Kenya, who had undeveloped credit systems, leapfrogging to mobile didn’t require ripping out a sophisticated system.

The US, however, developed a robust credit and debit infrastructure system from the 1950s to the 1980s. Today, debit and credit is still the dominant payment method in the US and has proven nearly impossible to remove. It’s a “good enough” system with high switching costs.

That’s the inherent value of a leapfrog event: once you’re in, you’re hard to remove.

The same processes that have made archaic industries so hard to overhaul become defensibilities for you, long-term.

If history is any indication, these leapfrogging opportunities don’t last long. We saw it with the emergence of mobile, and with digital payments. Within three to five years, the major players had already executed the jump.

Right now, the AI leapfrogging window is wide open.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.

Try ChatNFX