Many of today’s most prolific companies were founded during a downturn. This is now widely understood and backed by data.

But what is not well known are the deeper reasons why they were able to get a strong start in a bad economy. Why starting a company now—when it seems most perilous—gives you a serious lead on incumbents and smaller competitors.

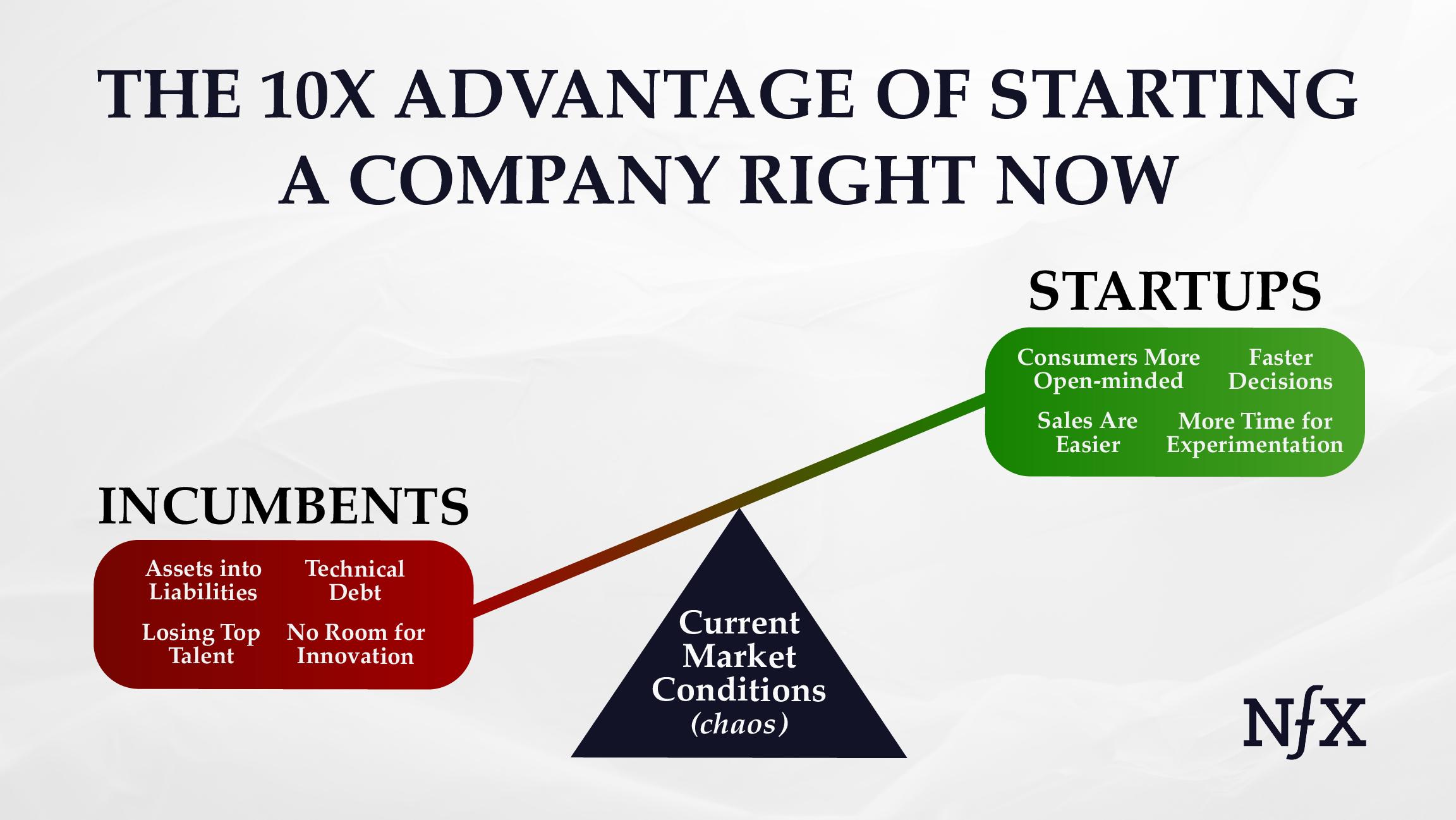

In a downturn, all the advantages that startups inherently have are magnified 10x and many of the advantages of incumbents have become liabilities.

