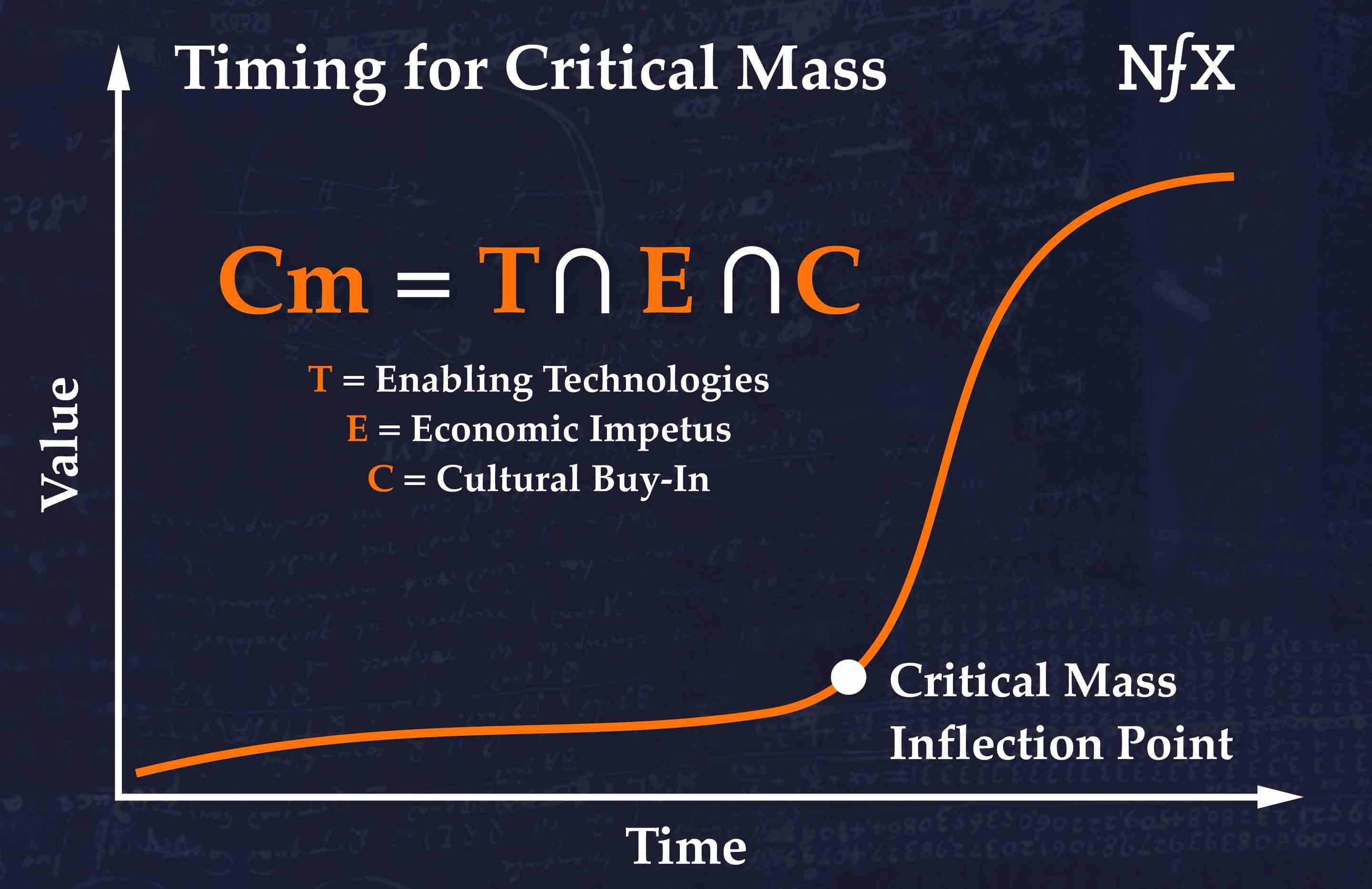

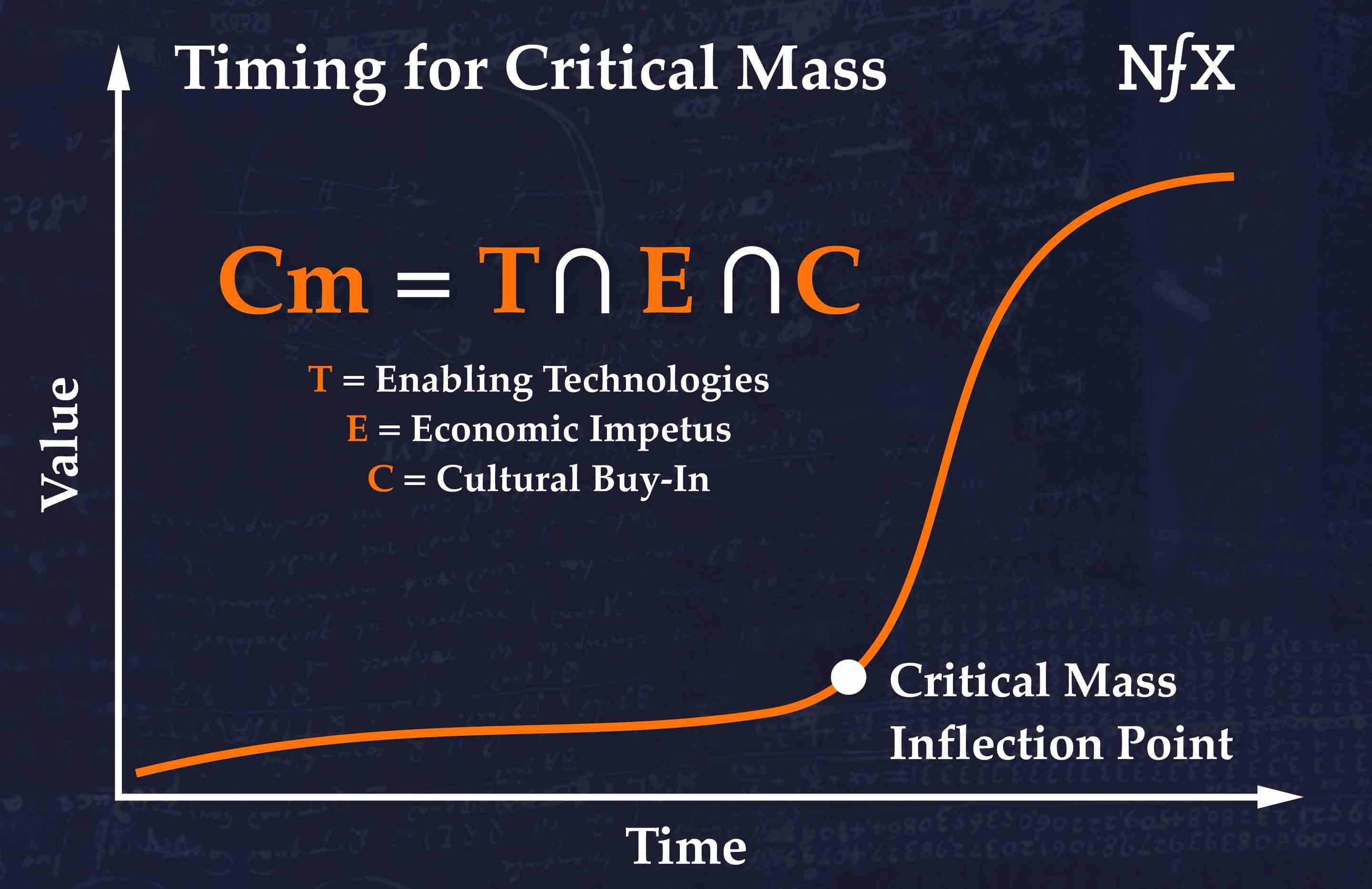

In nuclear physics, the minimum amount of fissile material needed to create a self-sustaining nuclear chain reaction is known as critical mass. The idea is that, in complex systems, moving beyond a threshold can suddenly unleash powerful, self-sustaining change.

From my own experience of founding and investing in companies, this was an irrefutable law that I applied to startups, too. Enter a market too early, no matter how strong the founding team, and you could be stuck waiting for a day that never comes. Enter too late and you’re fighting an uphill battle against incumbents with greater scale. In startups, timing is everything.

To help better understand startup timing, we’ve developed a framework we call the Critical Mass Theory of Startups. It’s the tipping point for when a product or market goes under rapid transformation, seemingly overnight. A critical mass point for a startup opportunity arrives when there’s a minimum threshold of three preconditions:

- Economic impetus

- Enabling technology

- Cultural acceptance

The Critical Mass Theory of Startups

As a Founder, you typically can’t control these three preconditions — they’re all external circumstances. But by understanding them, and the power of their confluence, you can identify new startup opportunities, how to sequence resource allocation, and determine your startup’s own fate.