When you can see the underlying conditions in clear detail, it is indisputable that:

- Starting a company now puts you at an advantage, and

- Waiting to start a company after the chaos clears puts you at a disadvantage.

Let’s examine why this is true.

Incumbents are in a (historically) weak competitive position compared to startups

Think of a downturn as a bumpy road full of potholes, and incumbent companies as big cars. They are very efficient at carrying lots of things and people from Point A to Point B on smooth roads. But they can’t easily swerve when the road is bumpy and full of potholes. Startups, by contrast, are more like little, zippy bumblebee cars. They can swerve, adjust, and change direction quickly. They can drive on tiny roads that would be unnavigable for big cars. In a downturn, that small bumblebee can get from Point A to Point B faster and more efficiently. There are specific reasons why.

1. For incumbents, assets become liabilities.

In today’s compounding crisis, many assets that once benefitted incumbent companies are now large liabilities. For example, offices and leased data centers have become unwanted financial burdens. Deals and partnerships that are no longer viable can suck up money, time, and energy. Companies focused on minimizing the weight of these liabilities tend to slow down or halt efforts to pivot, or open new lines of business, or test new products.

By contrast, startups are smaller, leaner, and have fewer assets to slow them down. They usually don’t have costly or long term leases. No thousand-person teams or cultural entropy. It is also easier for startups to jettison deals and partnerships that are no longer useful. Simply put, startups don’t carry the heavy burdens of their bigger competitors. They come with less “baggage” which allows them to address new opportunities and iterate more quickly to meet customers’ needs. Startups can take advantage of little-noticed market trends, move more quickly, and think more creatively about how to solve customer problems.

2. Incumbents must focus on core business lines rather than innovation.

Even during the best of times, incumbent companies struggle to create new growth opportunities and embrace innovation as they’re forced to maintain their core businesses. This is a natural reaction and nearly impossible to overcome. Faced with a choice between the known and the unknown, risk-averse big companies will pick what they know. If making a decision between a cash cow product line (even if the cow is limping) and a speculative new business unit (which is starting at $0), the cash cow always wins.

Consequently, growth and innovation efforts are quickly deprioritized or even fully abandoned. Incumbents place their primary focus on stopping the decline of existing revenue streams rather than creating new ones. This mindset slows them down even more during crises and tethers them to mature and declining business models.

That’s why right now, startups have even more room to maneuver in and around (and even beyond) their bigger competitors than in “good” times. Startups can try more things without attracting a response or even being noticed. It also gives Founders time to iterate and test more, granting more runway for one of the holy grails of startups: product-market fit.

3. Incumbents cannot easily upgrade their talent pool during a crisis.

When the COVID-19 crisis first hit, incumbents started laying off employees. This was a classic move to downsize and reduce payroll liability. Because incumbents have many more employees than startups and are often held more tightly accountable to public markets or investors, they have by necessity continued to bleed jobs. Unfortunately, this often means terminating talented employees.

Again here we see a great opportunity for startups to move in and hire new talent quickly, often at lower salaries. In troubled industries especially, startups can easily recruit experienced talent away from incumbents because employees are uncomfortable with the risk of sticking around during a decline. This new reality changes the risk/reward calculation dramatically in favor of startups — for the relevant employees. It also increases the relative and absolute rewards that an employee can access when joining smaller, younger companies. This is powerful leverage that smart Founders use to pull in top-grade talent.

4. Incumbents cannot easily respond to disruptive startup tactics.

No matter if you are a startup or a big company, it’s possible that now may be the best time ever to open source your code or offer your premium service for free for an extended period. The trouble is, the ability to greenlight experimental changes like these can often take incumbents months and involve numerous stakeholders — even during good times. During bad times, incumbents simply do not have the internal bandwidth to respond or the corporate courage to make risky changes.

Let’s look at how this plays out. When a big company wants to open source code, they need to consult their legal team, check with their VP of Engineering and CTO, defend the strategy to the rest of the company, allocate budget for dedicated developers to support that code, and accept the potential immediate decline in revenues. Not to mention figuring out how to market their decision to their customers and community. In a startup, Founders and their small engineering teams just make a plan and open source the code. Done! There is far less bureaucracy and far fewer boxes to check.