Precondition #1: Enabling Technologies

One critical factor in getting the timing right is the pre-existence of enabling technologies. Virtual assistants (Alexa), streaming services (Twitch, Netflix), ride-sharing (Lyft, Uber) and wearables (AirPods) are untenable without tech such as low-latency voice recognition, smartphones, Bluetooth, and sensors, respectively.

For founders, being ahead of your time can be the same thing as being wrong. And if a startup enters a market without the right structure of enabling technologies, it’s unlikely they’ll be able to gain traction within the available runway. What we see in many great founders is a clear understanding of the trajectory of emerging technologies, and when these technologies are on the cusp of a transition that will enable transformational product experiences.

Precondition #2: Economic Impetus

Founders are wired to constantly look for a better way to do things; to stay on the bleeding edge of technology. At the same time, the leading founders have the foresight to keep a close watch on economic trends. Economic impetus can create new opportunities, like when providing a product or service shifts from unprofitable to profitable, or when a previously niche market shifts from small to significant. And if you’re not observing economic trends and applying them to the problems your startup is solving, you’re probably missing out on huge opportunities.

One manifestation of this is rooted in economies of scale. When something that was expensive becomes cheap it creates an economic impetus that can shake up what’s adopted in the mainstream. For example, off-grid devices only really proliferated once the cost of solar panels fell which enabled entirely new products. Tesla and electric cars became much more viable once the cell-phone boom drove down prices of batteries. And lower costs for the same amount of processing power (Moore’s Law) created an opportunity for the smartphone revolution.

The inverse of this dynamic—when something that was once cheap becomes expensive, like education or childcare—can also create new market opportunities.

So can inflated prices. Expensive cable subscriptions and record albums in part fueled the rise of streaming companies like Netflix, Spotify, and Hulu. High, inflexible costs for contract labor and stagnant wage growth in parts of the economy gave birth to the gig economy and startups like TaskRabbit, Postmates, and DoorDash.

And some macroeconomic forces—like the recession—created the sharing economy. It’s no coincidence that Airbnb and Lyft popped up in the years following the financial crisis.

Precondition #3: Cultural Acceptance

How we interact with technology changes rapidly. As behaviors change, the viability of a market category can change as well.

Startups often benefit from the heavy lifting done by their predecessors; pioneers who changed cultural norms and, later, behaviors. 20 years of cultural reprogramming went into the success of Instagram, from the rollout of blogging and vlogging platforms to Facebook and “selfie” culture. Instagram’s predecessors pushed the collective conscience from “stranger-danger” to a place where sharing online is accepted and practically obligatory.

Cultural acceptance can seem like an intangible, but it’s a crucial part of the critical mass equation. Further, cultural shifts can lead to regulatory change, and that can have a huge impact on the viability of a particular category. For example, the online sports gambling category is much more viable now that the Supreme Court overturned its federal ban. The ruling will surely drive a large amount of startup and investment activity; just last week Fanduel was acquired by a European gambling company. The rise of marijuana startups, reportedly a $9 billion market, is another recent example.

The Ultimate Case Study on Critical Mass: iPhone

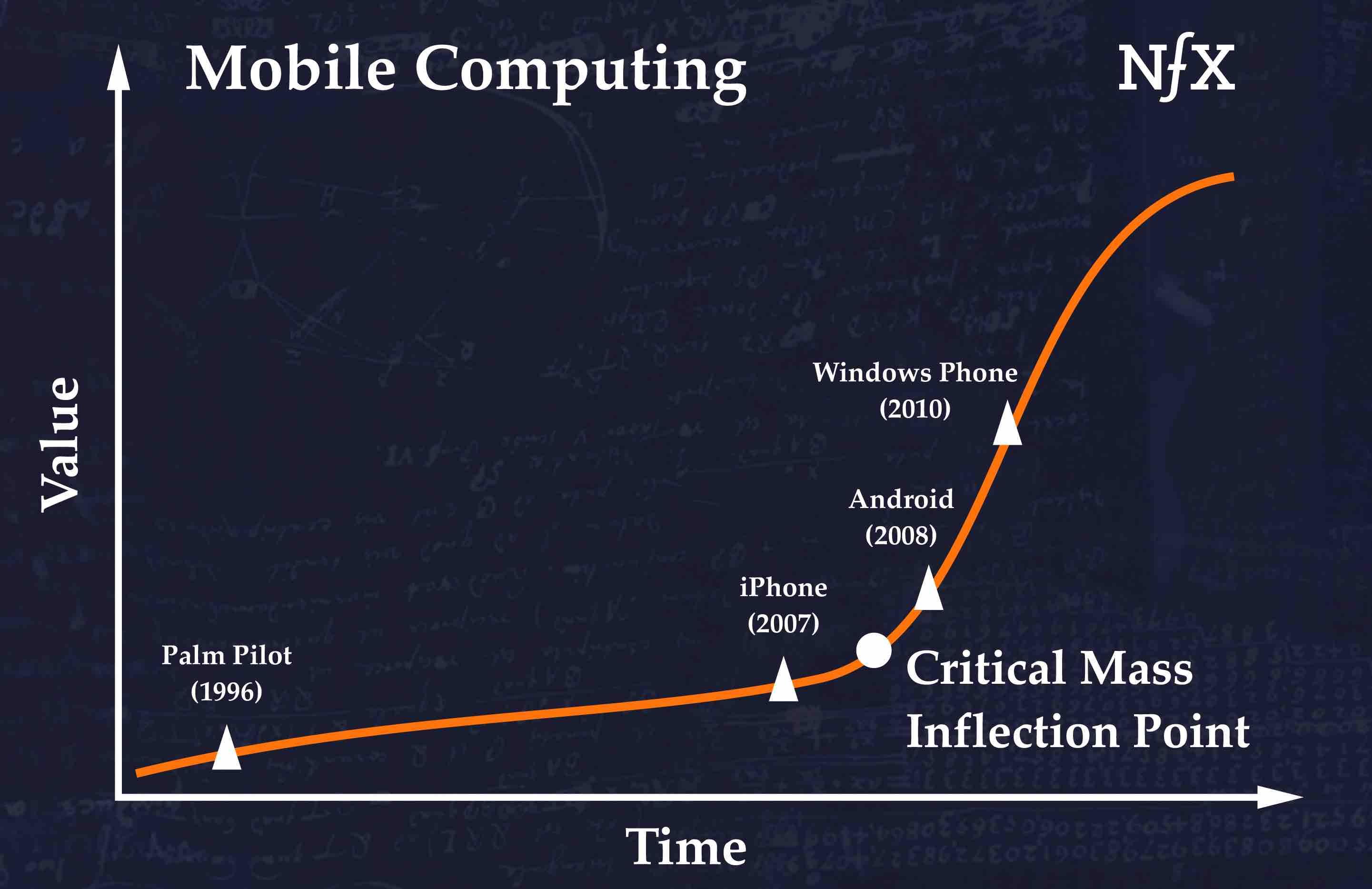

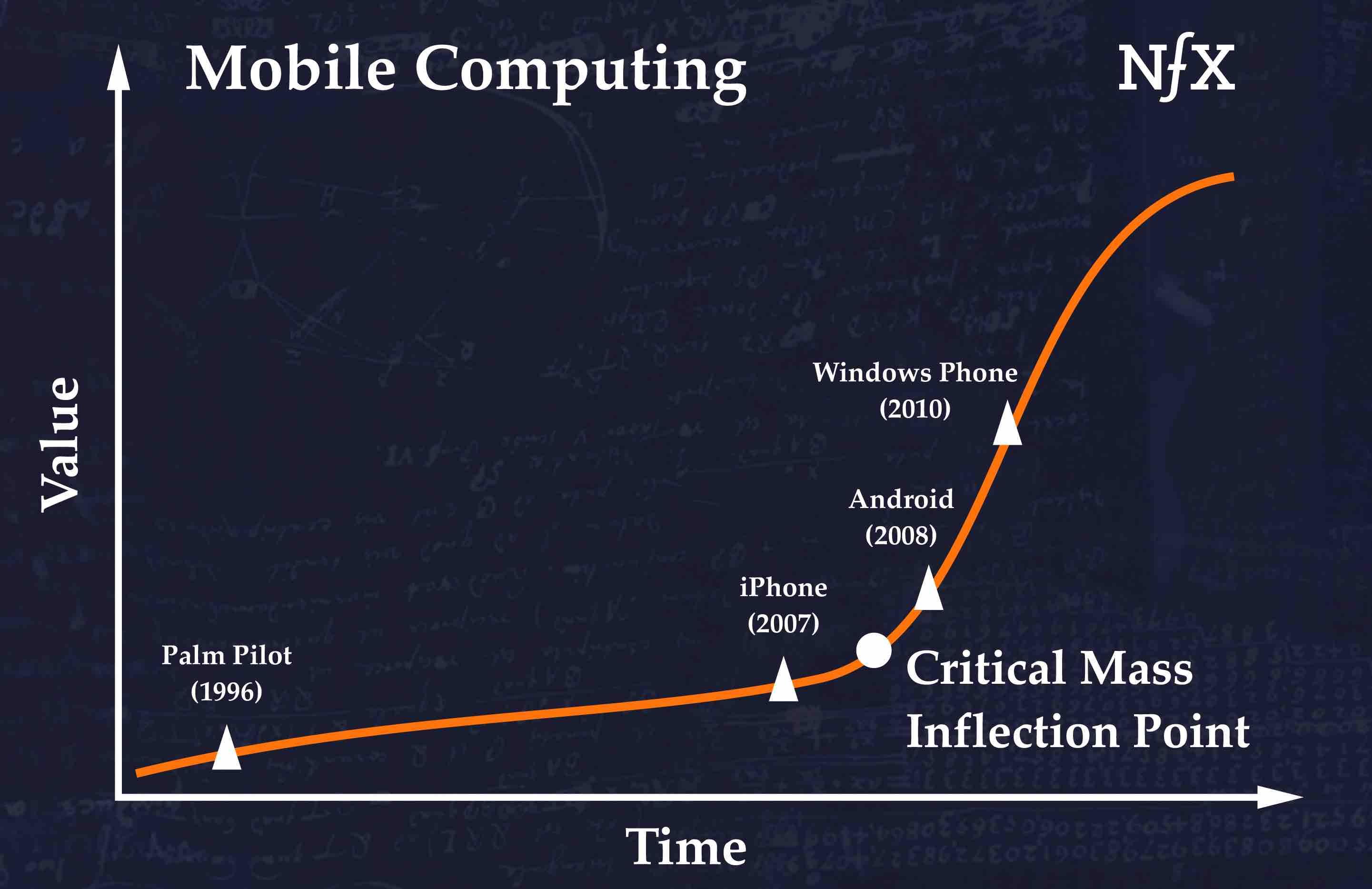

Before you build, it’s crucial to understand all that goes into good timing — just look at the Palm Pilot. Consider for a moment all of the innovative products that existed pre- iPhone. From the late 1990s to the early 2000s the Palm Pilot created an abundance of new, amazing technologies. Yet, in retrospect, their achievements amounted to little more than enabling technologies. The Palm Pilot had access to many of the core technologies that power today’s mobile companies: touch screens, processors, broadband internet, and mobile operating systems.

So why aren’t we all using Palm Pilots?

The Palm Pilot needed two key external circumstances in order to really take off: mobile telephony infrastructure (enabling technology) and a widespread adoption of mobile digital devices (cultural acceptance) that came with the iPod revolution.

When the mobile telephony infrastructure reached its critical mass around 2007, the same core technologies that had been flopping on Palm Pilot devices for over a decade helped catapult Apple into the most valuable company on earth.

But couldn’t we attribute Apple’s success to genius in product innovation and UX?

Those were undoubtedly crucial factors, as were iOS’s platform network effects. But the real reason Apple experienced such tremendous growth was that they saw the critical mass. Apple entered the mobile computing market at the exact right time—on the eve of the smartphone revolution, with the product and marketing savvy to create a cultural phenomenon.

The company that can achieve scale at the critical mass point will win, and that’s exactly what Apple did with the iPhone. Amazon did this with eCommerce, Google did this with search, and virtually every other category-defining company in history has also done this.

This is where the first-mover (or last-mover) advantage paradigm gets it wrong. What’s important isn’t whether you’re earlier or later than your competitors on an absolute basis – rather, it’s all about who enters the market closest to the critical mass point. It’s at this point when technology, economic and cultural forces can combine to enable explosive growth for founders.

As Founders ourselves, we respect your time. That’s why we built BriefLink, a new software tool that minimizes the upfront time of getting the VC meeting. Simply tell us about your company in 9 easy questions, and you’ll hear from us if it’s a fit.

Try ChatNFX