For making big shifts to pricing, incumbents have to check in with their CRO, see how it might impact existing renewal pipelines, and revamp sales rep compensation. But for startups, giving away the premium version of their product for six months instead of 30 days could be just a smart customer acquisition strategy — and often only takes a few lines of code to change and the Founders’ decision.

How to pick a field for your startup in a downturn

If you’re thinking about starting a new company right now, it’s important not to get caught up in conventional thinking about how to size a market or what type of business to launch. In a downturn, just about any type of business operates at an advantage as a startup. Here are some of the dynamics you’ll want to consider.

1. Disruption and market change are accelerated.

Generally speaking, the startup opportunities you were exploring prior to the downturn are still intact. That’s because the underlying drivers of innovation are still at work. Better, they are moving even more quickly.

For example, the digitization of manual business processes was a good business model before the pandemic. Now it’s an even better business model. Computational biology was important before; now it’s supercharged and getting even more funding. Online coaching and education, previously growing well, are now becoming a powerful new normal as society struggles to imagine new ways to educate. All businesses across every industry are looking at becoming more resilient to quarantines and social distancing, more able to handle another shutdown or crisis.

2. Some of the best opportunities lie in the hardest hit business sectors.

Even the fields that look the worst right now—like travel—will not disappear. They meet a market demand or a fundamental human need. Instead, the most challenged sectors will reappear in a different form. This is a perfect opportunity for startups to try new ways of approaching the most damaged fields and get ahead of incumbents.

Let’s take, for example, live music and concerts. People will not crowd into stadiums for a long time to come. Perhaps that means the time for VR or better versions of virtual concerts is finally here. Maybe amazing new audio codecs could make it sound like you are actually at the concert. Or setting up experiential packages of VR plus merchandise plus food delivery can create a virtual concert experience that in some ways is even better than the real thing. Already some artists we know are experimenting in new ways to connect with fans. People are far more likely to be willing to try something new during a downturn when so many social and business practices are undergoing dramatic change.

3. Think creatively about fulfilling fundamental human needs in new ways.

One of our NFX portfolio companies is the recreational vehicle (RV) marketplace Outdoorsy. The company took a huge hit when the downturn started. Everyone everywhere was afraid of any kind of travel. Now, Outdoorsy is actually doing better than ever. It’s a fascinating story of secondary opportunities from a crisis. The initial reaction of most people was not to travel because they felt unsafe on planes and in other shared transportation. They also felt unsafe in hotels and places where they could not control their surroundings. Yet, the desire to travel remains. Humans need to get away from their everyday surroundings and see the world.

Outdoorsy did a great job with an innovative PR campaign pushing the message that RVs are a great way to keep traveling. It clearly resonated. Now, investors are starting to look at RVs as a new asset class for generating income. This resembles what we saw with AirBnB. First the initial opportunity, then people started to see the value of it as an asset, then came cleaning businesses and other services like tools to optimize homeshare pricing. Even the shift to RVs is a secondary impact that few people expected. It’s not a safer airline or a cleaner hotel room. RVs are an entirely different thing.

The emotional drivers behind human behaviors are constant. Where we are forced to change those behaviors, business models that can fulfill fundamental emotional needs in different and innovative ways can be huge winners.

4. Look for secondary and tertiary opportunities that come from changes in behavior and consumption.

The rise of the RV market is just one example of a secondary opportunity that generates tertiary opportunities. To find these opportunities, Founders must look beyond first-order impacts, which are already crowded. (How many new video conference technology companies have launched since March 2020?). Take the simple handshake. People are no longer shaking hands. And they may not shake hands much ever again. But the social ritual of greeting remains important. What could replace it and what opportunities might that create? Or in travel, the first-order impact is to stay away from planes and hotels as people fear the virus. The second-order impact is to shift travel to open spaces where we are safer—for example, national parks—or to reduce the density of our experiences by creating ways for smaller groups to enjoy the Taj Mahal. So a third-order opportunity might be offering group VR tours of the Taj Mahal with your friends powered by drone-mounted cameras streaming real-time video. The first order is obvious. As you move into the second and third layers, there is more room to try new things and iterate on new business models.

In general, the field has never been this wide open for startups to take on incumbents or to try out entirely new business ideas and approaches. People are more open to change than they have been in many years. This means they will try new things and change their consumption patterns and behaviors. For Founders, this presents a historic opportunity to tap into massive shifts and build something unique, durable, and scalable.

What can Founders do right now more easily than before

Common wisdom holds that now is a tougher time to sell to customers and grow a business, test ideas, and get product-market fit. But in fact, good Founders will find that these core activities required to grow a startup are actually easier in a downturn.

1. It’s easier for startups to iterate for product-market fit.

A new startup does not have a fully-developed product with all the technical debt or sunk costs that an incumbent or even an older startup company has. This clean slate means that a fresh startup can build its product to better fit current customers’ needs. The clean slate is especially important during a time of massive change. You may need to iterate a product multiple times until you feel you have properly captured what the customers want — and what they want may be very different from what they wanted only six months ago.

New startups also may have longer to achieve product-market fit than in good times because there is less pressure to rush a product to market, burn rates may be lower, and incumbents are less likely to launch competing products. All told, this may be the best environment to achieve product-market fit in recent history.

2. It’s easier to get sales meetings and trial customers.

The move to Zoom and other video platforms has made it easier to get sales meetings than ever before. That’s because Zoom has replaced in-person. The barrier to getting a Zoom call scheduled versus an in-person meeting is much lower.

During downturns, it’s also easier to get people to try your product. Just like you might be willing to try new foods when you are on vacation or are visiting a new city, shifts in behavior caused by COVID-19 have made it easier to break through and talk to people. Beta testing a new product can seem more relevant if it promises to improve a user’s life or entertain them in a concrete way.

Some of this is simply due to people having more time. Business travelers are no longer traveling. Teams that formerly ran field marketing, direct mail or other disciplines impacted by COVID-19 may be looking for new ways to accomplish their job effectively.

3. People are psychologically more open to new things.

Consumers are also looking for new things to do. They used to go out to eat, hang out with friends, or go shopping. Now they are spending more time at home. They want to feel alive and feed their brains. They want to see friends and listen to new music and try out new recipes — often at the same time. COVID-19 dynamics are likely driving usage and membership spikes of products like Houseparty and Masterclass. Consumers using those services want to find new ways to spend time together online and new types of online experiences.

The good news is new experiences can lead to new habits — and habits stay for the long term. It’s like when you move to a new city or you start at a new school or a new job. You are more open at that moment to changing your habits and preferences. And you are more likely to share what you find with others. This gives startups a tremendous opportunity to leverage this desire for new things to create new, sticky behavior, and consumption patterns.

4. The VC math for early-stage startup fundraising remains intact.

Isn’t it impossible to raise money during a downturn? Not really. Fundraising continues at a healthy pace. We are busier than ever looking for good investments. In fact, VC interest in finding attractive investments is at an all-time high by some measures. While there remains debate on the absolute level of funding, no one disputes that good teams with solid ideas can still get funding.

VCs love to invest in a downturn because startups have better economics in a downturn. As costs have gone down for many business services and salaries, Founders can achieve more with less capital. Lower prices allow smart startups and Founders to enjoy longer runways or to dedicate more resources to growth than was possible before the pandemic.

5. Starting a company during a crisis creates a culture of speed and shared purpose.

Starting a company in a crisis is trial by fire. Founders will have fewer resources. You will have to operate leaner and more efficiently. To survive and win big, Founders will need to move faster than before, setting the speed bar at a higher level. Teams will need to function more efficiently. Every employee will need to do more and be better at their jobs. The sense of shared purpose created by conditions of adversity is a powerful cultural force. When the COVID-19 crisis recedes and more normal conditions return, these attributes and performance expectations—the DNA of your company—will allow you to break away from competitors.

What to Pay Attention To If You Start Right Now

- Understand what fields are changing and try to gain insight into important trends affecting those fields. You need to see over the horizon and anticipate what the world will be like in the near future. Keep in mind the crisis is probably accelerating the pace of these changes. The future may come sooner than industry experts forecast.

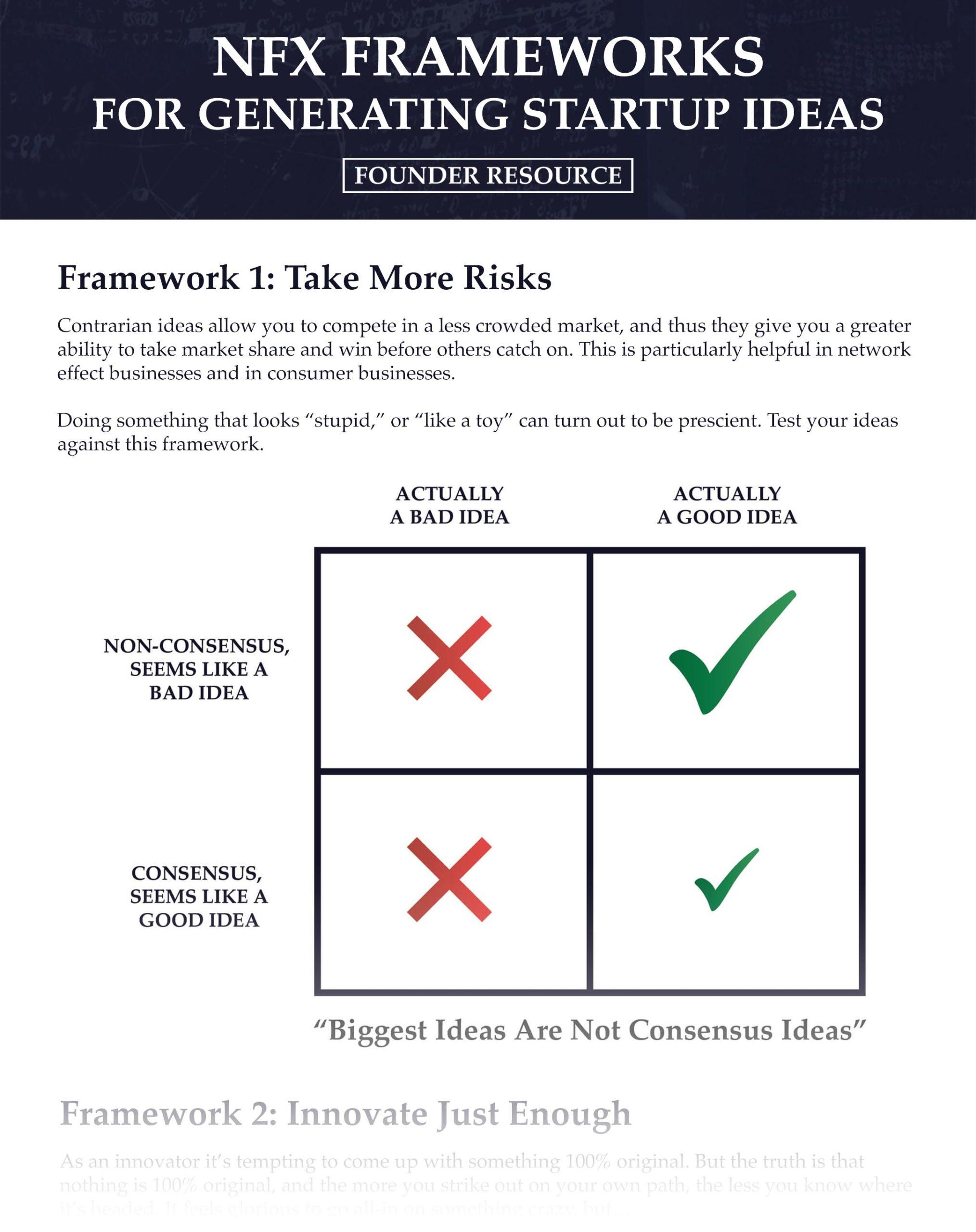

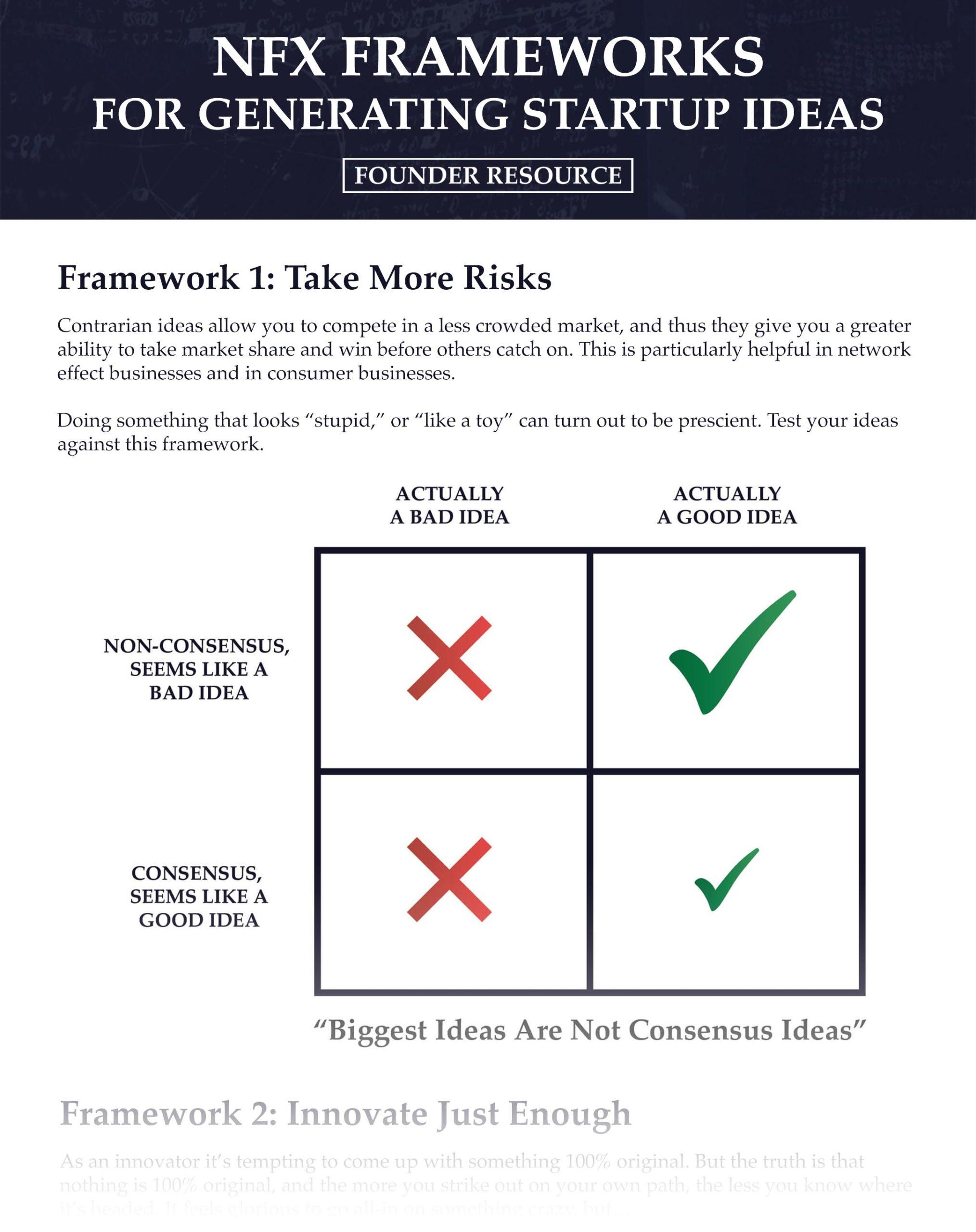

- Find the right frameworks for your new company. Now is the time to focus on the true ‘painkiller’ — product-market fit.

- Try your ideas quickly to ensure you identified the right trends and are building the right painkiller solution. No long cycles. Talk to your customers as the first step.

- Other people who think times are too chaotic will self-select out of the running. Use the chaos as your smokescreen while you start something new.

- A final word of advice: Make sure you think carefully if starting a new company is really what you want. And if it is — move fast. Speed is more important now than ever.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.